What is ERC and how can I claim It?

Quick links

Introduction

At the start of the Coronavirus Pandemic, the US government passed a number of laws to help the businesses who were struggling to keep employees on the payroll. The Employee Retention Credit (ERC) program was part of one such law CARES act. It provided tax credit to businesses if they were impacted by Coronavirus shut down.

What is ERC

ERC is a refundable employment tax credit which businesses can get to help with the cost of keeping staff employed during Coronavirus shutdown. The ERC was created as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in March 2020. Since then ERC has been amended twice, once as part of the American Rescue Plan of 2021 and then as part of the Infrastructure bill signed into law by President Biden in November 2021.

What Wage Period ERC is applicable to

For most businesses, ERC is applicable for wages paid between March 2020 and September 2021.

The ERC was repealed effective October 1, 2021 for most businesses by the Infrastructure bill. The sole exception was “Recovery Startup Businesses” who can claim ERC thru December 31st 2021.

A Recovery Startup Business is one that:

- Began operations on or after Feb. 15, 2020

- Maintains average annual gross receipts that do not exceed $1 million

- Employs one or more employees (other than 50% owners)

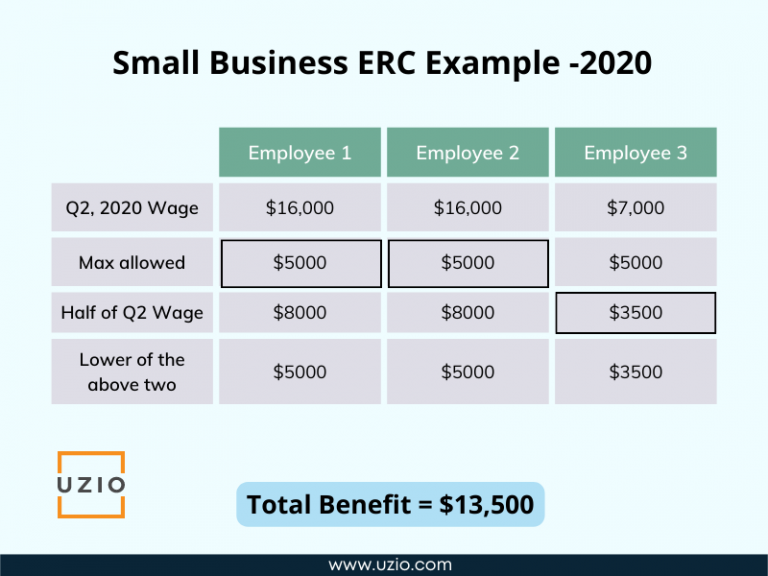

How Much Tax Credit Can I receive as part of ERC

You can receive up to $5,000 per employee for 2020 and up to $7,000 per employee per quarter in 2021.

Am I Qualified to Receive ERC?

Whether you qualify as an eligible employer depends on the period. Here are the dates and the eligibility requirements.

March 13, 2020, through Dec. 31, 2020

For the period from March 13, 2020, through Dec. 31, 2020, you must have carried on a trade or business, or you must have been a tax-exempt organization that:

- Was partially or fully suspended due to COVID-19 orders from an appropriate governmental authority

- Experienced a significant decline in gross receipts, defined as less than 50% of gross receipts for the same calendar quarter in 2019

If you were self-employed, you were not eligible for the 2020 ERC for your wages.

Jan. 1, 2021, through Sept. 30, 2021

For the period from Jan. 1, 2021, through Sept. 30, 2021, you must have carried on a trade or business or were a tax-exempt organization that:

- Was partially or fully suspended due to COVID-19 orders from an appropriate governmental authority

- Experienced a significant decline in gross receipts, defined as less than 80% of gross receipts for the same calendar quarter in 2019

For this period, If you were not in business in 2019, you could use 2020 as your comparison year.

Self-employed people were not eligible for the 2021 ERC for their wages.

What Wages Will be Qualified for ERC?

What wages will be qualified also depends on the period. Here are the dates and the eligibility requirements.

March 13, 2020, through Dec. 31, 2020

If you had 100 or fewer FTE (Full Time Employees) in 2019, wages paid to all employees (providing service and not providing service) are eligible for ERC.

If you had greater than 100 FTE, wages paid to employees not providing services are qualified.

Jan. 1, 2021, through Sept. 30, 2021

For calendar quarters in 2021, if you had 500 or fewer FTEs in 201, wages paid to all (providing service and not providing service) are eligible for ERC.

If you had greater than 500 FTEs, wages paid to employees not providing services are qualified.

If I took a PPP loan, can I still claim ERC?

Yes. The ERC is available to PPP borrowers. However, the employer can not double dip meaning they can only claim the ERC on any qualified wages that are not counted as payroll costs in obtaining PPP loan forgiveness.

How Can I Claim ERC?

Employers should consult with their legal and tax advisors to whether they are eligible for ERC and how to claim it. However, here is the summary of the process to claim ERC.

Although the program was repealed for most employers by September 30, 2021, the employers can still claim the credit by filing amended payroll tax returns. Eligible businesses can file a claim for a retroactive refund on previously paid qualified wages for past calendar quarters by filing Form 941-x, Adjusted Employer’s Quarterly Federal Tax Refund.