FUTA Tax: How to Calculate and Understand Employer’s Obligations

Quick links

-

Introduction

-

The Basics of FUTA Tax

-

When is FUTA Tax due?

-

How to Calculate the Amount of FUTA Tax Owed

-

Who is exempt from FUTA?

-

How to report your FUTA Tax?

Introduction

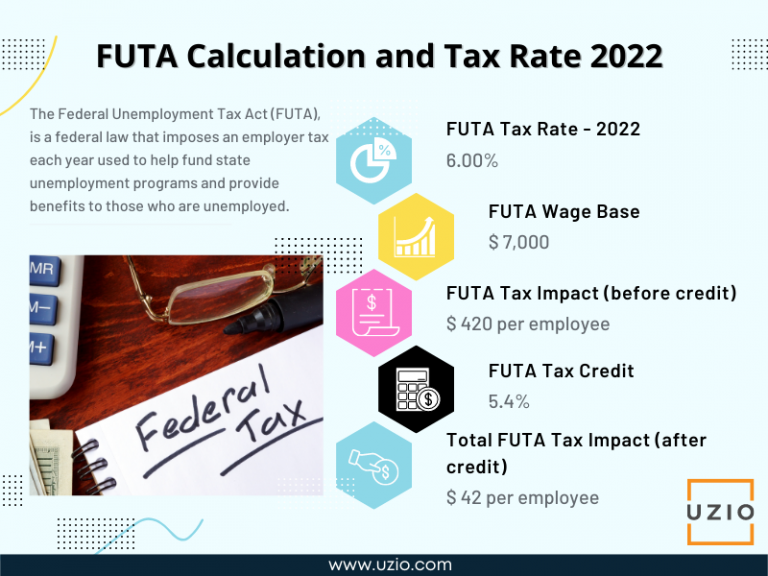

The Federal Unemployment Tax Act (FUTA), is a federal law that imposes an employer tax each year used to help fund state unemployment programs and provide benefits to those who are unemployed.

The Basics of FUTA Tax

FUTA tax is a federal payroll tax that employers must pay to the federal government if a business pays wages above $1,500 or more in a calendar quarter. The FUTA tax rate for 2022 is 6.0% on the first $7,000 of wages paid to each employee during the year. However, it is subject to a reduction of a maximum of 5.4% from state unemployment contributions.

FUTA tax is only paid by the employer. No amount is deducted from an employee’s paycheck towards FUTA taxes.

FUTA tax is used to fund the following:

- Share of the federal government cost of unemployment programs with all the states.

- The unemployment program of the states.

- The unemployed workers who are eligible to claim their unemployment insurance.

When is FUTA Tax due?

First Quarter: April 30th

Second Quarter: July 31st

Third Quarter: October 31st

Fourth Quarter: January 31st

Note: If the FUTA tax liability of your business for a quarter is less than $500, there’s no need to deposit taxes at the end of the quarter. You may roll over the tax liability to the next quarter and pay the tax amount if the liability exceeds the $500 threshold.

How to Calculate the Amount of FUTA Tax Owed

A company is subject to FUTA taxes on the first $7,000 of wages paid to each employee. The FUTA tax rate for 2022 is 6.0%, and employers often receive a credit of up to 5.4% against this tax.

Sample Calculation

Let’s take the example of Company ABC, which employs two individuals. Employee A was paid $10,000 of wages subject to FUTA taxes in Q1 and Employee B was paid $5,000 of wages subject to FUTA taxes in Q1.

FUTA Sample Calculation

| Employer: Company ABC | EIN: 99-9999999 |

|

|---|---|---|

| John Smith | Jesse Black | |

| Gross Wages | $10,000 | $5,000 |

| Taxable Wages | $7,000 | $5,000 |

| Tax Due | $420 (7000*.06) | $300 (5000*.06) |

FUTA Liability for Company ABC = (Employee A’s Eligible Wages + Employee B’s Eligible Wages) * 6% (0.06)

FUTA Liability = ($7,000 + $5,000) * 6%

FUTA Liability = $720

The company’s FUTA tax liability would be $720. Please note that the company may be eligible for a tax credit of $648 ($12,000 * 5.4%); if this is the case, the company would only owe $72.

In this example, the company ABC doesn’t have to make a deposit because its liability is less than $500 for the first quarter. However, the company must carry this liability over to the second quarter.

Who is exempt from FUTA?

Most businesses are required to pay federal unemployment tax (FUTA) and state unemployment tax (SUTA). Certain organizations, including government employers, and nonprofit religious, charitable, and educational institutions are exempt from paying these taxes.

Also an employer is exempt from paying FUTA only if they have paid an employee less than $1,500 in wages during a calendar quarter, or if they haven’t had an employee for 20 weeks or more within a calendar year.

Payments Exempt From FUTA Tax

Various forms of payments are paid to employees that are exempt from the Federal Unemployment Tax Act. The payments include:

- Fringe benefits, which include the value of certain meals and lodgings, employer contributions to accident and health plans for employees, as well as employer reimbursements for qualified moving expenses.

- Group term life insurance

- Employer retirement/pension contributions to a qualified plan, such as a SIMPLE IRA plan or a 401(k) plan

- Dependent care not exceeding $500 per employee (or $2,500 for married couples filing separately) for qualifying person’s care

- Other payments, such as payment made to an employee under worker’s compensation law because of a sickness or injury inflicted at work; non-cash payments and certain cash payments to H-2A Visa workers for agricultural labor; payments for services provided by a spouse, parent, or child under 21 years; and payments to non-employees who are treated as your employees by the state unemployment agency

Recommended Reading: The Ultimate SUTA Tax Guide: What You Need to Know

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

How to report your FUTA Tax?

The employers use Form 940 to report their annual FUTA tax. The due date for filing the Form 940 is January 31. However, if you deposited all FUTA tax when due, you have until February 10 to file.

For more details, please click the official link to the Employer’s Annual Federal Unemployment (FUTA) Tax Return – Filing and Deposit Requirements.