How to transition out of a PEO and bring your HR, payroll and benefits in-house?

Quick links

-

Introduction

-

Reasons for wanting to leave your PEO

-

Do you have the right team in-house?

-

How to leave a PEO and bring your HR, payroll and benefits in-house

-

What to Consider After Leaving the PEO

-

Conclusion

Many companies, typically in the earlier stages of their growth cycle, decide to outsource their payroll, HR and Benefits functions to PEOs (Professional Employer Organizations).

When you are small, it makes sense to outsource these functions. Even though PEOs charge a high fee to provide these services, outsourcing seems cost effective compared to hiring people inhouse to manage different HR functions.

Moreover there could be other factors that may favor using a PEO. For example, you may only have a few employees and if one of these employees has a medical condition that makes it cost prohibitive to purchase medical benefits in the open market, it probably makes sense to join a PEO so that you can be covered under their master plan.

However many of these benefits of working with a PEO seem to fade away as you start to grow and at a certain point you may decide to leave the PEO and bring the HR functions inhouse. Here are some of the reasons you may decide to leave your PEO:

Reasons for wanting to leave your PEO

Higher Monthly Fees:

PEOs charge a significant high PEPM (Per Employee Per Month) fee for their services. When you are small, these high fees seem justified because of perceived savings in the cost of health benefits. As you hire more and more employees, the total service cost per month starts to become prohibitive.

Limited choice of medical benefits:

What was once an advantage when you were small, quickly becomes a disadvantage when you start to grow and hire more and more employees, maybe in different parts of the country. Your benefit choice is limited by the master plan of the PEO. You can not shop around across national and regional insurance carriers to get the best benefit for your employees.

Poor Employee Experience:

In today’s hot job market, the key to attracting and retaining talent is providing competitive compensation along with top-notch benefits and great employee experience.

When employees have questions about their ‘401K deductions’ or ‘whether a doctor is in the network’ or ‘why a claim was not approved’, they want quick and accurate answers.

This is easy to achieve if you have a dedicated internal staff who is measured on the employees satisfaction. Typically, we have seen, PEOs are not able to be as responsive as an in-inhouse employee when it comes to resolving complex employee issues.

For reasons outlined above, you may decide to transition out of a PEO and bring your HR functions in-house. In this article, we will provide you step by step instructions on how to complete this transition.

Do you have the right team in-house?

The first thing you want to do is to assess the capabilities and skill sets of your in-house HR team.

When you were working with the PEO, you might not have hired experienced HR professionals in house. However, now your team will be responsible for all employee related functions starting with hiring and onboarding, payroll, benefits, performance management, training, terminations etc.

Do you have the right kind of team members? If not, you can either hire somebody from outside right away or you can lean on the HRIS technology vendor you will work with to provide you some dedicated HR bandwidth giving you time to build this capability inhouse.

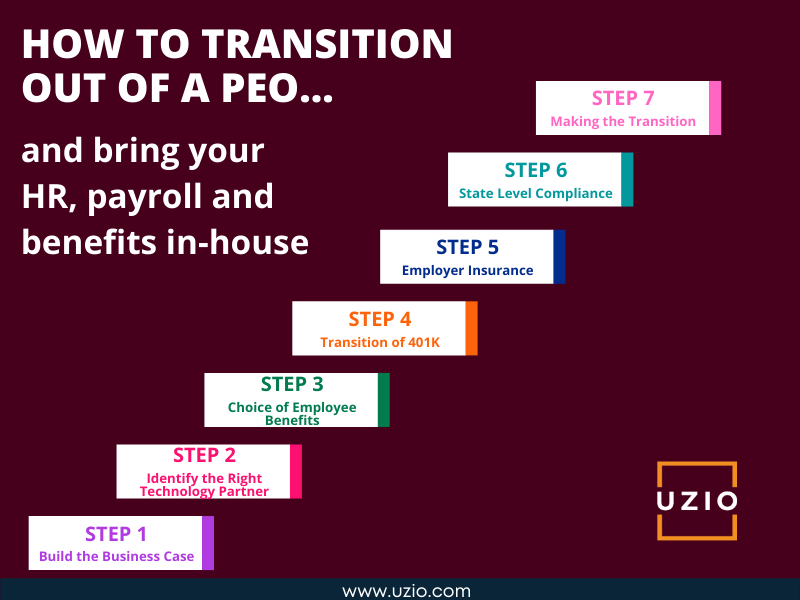

How to leave a PEO and bring your HR, payroll and benefits in-house

Step One : Build the Business Case

There are many reasons why you may want to transition away from a PEO, but cost efficiency is often cited as being one of the top motivators.

