UZIO’s November 2024 Product Release – Exciting New Features!

Great Falls, VA.

We are thrilled to introduce the latest updates to our HRIS, Scheduling, and Payroll modules! These enhancements are thoughtfully designed to streamline your workflows, boost flexibility, and elevate your overall UZIO experience.

Here’s What’s New

UZIO Scheduling Enhancements

- Empower employees with shift swaps and offers for greater flexibility.

- Gain insights with shift approval tracking to enhance transparency.

- Monitor and manage budgets across work locations.

- Assign open shifts across multiple locations with ease.

UZIO HRIS Enhancements

- Meet compliance with our Clear I-9 integration, combining I-9 and E-Verify in one seamless solution.

- Mandatory Document Completion for Onboarding.

- Advanced Timesheet Access Controls for Reporting Managers.

UZIO Payroll Enhancements

- Support for Quarterly and Annual payroll frequencies, enabling greater flexibility in payroll processing.

UZIO Help Center Update

- The Help Center URL has changed to https://help.uzio.com/s/

For more details about any of these features, please click here. For any other query, please email info@uzio.com or give us a call at (866) 404-0284.

A word from the CEO:

“Right from the beginning, we have instituted a company culture where our team members make an extra effort to listen to the feedback from our customers and are always on the lookout for ways to improve the end user experience.” said Sanjay Singh, CEO of UZIO Technology, Inc. “A number of enhancements in this release are the direct result of a collaborative working relationship we have with our customers where their feedback is listened to and given high priority as we make investment in our product roadmap.“

About UZIO Technology Inc.:

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carriers serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

UZIO Technology, Inc. Welcomes Mak Thigale as CTO

Great Falls, VA.

UZIO Technology, Inc. is delighted to announce the appointment of Mak Thigale as the Chief Technology Officer (CTO). Mak officially joined the team in November 2024 and will report directly to UZIO’s CEO, Sanjay Singh

Meet Mak Thigale:

With an illustrious career spanning over three decades, Mak Thigale is a technology visionary specializing in IT transformation, automation, and artificial intelligence. He has successfully led multi-million and billion-dollar outsourcing engagements across industries, including Healthcare, Manufacturing, Technology, BFSI, and Utilities, for Fortune 500 companies. Mak’s professional journey includes leadership roles at Wipro, where he spearheaded initiatives in hyper-automation, delivery transition & transformation, and M&A integration. He has also advised companies on leveraging Generative AI (Gen AI) and large language models (LLMs) to deliver greater value to stakeholders. His career highlights include:

- Leading AI-driven delivery transformations, improving customer satisfaction and efficiency.

- Driving automation and cloud migrations, resulting in enhanced user experience, cost savings and operational excellence.

- Earning prestigious accolades, including the CFO Award (2023) and CEO Award (2017) for exceptional leadership.

- Establishing frameworks and methodologies recognized as industry benchmarks.

- Mak has lived and worked across India, the USA, Germany, and Canada, gaining a global perspective and cultivating a deep understanding of diverse markets.

Mak’s Role at UZIO:

As CTO, Mak will lead UZIO’s technology vision and strategy, overseeing the transformation of the company to become an AI-First company. His leadership will focus on integrating AI-powered innovations and scaling UZIO’s SaaS platform to meet the dynamic needs of SMBs in the United States.

A word from the CEO:

“We are honored to welcome Mak to the UZIO leadership team,” said Sanjay Singh, CEO of UZIO. “Mak’s unparalleled expertise in AI, automation, and large-scale transformations aligns perfectly with UZIO’s commitment to become an AI-First company and empowering SMBs with innovative solutions. His strategic vision and global experience will be instrumental in propelling UZIO’s growth and delivering exceptional value to our clients.”

About UZIO:

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carriers serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

California Workers’ Push for Fair Wages: What It Means for Cannabis SMBs

Quick links

-

Introduction

-

The Wage Landscape: Challenges and Opportunities

-

Why Wages Matter: Retaining Talent in a Competitive Market

-

Practical Strategies for Cannabis SMBs

-

The Path Forward for Cannabis SMBs

1. Introduction

California’s cannabis industry is at a crossroads. While celebrated for its innovation and growth, the sector faces mounting challenges, including rising operational costs, stiff competition, and increasing worker demands for fair wages and benefits. For cannabis small and medium-sized businesses (SMBs), these pressures underscore the need to rethink workforce strategies to remain competitive in a rapidly evolving job market. A recent strike vote by more than 500 delivery drivers highlights deeper challenges in an industry grappling with high taxes, overregulation, and fierce competition.

2. The Wage Landscape: Challenges and Opportunities

California’s current minimum wage stands at $16 per hour, but regional disparities and industry-specific standards create a more complex picture. Fast-food workers now earn $20 per hour, and healthcare employees are on a path to a $25/hour minimum wage. For cannabis SMBs, the pressure to offer competitive pay is compounded by California’s high cost of living, which demands an estimated $27/hour for basic expenses.

Key Insights for Cannabis SMBs:

- Entry-Level Roles: Budtenders and delivery drivers often earn between $17 and $20 per hour, competitive in some areas but insufficient in others.

- Management Roles: Positions like dispensary managers earn $30/hour, providing an opportunity to attract talent with clear career paths and growth potential.

Cost Pressures: Regulatory fees, taxes, and slim margins make wage increases challenging, but failing to compete on pay and benefits could lead to high turnover and difficulty hiring skilled workers.

3. Why Wages Matter: Retaining Talent in a Competitive Market

The rise of fast-food wages and benefits, such as tuition assistance and healthcare, has shifted worker expectations across industries. Cannabis SMBs that fail to meet these standards risk losing talent to sectors perceived as more stable and rewarding.

Implications for Cannabis SMBs:

- Turnover Costs: High turnover disrupts operations and increases hiring costs. Retaining skilled workers saves money in the long run.

- Brand Reputation: Businesses known for fair pay and supportive workplaces are more likely to attract loyal employees and customers.

Operational Efficiency: A well-compensated, motivated workforce delivers better customer service and operational outcomes.

4. Practical Strategies for Cannabis SMBs

Despite tight margins, cannabis SMBs can adopt creative strategies to offer competitive compensation and build a loyal workforce.

Performance-Based Incentives

Tie employee bonuses directly to measurable achievements, creating a win-win scenario for both the business and its workforce. For example:

- Sales Bonuses: Reward budtenders who exceed monthly sales goals, upsell premium products, or achieve a high percentage of repeat customer sales.

- Customer Service Rewards: Offer bonuses for exceptional customer feedback or for maintaining high ratings on review platforms.

- Team-Based Incentives: Introduce team goals where the entire staff benefits from hitting overall sales or customer satisfaction benchmarks, fostering collaboration and team spirit.

- Seasonal Incentives: Create special reward programs during peak seasons or promotional periods, such as cash bonuses or gift cards for employees who hit specific targets.

