The Payroll Companies are Gouging the Cannabis Related Businesses (CRBs)

Quick links

-

Introduction

-

Discrimination: A Growing Concern

-

Pricing: High on Costs

-

Innovation: Beyond the Basics

-

Customization and Efficiency: No More Waiting Games

-

Economic Impact on the Cannabis Industry

-

How CRBs Can Advocate for Fair Treatment

-

Conclusion

1. Introduction

In an industry that’s surging forward with growth and innovation, Cannabis Related Businesses (CRBs) find themselves grappling with an unlikely adversary: payroll systems. While the industry at large grapples with regulatory intricacies, CRBs shouldn’t have to combat unfair payroll practices on top of that. Let’s dive into how leading payroll vendors fare against CRBs, and how UZIO is charting a distinct course.

2. Discrimination: A Growing Concern

Amid the regulatory complexities, CRBs have been facing overt discrimination from major payroll companies. It’s not just about higher pricing, but the underlying sentiment that treats CRBs as high-risk entities, consequently pushing them towards premium plans, which might be excessive for their needs.

Such practices not only impose financial burdens on CRBs but also propagate a narrative that CRBs are inherently riskier. This not only affects their operational costs but also can influence perceptions among potential business partners, investors, and even customers.

3. Pricing: High on Costs

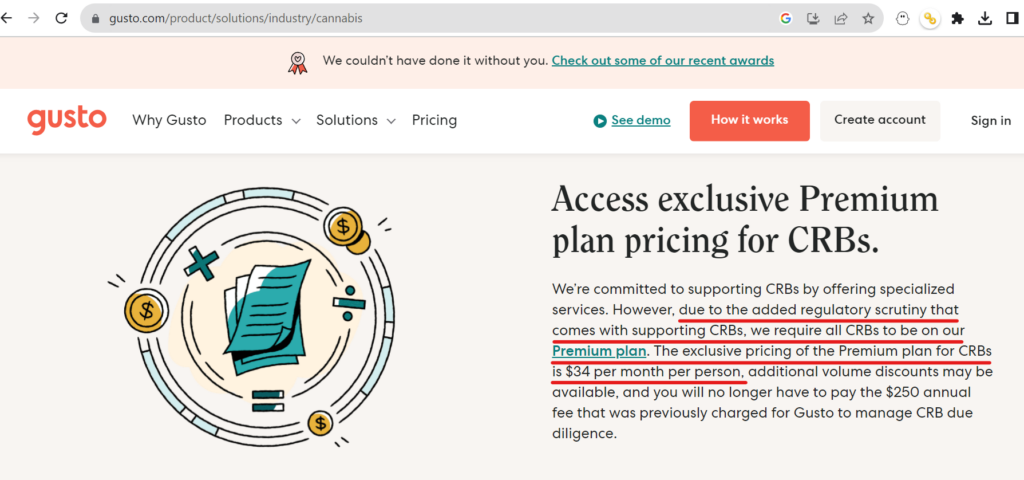

Gusto, one of the notable names in the payroll sector, obligates all CRBs to their Premium plan. With a price tag of $34 per month per person, the justification given is the “added regulatory scrutiny” that comes with CRBs. But is this price tag justified?

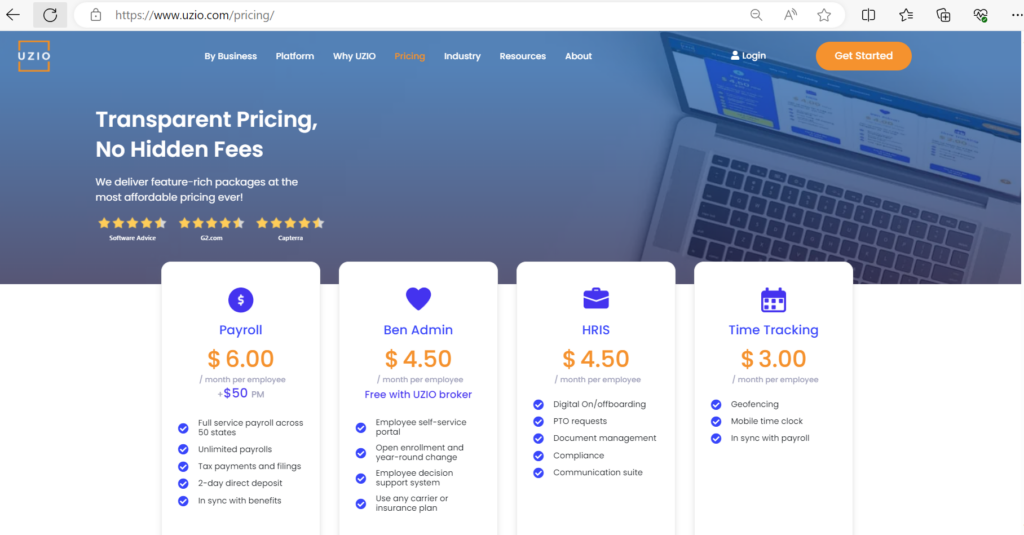

Contrast this with UZIO’s straightforward pricing – a mere $6 per person. No hidden fees, no discrimination against CRBs, just a fair deal.

