What happens if the gross wages are under-reported by the employer?

Quick links

-

Introduction

-

Gross Wages VS Taxable Wages

-

Unemployment Taxation Breakdown

-

What Happens if gross wages are under reported?

-

Conclusion

Introduction

If you are using a payroll provider to process your payroll, it is their responsibility to report gross wages, taxable wages, income taxes, unemployment tax, social security tax and Medicare taxes to the IRS as well as state agencies. Payroll providers do that thru Quarterly and Year end filings with IRS and the state agencies. Sometimes, because of the glitch in the software or human error, gross wages might be under reported. In this article, we will explore the implications of reporting errors on wages and/or employment taxation.

Gross Wages VS Taxable Wages

Gross wage is what an employee earns before any deductions for taxes, benefits and other payroll deductions are withheld from their wages. Examples of gross wages:

- An employee works full time (40 hours per week) at $20 per hour would have a weekly gross wage of $800 (40×20=800)

- A salaried employee earns $50,000 annually. The gross wage would be $50,000 or equivalent to the annual salary.

Taxable Wages is the portion of your gross wages which are subject to taxation by a governmental agency…Here is an example to clarify this. In this example, an employer has one employee to report to Virginia for SUTA. The first $8,000 in wages is taxable. The employer would calculate taxable wages for the four quarters during the year as follows:

- Taxable Wages subject to withholding: Gross wages reduced by section 125 deductions

- Taxable Wages subject to unemployment: Gross wages up to each states or federal taxable wage base

Here is an example to clarify this. In this example, an employer has one employee to report to Virginia. The current wage base for Virgina is $8,000 for 2022. Which means the employer is liable for unemployment taxation for the first $8,000 of each employee’s gross wages. The employer would calculate taxable wages for the four quarters during the year as follows:

Unemployment Taxation Breakdown

| Employer: ACME Corp. |

EIN: 99-9999 |

|||

|---|---|---|---|---|

| Name/SSN | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

| John Smith Wages Paid ***-**-9999 |

$5,000 | $12,000 | $12,500 | $13,000 |

| Taxable wages VA Wage Base: $8,000 VA SUI Rate: 5% |

$5,000 | $ 3,000 (8,000-5,000=3,000) |

$ 0 (Wage Base reached in Q2) |

$ 0 (Wage Base reached in Q2) |

| Tax due (5%) | $250.00 (5000x.005=$250) |

$150.00 (3000x.005=$150) |

$ 0 | $ 0 |

What Happens if gross wages are under reported?

If the gross wages were under reported, the impact on the employer will depend on a number of factors.

Let us consider these factors one at a time.

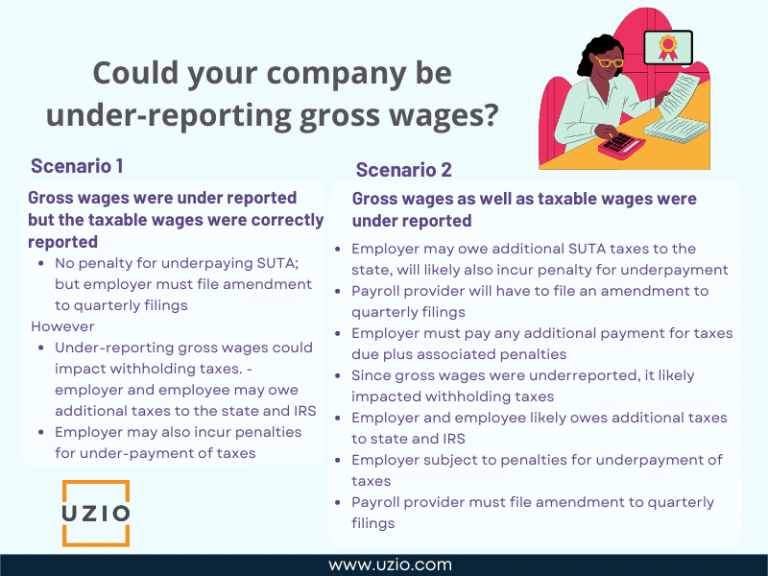

Scenario 1

Gross wages were under reported but the taxable wages were correctly reported

In this case, where the gross wages were under reported but the taxable wages were correctly reported, the employer would have paid the correct amount for the SUTA tax because the SUTA is calculated based on the taxable wage. So there will be no penalty assessed for underpaying SUTA. The payroll provider will have to file an amendment to the quarterly filings done to the state with the correct amount for the gross wages.

Because gross wages were under reported, it may have an impact on withholding taxes. If the system under-calculates the withholding taxes because of under-reporting of gross wages, the employer and the employee may owe additional taxes to the state and to the IRS. The employer may also be levied with penalties for under-payment of the taxes. However, if the taxes were withheld correctly and the error was simply in reporting of the gross wages, in that case, the state and IRS will not levy the penalty for underpayment of taxes. The payroll provider will still be required to file the amendment to the quarterly filings.

Scenario 2

Gross wages as well as taxable wages were under reported

In this scenario where the taxable wages were also under reported, the employer may owe additional SUTA taxes to the states. The state will most likely levy a penalty for underpayment of SUTA tax. The payroll provider will have to file an amendment to the quarterly filings done to the state with the correct amount for the gross and taxable wages. The employer will have to make additional payment for the taxes due as well as for the penalty.

Similar to scenario 1, because gross wages were also under reported, it may have an impact on withholding taxes. If the system under-calculates the withholding taxes because of under-reporting of gross wages, the employer and the employee may owe additional taxes to the state and to the IRS. The employer may also be levied with penalties for under-payment of the taxes. However, if the taxes were withheld correctly and the error was simply in reporting of the gross wages, in that case, the state and IRS will not levy the penalty for underpayment of taxes. The payroll provider will still be required to file the amendment to the quarterly filings.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

The under reporting of the gross wages and or taxable wages can lead to considerable headaches for the employer. If this happens, clear communication between the employer and the payroll provider would be essential. The Payroll provider would have to reconcile past payrolls to determine adjustments to be made, update their system and file the amendments with the IRS and the state agencies.