Even if you choose not to bring everything in-house at once, there will be some immediate savings if you have been using managed payroll services from PEOs or outsourced providers. You’ll need to build a business case before making the big decision about bringing the HR function in-house.

That means breaking down what your PEO is costing you now and what you will likely pay to replace it. Part of the challenge in this step is determining what you’re paying the PEO and what it covers.

PEOs tend to charge just one large service fee on top of the benefits and business insurance costs. That makes it hard to determine what each individual HR function is costing you. So it’s better to break down what it will cost to replace each service and compare the total costs. You should end up with a table like the one below (this table is an example of a company choosing between a PEO and bringing it in house as an unbundled option).

Let us assume that the company has 100 employees, PEO service fee is $125 PEPM (Per Employee Per Month) and total fee for the unbundled option is $25 PEPM. These numbers are quite typical.

In this scenario, the annualized savings will be around $220,000. This includes a saving of $100,000 on Medical benefits which is again quite typical when you shop around a group of this size.

| Unbundled Option | PEO | Difference | ||

|---|---|---|---|---|

| Employer Insurance | ||||

| Workers Compensation | $30,000 | $30,000 | $0 | |

| EPLI | Included | Included | ||

| Compliance | ||||

| COBRA | Included | Included | ||

| State Registration | Included | Included | ||

| New Hire Registration | Included | Included | ||

| ACA Reporting | Included | Included | ||

| Employee Benefits | ||||

| Medical | $500,000 | $600,000 | $100,000 | |

| Open Enrollment Support | Included | Included | ||

| Benefit Guide | Included | Included | ||

| Retirement Planning | ||||

| 401K | Included | Included | ||

| Service Fee | $30,000 | $150,000 | $120,000 | |

| Hiring & Onboarding | Included | Included | ||

| PTO Tracking | Included | Included | ||

| Document Storage | Included | Included | ||

| Employee Communication | Included | Included | ||

| Time Tracking | Included | Included | ||

| Payroll | Included | Included | ||

| Benefit Enrollment | Included | Included | ||

| HR Legal | Included | Included | ||

| Dedicated A/C Rep | Included | |||

| Total Annualized Savings | $560,000 | $780,000 | $220,000 | |

Step Two : Identify the Right Technology Partner

One of the advantages of working with the PEO is that you have one platform for all your HRIS functions. You don’t need to duplicate data across multiple systems.

Now that you are coming out of the PEO, your HR team members and your employees will expect the same seamless workflow for payroll, benefits, HRIS etc. This means you should identify a partner who offers a technology platform where all the core HR functions Payroll, HRIS, Benefits etc work seamlessly. Uzio offers such a platform and a number of our current customers were previously with a PEO.

Step Three: Choice of Employee Benefits

In addition to savings coming from not having to pay very high PEO service fees, the next big savings will come from your ability to get competitive quotes from different insurance carriers for health benefits.

To be able to do this, the key would be working with the right benefits broker. When customers who are leaving the PEOs come to Uzio, we introduce them to our strategic broker partners.

The broker partner works directly with the company to collect the census information and shops around the group for the most competitive quotes. The next step would be to choose the right benefit from a number of quotes provided by your benefits broker. This requires a collaborative effort between the company and the benefits broker.

Once the decision is made and the benefit provider is selected, the benefit plans are loaded onto the technology platform and an open enrollment is kicked off. As part of open enrollment, employees are invited to log onto the platform and make benefits selections. Because this will be the first open enrollment outside of the PEO, the company, the broker and the technology vendor need to work very closely to ensure a smooth experience for the employees.

Step Four: Transition of 401K

If your company offered 401K thru the PEO, you will have to make important decisions regarding the transition.