Recommended Reading: Biggest pain point with Payroll and HR software

4. Innovation: Beyond the Basics

Other Major players who claim to serve the Cannabis industry often sideline innovative features for CRBs. As the cannabis industry evolves, it’s imperative to have a payroll system that’s equally dynamic. UZIO is well aware of this need, frequently rolling out updates and ensuring that CRBs stay ahead in the game.

5. Customization and Efficiency: No More Waiting Games

Delays in generating reports, implementing customizations, or tweaking the platform are a common gripe with many vendors. This sluggish pace is often due to their dependence on white-labeled solutions. In stark contrast, UZIO, with its in-house platform, promises swift turnarounds, often in just a day.

6. Economic Impact on the Cannabis Industry

The economic ramifications of discriminatory payroll practices stretch beyond the immediate financial burden on individual Cannabis Related Businesses (CRBs). Let’s delve deeper into the ripple effects:

- Stunted Growth and Innovation: Elevated payroll costs can limit the resources available for CRBs to invest in research, development, and market expansion. Over time, this can hinder the pace at which the industry innovates, potentially putting it behind other sectors.

- Barrier to New Entrants: For startups and new entrants in the cannabis sector, exorbitant payroll costs can be prohibitive. This could reduce competition, which in turn, may lead to reduced consumer choice and higher product prices.

- Loss of Jobs: Higher operational costs might force CRBs to adopt leaner staffing models, potentially leading to job cuts. Considering the potential of the cannabis industry as a significant job creator, this is a concerning prospect.

- Reduced Investor Confidence: Discriminatory practices and the associated financial strains can deter investors. A perceived high-risk, low-reward scenario might make investors think twice before funneling capital into CRBs.

7. How CRBs Can Advocate for Fair Treatment

For CRBs, it’s not just about navigating these challenges but turning them around. Here are proactive steps that CRBs can take to advocate for fair treatment:

- Forming Industry Alliances: By coming together and forming alliances or coalitions, CRBs can pool resources, share experiences, and speak with a unified voice. There’s strength in numbers, and a collective stand can exert pressure on payroll providers to revisit their discriminatory practices.

- Lobbying for Clearer Regulations: One of the reasons cited for discriminatory pricing is the “regulatory scrutiny.” CRBs can lobby for clearer, fairer regulations that can mitigate the perceived risks and pave the way for standardized, equitable pricing models.

- Public Awareness Campaigns: Enlightening the public about the unfair practices faced by CRBs can rally support. Leveraging social media campaigns, press releases, and partnerships with influencers can help in shedding light on the issue.

- Engaging with Fair-Practice Providers: By actively choosing and promoting payroll providers that practice transparent and fair pricing, CRBs can incentivize better business practices. This not only helps the individual businesses but sets a precedent in the industry.

- Legal Recourse: While it’s a more aggressive step, CRBs shouldn’t shy away from exploring legal options against blatantly discriminatory practices, especially if they’re baseless and exploitative.

By adopting these measures and maintaining a unified front, CRBs can move towards creating an industry landscape where fair treatment isn’t the exception but the norm.

8. Conclusion

The cannabis industry, in its path to maturity and mainstream acceptance, deserves partners that value and understand its unique nuances. Discriminatory practices, hidden fees, and unnecessary complexities should be a thing of the past. With UZIO’s transparent approach, innovation, and responsiveness, CRBs have the chance to collaborate with a true ally. It’s time CRBs experience fairness and unmatched value – and with UZIO, they certainly can.

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

Importance of Standard Operating Procedures (SOPs) for Modern Dispensaries

Quick links

-

Introduction

-

Understanding SOPs and Their Role in Dispensaries

-

Benefits of Implementing SOPs in Dispensaries

-

Challenges Faced by Dispensaries without SOPs

-

The UZIO Advantage: Streamlining Payroll with SOPs

-

Tips for Implementing and Maintaining SOPs

-

Conclusion

1. Introduction

The cannabis industry is not only budding—it’s flourishing. According to a report by Grand View Research, the global cannabis market is expected to reach USD $102.2 billion by 2030. This growth is being driven by the increasing legalization of cannabis in various countries, as well as the growing popularity of CBD products.

So with more states and countries legalizing its use, professionalism, consistency, and stringent operations are more crucial than ever. At the heart of this operational excellence? Standard Operating Procedures (SOPs). Let’s dive into why SOPs are a game-changer for modern dispensaries and how tools like UZIO can elevate their efficiency.

2. Understanding SOPs and Their Role in Dispensaries

Standard Operating Procedures, commonly known as SOPs, are a set of step-by-step guidelines crafted to help businesses maintain efficiency, quality output, and uniformity in daily functions. For dispensaries, SOPs aren’t just recommended—they’re essential. With regulations changing rapidly and customer expectations on the rise, SOPs act as the bridge to streamlined operations and top-notch service.

