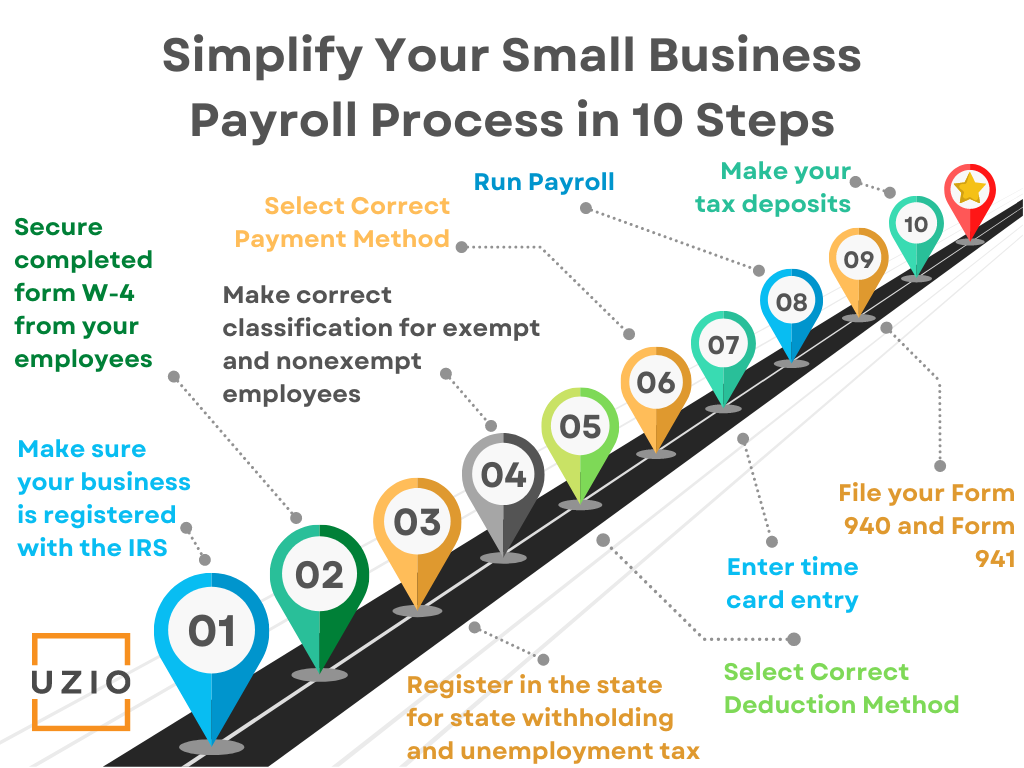

How to Simplify Your Small Business Payroll Process

Quick links

-

Introduction

-

Step 1. Make sure your business is registered with the IRS

-

Step 2. Secure completed form W-4 from your employees

-

Step 3. Register in the state for state withholding and unemployment tax

-

Step 4. Make correct classification for exempt and nonexempt employees

-

Step 5. Select Correct Deduction Method

-

Step 6. Select Correct Payment Method

-

Step 7. Enter time card entry

-

Step 8. Run Payroll

-

Step 9. File your Form 940 and Form 941

-

Step 10. Make your tax deposits

So you decided to start a business! Congratulations.

Among the tons of things you will be responsible for, one will be to process payroll for your employees. While you can always use a payroll software provider like Uzio to ease your burden, if you decide to do it yourself, here we will share with you the steps you can take to simplify your small business payroll process.

In fact we have helped hundreds of companies since 2018 to successfully transition from their existing Payroll provider to Uzio.

The following tips will help you get started on simplifying your small business payroll process and getting back to running your business efficiently and profitably.

Step 1. Make sure your business is registered with the IRS

When you process the payroll, you will have to withhold federal income tax from your employees wages and deposit it with the IRS. To be able to do that, the first thing you will need is an EIN (Employer Identification Number) which is issued by the IRS.

You can apply for the EIN online by going to the official website of the United States Government.

Step 2. Secure completed form W-4 from your employees

You will have to secure a completed W-4 form from your employees to know how much federal income tax to withhold from their wages. Each employee should give you his/her signed copy of the W-4 form.

Step 3. Register in the state for state withholding and unemployment tax

You will also have to register your business in your state to be able to withhold state taxes from your employee wages as well as pay for state unemployment tax.

Every state does it their own way so your best option is to go to the state’s small business website to find out these details.

Please note that if you have hired employees in states other than where your business is incorporated, you will have to withhold wages and pay state unemployment tax in that state as well.

Step 4. Make correct classification for exempt and nonexempt employees

Before you can run payroll, you will have to make sure you correctly classify each employee as Exempt or Non-Exempt.

Employees who are classified as Exempt employees, are not entitled to overtime pay as guaranteed by the Fair Labor Standards Act (FLSA) whereas the Non-Exempt employees are entitled to the overtime pay. The other difference between exempt employees and nonexempt employees is that exempt employees receive a salary for the work they perform, while non-exempt employees earn an hourly wage.

Step 5. Select Correct Deduction Method

A deduction from employee wages can be pre-tax or post-tax so please make sure you choose the correct deduction method. For example, if you offer medical/dental/vision coverage, the employee portion of the premium for these benefits should be deducted pre-tax from their wages. The same is true for retirement benefits like 401K etc.

Step 6. Select Correct Payment Method

Are employees getting paid via checks or ACH or a combination of both. For those employees who are getting paid via ACH, please make sure you have their correct banking information.

Step 7. Enter time card entry

If you have hourly employees who get paid based on hours worked, you will have to calculate their total hours worked for the pay period. If they did not earn overtime, total hours worked times their hourly rate would be their gross pay. If they did work overtime, you will need to compute their overtime pay based on the overtime pay rules in your state. In most cases, overtime pay rate is 1.5 times of the hourly rate.

Step 8. Run Payroll

If you have completed all the steps outlined above, you are ready to run payroll! You will have to do it for each pay period before the pay date. If you get tired of doing it manually, you can always use Uzio Payroll Software where it can be done in minutes instead of hours.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Step 9. File your Form 940 and Form 941

Your responsibility does not end as soon as you process the payroll. You have to file different forms with the IRS and the state agencies. Generally, employers are required to file Forms 941 quarterly. Employers are also generally required to file Form 940 annually.

Recommended reading: A Guide to Essential Payroll Forms & More for Small Business Owners

Step 10. Make your tax deposits

Monthly or semiweekly deposits may be required for taxes reported on Form 941 (or Form 944), and quarterly deposits may be required for taxes reported on Form 940. It is very important that you make these deposits timely if you want to avoid receiving penalties from the IRS.

Conclusion

While here we have given you tips to simplify your small business payroll process, you can see that it is not easy to run your payroll manually.

A small error or delay in making tax deposits can result in thousands of dollars in penalties. You might be better off working with a company like Uzio where we guarantee your payroll would be accurate and you will not get in trouble with the IRS.