- Recognition-Based Rewards: Incorporate “Employee of the Month” programs with tangible rewards like bonus pay, extra PTO, or gift certificates.

Performance-based incentives not only encourage employees to excel but also align their efforts with your business goals, ensuring that top performers feel valued and motivated to stay. By tailoring incentives to your dispensary’s unique operations, you can enhance both productivity and morale without significantly increasing fixed costs.

Flexible Work Arrangements

Providing flexibility in scheduling and work arrangements can significantly improve employee satisfaction and retention. For cannabis SMBs, this approach can be tailored to the unique demands of the industry:

- Shift Swapping: Allow employees to swap shifts with co-workers using simple approval processes, reducing scheduling conflicts and absenteeism.

- Custom Schedules: Offer part-time or compressed workweek options to accommodate employees with personal or family commitments.

- Split Shifts: Permit employees to split their workday into two shorter shifts, ideal for those balancing work with education or caregiving responsibilities.

- On-Call Flexibility: Create an on-call system where employees can voluntarily cover shifts during busy periods, earning extra pay for their availability.

- Remote or Hybrid Roles: For positions such as inventory management or administrative support, consider hybrid or remote work options, leveraging technology to maintain efficiency.

- Predictable Scheduling: Implement consistent and predictable scheduling practices to help employees better manage their personal lives, reducing stress and improving productivity.

- Personalized Hours: When feasible, allow employees to request specific working hours based on their individual needs or preferences.

Flexible work arrangements show employees that you value their time and well-being, fostering loyalty and reducing turnover. By offering adaptability within operational constraints, cannabis SMBs can cultivate a supportive workplace that attracts and retains top talent.

Career Growth Opportunities

Providing employees with clear pathways for advancement is essential for retaining talent and maintaining a motivated workforce. For cannabis SMBs, structuring opportunities for professional growth can differentiate your business in a competitive job market:

- Defined Career Paths: Develop step-by-step progression plans for roles, such as moving a budtender to assistant manager, then to dispensary manager, with specific milestones and salary increases at each level.

- Skill Development Programs: Offer regular training sessions on topics like cannabis product knowledge, customer service, compliance, or sales strategies. This not only enhances employee performance but also prepares them for advanced roles.

- Mentorship Initiatives: Pair seasoned employees with newer team members to provide guidance and foster leadership skills. Mentorship can accelerate professional growth and build a sense of community within the workplace.

- Certifications and Education Support: Provide funding or reimbursements for certifications related to cannabis, such as compliance training or advanced cultivation techniques. Employees who feel supported in their educational pursuits are more likely to stay.

- Leadership Development: Identify high-performing employees and offer them leadership development programs to prepare them for managerial roles.

- Internal Promotions: Prioritize promoting from within whenever possible. Highlight success stories of employees who have advanced within your company to inspire others.

- Stretch Assignments: Give employees opportunities to take on new responsibilities, such as overseeing a marketing campaign or leading a new product launch, to help them develop skills and confidence.

- Regular Career Reviews: Schedule biannual or quarterly career discussions to map out individual goals and provide feedback, ensuring employees see a long-term future with your company.

By investing in career growth opportunities, cannabis SMBs can create a culture of learning and advancement. This not only improves retention but also builds a skilled workforce capable of supporting the company’s long-term success. Employees who see a clear path to growth are more likely to stay engaged and committed, helping your business thrive in a competitive industry.

Employee Wellness Programs

A healthy and financially secure workforce is essential for the success of cannabis SMBs. Offering wellness programs that address physical, mental, and financial well-being can significantly enhance employee satisfaction and loyalty. Here’s how:

Physical Wellness Initiatives:

- Healthcare Coverage: Provide basic healthcare plans or access to telemedicine services. Affordable options, even with partial employer contributions, can make a big difference.

- Fitness Perks: Offer gym memberships, fitness class reimbursements, or discounts on wellness apps to encourage employees to stay active and healthy.

- Healthy Work Environments: Ensure employees have access to ergonomic workspaces and break areas to reduce stress and physical fatigue.

Mental Health Support

- Employee Assistance Programs (EAPs): Introduce programs that offer counseling services, stress management resources, or mental health support hotlines.

- Mental Health Days: Provide paid days off specifically for mental health needs, showing employees you value their well-being beyond productivity.

- Mindfulness and Meditation: Host occasional wellness sessions or provide access to mindfulness and meditation apps.

Financial Wellness:

- 401(k) Matching: Offer a modest 401(k) matching program, even if it’s small. For example, matching up to 3-5% of an employee’s contributions shows you care about their long-term financial stability.

- Financial Literacy Workshops: Provide sessions on budgeting, saving, and investing to empower employees to manage their finances effectively.

- Bonuses for Financial Goals: Reward employees who hit specific financial milestones, such as paying off student loans or saving for a home, with one-time bonuses or incentives.

Holistic Wellness:

- Wellness Challenges: Organize fun and engaging challenges, such as step-count competitions or hydration goals, with rewards for participation or winners.

- Family Support Programs: Offer childcare assistance, parental leave, or flexible schedules to help employees balance work and family life.

Loyalty and Milestone Rewards

Recognizing and rewarding employee loyalty fosters a sense of appreciation and encourages long-term commitment. Cannabis SMBs can leverage creative and meaningful rewards to retain their workforce while celebrating milestones that strengthen employee morale and company culture.

Tenure-Based Rewards

- Cash Bonuses: Offer milestone bonuses at key intervals, such as after one year, three years, and five years of service. For instance, a $500 bonus for one year of service and larger bonuses for subsequent milestones can make employees feel valued.

- Additional PTO: Reward long-term employees with extra paid time off for each year of service. For example, add an extra vacation day annually or grant a sabbatical after five years.

- Gifts or Experiences: Celebrate loyalty with personalized gifts, such as branded merchandise, gift cards, or tickets to events. For higher milestones, consider more substantial rewards like a weekend getaway or a luxury dinner experience.

Public Recognition

- Employee Spotlights: Feature loyal employees in newsletters, team meetings, or on social media to publicly acknowledge their contributions.

- Service Awards: Host annual award ceremonies or informal gatherings to celebrate employee anniversaries and milestones.

Progressive Rewards

- Tiered Incentives: Offer increasingly valuable rewards the longer an employee stays. For example, a one-year service bonus could be $500, a three-year bonus $1,000, and a five-year bonus $2,500.

- Loyalty Programs: Create an internal rewards system where employees earn points for tenure, which can be redeemed for perks like PTO, gifts, or financial incentives.

Team Celebrations

- Milestone Parties: Celebrate company-wide or team anniversaries with special events, such as catered lunches, team outings, or themed celebrations.

- Shared Achievements: When the business hits a significant milestone, recognize employee contributions with a shared reward, like bonuses or a celebratory team event.

Long-Term Retention Bonuses

- Equity or Profit Sharing: For employees with significant tenure, consider offering a share in the company’s success through equity or profit-sharing programs.