3. Benefits of Implementing SOPs in Dispensaries

- Ensuring Compliance: With different states and countries having varied cannabis regulations, SOPs provide a roadmap for dispensaries to remain compliant. They act as a checklist ensuring every procedure meets legal standards.

- Consistency in Operations: Imagine walking into your favorite coffee shop and receiving a different tasting brew each time. That’s what dispensaries without SOPs risk with their products. SOPs ensure that every customer gets the same high-quality experience, every time.

- Training and Onboarding: New employees? No problem. SOPs serve as an excellent training tool, ensuring that each staff member understands their roles and responsibilities.

- Risk Management: Well-defined SOPs minimize errors, accidents, and oversights, which could lead to potential legal repercussions. They are the shield against unforeseen operational pitfalls.

Recommended Reading: Biggest pain point with Payroll and HR software

4. Challenges Faced by Dispensaries without SOPs

Take, for example, Dispensary X. They started with great enthusiasm but overlooked the importance of SOPs. Soon, they faced regulatory fines, inconsistent product quality, and high employee turnover. Their lack of a structured operational guideline reflected in their declining customer reviews and diminishing profitability.

5. The UZIO Advantage: Streamlining Payroll with SOPs

Enter UZIO. In the realm of operational efficiency, UZIO’s all-in-one payroll solution emerges as the superhero for dispensaries. Here’s why:

- Operational Efficiency: UZIO automates and simplifies payroll processes, ensuring employees are paid timely and accurately. It’s the SOP for your payroll!

- Compliance Assurance: Navigating the maze of payroll compliance? UZIO is equipped with features that ensure your payroll is always in line with regulations.

- Ease of Integration: Modern dispensaries often juggle multiple systems. UZIO seamlessly integrates, making it a hassle-free addition to any dispensary’s operational toolkit.

- Cost Savings: Think about the hours saved and errors prevented. UZIO’s efficient payroll processing doesn’t just save time—it boosts the bottom line.

6. Tips for Implementing and Maintaining SOPs

- Regular Reviews: The cannabis landscape is evolving. Ensure your SOPs do too with regular reviews and updates.

- Training: Regular training sessions ensure staff stay updated and SOPs are consistently followed.

- Use Technology: Platforms like UZIO not only streamline operations but also ensure they align with your SOPs.

7. Conclusion

In the thriving world of cannabis, standing out requires more than just quality products. It demands operational excellence, consistency, and a forward-thinking approach. SOPs are the guiding stars for dispensaries aiming for success, and tools like UZIO are the vessels helping them navigate this exciting journey.

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

5 Ways Automated Payroll Will Save Your Dispensary Money

Quick links

1. Introduction

The cannabis industry is rapidly growing, but with that growth comes a set of unique challenges, especially when managing the financial side of the business. One of the most intricate areas to navigate? Payroll. With the nuances in regulations, hours, and payments in the cannabis sector, ensuring your employees are paid accurately and on time becomes paramount. Enter automated payroll systems, a game-changer for dispensaries.

2. Key ways automation can help save your dispensary money

As a dispensary owner, you know that every penny counts. That’s why it’s important to find ways to save money on your business expenses. And the one area where you can save a significant amount of money is on payroll. Let’s explore the five key ways automation can help save your dispensary money:

- Helps avoid time theft: Time theft is a serious problem for businesses of all sizes, and it can be especially costly for dispensaries. Automated payroll can help dispensaries avoid time theft in a number of ways. It can track employee hours more accurately. Automated payroll systems use time clocks or GPS tracking to track employee hours more accurately. This can help you identify and address time theft issues. It can identify suspicious activity. Automated payroll systems can identify suspicious activity, such as employees clocking in and out at the same time or clocking in early and clocking out late. This can help you investigate potential time theft cases. For example, one dispensary owner used automated payroll software to track their employees’ clock-in and clock-out times. This software helped them to identify employees who were clocking in late or clocking out early. The dispensary owner was able to address these issues and reduce time theft.

- Helps reduce errors: Manual payroll is prone to errors, such as incorrect hours worked, incorrect pay rates, and missed payments. Automated payroll eliminates these errors, which can save you money in the long run. For example, one dispensary owner accidentally paid one of their employees twice. This mistake cost the dispensary $1,000. Automated payroll software can help you avoid these errors by automating the calculations and ensuring that all of your employees are paid correctly.

- Saves time: Manual payroll can be time-consuming, especially for small businesses with a large number of employees. Automated payroll can save you hours of time each week, which you can then use to focus on other aspects of your business like driving profitable growth. For example, one dispensary owner used to spend 10 hours each week processing payroll. After implementing automated payroll software, they were able to reduce this time to two hours per week. Those eight hours of savings can now be dedicated to growing the business.

- Improves accuracy: Automated payroll is more accurate than manual payroll, which can help you avoid costly mistakes. For example, one dispensary owner used automated payroll software to track their payroll costs over time. This data showed them that they were overpaying their employees by $1,000 per month. By adjusting their payroll practices, they were able to save this money ($12,000+ savings a year).

