How to Choose the Right Payment System for Your Gig Workers?

Quick links

-

Introduction

-

Emergence of Gig Economy

-

How to choose the right payment system for your gig workers?

-

Factors to consider when choosing a the payroll provider for paying the gig workers

-

Implications of AB5 and the road ahead

Introduction

The gig economy has grown substantially in recent years, and this trend isn’t likely to slow down anytime soon. In fact, many people are now turning to the gig economy as their main source of income, which means that you’ll need to be prepared to pay gig workers on a regular basis. Whether you’re just getting started or you already have lots of freelancers working for you, it’s important to choose the right payment system for your Gig workers so that everyone gets paid consistently and on time.

Emergence of Gig Economy

The gig economy is a labor market characterized by the prevalence of short-term contracts or freelance work as opposed to permanent jobs. You can pay your gig workers using the same payroll system you use to pay your W2 employees. The difference will be that in case of gig workers, you will not withhold any taxes or make any deductions for benefits etc because gig workers are responsible for paying their own taxes and are typically not offered any benefits. There are many different payroll systems available, and choosing the right one will depend on your specific needs.

How to choose the right payment system for your gig workers?

You should consider the following factors when choosing a payment method for your gig workers.

Scale of the business

If you are just starting out, you might be writing checks to pay your gig workers. It is also possible you are using new payment methods like Venmo, Zelle etc to make your payments when you are working on a small scale. However when you start to grow, these payment methods will not scale. You need a more robust system to pay your gig workers and it might be the right time to select a payroll system for paying your gig workers.

Need to switch from contractors to W2 employees

Hiring freelancers or independent contractors provides much needed flexibility to the business. You don’t have to be responsible for deducting taxes, you do not need to offer benefits, overtime etc. If you think you can run and scale your business by hiring freelancers or contractors alone, you can work with a payment system that lets you easily ACH payments to your contractors. However if you think you will need W2 employees also either now or in the future and may also need to convert some or all of your freelancers and contractors to W2 employees because of state laws like the one in California (law AB5), you may be better off choosing a payroll system that can support paying your W2 employees as well as your freelancers and contractors.

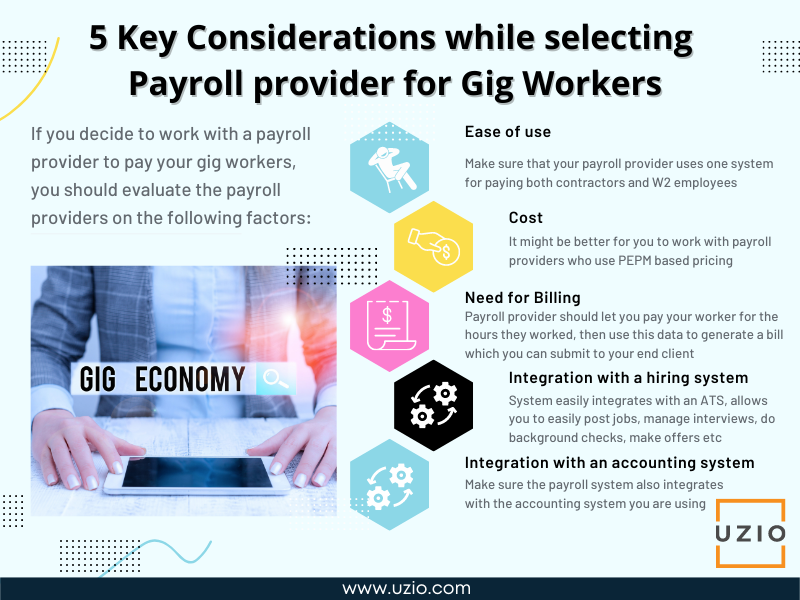

Factors to consider when choosing a the payroll provider for paying the gig workers

If you decide to work with a payroll provider to pay your gig workers, you should evaluate the payroll providers on the following factors:

-

Ease of use

- Let us say you are starting out with a few W2 employees and a large number of contractors and you know that down the road you will have to convert your contractors to W2 employees, you should make sure that your payroll provider uses one system for paying both contractors and W2 employees. If that is the case, it will be much easier to convert contractors to employees. However if your provider has completely different systems to pay contractors versus the employees, when the time comes to convert the contractors to employees, it will be a heavy lift because all the information from one system will have to be transferred to another system. This can lead to delayed payments, errors etc.

-

Cost

- Many payroll providers have different pricing mechanisms for paying contractors versus W2 employees. Contractors might be getting paid daily, weekly, biweekly or monthly. W2 employees typically do not get paid daily. Some payroll providers charge on “per pay check basis” whereas others charge on PEPM (Per Employee Per Month) basis where they allow you to run as many payroll as you want within a month for a fixed fee per employee. Depending on the number of employees and the frequency of payment, it might be better for you to work with payroll providers who use PEPM based pricing.

-

Need for Billing

- In many industries who employ gig workers or freelancers, the amount paid to the contractor is an exact fraction of the amount charged to the end client by the company. For example, you may be running a tutoring service which provides qualified tutors to families. You charge families by the hour, for example $100/hour for every hour of tutoring provided. You also pay the tutor you have hired on an hourly basis, for example $50/hour. Because you will pay your tutor for the hours she worked and you will also charge the family for the same number of hours, you should look for a payroll provider who lets you pay your tutor for the hours she worked and use the same hours to generate a bill which you can submit to your end client. By combining the two functions into one system, you will avoid duplicity of data, errors and also potentially save on cost.

-

Need for integration with a hiring system

- Industries which employ a lot of contractors or freelancers typically see high turnover of workers. The employers are constantly hiring. When choosing a payment system, you should make sure that the system easily integrates with an Application Tracking System (ATS). These systems allow you to easily post jobs, manage the interview process, do background checks, make offers etc. You want to make sure that your ATS system easily integrates with your payroll system. It will save you lots of time and avoid errors. Otherwise your staff will spend countless hours copying and pasting data from your ATS system to your Payroll system. UZIO payroll platform seamlessly integrates with ZOHO Recruit which is a system used by lots of companies who hire contractors and temp employees.

-

Need for integration with an accounting system

- Similar to the need for integration with ATS, you want to make sure the payroll system you choose also integrates with the accounting system you are using. For example UZIO payroll system seamlessly integrates Quickbooks online system so that when you run your payroll, the needed data is seamlessly transferred to Quickbooks.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

Choosing the right payment system is a strategic decision which can impact the growth and profitability of your business down the road. You will be well served by taking into account all the factors outlined above when choosing the right payment system for your business.