- Pension or Savings Contributions: Boost retirement savings for loyal employees with additional contributions to their 401(k) or similar plans.

By creating meaningful and personalized loyalty and milestone rewards, cannabis SMBs can build a positive company culture where employees feel appreciated and motivated to grow with the organization. These gestures not only boost morale but also reduce turnover, ensuring a more stable and committed workforce.

Recommended Reading: Transforming HR Efficiency: The Power of AI in Document Processing

5. The Path Forward for Cannabis SMBs

California’s cannabis industry is uniquely positioned to lead in workforce innovation. By investing in employees through fair wages, benefits, and growth opportunities, cannabis SMBs can not only meet rising worker expectations but also drive long-term business success.

While challenges like high taxes and overregulation persist, a strong and motivated workforce remains the most valuable asset for any cannabis SMB. As the industry evolves, those who prioritize their teams will set the standard for sustainable growth and profitability.

To know more about UZIO Payroll/HR solution for the cannabis industry and get in touch with us for an expert-led demo.

List of 2026 Federal Holidays for Small Businesses That You Need To Know

Quick links

-

New Year’s Day

-

Martin Luther King Jr.’s Birthday

-

Washington’s Birthday (Presidents’ Day)

-

Memorial Day

-

Juneteenth

-

Independence Day (4th of July)

-

Labor Day

-

Columbus Day

-

Veterans Day

-

Thanksgiving Day

-

Christmas Day

There are two types of federal holidays in the United States.

First, there are paid holidays that are required by law to be observed by all private and government employers—these include holidays such as Labor Day and Veteran’s Day that commemorate events of national importance.

Then there are those holidays that are simply days off—holidays such as New Year’s Day and Independence Day that celebrate significant events in American history—which might or might not be observed depending on the individual employer’s practices.

Here’s a full list of federal holidays in 2026 so you can plan your year accordingly!

New Year’s Day

Thursday, January 1, 2026

January 1, 2026 is New Year’s Day and will be a federal holiday honoring new years and will be treated as a holiday for pay and leave purposes.

Martin Luther King Jr.’s Birthday

Third Monday in January | Monday, January 19, 2026

One of America’s biggest holiday celebrations, Martin Luther King Jr.’s Birthday, is held on January 19 in 2026. On that day, thousands of communities across America host a variety of events to commemorate Dr. King’s life and work.

Washington’s Birthday (Presidents’ Day)

Third Monday in February | Monday, February 16, 2026

President’s Day is a federal holiday observed on Monday, February 16, to honor presidents of the United States.

Memorial Day

Last Monday in May | Monday, May 25, 2026

This federal holiday honors those who have died serving in the U.S. Armed Forces and takes place on May 25 this year.

Juneteenth

Friday, June 19, 2026

Juneteenth (short for “June Nineteenth”) is usually celebrated on the third Saturday in June and commemorates the end of slavery, is a federal holiday in the United States.

Independence Day (4th of July)/Observed (3rd of July)

Friday, July 3, 2026

Independence Day is a federal holiday in the US. Independence Day, or more commonly known as the Fourth of July, is a federal holiday to commemorate the adoption of the Declaration of Independence on 4 July 1776, declaring independence from the Kingdom of Great Britain.

Labor Day

First Monday in September | Monday, September 7, 2026

This holiday is held to honor American workers for their contributions to society through labor unions, minimum wage laws, and other benefits.

Columbus Day

Second Monday in October | Monday, October 12, 2026

This federal holiday is observed on October 12 this year and honors Christopher Columbus, who was born on October 12, 1451. (also observed as Indigenous Peoples Day)

Veterans Day

Wednesday, November 11, 2026

Veterans Day is an annual holiday in America honoring the 24.9 million military veterans in the United States. Veterans Day is both a federal and state holiday and is usually observed on November 11 each year.

Recommended reading: Looking for ACA Health Insurance Coverage? Learn here what is new in 2023!

Thanksgiving Day

Fourth Thursday in November | Thursday, November 26, 2026

Thanksgiving, or Thanksgiving Day as it is called by many is celebrated on the fourth Thursday in November each year.

Christmas Day

Friday, December 25, 2026

Christmas Day is celebrated in the USA on the 25th December each year. Christmas is a time of getting together with family and friends and the giving and receiving of gifts.

Does your state celebrate other holidays?

Certain U.S. states have their own state-wide holidays that are observed by state governments and banks. Some of these include:

- Nevada’s Nevada Day – the last Friday in October of every year

- Georgia’s Founding Day – a holiday that celebrates its founding on February 12, 1733

- Wisconsin has several – Casimir Pulaski Day on March 4, and Robert La Follette Sr. Day on June 14

- Hawaii Native Royalty – March 26 and June 11

Get in touch with us for an expert-led demo to know more about UZIO, the best payroll management system for SMBs.

Finding the Right Payroll Partner: Key Considerations for Growing Cannabis Businesses in 2025

Quick links

-

Introduction: Payroll Challenges for Growing Cannabis Businesses

-

Key Considerations in Choosing a Payroll Solution for Cannabis Businesses

-

Leveraging Technology & Innovation in Payroll Management

-

Why It’s Time for Cannabis Businesses to Reevaluate Their Payroll Partner in 2025

-

Taking the Next Step: Finding the Right Payroll Partner for Cannabis Success

-

Final Thoughts

1. Introduction: Payroll Challenges for Growing Cannabis Businesses

For cannabis businesses, managing payroll is more than just an operational task—it’s a critical component of building trust with employees and maintaining compliance in a highly regulated industry. As these businesses grow, they face unique payroll challenges that often demand more specialized support. Rising costs, compliance with shifting regulations, and issues like delayed payments can disrupt the flow of operations and impact employee morale.

In the cannabis sector, staying compliant isn’t optional; it’s essential. However, not all payroll providers understand the regulatory complexities specific to cannabis, leading to errors in tax reporting or direct deposits. Many cannabis businesses have experienced the frustration of working with providers who aren’t fully invested in or prepared for the compliance needs of this industry, resulting in costly mistakes and unmet expectations.

Going into 2025, it’s clear that cannabis businesses need payroll partners who are not only capable of handling the demands of a complex industry but also committed to growing alongside them. A reliable payroll provider will ensure every paycheck is on time, compliance requirements are met seamlessly, and the cost structure is both transparent and predictable—allowing business owners to focus on what really matters: building their brand and serving their customers.

2. Key Considerations in Choosing a Payroll Solution for Cannabis Businesses

As cannabis businesses evaluate their payroll options, there are several crucial factors to consider. Given the unique regulatory environment and fast-paced growth of the industry, having the right payroll partner can make all the difference. Here are some key qualities to look for:

1. Customer Service Quality

- In the cannabis sector, the stakes are high when it comes to payroll accuracy. Late payments or missed deposits can hurt employee trust, and errors in tax reporting can lead to costly penalties. For cannabis businesses, it’s essential to work with a provider that offers fast, responsive support from a knowledgeable team that understands the specific needs of the industry.