- Increases compliance: Automated payroll helps you stay compliant with federal, state, and local payroll regulations. This is important to avoid costly fines and penalties. The U.S. Department of Labor (DOL) fines businesses up to $1,100 per day for each violation of wage and hour laws.

Automated payroll systems can help you stay compliant with these laws by automatically calculating overtime pay and deductions. For example, one dispensary owner was audited by the IRS and found to be out of compliance with payroll regulations. This resulted in a fine of $5,000. Automated payroll software can help you avoid these problems by ensuring that your payroll records are always up-to-date and compliant.

Recommended Reading: Biggest pain point with Payroll and HR software

3. Conclusion

In the dynamic world of the cannabis industry, every edge counts. Automated payroll isn’t just about convenience; it’s a strategic move that can yield significant financial benefits. For dispensaries aiming to streamline operations, boost accuracy, and ensure compliance, transitioning to an automated solution is more than a recommendation – it’s a necessity.

So if you’re concerned about time theft in your dispensary, automated payroll is a great way to help prevent it. It can help you track employee hours more accurately, identify suspicious activity, and enforce policies. This can save you money and help you protect your business from fraud.

If you’re not already using automated payroll, we encourage you to consider it.

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

UZIO Technology Inc. welcomes Lilly Raney as Head of Sales

Great Falls, VA. Aug 3rd, 2023

UZIO Technology Inc. is delighted to announce the appointment of Lilly Raney as the Head of Sales. She officially joined our team on August 3rd, 2023. Reporting directly to our CEO, Sanjay Singh, Lilly brings a wealth of experience and expertise especially in the Cannabis space to our leadership team.

Meet Lilly Raney:

Lilly Raney, the newly appointed Head of Sales for UZIO, brings over 15 years of diversified industry experience to her new leadership role. Beginning her professional journey in the athletic footwear and apparel sector, she spent a decade supporting specialty brick-and-mortar establishments. In 2018, Lilly made a strategic transition into the cannabis field.

She has since devoted 5 years to specializing in SaaS POS systems, first within the cannabis industry, and subsequently expanding into other SaaS verticals including HR/Payroll with UZIO. As a former Regional Sales Director at Dutchie, Lilly’s core expertise centers on sales leadership and operational efficiency.

With a proven track record and a steadfast dedication to pushing boundaries, Lilly Raney emerges as a beacon of excellence within the realm of sales leadership. Her unwavering dedication to fostering a strong and sustainable future for the cannabis industry is a testament to her commitment to innovation and growth.

Lilly’s Role at UZIO:

In her capacity as Head of Sales, Lilly Raney will play a pivotal role in driving the growth and success of UZIO Technology Inc. Her extensive experience in sales leadership and deep understanding of the cannabis industry and SaaS solutions will be instrumental as we continue to expand our presence and offerings.

A word from the CEO:

“We are very pleased that Lilly has been able to join us and lead our sales team. Lilly’s skillset is very well aligned to our company vision and the verticals we serve. She brings not only tremendous experience and energy, she has a passion for exemplary customer service which very much corresponds to our culture here. I feel confident our customers will be in great hands with Lilly’s leadership.” said Sanjay Singh, CEO of UZIO.

About UZIO:

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carriers serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

Cannabis Moving from Schedule I to Schedule III: What Does It Mean for the Industry?

Quick links

-

Introduction

-

Understanding the Schedules

-

Some of the potential impacts of cannabis moving from Schedule I to Schedule III

-

What’s Next

1. Introduction

On August 29, 2023, the US Department of Health & Human Services (HHS) sent a letter to the Drug Enforcement Administration (DEA) recommending that cannabis be moved from Schedule I to Schedule III. This is a significant development, as it could have a major impact on the cannabis industry.

2. Understanding the Schedules

Schedule I drugs are considered to have no accepted medical use and a high potential for abuse. Schedule III drugs, on the other hand, are considered to have a moderate potential for abuse and some accepted medical use.

If cannabis is moved to Schedule III, it would mean that businesses could deduct their ordinary business expenses from their federal taxes. This would be a major boon to the cannabis industry, as it would make businesses more profitable and allow them to invest more in growth and hiring.

It would also make it easier for banks to do business with cannabis companies, as they would no longer be considered to be money laundering businesses. This would help to legitimize the cannabis industry and make it more accessible to consumers.

Of course, there are still some hurdles that would need to be overcome before cannabis could be moved to Schedule III. The DEA would need to agree to the HHS’s recommendation, and Congress would need to pass legislation to make the change. However, this is a positive step forward for the cannabis industry, and it could lead to significant changes in the way that cannabis is regulated and taxed.

