What does a Pay Stub look like?

A pay stub is part of a paycheck that enumerates information about the employee’s pay.

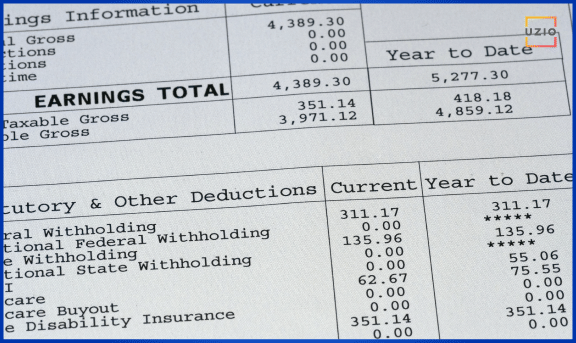

It lists the wages earned for the pay period and year-to-date payroll. The pay stub also attests to taxes and other deductions taken out of an employee’s income. And, the pay stub shows the amount the employee receives (net pay).

Fair Labor Standards and Labor Standards Act Compliance: In compliance with the Fair Labor Standards Act (FLSA), pay stubs must meet certain standards to ensure workers are paid for all the hours they work, including overtime. This federal act establishes minimum wage, overtime pay eligibility, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in federal, state, and local governments.

A pay stub incorporates information both managers and employees can use. Employees get pay stubs as records of their earnings. By reviewing their pay stubs, workers can make sure they were paid rightly and follow their deductions.

- Gross wages

- Taxes, deductions, and contributions

- Net pay

1. Gross wages

Gross wages are the beginning stage of your worker’s salary. The gross wages incorporates cash owed to a worker before deductions are taken out.

Hours worked: Pay stubs for hourly workers consolidate the number of hours worked. Salary workers likewise have the hours worked recorded on their pay stubs.

If you get paid every hour, your pay stub should include:

- The rate every hour for both standard and extra time work

- The number of hours worked at each rate

- The aggregate sum due for each pay rate

Pay rate: The pay rate should be remembered for a worker’s pay stub. For hourly workers, note every representative’s time-based pay rate.

Understanding Your Hourly Rate: For non-salaried employees, the pay stub should break down the hourly rate. This includes the regular hourly rate, as well as any differential rates for overtime or holiday pay. Understanding your hourly rate is crucial for verifying that you are being paid correctly for all the time you work.

Gross pay: A pay stub records the absolute wages procured before allowances. Other than standard wages, a representative may gain extra pay. This can incorporate overtime, sick pay, holiday pay, bonuses, personal time, and payroll advances.

Direct Deposit Details: Many employers offer direct deposit, which is an electronic transfer of a paycheck directly into the employee’s bank account. Pay stubs often include direct deposit information, showing the bank account number and routing number where the paycheck was deposited.

2. Taxes, deductions, and contributions

Alike gross pay, taxes, and deductions are separated into two sections. One category shows prevailing deductions, and the other shows year-to-date results.

The following are common deductions seen on pay stubs:

Employee tax deductions: Usually, government agencies (like the IRS and state tax departments) tax an employee’s salary. Taxes deducted involve federal income tax, the employee portion of FICA tax, and, state and local income taxes.

Understanding Social Security and Medicare Deductions: Social Security and Medicare taxes, commonly known as FICA tax, are key components of payroll deductions. Every pay stub should clearly list these deductions to ensure employees are aware of their contributions towards Social Security and Medicare. These contributions provide long-term benefits, such as retirement income and healthcare coverage during retirement.

The Role of Medicare Taxes: Medicare taxes are withheld from an employee’s earnings and are used to provide medical benefits to individuals when they reach retirement age. Your pay stub will show the exact amount deducted for Medicare, which is critical for future healthcare entitlement.

Benefits and other deductions: Other payroll deductions shown on a pay stub differ depending on the small business employee benefits you render.

Health Insurance Premium Deductions: For many employees, health insurance premiums are deducted directly from their wages. The pay stub should list these deductions separately, often under a section for ‘benefits’. This transparency helps employees understand how much of their paycheck goes toward health coverage each pay period.

Employer contributions: Some things remembered for a worker’s pay stub are not deducted from the gross compensation. They display sums you provide as a business.

Employer Contributions Beyond Deductions: Employers often contribute to certain taxes and benefits on behalf of their employees. These employer contributions, such as those toward unemployment tax, workers’ compensation, or additional health insurance benefits, should also be indicated on the pay stub, even though they are not deducted from the employee’s gross pay.

3. Net pay

Net pay is the sum left over after taking away allowances from the gross pay. It is the employee’s salary.

If an employee abruptly quits or is fired, you might need to pay them quickly. Knowing pay stub data makes the cycle smoother.

Exploring worker pay stubs can likewise draw botches out into the open. Check for the right pay rates, hours worked, and complete income. On the off chance that a sum appears to be strangely high or low, you can get blunders right on time to dodge IRS punishments and clashes with employees.

Pay stubs make it easier for workers to know how and how much they are getting paid.

It might save you the trouble of answering repeated questions about withholdings and overtime payment.

