What is WOTC and how can my business benefit from it?

Quick links

-

What is the Work Opportunity Tax Credit (WOTC)?

-

Employees not eligible under the Work Opportunity Tax Credit program

-

How To Apply for the WOTC Credit:

-

How To Claim for the WOTC Credit:

-

Benefits of WOTC

-

Is participation in the Work Opportunity Tax Credit program mandatory?

-

Conclusion

The Work Opportunity Tax Credit (WOTC) was created in 1997 to assist employers in hiring and retaining workers from certain target groups by providing tax credits as an incentive for hiring them.

Since its creation, it has been modified and expanded several times; The latest legislation extended WOTC tax credits retroactively from January 1, 2015, through the end of 2019. Apart from a 5-year extension, the Protecting Americans from Tax Hikes (PATH) Act introduced a new targeted group – long-term unemployed individuals. The WOTC is authorized until December 31, 2025.

The goal of the WOTC tax credit incentive is to reduce poverty and welfare dependency by enabling employees to gradually move from economic dependency into self-sufficiency as they earn a steady income and become contributing taxpayers.

The employers can receive up to $2,400-$9,600 in tax credits per employee, depending on the type of employee they have hired through the WOTC program.

WOTC credit is calculated as a percentage of wages paid to certified employees who work at least 120 hours in the first year of employment. The percentage varies depending on how long employers retain the employee, and the amount of wages applied is determined by the category.

Another added benefit of this incentive is that you can file multiple applications each year if your company hires multiple employees. However, you are not allowed to use the same worker more than once every two years.

What is the Work Opportunity Tax Credit (WOTC)?

WOTC is the tax credit employers can claim when hiring a candidate from one of following different targeted groups:

- Unemployed Veterans

- Temporary Assistance for Needy Families (TANF) Recipients

- Food Stamp (SNAP) recipients

- Designated Community Residents

- Vocational Rehabilitation Referrals

- Ex-Felons

- Supplemental Security Income (SSI) Recipients

- Summer Youth Employees living in Empowerment Zones

- Qualified Long-Term Unemployment Recipient

- Long-Term Family Recipient

Each group has its own eligibility requirements that the individual must meet in order for the employer to qualify for the credit.

No credit is available unless the worker completes at least 120 hours of work. The credit is reduced if the individual works at least 120 hours but less than 400 hours.

WOTC benefits are available only for new hires. Wages paid to an individual who was previously employed and is rehired do not qualify. In addition, wages paid to certain individuals who are related to the employer or business owner do not qualify.

Employees not eligible under the Work Opportunity Tax Credit program

Some exclusions apply to the list of WOTC target groups. Employers who rehire a former employee, a family member or dependent, or someone who will be a majority owner in the business may not be able to claim the tax credit for that individual (even if the individual is otherwise a member of an eligible target group).

How To Apply for the WOTC Credit:

To claim for WOTC, an employer must obtain certification that the individual they are about to hire is a member of the targeted group. To do this, an employer must file the Form 8850 together with ETA Form 9061 or ETA Form 9062 for Pre-Screening Notice and Certification Request for WOTC, with their respective state workforce agency within 28 days after the eligible worker begins work.

How To Claim for the WOTC Credit:

The Employer will claim the credit on form 5884-C, as a credit against the employer’s share of Social Security tax. The credit will not affect the employer’s Social Security tax liability reported on the organization’s employment tax return.

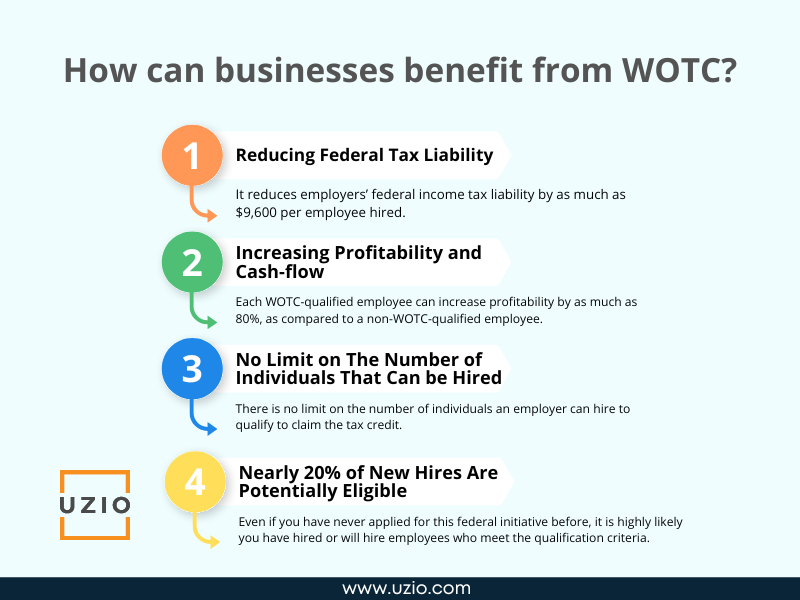

Benefits of WOTC

- Reducing Federal Tax Liability: It reduces employers’ federal income tax liability by as much as $9,600 per employee hired

- Increasing Profitability and Cash-flow

- No Limit on The Number of Individuals An Employer Can Hire: There is no limit on the number of individuals an employer can hire to qualify to claim the tax credit

- Nearly 20% of New Hires Are Potentially Eligible

The Work Opportunity Tax Credit (WOTC) is designed to reduce federal tax liability and help employers hire workers from groups that face significant barriers to employment. By implementing a work-focused program that meets qualifications under these tax credits, a company can reduce its federal income tax bill and offer an alternative to traditional hiring methods. The WOTC incentives can be used as an effective tool in retaining valued employees or in new recruitment opportunities.

In case there is no tax liability, employers can still apply for the credit. Unused credits can be carried back one year and carried forward on future tax returns for up to 20 years. It is therefore likely that you will be able to use the credit in the future, once there is tax liability.

Each WOTC-qualified employee can increase profitability by as much as 80%, as compared to a non-WOTC-qualified employee.

By taking advantage of the WOTC benefits, you can increase cash flow, therefore improving your margins and sustainability. With an increasingly high cost of doing business these days, WOTC can make your company more profitable.

There is no restriction on the number of new hires who can qualify you for the tax savings. Whether your business hires 10 or 10,000 eligible employees, your tax credits will continue to pile up and improve your profit margin.

One of WOTC’s benefits is that even if you have never applied for this federal initiative before, it is highly likely you have hired or will hire employees who meet the qualification criteria. Typically about twenty percent of new hires potentially qualify for the program as per many industry reports.

According to the U.S. Department of Labor, an average of more than 500,000 new jobs were added per month in 2022. With an average of 20% of those workers eligible for WOTC tax credits, that’s more than $0.24 billion in tax credits per month that potentially could have been claimed.

Is participation in the Work Opportunity Tax Credit program mandatory?

The Work Opportunity Tax Credit is a voluntary program. As such, employers are not obligated to recruit WOTC-eligible applicants and job applicants don’t have to complete the WOTC eligibility questionnaire. Employers can still hire these individuals if they so choose, but will not be able to claim the tax credit.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

Participating in WOTC can lead to numerous benefits for both an employer and future employees since it encourages business growth while assisting disadvantaged members of a community. Therefore, both sides win.

Even though there are complexities associated with the WOTC administrative process, there are also ways to overcome them. Replacing manual processing with an automated solution ensures that employers complete the full WOTC process in a timely manner, efficiently, and in accordance with program requirements.

Also, by keeping WOTC best practices in mind, companies can be better prepared to capture the credits for which they may be eligible, which can have a significant impact on their bottom line.