As a small employer, what are your options to offer cost effective health insurance coverage to your employees?

Quick links

-

Introduction

-

Join a PEO

-

QSEHRA

-

Allow employees to purchase insurance in the individual marketplace

-

Conclusion

If you are a small business, let us say with less than five employees, you have very few options to offer cost effective health insurance coverage to your employees.

The main reason is that Health Insurance Carriers consider these micro groups (employers with less than 5 employees), “bad risk”.

Typically, these micro groups are not profitable for carriers and carriers don’t want these groups. So carriers do not offer any commission to broker agents for selling these groups.

Thus broker agents have no incentive to sell health insurance coverage to “micro groups”. Because group insurance coverage is mostly sold thru broker agents, small employers find it very hard to get cost effective coverage for their employees.

In this article, we will explore different options available to small businesses to obtain cost effective health insurance coverage.

Join a PEO

For very small employers, joining a PEO (Professional Employer Organization) can be an option to be able to offer benefit coverage to their employees.

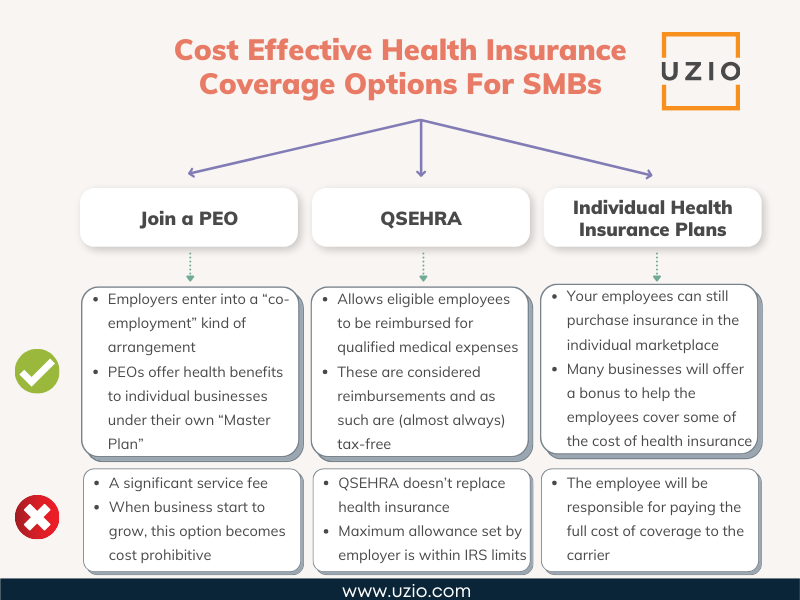

With PEOs, employers enter into a “co-employment” kind of arrangement. Because of the co-employment arrangement, PEOs can combine the risk across all the employees of their customers and use that to offer health benefits to individual businesses under their own “Master Plan”.

For a small business owner, this might seem like a good option. The downside is that PEOs charge a significant service fee which in some cases can outweigh the savings on the benefits side. Also, even though PEOs might be a viable option when the business is small, when business start to grow and hire more and more employees, the PEO option becomes cost prohibitive.

Below is an article which explains the challenges of working with PEOs.

Recommended Reading: How to transition out of a PEO and bring your HR, payroll and benefits in-house?

QSEHRA

Another option for small employers is QSEHRA which stands for qualified small employer health reimbursement arrangement (QSEHRA). It’s a way for small businesses—that don’t offer a group health insurance plan—to reimburse employees for health-related and medical costs. It doesn’t replace health insurance, but rather allows eligible employees to be reimbursed for qualified medical expenses. This is how it works:

Employees pay for their health expenses. For example, employees can purchase health insurance in the individual market either through Obamacare or by directly going to the website of the carriers in their state.

The cost of the health insurance premium as well as other medical services, or eligible medical product expenses are reimbursed by the employers under QSEHRA. Employees pay the insurance company or medical bill directly and then submit eligible claims to get reimbursed by their employer. These are considered reimbursements and as such are (almost always) tax-free for employees and employers.

QSEHRA doesn’t replace health insurance. Employees must get qualifying health insurance coverage through the health insurance marketplace, or another employer-sponsored plan (like through a spouse’s or parent’s coverage), in order to participate in a QSEHRA.

The employer sets a maximum allowance; this is the maximum amount per year that can be reimbursed for each employee. The IRS has dictated a ceiling on these so that the maximum allowance set by the employer cannot exceed a certain amount.

According the IRS, the 2022 QSEHRA limits can reimburse employees for:

– Up to $5,450 of qualified medical expenses per year (or $454.16 per month) for employee-only coverage, or

– Up to $11,050 per year (or $920.83 per month) for family coverage.

QSEHRA benefits are completely funded by employers (meaning: employers are responsible for covering the approved reimbursement costs up to the max allowance for each employee).

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Allow employees to purchase insurance in the individual marketplace

If QSEHRA is not an option for you, your employees can still purchase insurance in the individual marketplace.

While you can not offer pre-tax dollars to cover the cost of the premium, many businesses will offer a bonus to help the employees cover some of the cost of health insurance.

Of course, the bonus will be considered part of the compensation and would be taxed. In this option, employees will go to Healthcare.gov or their state SBE (State Based Exchange) to directly enroll in an individual health insurance plan.

The employee can also enroll in the plan by directly going to websites of health insurance carriers in their state. The employee will be responsible for paying the full cost of coverage to the carrier.

Conclusion

If you are a small business, it is not easy to obtain cost effective health insurance coverage for your employees. The options outlined above can help you navigate the complex world of health insurance and obtain coverage for your employees.