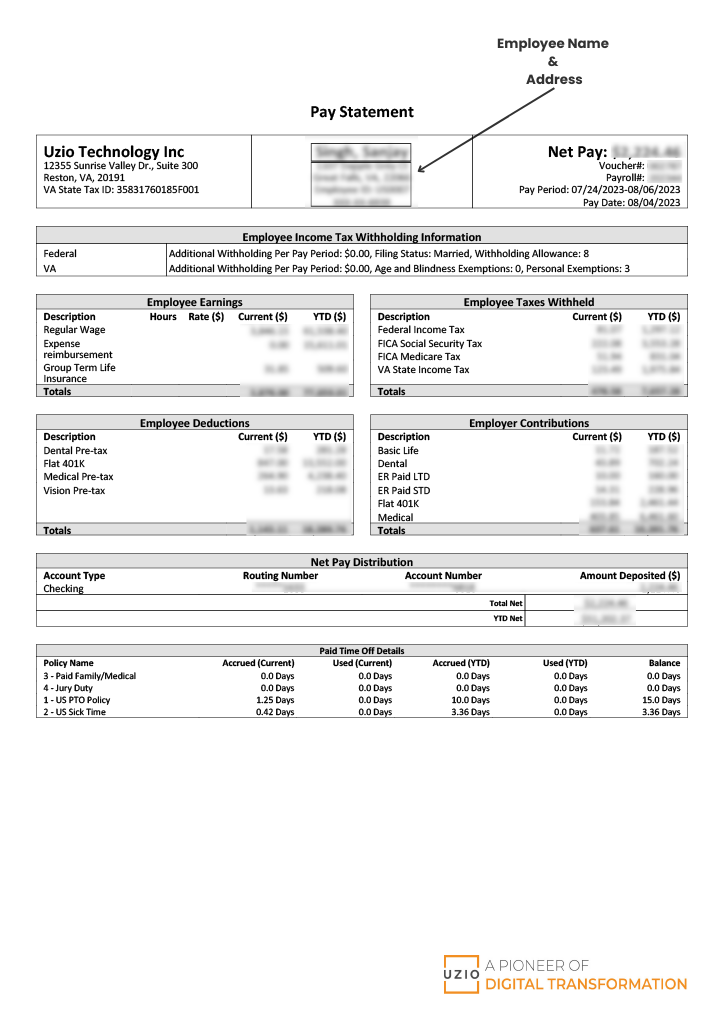

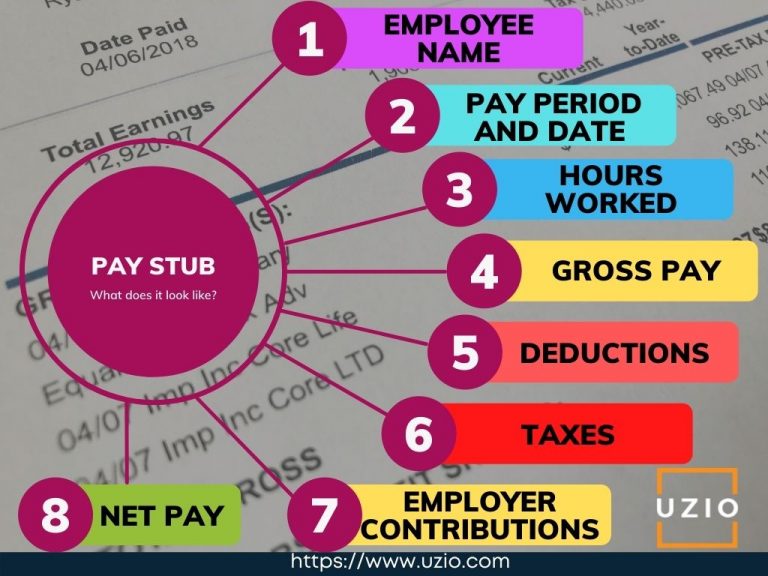

What does a pay stub look like?

- Employee name

- Pay period and date

- Hours worked

- Gross pay

- Deductions

- Taxes

- Employer contributions

- Net pay

For what reason should a pay stub be given?

As an employee, a pay stub is valuable for charge purposes, and it tends to be utilized to determine any disparities with representative compensation.

Why You Might Need Your Pay Stub

- To secure lodging or get credit: When you’re applying for a loan, leasing an apartment, or buying a house, you may be asked to render copies of your pay stubs from a certain period.

- To verify employment and salary history: Requesting later and current salary hits are one way that employers confirm employment. Corporations may also ask for pay stubs as part of the hiring process, to check that you’ve provided an accurate salary history.

- To ensure the data is right: It’s a smart thought to start checking on your pay stub and keeping either a physical or an advanced copy if you actually need to confirm your payment or deductions. This is particularly significant when you start a new job, so you can affirm that all the allowances in your first paycheck are correct.

- Retirement Plan Contributions: Contributions to retirement plans, whether a 401(k), an IRA, or other retirement funds, can also be found on a pay stub. These deductions are part of the employee’s pre-tax contributions, lowering taxable income and simultaneously preparing for long-term financial stability.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.