- Look for payroll partners that offer U.S.-based support with dedicated account managers who are accessible and proactive. Quick resolution times (ideally under 60 minutes) and the ability to connect directly with specialists rather than call centers can help cannabis businesses avoid costly disruptions.

2. Cost Transparency

- Transparent pricing is vital, especially in an industry where fluctuating fees and hidden charges are common. Some payroll providers increase costs for cannabis businesses simply due to the nature of their work. It’s important to find a partner that offers a consistent, fair pricing model—one that won’t penalize your business simply because it operates in the cannabis sector.

- Seek out providers that clearly outline their fees and offer predictable cost structures without hidden add-ons. For many cannabis businesses, a modular payroll system that charges based on active employees or payroll frequency can provide much-needed flexibility and predictability.

3. Customizable, Scalable Solutions

- As the cannabis industry continues to evolve, so do the needs of its businesses. A payroll solution that can adapt to your company’s growth and offer customizable features—such as time tracking, tax compliance, and reporting—can be invaluable. Modular systems are especially beneficial as they allow businesses to add features as they scale, ensuring they only pay for what they truly need.

- Additionally, integration with third-party software is an important feature, particularly if your business relies on multiple platforms for HR, compliance, or tax management.

4. Implementation and Data Migration

- Switching payroll providers can feel daunting, especially with the complexities of employee and tax data. However, the right provider will handle most of the heavy lifting, ensuring a smooth transition by migrating all employee information, tax records, and payroll history.

- Look for providers that offer hands-on implementation support, including training sessions, so your team feels fully prepared to manage the new system. For many cannabis businesses, timing the switch for the beginning of a new fiscal year can also help streamline this process and avoid mid-year reporting complications.

3. Leveraging Technology & Innovation in Payroll Management

In today’s digital world, technology is transforming the way payroll is managed, and cannabis businesses stand to benefit significantly from these innovations. With advancements like automation, AI-powered assistance, and mobile access, payroll providers are making it easier for cannabis businesses to stay compliant, save time, and improve accuracy.

1. Automation and Efficiency

- Automated payroll processes help cannabis companies handle recurring tasks like tax filing, payroll processing, and direct deposits without manual input. This not only saves valuable time but also reduces the risk of human error, which is especially important in a highly regulated industry. Look for providers that offer automated reporting, compliance alerts, and customizable workflows, as these can help ensure that your payroll operations run smoothly every pay cycle.

- Payroll automation is particularly beneficial for cannabis companies with multi-state operations, as it helps maintain compliance with each state’s unique tax and labor requirements seamlessly.

2. AI-Powered Assistance

- Payroll platforms that integrate AI tools can offer tremendous value to cannabis businesses. For example, AI assistants—similar to popular digital assistants—can answer questions, generate reports, and even flag discrepancies in payroll data. These capabilities make it easy for businesses to access the information they need instantly, without navigating multiple screens or waiting for customer support.

- An AI assistant can also be a valuable resource for spotting inconsistencies between payroll periods, helping businesses stay on top of any unusual patterns, which is especially important in an industry where payroll data needs to be accurate and reliable.

3. Mobile and Self-Service Portals

- Mobile-friendly payroll platforms with self-service portals allow employees to access their payroll data anytime, anywhere. This is particularly useful for cannabis businesses with employees working across different locations. A self-service portal where employees can view pay stubs, update personal details, and access tax documents improves transparency and reduces administrative work for HR teams.

- Additionally, a mobile option enables employees to receive important notifications about payroll and benefits changes directly on their phones, making it easier to stay informed and engaged.

4. Security and Compliance

- Data security is a priority in payroll management, especially when dealing with sensitive employee information and compliance with industry regulations. Cannabis businesses should look for payroll providers that offer encrypted communication, centralized document storage, and regular compliance updates.

- Platforms that centralize communications and payroll-related tasks on one secure platform help reduce the risk of sensitive data being shared over unsecure channels, such as email. Compliance alerts and regular updates on regulatory changes also ensure that cannabis businesses are always up-to-date with their legal requirements.

4. Why It’s Time for Cannabis Businesses to Reevaluate Their Payroll Partner in 2025

As the cannabis industry continues to grow, the need for a reliable, efficient payroll partner has never been more crucial. With increasing compliance demands and the fast-paced nature of the sector, outdated or poorly managed payroll solutions can quickly become a liability. Here’s why cannabis businesses should consider reevaluating their payroll provider in 2025:

1. Adaptability to Industry Changes

- The cannabis industry is evolving rapidly, with new regulations emerging at state and federal levels. A payroll provider that keeps up with these changes and ensures your business remains compliant is invaluable. If your current provider isn’t able to adapt to evolving cannabis regulations or lacks expertise in this area, it may be time to look for one that specializes in supporting cannabis businesses.

2. Support for Business Growth

- As cannabis businesses scale, their payroll needs become more complex. Growing companies often need features like multi-entity management, multi-state compliance, and customizable reporting—all tools that not all payroll providers offer. Partnering with a payroll solution that provides these scalable options ensures that as your business grows, your payroll system can handle increased complexity without adding significant administrative burdens.

3. Customer Support You Can Count On

- In an industry where timely payroll is essential, customer support becomes a critical factor. Cannabis businesses benefit greatly from a payroll partner with accessible, knowledgeable support that can address urgent needs promptly. If your current provider’s support is lacking, especially during critical payroll processing times, it’s worth considering a partner that prioritizes responsive and personalized service.

4. Transparent Pricing Structures

- For cannabis companies, budgeting can be challenging due to fluctuating regulations and operational costs. Payroll providers with transparent, predictable pricing structures help businesses avoid unexpected costs. Many providers charge cannabis businesses higher fees, often without clear justification. If your payroll costs keep rising unexpectedly, consider exploring solutions that offer fair and stable pricing, designed with small and mid-sized cannabis businesses in mind.

5. Commitment to Cannabis Industry Needs

- While many payroll providers serve a variety of industries, cannabis businesses benefit most from partners who understand their unique challenges. Look for providers who have experience in the cannabis sector and are committed to supporting its compliance and operational needs. A provider focused on the cannabis industry is more likely to offer relevant features, faster updates for regulatory changes, and greater flexibility in their offerings.

Recommended Reading: Transforming HR Efficiency: The Power of AI in Document Processing

5. Taking the Next Step: Finding the Right Payroll Partner for Cannabis Success

The cannabis industry’s growth and unique regulatory requirements make choosing the right payroll partner a critical decision for long-term success. By carefully assessing your current provider and considering essential factors like adaptability, responsive support, transparent pricing, and industry-specific experience, cannabis businesses can find a payroll solution that truly meets their needs.

For businesses ready to make a change, starting with a clear list of priorities can help in identifying the best fit. Look for a provider that offers:

- Dedicated Support: Ensure the support team is not only accessible but knowledgeable about cannabis-specific regulations.