Decision regarding 401k Record Keeper

The first decision would be whether you want to stay with the record keeper offered by the PEO.

The record keepers are like the book keeper of your plan. They keep track of who is in the plan, what each participant owes etc. Record Keepers are companies like Fidelity, Empower, Vanguard, TransAmerica etc.

Some PEOs will allow you to keep the record keeper even when you are transitioning out of the PEO. If you like the record keeper and your PEO lets you keep it after transition, that may be your best option.

If not, you will have to find a different record keeper and this is where 401K Advisor comes into the picture.

Decision regarding Advisor of Record

You will need to select an Advisor/Agent of Record. As the name says, an advisor will advise you and your employees regarding 401K. The Advisor will help you make decisions regarding the Record Keeper as well as the TPA (Third Party Administrators). The Advisor will ask for a “Agent of Record” change letter from you before s/he starts working with you. Your HRMS technology vendor should be able to introduce you to a number of Advisors.

Decision regarding TPA

You will need to select a TPA for your 401K plan. The TPA manages the day-to-day aspects of your 401k plan. The TPA is responsible for preparing plan documents, making sure the plan is in compliance with IRS requirements etc. Your Advisor should help you choose the TPA.

Step Five: Employer Insurance

Now that you are not part of the PEO, you will need to get your own Workers Compensation insurance. You may also need Employment Practice Liability Insurance (EPLI). Your technology provider should be able to arrange this for you by introducing you to the right broker agent.

Step Six: State Level Compliance

When you were with the PEO, all your HR related compliance needs were handled by the PEO. Now that you are on your own, you would be responsible for all the HR compliance needs. Here is a list of compliance items you will be responsible for.

- Out of state registration: If you decide to hire an employee in a state different from the home state, you want to make sure that you are registered in that state. Your technology vendor might be able to offer you this service. We at Uzio do this for our clients who are transitioning away from the PEOs.

Checkout our blog: Hiring an Out-of-State Employee? Here’s What You Need to Know

- New Hire Registration: In addition to the state registration, you also need to register your new hires with that state agency. Please make sure the technology partner you have chosen does it otherwise this responsibility will fall on your HR team.

Step Seven: Making the Transition

Once you’ve figured out how to replace your PEO effectively, it’s time to make the transition.

While it’s most important to make sure the final result leaves your company and its employees in better positions than they were in under a PEO, it is also important to make the transition as smoothly and efficiently as possible.

You want to cause as little disruption to your employees’ experience and your processes as possible to achieve the best business outcomes.

You can make the transition in a matter of just 60-120 days so long as you understand the steps involved in a successful transition.

Here is a high-level list of the steps you will need to take once you have decided on your new go-live date:

- Choose the right HRMS technology vendor

- Assign a dedicated person who will act as the primary contact and liaison for the implementation of the new HRMS system

- Ensure all the necessary data is provided to the new HRMS software provider, making sure forms contain complete and accurate information

- Set up payroll-related items (i.e., tax setups and filings, deductions, pay schedule, time and attendance)

- Set up applicable federal and state tax accounts

- Create standardized procedures and workflows for the employee lifecycle

- Assist with the creation of an employee handbook customized to your companies need

- Select employee benefit and retirement plans that are appropriate for your workforce and will integrate with your HRMS

- Create a communication plan for employees regarding changes in systems and responsibilities

- Transition to new HRMS

What to Consider After Leaving the PEO

After you have completed the transition and have run your first payroll inhouse, your work does not stop. Hopefully, the change went well, but if not, now is the time to fix any issues.

Your situation will be unique, but it may help to consider the following actions:

- Schedule the HR team to follow up with the “new employees” to help them navigate the changes

- Make sure your payroll data is being fed into your accounting system

- Make sure you are paying invoices from your benefits carriers, your workers comp carrier and other HR services you have contracted with

- Setup regular reviews with your HR technology vendor. In these reviews you can provide them feedback on the gaps and issues you are encountering

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

If you follow the steps outlined above, you should be able to complete the transition out of the PEO with the least amount of disruption and realize the core objectives of cost savings and better employee satisfaction. At Uzio, we have helped countless companies transition away from the PEOs. If you are considering such a transition, please get in touch with us.