![Social Security Wage Base 2021 [Updated for 2024]](https://www.uzio.com/resources/wp-content/uploads/2021/09/security-taxes-blog.jpg)

Social Security Wage Base 2021 [Updated for 2024]

Quick links

-

What is the social security wage base?

-

Social Security Wage Base 2024

-

What are social security taxes and their limits?

-

What does social security tax include or fund?

-

Changes in the wage base and social security taxes in the past 10 years

-

Social Security Wage Base 2024 Estimation by SSA

-

Automate Payroll & Compliance with UZIO

The payroll tax that funds Social Security benefits has been a relatively constant 12.4% of wages since its inception in 1937, but the amount of income it applies to has not remained fixed. The wage base limit, also known as the taxable maximum, changes almost every year. It is crucial to understand the wage base limit for both employers and employees. The taxes you pay and the maximum Social Security benefits you are liable to receive depends on this wage base limit.

What is the social security wage base?

Social security wage base is the maximum amount of your wages subject to social security tax. That means you pay social security tax on all of your wages until they hit that point. As an employer, you should already be withholding FICA taxes from your employees’ paychecks if they are making more than the minimum wage base per year (or $0 if they are making less). Individuals must know that any self-employed income also counts toward the annual earnings. Also, keep in mind that wage bases change every year on January 1st or whenever there is a cost of living increase due to inflation based upon averages provided by a specific organization such as the labor statistics bureau or Bureau of Labor Statistics.

Social Security Wage Base 2024

The Social Security wage base for 2024 is $168,600. This is an increase of $8,400 (or 5.2%) from 2023. If you earn over $168,600 in 2024, then only $168,600 will be subject to FICA tax – not your entire salary.

What are social security taxes and their limits?

Social security tax, also known as FICA (Federal Insurance Contributions Act) is an employment tax levied by the Federal Government on individuals earning income in the United States. It is paid by both employees (6.2%) and employers (6.2%). If your total wages are above $168,600 then only the first $168,600 will be subject to social security tax. The wage base is set to rise from year to year based on average national wage indexing. However, what most people don’t know about FICA tax rules is that there are no limits when it comes to Medicare taxes which is 1.45% of all earnings regardless of how much or how little you earn each year or what age you are.

What does social security tax include or fund?

Social security tax is used to fund Social Security Retirement, Dependents’ Benefits, Spousal Benefits, and Disability Benefits. Even though SS tax is often called FICA (Federal Insurance Contributions Act) tax, it only applies to about half of an employee’s contributions. No portion comes from employers’ profit margins or taxes they pay on their profits from businesses they operate—and employees aren’t allowed to deduct either part of their taxes as a business expense. This makes sense when you think about social security: It isn’t a company or self-employment benefit. It was created in 1935 so workers who had spent most of their lives contributing to society wouldn’t be left behind when they needed support. But there are special rules around self-employed people and small business owners: They can claim certain portions as deductible business expenses on Schedule C because they’re paying into social security even if it isn’t taken out directly from each paycheck.

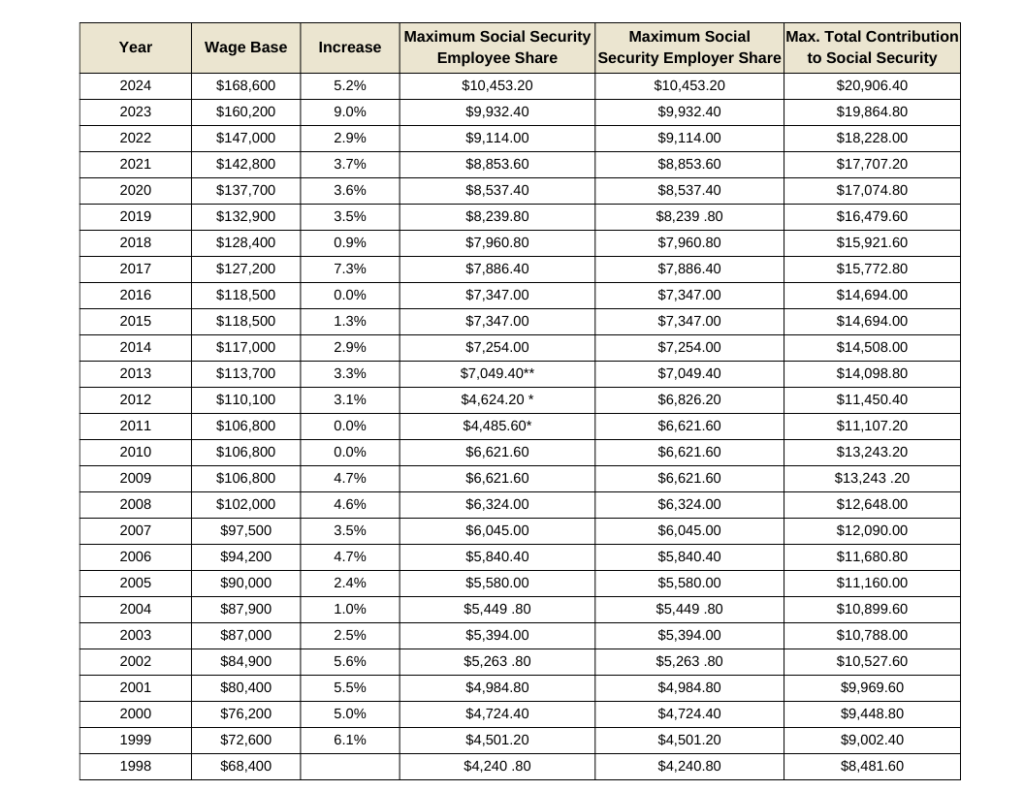

Changes in the wage base and social security taxes in the past few years (1998-2024)

(Source-Wikipedia)

The Social Security wage base is increasing in 2024

The Social Security Administration announced that the wage base for computing Social Security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Wages and self-employment income above this threshold aren’t subject to Social Security tax.

2024 Updates

For 2024, an employee will pay:

- 6.2% Social Security tax on the first $168,600 of wages (6.2% of $168,600 makes the maximum tax $10,453.20), plus

- 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus

- 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

For 2024, the self-employment tax imposed on self-employed people is:

- 12.4% OASDI on the first $168,600 of self-employment income, for a maximum tax of $20,906.40 (12.4% of $168,600); plus

- 2.90% Medicare tax on the first $200,000 of self-employment income ($250,000 of combined self-employment income on a joint return, $125,000 on a return of a married individual filing separately), plus

- 3.8% (2.90% regular Medicare tax plus 0.9% additional Medicare tax) on all self-employment income in excess of $200,000 ($250,000 of combined self-employment income on a joint return, $125,000 for married taxpayers filing a separate return).

Automate Payroll & Compliance with UZIO

These changes are bound to happen every year, and yet UZIO can ensure you are adhered to all the latest compliances and taxes by the federal and state government. Process your payroll with UZIO with just a few clicks. Get an expert-led demo of our full-service payroll platform available for all the 50 states in the US. Click here to book a demo with us.

Recommended reading: Social Security Changes in 2023: What you need to know?