- Scalability: As your business grows, your payroll system should grow with you, offering features that meet both current and future needs.

- Compliance Expertise: With constantly shifting regulations, especially in states where cannabis laws are still evolving, working with a provider that offers proactive compliance support is invaluable.

- Tech-Forward Solutions: Tools like automation, self-service portals, and AI-powered assistance add efficiency and ease to payroll processing, freeing up time for more strategic business tasks.

With these considerations in mind, finding a payroll partner aligned with your growth and regulatory needs is within reach. Investing in a payroll system that prioritizes transparency, efficiency, and adaptability will ultimately strengthen your business foundation and enhance your ability to attract and retain talent.

6. Closing Thought

For cannabis businesses, a payroll solution isn’t just a back-office tool—it’s a key component of operational success and employee satisfaction. By taking the time to evaluate and choose a provider that offers both the technology and the personalized support cannabis companies need, you’ll be better positioned to achieve sustainable growth in this dynamic industry.

To know more about UZIO Payroll/HR solution for the cannabis industry and get in touch with us for an expert-led demo.

The Benefits of Modular Payroll and HR Solutions for Growing Cannabis Businesses

Quick links

-

Introduction

-

Flexibility to Grow at Your Own Pace

-

Pay for What You Use

-

Seamless Integration with Existing Systems

-

Scalability for a Growing Workforce

-

Simplified Benefits Administration

-

HR Compliance Made Easy

-

Real-Time Data and Reporting

-

Conclusion

1. Introduction

As cannabis businesses expand, they face increasing complexities in managing payroll, taxes, employee benefits, and HR compliance. These challenges often grow faster than the business itself, putting pressure on HR teams and business owners. For companies in highly regulated industries like cannabis, flexibility is key—having a modular payroll and HR solution that can adapt to changing needs can make all the difference.

In this blog, we’ll explore why modular payroll and HR solutions are ideal for growing cannabis businesses and how UZIO’s platform can help you scale efficiently.

2. Flexibility to Grow at Your Own Pace

As a cannabis business, your needs are constantly evolving—whether it’s hiring more employees, expanding to new states, or adding new service lines. A one-size-fits-all HR solution might not be able to keep up with your growth. This is where a modular platform stands out.

Why It Matters: Customized Features for Every Stage of Growth

A modular system like UZIO allows you to pick and choose the features you need when you need them. Whether you want to start with just payroll and expand later to benefits management, time tracking, or HR compliance, you have the flexibility to grow at your own pace. As your business evolves, so does your HR platform, giving you the ability to add new modules as needed without disrupting existing processes.

3. Pay for What You Use

Traditional HR and payroll platforms often lock you into paying for features you don’t need, driving up costs unnecessarily. For cannabis businesses, where profitability can be impacted by fluctuating regulations and market conditions, controlling overhead is crucial.

Why It Matters: Cost-Efficiency Through Modularity

With UZIO’s modular platform, you only pay for the features and services you actually use. For example, if you only need payroll and time tracking for now, you won’t be paying for unnecessary features like benefits administration or compliance tracking until you’re ready to add them. This cost-efficiency is a major advantage for cannabis businesses looking to optimize their budget while still having access to high-quality HR tools.

4. Seamless Integration with Existing Systems

Cannabis businesses often use a variety of tools to manage payroll, benefits, and time tracking, and switching between multiple systems can be inefficient and error-prone. A modular platform provides the flexibility to integrate smoothly with your existing tools, making data transfers seamless and reducing the risk of errors.

Why It Matters: Compatibility with Third-Party Tools

UZIO’s platform integrates easily with third-party systems like Employee Navigator and QuickBooks, meaning you don’t have to overhaul your entire operation to benefit from our services. Whether you’re using a specific tool for benefits administration or an accounting system for financial tracking, UZIO works in harmony with your existing setup. This ensures a smooth, streamlined workflow that reduces administrative burden and saves time.

Recommended Reading: Transforming HR Efficiency: The Power of AI in Document Processing

5. Scalability for a Growing Workforce

One of the biggest challenges cannabis companies face is scaling their workforce while keeping payroll, tax compliance, and HR processes running smoothly. As you hire more employees, your HR system needs to be able to handle the increased load efficiently.

Why It Matters: Adapting to a Growing Team

UZIO’s modular platform is designed to scale with your business. Whether you have 50 employees today and 500 next year, UZIO can accommodate your growth. Payroll and time tracking are fully automated, ensuring that no matter how many employees you add, the process remains smooth and efficient. Additionally, UZIO handles multi-state compliance, so expanding to new regions doesn’t require additional manual work for your HR team.

6. Simplified Benefits Administration

Offering competitive benefits packages is crucial for attracting and retaining top talent in the cannabis industry, but managing these benefits can quickly become overwhelming, especially as your team grows. A modular HR platform simplifies benefits administration by integrating it with payroll, allowing for a smoother, more efficient process.

Why It Matters: Effortless Benefits Integration

UZIO’s benefits administration module integrates directly with your payroll system, ensuring that employee benefits deductions are accurately reflected in payroll. This eliminates the need for manual data entry or cross-checking multiple systems. You can easily manage open enrollment, track employee benefits usage, and make changes as needed, all from one central platform.

7. HR Compliance Made Easy

Cannabis businesses operate under strict regulations, and ensuring HR compliance with state and federal laws is essential to avoid penalties. As your business grows, staying on top of ever-changing compliance requirements can be challenging.

Why It Matters: Built-In Compliance Features

UZIO’s platform includes HR compliance tools that help you stay up-to-date with the latest regulations. Whether it’s tax filings, employee documentation, or workplace safety requirements, our platform helps you maintain compliance effortlessly. You can set automated alerts for key compliance dates and easily generate reports for audits or internal reviews. This ensures you’re always prepared and compliant, no matter how quickly your business is expanding.

8. Real-Time Data and Reporting

As your cannabis business grows, gaining insights into workforce performance, payroll costs, and benefits usage becomes increasingly important for strategic decision-making. A modular platform provides real-time data that can help you make informed business decisions.

Why It Matters: Actionable Insights for Better Decision-Making

UZIO’s platform offers real-time reporting across all HR modules, giving you a clear view of key metrics such as payroll expenses, overtime costs, and benefits enrollment rates. With our AI-powered reporting tools, you can generate customized reports that provide valuable insights into your workforce. This data helps you make informed decisions about scaling your team, optimizing benefits packages, and managing operational costs.

9. Conclusion

In the fast-paced cannabis industry, flexibility is key to staying competitive. A modular payroll and HR solution allows you to adapt to your business’s changing needs, scale efficiently, and maintain control over your costs. By choosing a platform like UZIO, cannabis businesses can streamline their HR processes, improve compliance, and gain the flexibility they need to grow.

Whether you’re just starting out or expanding rapidly, UZIO’s modular platform is built to support you every step of the way.

To know more about UZIO Payroll/HR solution for the cannabis industry and get in touch with us for an expert-led demo.

