What is R&D Tax Credit and How Do I Claim it?

Quick links

-

What is R&D Tax Credit in the US?

-

How Does R&D Tax Credit Work?

-

Do I Qualify for R&D Tax Credit?

-

How to Claim R&D Tax Credit?

-

What happens after I submit my R&D tax credit claim?

-

How long does it take to get R&D tax credits?

-

Conclusion

What is R&D Tax Credit in the US?

The R&D tax credit is a dollar-for-dollar, non-dilutive tax incentive for US-based companies that innovate. The Tax Credit was originally established in 1981. The Protecting Americans from Tax Hikes (PATH) Act of 2015, which broadened the ability of many small-to-midsize businesses to monetize the R&D credit made the credit permanent. Companies across industries can qualify, including early-stage startups and profitable companies. Qualifying expenditures generally include the design, development or improvement of products, processes, techniques, formulas or software.

As per one of the reports of OECD: Between 2000 and 2018, the number of R&D tax relief recipients effectively more than doubled in the US, from around 10,500 R&D tax relief recipients in 2000 to over 26,000 in 2018.

Over the period 2000-2013 period (for which relevant data are available), SMEs accounted for the majority of R&D tax relief recipients with a share of around 70-75% in more recent years.

How Does R&D Tax Credit Work?

For early-stage startups – Startups may use federal R&D credits against up to $250,000 of their payroll taxes in five separate taxable years—a total of $1.25M—if they have:

Gross receipts less than $5M in the tax credit year and no gross receipts for any of the four preceding tax years. The credits can also be carried forward as an asset on their balance sheet until utilized.

For mid-stage and mature companies – If a company has gross receipts over $5M or began bringing in sales over 5 years ago, it could qualify to offset unlimited income taxes with R&D credits.

Do I Qualify for R&D Tax Credit?

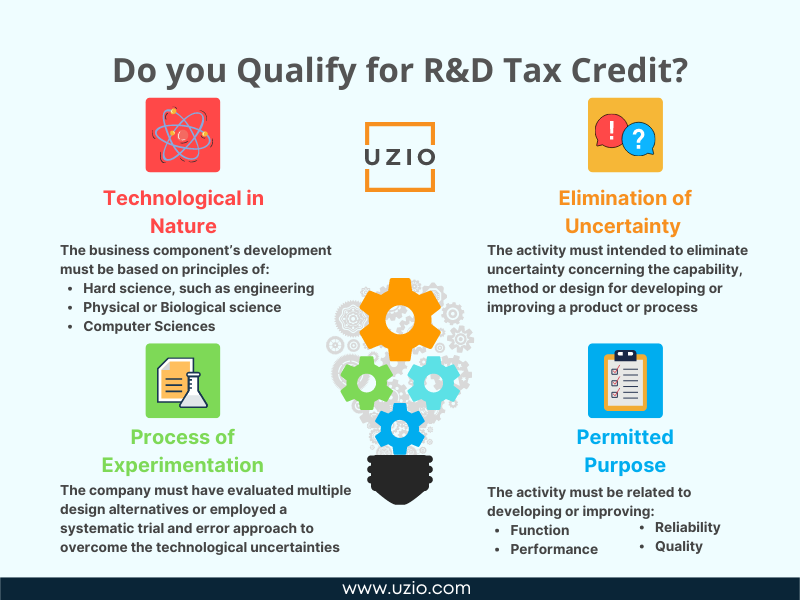

To claim R&D Tax Credit, you need to be sure that your expenses qualify as qualified research expenses (QREs). QREs are defined by the four-part test outlined below:

- Permitted purpose: The activity must be related to developing or improving the functionality, quality, reliability or performance of a business component (i.e. product, process, software, technique, formula or invention).

- Technological in nature: The business component’s development must be based on a hard science, such as engineering, physics and chemistry, or the life, biological or computer sciences.

- Elimination of uncertainty: From the outset, the organization must have faced technological uncertainty when designing or developing the business component.

- Process of experimentation: The company must have evaluated multiple design alternatives or employed a systematic trial and error approach to overcome the technological uncertainties.

How to Claim R&D Tax Credit?

You can claim R&D Tax credit by filing the IRS Form 6765.

Here is the official IRS document link (revised Jan 2022) to “Instructions for Form 6765”.

This form has five parts which correspond to specific categories used by the IRS to calculate your R&D tax credits.

To document their qualified R&D expenses, businesses must complete the four basic sections of Form 6765:

- Section A is used to claim the regular credit and has eight lines of required information (lines 1, 2, 3, 7, 8, 10, 11 and 17).

- Section B applies to the alternative simplified credit (ASC).

- Section C identifies additional forms and schedules that warrant reporting based on business structure.

- Section D is only required for qualified small businesses (QSBs) making a payroll tax election.

What happens after I submit my R&D tax credit claim?

After submitting your completed Form 6765, it takes anywhere from 4–6 weeks for your application to go through review at the IRS. During that time, you will receive one or two letters asking for additional documentation depending on how thorough your original application was.

When everything is finalized, you will receive either a Notice of Allowance or Rejection letter explaining why your claim was accepted or denied. If you did not qualify for R&D tax credits, then you might still be eligible for Alternative Simplified Credit (ASC). ASC works similarly to regular research credits (RRC) except that it doesn’t require quite as much work on behalf of both taxpayers and auditors.

Know More about Calculating the R&D Tax Credit: RRC vs ASC Method

How long does it take to get R&D tax credits?

It depends on a number of factors including the complexity of your claim and the size of your company. Most claims take between four and six months to complete, but some can take up to a year.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

R&D Tax Credit is an important tax incentive for US based companies to innovate. It can result in significant savings for companies of all sizes in a wide variety of industries. Because the onus of proving eligibility for the tax credit is on the business, it is strongly recommended that businesses work with their CPAs or with firms specializing in helping companies claim this credit.