3. Here are some of the potential impacts of cannabis moving from Schedule I to Schedule III

- Cannabis moving from Schedule I to Schedule III would eliminate 280E: 280E is the federal tax code that prevents businesses selling Schedule I or Schedule II controlled substances (such as cocaine, cannabis, etc) from claiming deductions for their ordinary business expenses. A lot of well managed cannabis companies are still in the red because they cannot deduct the expenses. Transitioning from schedule I to schedule III could not only make 280E to be unenforceable, but also positively impact companies’ profitability.

- Increased investment in the cannabis industry: As businesses become more profitable, they will be more likely to attract investment from venture capitalists and other investors. This could lead to increased research and development, as well as the expansion of existing businesses.

- Increased employment opportunities: The cannabis industry is already a major job creator, and moving to Schedule III could create even more jobs. This is especially true in the areas of cultivation, manufacturing, and retail.

- Increased access to cannabis for medical patients: Schedule III drugs are considered to have some accepted medical use, which means that it would be easier for patients to get access to cannabis for medical purposes. This could help to improve the quality of life for many patients.

- Ease restrictions to access for cannabis researchers: The Schedule I classification imposes significant requirements on researchers, making it difficult for scientists to study the potential benefits and risks of cannabis. The move to Schedule III could unlock new opportunities for research, potentially leading to new medical treatments and a better understanding of cannabinoids like tetrahydrocannabinol, the main psychoactive substance contained in cannabis plants.

- Reduced criminal penalties for cannabis possession: Currently, possession of even small amounts of cannabis can result in criminal charges. Moving to Schedule III would mean that these charges would be less severe, and it could also lead to the expungement of past convictions.

Overall, the potential impacts of cannabis moving from Schedule I to Schedule III are positive. It would make the industry more legitimate, create jobs, and improve access to cannabis for medical patients. While there are still some hurdles that would need to be overcome, this is a significant step forward for the cannabis industry.

For companies specializing in cannabis staffing, the reclassification would signify a resurgence of growth and hiring. Investment is likely to flow back into the cannabis sector, leading to a positive ripple effect.

Recommended Reading: Biggest pain point with Payroll and HR software

4. What’s Next

The timeline for these changes remains uncertain, but industry experts predict that we may receive an update from the DEA by the end of the year. Implementation, however, could take several quarters. While it might take a bit of time before the positive impact becomes evident in terms of increased hiring, anticipation is building as more information emerges.

In conclusion, the potential reclassification of cannabis from Schedule I to Schedule III and the removal of Section 280E marks a significant step forward in federal cannabis reform. It offers renewed hope to an industry that has faced numerous challenges. While the road ahead may be winding, it presents an opportunity for growth, job creation, and positive change in the cannabis landscape. As developments unfold, the industry and its stakeholders eagerly await a promising future.

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

How Much Does a Dispensary Owner Make in 2024 [Updated]?

![How Much Does a Dispensary Owner Make in 2024 [Updated]?](https://www.uzio.com/resources/wp-content/uploads/2023/08/Income-Potential-of-Dispensary-Owners_Uzio.png)

Quick links

-

Introduction

-

Dispensary Owner Earning Statistics

-

Factors Affecting Dispensary Owner Income

-

Costs and Expenses of Running a Dispensary

-

Legal and Regulatory Considerations

-

Success Stories of Dispensary Owners

-

Tips for Maximizing Dispensary Profit Margins

-

Conclusion

1. Introduction

The cannabis industry has been growing rapidly in recent years, with more and more states legalizing both recreational and medical marijuana. As a result, many entrepreneurs are considering opening a dispensary and becoming a part of this booming industry. One of the most common questions that potential dispensary owners have is how much they can expect to make from their business in 2024. In this blog, we will explore the factors that affect a dispensary owner’s income and provide an overview of the costs and expenses associated with opening and running a dispensary.

2. Dispensary Owner Earning Statistics

According to a survey by MJBizDaily, the average dispensary owner makes between $250,000 and $500,000 per year. However, a small percentage of dispensary owners make up to $1,000,000 a year. The average dispensary produces around $2 million in sales yearly with a 12% profit margin. This means that dispensary owners can take home a minimum gross profit of $240,000 annually.

3. Factors Affecting Dispensary Owner Income

There are several factors that can affect a dispensary owner’s income. These include overhead costs, monthly rent, loans, income, profit margin, foot traffic, and eCommerce channel. The type of dispensary (recreational or medical), number of employees hired, and inventory management can also influence an owner’s earnings.

Location is a critical factor that can affect a dispensary’s success. Dispensaries located in areas with high foot traffic and a large customer base are more likely to generate higher revenue. Additionally, the type of products sold and the pricing strategy can also impact a dispensary’s profitability.

4. Costs and Expenses of Running a Dispensary

The cost of opening and running a dispensary can vary widely depending on several factors. The average up-front investment to open a dispensary in California is between $80,000 and $250,000, and ongoing operating expenses can cost between $30,000 and $70,000 per month. However, the total cost of opening a dispensary can range anywhere from $150,000 to over $2 million.

Dispensary owners need to consider several expenses, such as rent, utilities, staff salaries, security, insurance, and compliance with state regulations. Additionally, dispensaries need to invest in a compliant POS system to tender sales, a security system, and a sufficient supply of cannabis inventory to sell.