How to Overcome Payroll Tax Challenges in the Cannabis Industry

Quick links

-

Introduction

-

Navigating Cannabis-Specific Payroll Tax Regulations

-

Managing Payroll for a Growing Workforce

-

Multi-State Compliance

-

Avoiding Payroll Tax Penalties

-

Integration with Benefits and Time Tracking

-

Conclusion

1. Introduction

The cannabis industry is growing rapidly, but along with this growth comes a unique set of challenges, especially when it comes to payroll and tax management. For cannabis business owners, navigating complex payroll tax laws can be daunting and time-consuming. The good news? With the right approach and tools, these challenges can be managed effectively, ensuring compliance while freeing up time to focus on growing your business.

In this blog, we’ll explore the key payroll tax challenges cannabis businesses face and how to overcome them.

2. Navigating Cannabis-Specific Payroll Tax Regulations

Cannabis businesses face unique regulations when it comes to payroll taxes, particularly at the state and federal levels. Many cannabis companies find themselves caught in a tangle of rules related to income withholding, unemployment taxes, and 280E tax code restrictions, which disallow standard business expense deductions.

Solution: Automated Payroll Systems

To stay compliant, cannabis companies must accurately file payroll taxes and track changes in tax laws. This is where automated payroll systems like UZIO’s platform come in. With automated tax filings, cannabis businesses can reduce the risk of human error and ensure that tax payments are made on time and accurately. UZIO’s platform also includes real-time compliance updates, so your payroll processes are always in line with the latest regulations.

3. Managing Payroll for a Growing Workforce

As cannabis companies expand, managing payroll becomes more complex. Tracking hours, calculating overtime, and ensuring payroll tax accuracy for an increasing number of employees can quickly overwhelm manual processes or outdated systems.

Solution: Scalable Payroll Solutions

UZIO’s payroll system is built to grow with your business. Whether you’re managing payroll for a few employees or hundreds, UZIO’s platform can handle it seamlessly. Features like automated overtime calculations, payroll tax deductions, and integrated time tracking ensure that you’re paying employees accurately and on time, no matter how large your team gets.

4. Multi-State Compliance

Cannabis businesses often operate in multiple states, each with its own set of payroll tax regulations. Handling the intricacies of multi-state compliance—including state income taxes, unemployment insurance, and workers’ compensation—can be a significant burden for HR teams.

Solution: Unified Payroll Management

With UZIO’s multi-state payroll management, cannabis companies can simplify this process. The platform automatically handles payroll tax deductions for all states where you operate, ensuring compliance across different jurisdictions. This includes managing specific state requirements for unemployment insurance and income withholding, so you can rest easy knowing your business is compliant in every location.

Recommended Reading: Transforming HR Efficiency: The Power of AI in Document Processing

5. Avoiding Payroll Tax Penalties

One of the biggest risks cannabis companies face is incurring payroll tax penalties due to late or inaccurate filings. With state and federal tax agencies keeping a close eye on the cannabis industry, mistakes can result in hefty fines or even legal issues.

Solution: Dedicated Payroll Tax Support

UZIO’s platform includes a dedicated payroll tax administration team that audits every filing before submission. This means that any potential errors are caught early, ensuring that your filings are accurate and on time. Plus, UZIO’s payroll insurance protects you from potential issues like NSF (Non-Sufficient Funds), giving you additional peace of mind.

6. Integration with Benefits and Time Tracking

Managing payroll doesn’t happen in isolation. Payroll taxes, employee benefits, and time tracking are all interconnected, and managing them manually or across multiple platforms can create inefficiencies and errors.

Solution: All-in-One HR Platform

UZIO’s platform integrates payroll, benefits administration, and time tracking into a single, unified system. This eliminates the need to juggle multiple tools and ensures that data flows seamlessly between payroll and other HR processes. Whether you’re tracking employee hours, managing benefits, or filing payroll taxes, UZIO’s platform handles it all in one place.

7. Conclusion

Managing payroll and taxes in the cannabis industry doesn’t have to be a headache. By implementing a scalable, automated payroll system that’s tailored to your industry, you can overcome the challenges of payroll tax compliance, avoid costly penalties, and ensure smooth operations as your business grows.

At UZIO, we specialize in providing cannabis businesses with the tools they need to manage payroll and taxes efficiently. If you’re ready to streamline your payroll processes and stay compliant, schedule a demo with UZIO today.

To know more about UZIO Payroll/HR solution for the cannabis industry and get in touch with us for an expert-led demo.

UZIO’s October 2024 Product Release – Exciting New Features!

Great Falls, VA.

We are excited to announce the launch of new features in our Time Management and Benefits modules! These updates are designed to streamline customer workflows, offer more flexibility, and enhance the overall user experience. Below is a summary of the key features and enhancements:

UZIO Time & Attendance Enhancements: For Employers, we’re introducing some key features to improve your workforce management and compliance:

- Time Kiosk: Easily track employee time with our new browser-enabled clock-in/out kiosk. No extra hardware needed!

- Break Premiums: Automate compliance for meal and rest period premiums, ensuring you meet labor law requirements effortlessly.

UZIO Benefits Enhancements: For Benefits Brokers, we have a set of powerful new features designed to simplify and enhance benefits administration:

- AI-Assisted Plan Upload: Quick and easy plan building by uploading carrier-sold proposals through the new AI-assisted plan upload tool.

- New Line of Benefits: New benefit categories like Supplemental Medical, Telemedicine, Legal Services, State Disability Insurance, Paid Family Leave, and Pet Insurance are available to manage client benefits.

- Enrollment-Specific Flat $ or Age-Based Guaranteed Issue (GI) Amounts: GI amounts for various enrollment scenarios like Open Enrollment, newly eligible employees, and late entrants are now supported.

- Evidence of Insurability (EOI): Now available for Critical Illness, Voluntary Short-Term Disability (Vol STD), and Voluntary Long-Term Disability (Vol LTD).

- Configurable Age Reduction Rules: More options available to configure age-based coverage reduction rules.

For more details about any of these features, please click here. For any other query, please email info@uzio.com or give us a call at (866) 404-0284.

A word from the CEO:

“Right from the beginning, we have instituted a company culture where our team members make an extra effort to listen to the feedback from our customers and are always on the lookout for ways to improve the end user experience.” said Sanjay Singh, CEO of UZIO Technology Inc. “A number of enhancements in this release are the direct result of a collaborative working relationship we have with our customers where their feedback is listened to and given high priority as we make investment in our product roadmap.“

About UZIO Technology Inc.:

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carriers serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

Why Customer Service is Crucial for HR Platforms in the Cannabis Industry

Quick links

-

Introduction

-

The Complexity of Cannabis Payroll and Tax Compliance

-

The Impact of Poor Implementation Support

-

Managing Benefits Administration

-

Quick Solutions for Time-Sensitive Payroll Issues

-

Ensuring Scalability and Flexibility

-

Transparent Communication and Proactive Problem Solving

-

Conclusion

1. Introduction

In the cannabis industry, where regulations and compliance requirements are constantly evolving, having the right tools in place is only half the battle. Equally important is ensuring that your payroll and HR platform comes with top-tier customer service. Without reliable support, even the best HR software can fall short when you need it the most—leading to missed payrolls, tax penalties, or compliance issues.

