Payroll

-

What is the Paycheck Protection Program?

As part of the CARES Act, the government released the Paycheck Protection Program (PPP) to help protect and sustain US small businesses during the COVID-19 pandemic. As long as the…

-

Ascertain The Right Payroll Period For Your Employees

Are you in a fix whether to process your payroll weekly, bi-weekly or semi-monthly? If that is so, then don’t worry we are about to shed some light on this.…

-

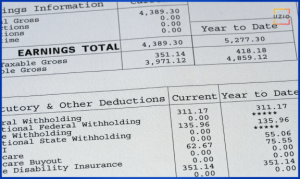

What does a Pay Stub look like?

A pay stub is part of a paycheck that enumerates information about the employee’s pay. It lists the wages earned for the pay period and year-to-date payroll. The pay stub…

-

The Payroll Tax Deferral Plan of 2020

On Aug. 8, 2020, President Donald Trump issued an executive order which deferred payroll tax obligation for employees in light of the ongoing COVID-19 crisis.

-

Online Pay Stubs: The First Step Towards a Paperless Payroll

Although it simply isn’t possible for many businesses to completely eliminate the use of paper, even a small reduction can yield enormous overhead savings, enhanced data security, and increased efficiency…

-

Types of Payroll Deductions Employers Should Know About

Calculating deductions and withholdings can be a complicated task for any business. Deductions and withholdings, which are mandated by both state and federal laws, can be voluntary or court-ordered, so…

-

Replenish the Exhausted Ppp Loans: Round 2 Stands Approved

The Paycheck Protection Program (PPP) has run out of funds. Yes, you read that right. On April 16, the PPP exhausted nearly $350 billion allotted for low-interest loans designed to…