5. Legal and Regulatory Considerations

The legal and regulatory frameworks surrounding cannabis in the United States are complex and constantly evolving. Cannabis is still illegal under federal law, but many states have legalized both recreational and medical marijuana. Dispensary owners need to comply with state regulations and obtain the necessary licenses and registrations.

There are potential legal complications related to financing, production, transport, and sale of cannabis products, even in states with legal recreational marijuana use. Dispensary owners need to work with legal and financial advisors that have cannabis-specific expertise to navigate the complex legal and regulatory landscape.

6. Success Stories of Dispensary Owners

Despite the challenges and expenses associated with opening and running a dispensary, many entrepreneurs have been able to generate substantial income from their businesses. For example, one dispensary owner in Colorado reported making $1.5 million in annual revenue.

Dispensary owners can optimize various aspects of their business, such as location, stock, foot traffic, and customer base, to increase their profitability. By providing high-quality products and excellent customer service, dispensary owners can build a loyal customer base and increase their revenue.

7. Tips for Maximizing Dispensary Profit Margins

- Find Your Break-Even Point: Use the break-even formula to determine your break-even point. This will help you understand the minimum amount of revenue you need to generate to cover your expenses and start making a profit.

- Provide Daily Deals: Consider providing a daily deal to attract more customers and increase sales. For example, you could offer 50% off a single item or a free gram with a purchase of an ounce.

- Streamline Your Operations: Identify your operation’s daily functions and look for ways to reduce costs. With the right system of checks and balances in place, you can ensure your business is operating as cost-effectively as possible.

- Reduce Operational Costs: Reduce operational costs by optimizing your staffing levels, negotiating better deals with suppliers, and minimizing waste.

- Boost Average Basket Size Per Customer: Encourage customers to purchase more by offering bundle deals or discounts for larger purchases.

- Plan Your Purchases and Inventory Well: Plan your purchases and inventory well to avoid overstocking or understocking. This will help you maximize your cash flow and minimize waste.

- Keep a Tight Control on Your Non-Cost of Goods Expenses: Keep your non-Cost of Goods expenses under control by finding ways to reduce your rent, utilities, and other operating costs.

Recommended Reading: Biggest pain point with Payroll and HR software

Conclusion

Opening and running a dispensary can be a profitable business, but it requires careful planning, investment, and compliance with state regulations. Dispensary owners need to consider several factors that can affect their income, such as location, overhead costs, and inventory management. By optimizing various aspects of their business and providing excellent customer service, dispensary owners can increase their profitability and generate substantial income.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.

Enhancing Employee Retention through Payroll Software: A Path to Diversity and Inclusion

Quick links

-

Introduction

-

Equitable Compensation: A Pillar of Retention and Inclusion

-

Tailored Benefits: Elevating Job Satisfaction and Inclusiveness

-

Flexible Work Arrangements: Balancing Work and Life for Enhanced Retention

-

Data-Driven Insights: Enhancing Inclusiveness and Retention Strategies

-

Seamless Onboarding and Engagement: A Critical Connection

-

Empowerment through Self-Service: Enhancing Inclusiveness

-

Nurturing a Culture of Recognition and Growth: Impact on Retention

-

Conclusion

1. Introduction

In today’s rapidly changing business landscape, small and medium-sized businesses (SMBs) are increasingly realizing the profound impact of diversity and inclusion on innovation, company culture, and overall success. As a versatile tool that contributes not only to nurturing diversity and inclusion but also significantly enhancing employee retention, modern payroll software has transcended its conventional role. This article delves into how payroll software can be strategically employed to achieve these dual objectives, complemented by real-world examples showcasing its positive influence.

2. Equitable Compensation: A Pillar of Retention and Inclusion

At the core of the employee-employer relationship lies equitable compensation. Payroll software forms the foundation for fair pay practices by standardizing roles and pay scales. This proactive approach not only eliminates pay disparities but also fosters an environment of inclusivity, where every employee’s contribution is valued. By ensuring fair compensation, payroll software becomes integral in building trust and loyalty, significantly impacting employee retention rates.

Example: A technology startup implemented payroll software that eradicated gender-based pay gaps. This initiative not only resulted in a diverse workforce but also increased employee morale and long-term commitment.

3. Tailored Benefits: Elevating Job Satisfaction and Inclusiveness

Acknowledging diverse work styles and personal commitments is integral to creating an inclusive workplace. Payroll software facilitates the provision of flexible work arrangements, such as remote work and adaptable hours. By empowering employees to balance their professional and personal lives effectively, SMBs can enhance job satisfaction, job performance, and ultimately, employee retention.

Example: A retail enterprise leveraged payroll software to implement flexible scheduling, leading to increased employee satisfaction and a higher rate of retention as employees enjoyed improved work-life balance.