In this blog, we’ll dive into why customer service is a critical component for HR platforms in the cannabis industry and how it can make or break your operations.

2. The Complexity of Cannabis Payroll and Tax Compliance

Cannabis businesses face unique payroll and tax challenges, from navigating 280E tax limitations to managing multi-state compliance. These complexities require specialized knowledge and support from your HR platform’s customer service team.

Why It Matters: Real-Time Assistance for Complex Issues

When tax deadlines loom or payroll issues arise, you need immediate assistance. Delays in customer service response can result in costly penalties or compliance failures. UZIO understands the specific needs of cannabis businesses and offers dedicated tax administration and payroll support teams who are available when you need them most. This real-time support ensures your business stays compliant and your employees are paid on time, every time.

3. The Impact of Poor Implementation Support

A seamless HR platform implementation is essential, especially for businesses in the cannabis industry, where employee turnover can be high and compliance is critical. Poor implementation can lead to data errors, incomplete employee onboarding, or mismatches in benefits setup.

Why It Matters: Ensuring a Smooth Transition

UZIO provides hands-on support throughout the implementation process, ensuring that all employee data, payroll, and benefits are transferred accurately. Our implementation specialists work closely with your team to understand your unique needs and set up your platform for success from day one. With UZIO, you won’t be left to figure things out on your own.

4. Managing Benefits Administration

In the cannabis industry, employee benefits are a key factor in attracting and retaining top talent. However, administering benefits—especially when integrated with payroll—can be a complex task. The last thing you want is to struggle with platform issues and receive delayed or inadequate customer support.

Why It Matters: Responsive and Knowledgeable Benefits Support

UZIO offers direct benefits administration support, making sure that your employees are enrolled properly and that deductions align with payroll. Our customer service team helps you set up benefits, manage open enrollment, and resolve any discrepancies quickly. Having a team of experts who understand both payroll and benefits ensures that your HR processes run smoothly and that your employees stay satisfied.

Recommended Reading: Transforming HR Efficiency: The Power of AI in Document Processing

5. Quick Solutions for Time-Sensitive Payroll Issues

In cannabis, missed payroll deadlines can create significant problems, from damaging employee morale to incurring fines. Time-sensitive payroll issues, such as direct deposit errors or final paychecks, require immediate attention from your HR platform provider.

Why It Matters: Fast and Effective Problem Resolution

At UZIO, our customer service team is available to resolve payroll issues in real-time. Whether it’s a direct deposit error or the need for a same-day payroll run, UZIO’s dedicated payroll support ensures that issues are addressed swiftly, preventing disruptions to your business. We pride ourselves on being a proactive partner for our clients, rather than just a service provider.

6. Ensuring Scalability and Flexibility

As cannabis companies grow, their payroll and HR needs evolve. What works for a team of 50 employees may not scale efficiently when you expand to 500. Whether you’re adding new states, offering new benefits, or onboarding more employees, you need an HR platform with the flexibility to scale—and customer support that helps you navigate these changes.

Why It Matters: Ongoing Support for Your Growing Business

UZIO’s customer service doesn’t end with implementation. We provide ongoing support to help your business scale smoothly, whether you’re expanding to new locations, adjusting your benefits offerings, or integrating new payroll features. Our team works with you to ensure that as your business grows, your HR platform grows with it, without disrupting your operations.

7. Transparent Communication and Proactive Problem Solving

The cannabis industry moves fast, and waiting for days to get answers from your HR platform’s customer service team simply won’t cut it. You need transparent communication and proactive problem-solving to keep your business running efficiently.

Why It Matters: Building Trust Through Reliable Support

At UZIO, we pride ourselves on offering transparent, clear communication with our clients. We don’t just react to problems; we help you prevent them. Whether you’re dealing with payroll taxes, benefits administration, or compliance issues, our support team keeps you informed every step of the way. This proactive approach builds trust and ensures that you’re always prepared for whatever challenges may arise.

8. Conclusion

In the cannabis industry, having a robust HR platform is essential—but without reliable, responsive customer service, even the best technology can fall short. Whether you’re facing complex payroll tax issues, implementing new benefits, or expanding to new states, UZIO’s dedicated customer service team is here to support you every step of the way.

By providing real-time assistance, proactive problem-solving, and specialized knowledge of the cannabis industry, UZIO ensures that your business runs smoothly, no matter how complex your HR and payroll needs may be.

To know more about UZIO Payroll/HR solution for the cannabis industry and get in touch with us for an expert-led demo.

Breaking Down Payroll Costs for Cannabis Companies: UZIO vs. Competitor

Quick links

-

Introduction: The Cannabis Industry’s Unique Payroll and HR Challenges

-

Our competitor’s High Costs for Cannabis Clients: A Deep Dive

-

UZIO’s Transparent and Affordable Pricing Model

-

AI-Powered Efficiency: UZIO’s Game-Changing AI Copilot

-

Why UZIO is the Ideal Payroll Provider for Cannabis Businesses

-

Conclusion: The Smarter Choice for Cannabis Payroll

1. Introduction: The Cannabis Industry’s Unique Payroll and HR Challenges

Cannabis-related businesses (CRBs) face unique regulatory hurdles, from federal tax restrictions like the 280E tax code to varying state compliance rules. Managing payroll, HR, and benefits in this environment can be costly and time-consuming, with a higher risk of non-compliance.

