For a Massage Franchise owner: How to correctly calculate wages for your massage therapist?

Quick links

-

Introduction

-

Does your Franchise POS system easily integrate with your payroll system?

-

Does your Payroll system understand the difference between Hours Worked and “Service Hours”?

-

An illustration

-

Case 1: Maria did 10 massages that week

-

Case 2: Maria did 15 massages that week

-

Summary

Owning and operating a massage franchise is a very challenging undertaking. Of the many challenges you will face, one of the hardest would be to hire and retain high quality massage therapists. Critical to that goal would be your ability to calculate and pay correct wages to your therapists as per the Fair Labor Standards Act (FLSA).

Here are some tips on how to calculate wages as a Massage Franchise owner, so that you can stay focused on running your business and still comply with the FLSA.

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, and recordkeeping standards affecting employees in the private sector and in Federal, State, and local governments. Covered nonexempt workers are entitled to a minimum wage of not less than $7.25 per hour. Overtime pay at a rate not less than one and one-half times the regular rate of pay is required after 40 hours of work in a workweek.

To be able to correctly pay your therapists, you will need to address the following two questions?

Does your Franchise POS system easily integrate with your payroll system?

Normally when you sign up for the massage franchise, as part of the package, you will receive access to use the POS (Point of Sale) system of the Franchise. This system will allow you to manage all parts of your franchise including clocking in and clocking out by your staff so you know how many hours your staff worked.

When you are ready to run your payroll, you will need the number of hours worked by your staff. Most of the payroll systems typically do not integrate with the Massage Franchise system which means you now have the responsibility and the extra work of manually entering hours worked from the Franchise system into your payroll system. This can lead to wasted time and to very costly errors resulting in your therapist not getting paid correctly.

Uzio payroll system seamlessly integrates with a number of Massage Franchise systems so that hours worked seamlessly flow from your Franchise system to your payroll system. It reduces errors and saves you lots of time.

Does your Payroll system understand the difference between Hours Worked and “Service Hours”?

What is the meaning of the the term “Hours Worked”?

According to the Department of Labor (DOL), “hours worked ordinarily include all the time during which an employee is required to be on the employer’s premises, on duty, or at a prescribed workplace.”

What is the meaning of the term “Service Hours”?

Service hours refer to the time spent actually working, for example, giving a massage.

Because FLSA requires you to pay at least the minimum wage for hours worked, it is important for you to know how to calculate the wages as per the hours worked as well as the service hours. Here is an example to help clarify:

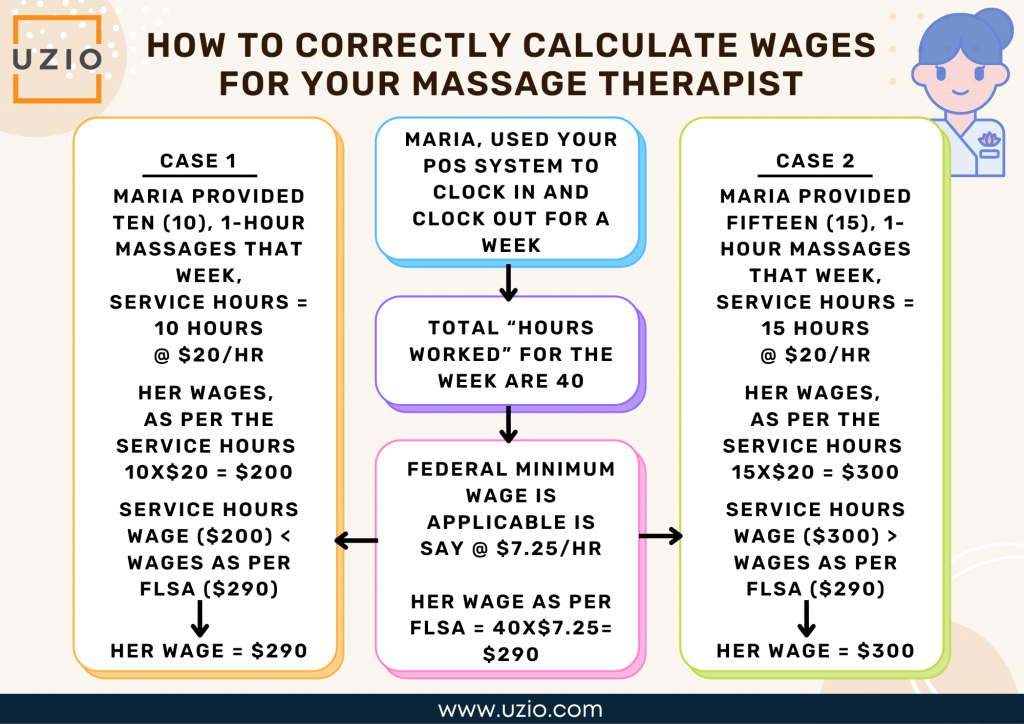

An illustration: How to calculate weekly wage for Maria, a massage therapist?

Let us say one of your massage therapists, Maria, used your POS system to clock in and clock out for a week such that her total “hours worked” for the week are 40. Let us assume that your franchise is in a state where the federal minimum wage is applicable.

This means, as per FLSA, Maria should be paid 40X$7.25=$290 for that week.

Let us assume that her rate as a massage therapist is $20/hr.

Case 1: Maria did 10 massages that week

Let us also assume that Maria provided ten, 1-hour massages that week, resulting in total “service hours” worked that week of 10 hours.

In this case her wages, as per the service hours, for the week would be 10X$20 = $200.

Because her wages as per her service hours are less than wages as per FLSA, Maria would be paid $290 for that week.

Case 2: Maria did 15 massages that week

Let us also assume that Maria provided fifteen (15), 1-hour massages that week, resulting in total “service hours” worked that week of 15 hours.

In this case her wages, as per the service hours, for the week would be 15X$20 = $300.

Because her wages as per her service hours are more than wages as per FLSA, Maria would be paid $300 for that week.

As you can see, the payroll system used by the franchise should have this logic built in. Otherwise, as the franchise owner, you will have to manually calculate the service hours pay, compare it with pay as per FLSA and determine the wages to be paid to the massage therapist. This will add to your workload and also can lead to errors.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

Being a Massage Franchise owner is a tough job. You can simplify a part of the job by choosing a payroll system like Uzio that has been customized for the Massage industry. It will reduce your workload, reduce errors and help you attract and retain massage therapists.