4. Flexible Work Arrangements: Balancing Work and Life for Enhanced Retention

Acknowledging diverse work styles and personal commitments is integral to creating an inclusive workplace. Payroll software facilitates the provision of flexible work arrangements, such as remote work and adaptable hours. By empowering employees to balance their professional and personal lives effectively, SMBs can enhance job satisfaction, job performance, and ultimately, employee retention.

Example: A retail enterprise leveraged payroll software to implement flexible scheduling, leading to increased employee satisfaction and a higher rate of retention as employees enjoyed improved work-life balance.

5. Data-Driven Insights: Enhancing Inclusiveness and Retention Strategies

Modern payroll software offers robust data analytics capabilities, providing insights into workforce demographics, turnover rates, and pay equity. By analyzing this data, SMBs can identify areas for improvement within their diversity and inclusion initiatives. Addressing these areas directly impacts employee retention by fostering an environment where all employees feel valued and supported.

Example: A manufacturing SMB used payroll software to analyze workforce data and identified higher turnover rates among specific employee groups. By implementing targeted inclusion strategies, they successfully improved retention among these employees.

6. Seamless Onboarding and Engagement: A Critical Connection

The integration of payroll software with applicant tracking systems streamlines the onboarding process for new hires. This seamless transition sets the stage for an inclusive workplace culture right from the start. A positive onboarding experience directly impacts employee engagement, job satisfaction, and long-term retention.

Example: A hospitality SMB integrated payroll software with its applicant tracking system, resulting in smoother onboarding experiences for new hires. This approach enhanced employee engagement and ultimately contributed to improved retention rates.

7. Empowerment through Self-Service: Enhancing Inclusiveness

Modern payroll software often includes employee self-service portals, allowing individuals to manage their payroll details, access tax forms, and update personal information autonomously. This empowerment fosters a sense of inclusiveness and involvement, further enhancing employee retention.

Example: An e-commerce SMB embraced payroll software’s self-service features, allowing employees to manage their information. This empowerment contributed to increased engagement and played a role in employee retention.

8. Nurturing a Culture of Recognition and Growth: Impact on Retention

Beyond equitable compensation and tailored benefits, fostering a culture of recognition and growth is pivotal for enhancing employee retention. Payroll software can play a role in facilitating this culture by streamlining performance appraisal processes, enabling timely feedback, and identifying opportunities for employee development.

Example: An advertising agency integrated performance appraisal functionalities into their payroll software. This allowed managers to provide real-time feedback, recognize outstanding contributions, and chart out personalized growth paths for each employee. This approach not only boosted employee morale but also significantly improved retention rates as employees felt valued and invested in their career progression.

Recommended Reading: Biggest pain point with Payroll and HR software

Conclusion

Diversity, inclusion, and employee retention have evolved from aspirational goals to essential elements of a thriving SMB’s strategy. By leveraging the capabilities of modern payroll solutions, SMBs can simultaneously advance these objectives. Through fair compensation, tailored benefits, flexible work arrangements, data-driven insights, seamless onboarding, and self-service empowerment, payroll software becomes a potent instrument in creating inclusive workplaces where employees flourish. These practices not only bolster diversity and inclusion initiatives but also directly influence employee retention rates, fostering a loyal and engaged workforce. As businesses continue to evolve, integrating payroll software into diversity and inclusion initiatives remains a strategic imperative for SMBs committed to building diverse, inclusive, and retention-focused workplaces.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.

Employee Background Checks for Dispensary Hiring: Owner’s Guide

Quick links

-

Introduction

-

Unique Considerations in the Cannabis Industry

-

Types of Background Checks

-

Laws and Regulations

-

Do all dispensaries need to run background checks on budtenders?

-

Benefits of Background Checks

-

Risks of Not Conducting Background Checks

-

The future of background screening requirements

-

Conclusion

1. Introduction

The cannabis industry is a rapidly growing industry in the United States. As of May 2023, there are 37 states and the District of Columbia that have legalized cannabis for medical or recreational use to varying degrees. This growth has led to a demand for qualified employees in the cannabis industry.

One of the most important steps in the hiring process for cannabis dispensaries is conducting background checks on potential employees. Background checks can help to ensure that dispensaries are hiring trustworthy and reliable employees who are not likely to engage in criminal activity.

2. Unique Considerations in the Cannabis Industry

The cannabis industry has some unique considerations when it comes to conducting background checks. These considerations include:

- The evolving legal status of cannabis: Cannabis is still illegal under federal law, even though it is legal in many states. This means that there is some uncertainty about the legal implications of conducting background checks on cannabis industry employees.

- The need to maintain compliance in a sensitive market: The cannabis industry is a sensitive market, and dispensaries need to be careful not to violate any laws or regulations. This includes being careful about the information that is obtained during background checks.

- The cost of background checks: Background checks can be expensive, especially for small businesses. This can be a barrier for some dispensaries, especially those that are just starting out.

3. Types of Background Checks

There are a variety of background checks that can be conducted on potential employees in the cannabis industry, including:

- Criminal background checks: Criminal background checks can help to identify potential employees who have a history of criminal activity, such as theft, fraud, or violence.