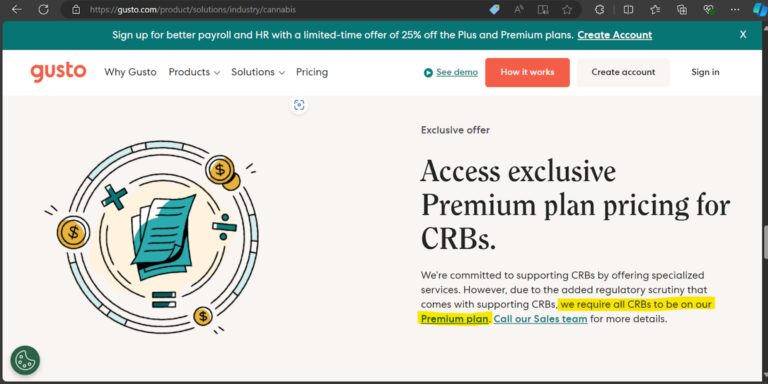

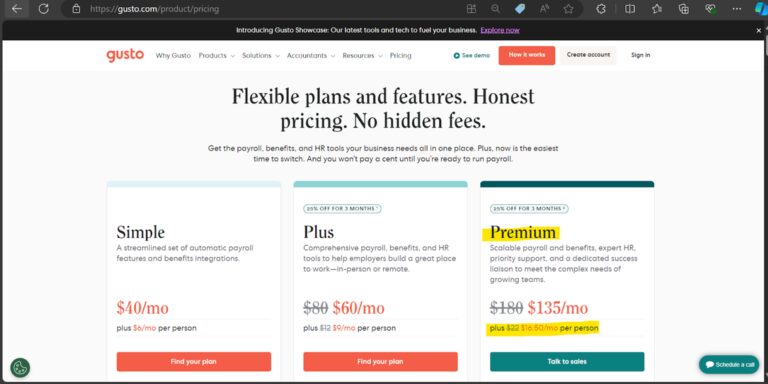

Finding a payroll provider that understands these complexities without charging excessive fees is a major challenge. While some services like Gusto support CRBs, they often impose premium pricing due to compliance demands. But is paying more necessary? UZIO offers a smarter, cost-effective solution tailored specifically for the cannabis industry—without the steep price.

2. Our competitor’s High Costs for Cannabis Clients: A Deep Dive

Gusto is a well-known payroll provider, but for CRBs, they charge their highest-tier Premium plan, costing $135 per month plus $16.50/mo per employee (2.75 times for a non-cannabis company). This makes Gusto a significant investment for CRBs, especially larger ones. Gusto justifies these high prices due to the compliance complexities cannabis businesses face, offering features like a dedicated customer success manager and compliance alerts. However, many CRBs question whether these features justify the steep cost, especially for smaller companies.

Moreover, Gusto’s pricing for CRBs seems disproportionate compared to non-cannabis businesses (costing $40 per month plus $6/mo per employee) raising concerns of unfair treatment. In an industry where margins are tight, these costs can add up quickly. UZIO, on the other hand, provides a more affordable, transparent alternative with flat pricing and no industry-based premiums.

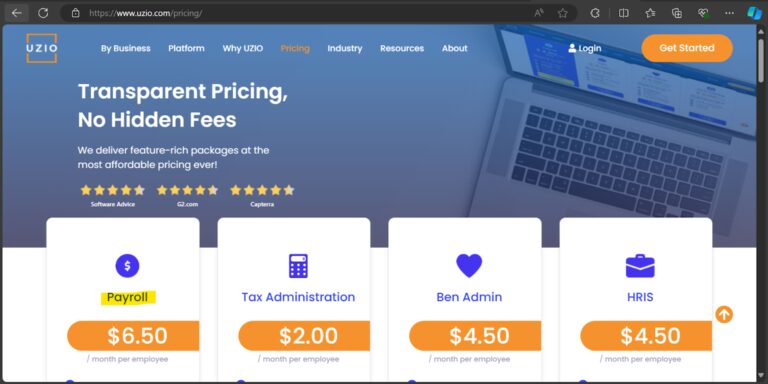

3. UZIO’s Transparent and Affordable Pricing Model

UZIO offers a flat-rate pricing model that doesn’t penalize businesses based on their industry, with payroll services priced at just $6.50 per employee per month. This flat rate includes all essential features for CRBs to stay compliant, without the hidden fees or premium charges imposed by Gusto.

Unlike Gusto, UZIO’s pricing remains the same for all businesses, ensuring fairness and predictability. CRBs can scale their operations without worrying about rising payroll costs. UZIO also provides cannabis-specific features like automated tax compliance and multi-state payroll management, making it a cost-effective solution tailored to their unique needs.

Another important issue of Gusto is cannabis customers experiencing price increase 3-6 months after they go live. And that is absolutely not the case with UZIO as it offers a uniform and consistent pricing models. Even if there is a marginal price increase, it is not specific to a client or a sector.

And lastly we have encountered situations where a cannabis client is paying for products/modules they don’t need. For e.g. 20 person companies paying $50+ PEPM and only using 10% of the the features. Here again, with UZIO’s flexible pricing options you pay for only what you use. One can opt for individual modules and add on modules only when required.

In a market where many providers overcharge CRBs, UZIO stands out with its affordable, comprehensive services designed to help cannabis businesses thrive.

4. AI-Powered Efficiency: UZIO’s Game-Changing AI Copilot

One of UZIO’s standout features is its AI-powered tool, AI Copilot, which automates payroll and HR processes, saving time and enhancing compliance for CRBs. Instead of manually pulling reports or tracking metrics like pay equity and turnover, AI Copilot provides instant insights with just a query.

AI Copilot can:

- Analyze Pay Equity across employees based on factors like gender and job title.

- Track Attrition and Turnover rates by department or location.

- Monitor Workforce Diversity, helping CRBs meet inclusivity goals.

Unlike Gusto’s manual reporting, UZIO’s AI Copilot streamlines complex tasks, offering faster, smarter solutions. By reducing manual work and delivering real-time data, UZIO empowers cannabis businesses to make better decisions while cutting costs, making it the superior payroll solution.

Recommended Reading: Transforming HR Efficiency: The Power of AI in Document Processing

5. Why UZIO is the Ideal Payroll Provider for Cannabis Businesses

CRBs face unique challenges, from complex regulations to compliance management. UZIO offers a payroll and HR solution tailored to the cannabis industry, without the high costs seen with services like Gusto.

Unlike Gusto’s one-size-fits-all approach, UZIO provides focused, affordable solutions that address CRB-specific needs. Key advantages include:

- Industry-Specific Expertise: UZIO automates compliance, including 280E tax and multi-state payroll.

- Transparent, Affordable Pricing: Flat rates for all businesses, avoiding Gusto’s premium pricing for CRBs.

- AI-Powered Efficiency: UZIO’s AI Copilot streamlines payroll, compliance, and workforce analytics.

- Seamless Compliance Support: Automated checks keep CRBs compliant with changing regulations.

- Dedicated Customer Support: UZIO ensures expert assistance for all payroll and compliance issues.

UZIO’s customized solutions, backed by AI and fair pricing, make it the best choice for cannabis businesses. Unlike Gusto, which charges significantly more, UZIO helps CRBs grow and thrive without inflated payroll costs.

6. Conclusion: The Smarter Choice for Cannabis Payroll

For CRBs, managing payroll and HR functions can be a complex and costly endeavor. Gusto’s high Premium plan pricing often forces businesses to pay more than necessary for features they may not fully utilize. This is where UZIO provides a clear advantage.

UZIO’s tailored payroll solutions for the cannabis industry, combined with AI-powered automation and transparent, flat-rate pricing, offer a smarter, more cost-effective option.

By choosing UZIO, cannabis businesses can reduce administrative burdens, improve operational efficiency, and focus on growth. With UZIO’s industry-specific expertise and affordable pricing, it’s easy to see why it’s the superior choice for CRBs looking to streamline their payroll and HR processes.

To know more about UZIO Payroll/HR solution for the cannabis industry and get in touch with us for an expert-led demo.