How to Choose the Right Payment System for Your Gig Workers?

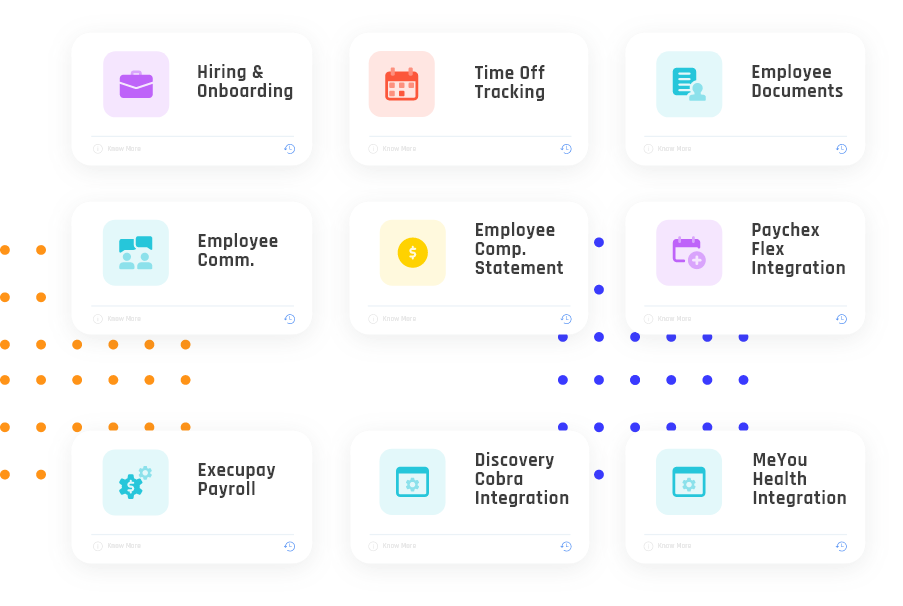

Quick links Introduction Emergence of Gig Economy How to choose the right payment system for your gig workers? Factors to consider when choosing a the payroll provider for paying the gig workers Implications of AB5 and the road ahead Introduction The gig economy has grown substantially in recent years, and this trend isn’t likely to …

How to Choose the Right Payment System for Your Gig Workers? Read More »