- Credit checks: Credit checks can help to identify potential employees who have financial problems, such as unpaid debts or bankruptcies.

- Drug tests: Drug tests can help to identify potential employees who use illegal drugs.

The specific types of background checks that are conducted will vary depending on the position and the state in which the dispensary is located. For example, dispensaries that are located in states with stricter regulations may require more extensive background checks than dispensaries that are located in states with less strict regulations.

4. Laws and Regulations

The laws and regulations governing background checks in the cannabis industry vary from state to state. Dispensaries should be familiar with the laws and regulations in their state before conducting background checks on potential employees.

In general, background checks are permissible in the cannabis industry. However, there are some restrictions on the types of background checks that can be conducted and the information that can be obtained. For example, some states prohibit background checks that include information about a person’s medical history or their use of cannabis.

Requirements for cannabis business owners and employees

Also as with other cannabis regulations, regarding the background check policy, it can be significantly stricter for a leader at the helm of a marijuana business than for an employee. Some states, for example, have rules that bar individuals with certain criminal convictions from getting a state license to open a cannabis business. At the same time, a person with the same conviction would often be allowed to go to work for an existing cannabis business without jeopardizing that company’s licensing.

5. Do all dispensaries need to run background checks on budtenders?

The answer to this question is not always clear-cut. In some states, all dispensaries are required to run background checks on all employees, including budtenders. In other states, dispensaries are only required to run background checks on budtenders if they are handling cash or if they have access to the dispensary’s inventory.

Ultimately, the decision of whether or not to run a background check on a budtender is up to the individual dispensary. However, it is important to note that running a background check can help to protect the dispensary and its customers from potential risks, such as employee theft, fraud, and drug dealing.

6. Benefits of Background Checks

Background checks can offer a number of benefits for cannabis dispensaries, including:

- Protection from employee theft: Background checks can help to identify potential employees who are more likely to steal from the dispensary.

- Protection from fraud: Background checks can help to identify potential employees who are more likely to commit fraud, such as embezzlement or financial statement fraud.

- Protection from drug dealing: Background checks can help to identify potential employees who are more likely to deal drugs from the dispensary.

- Protection from workplace violence: Background checks can help to identify potential employees who are more likely to commit workplace violence.

7. Risks of Not Conducting Background Checks

Dispensaries that do not conduct background checks on potential employees are taking on a significant risk. Without background checks, dispensaries may hire employees who have a criminal history, financial problems, or drug use problems. These employees could pose a risk to the dispensary and its customers.

For example, an employee with a criminal history could steal from the dispensary or commit fraud. An employee with financial problems could embezzle money from the dispensary or commit other financial crimes. An employee with drug use problems could be impaired on the job and pose a safety risk to themselves and others.

8. The future of background screening requirements

The future of background screening requirements in the cannabis dispensary space is likely to be shaped by a number of factors, including:

- The continued legalization of cannabis: As more states legalize cannabis, the demand for background checks on dispensary employees is likely to increase. This is because businesses will want to ensure that they are hiring qualified and trustworthy employees who are not a risk to their customers or their business.

- The development of new technologies: New technologies are being developed that can make background screening more efficient and effective. For example, there are now companies that offer blockchain-based background checks that are more secure and tamper-proof than traditional background checks.

- The changing attitudes towards cannabis: As attitudes towards cannabis continue to change, the stigma associated with cannabis use is likely to decline. This could lead to more businesses being willing to hire people with a history of cannabis use, which could reduce the need for background checks for cannabis-related offenses.

Overall, the future of background screening requirements in the cannabis dispensary space is likely to be a dynamic one. The specific requirements will vary from state to state, but it is clear that background screening will continue to be an important part of the hiring process for dispensaries.

Here are some additional trends that could impact the future of background screening requirements in the cannabis dispensary space:

- The increasing use of artificial intelligence (AI) in background screening: AI is being used to automate many aspects of the background screening process, from data collection to risk assessment. This could lead to more efficient and cost-effective background screening for dispensaries.

- The growing demand for customized background screening: Dispensaries may want to customize their background screening requirements to meet the specific needs of their business. For example, a dispensary that sells medical marijuana may want to conduct more stringent background checks on employees who will be handling the product.

- The increasing importance of social media screening: Social media screening is becoming an increasingly important part of the background screening process. Dispensaries may want to review the social media profiles of potential employees to look for red flags, such as evidence of drug use or violent behavior.

Recommended Reading: Biggest pain point with Payroll and HR software

Conclusion

By conducting background checks, cannabis dispensaries can help to protect themselves from risk and ensure that they are hiring the best possible employees. Background checks are an important part of the hiring process for any business, but they are especially important for businesses in the cannabis industry.

If you are a cannabis dispensary owner or manager, we encourage you to learn more about the laws and regulations governing background checks in your state. You should also work with a reputable background check company to conduct background checks on potential employees. By doing so, you can help to protect your business and your customers.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.