5 Sectors That Have Benefited Most From HRIS

Human resources (HR) is one of the most crucial functions within an organization.

The HR department handles all employee-related issues as well as payroll calculations. Considering the importance of this department, an effort should be made to streamline operations, optimizing both employee productivity and the employee experience as a whole.

Fortunately, companies are investing more in HR. In fact, the industry is projected to be worth $38.17 billion by 2027!

Sadly, many businesses still rely on manual management of their workforce, but companies can use Human Resource Information Systems (HRIS) to reduce or even eliminate many of their routine, time-consuming tasks.

An HRIS addresses many different issues often faced by the HR department, but its primary purpose is to simplify HR workflows. This is accomplished by speeding up HR processing and ensuring an accurate payroll.

Recommended reading: The Benefits of HRIS Technology for Small Businesses

An HRIS is effective for large enterprises, but they’re also perfect for any small business trying to improve the efficiency of its operations.

Before you pick an HRIS for your business, it’s important to look at the different types of HRIS available and which industries these solutions serve best. If your business falls within one of these sectors, then chances are it’s the right time to make the necessary adjustments and invest in an HRIS for your company!

1. Education

According to a report by the Economic Policy Institute, there is a shortage of teachers in the workforce.

In fact, the annual teacher shortage was estimated to reach 110,000 teachers in 2018 and is expected to quadruple by 2023.

This shortage highlights the importance of hiring enough teachers so that schools are not under-staffed. Of course, hiring the most-qualified candidates is also important, and attracting the best talent requires offering competitive salaries and enticing benefits to potential employees.

In education, HR serves as the middleman between teachers, staff, and the school administrations. HR is there to resolve any issues or concerns of the workforce, which can range anywhere from benefits concerns to labor issues. If teachers or staff feel that they deserve more from the administration, then it’s up to the HR department to convey that message to the stakeholders.

One of the most useful features of HRIS is benefit analysis, which helps find the most attractive and efficient benefits for your workers. This feature poses an obvious advantage for finding top-tier teachers, but it can be utilized in other sectors as well.

2. BPO / Call Centers

Business Process Outsourcing (BPO) and call centers have some of the most competitive atmospheres in the workforce today.

Employees, motivated by rewards such as commissions for their efforts, are bound to work harder to achieve their allotted quotas. This sector is best suited for resilient, resourceful workers who can adapt to the long calls and late-night schedules that tire out most employees.

HR is an important part of this industry as finding people willing to sit through long conversations and work extended hours is key to success. Quality call center agents who get along with their coworkers can be hard to find, although the competitive nature of the profession likely contributes to disputes among team members.

Since companies in this line of work usually have hundreds of employees, a proper HRIS is essential. The systems are ideal for managing a massive team and provide the perfect solution to all of your payroll issues.

Call centers may struggle to distribute the payroll on time due to their massive employee bases, but HRIS has features that allow the HR department to streamline the payroll process, ensuring that all employees are compensated properly and on time.

3. Construction

Construction is one of the most physically exhausting industries in the modern workforce. Workers are often deployed at multiple job sites, making it hard to keep track of attendance. If workers don’t get the proper benefits, salaries, and treatment, worker morale can plummet and projects will quickly crumble. An easy way to keep everything the workers need in check? Using an HRIS!

HR plays the crucial role of forecasting in the construction industry. Before a project begins, HR helps in distributing the workers among the job sites. During and after projects, HR acts as the workers’ go-to for all their labor needs. A proper HRIS can streamline both processes through its database, and the features it offers help reduce the likelihood of errors (and time required) from the HR department.

From ensuring salaries are paid on time to keeping workers up-to-date on the latest policies and compliance laws, an HRIS handles all of the heavy lifting, allowing your business to optimize its HR department.

4. Government

This sector needs HR the most. HR effectively empowers the government by allowing workers to provide the services required by the general public.

Utilizing an HRIS, the HR department can easily manage and organize the data of an employee for future reference. Whether it’s ensuring they are still qualified for a job or checking for past misconduct, an HRIS makes it easier for government agencies to maximize the amount of work they can process on any given day.

Beyond that, a proper HRIS provides workers with cost-effectiveness incentives, motivating them to work harder. Though often overlooked, these incentives are important as they let the workers know they are valued by their employer, regardless of the industry they work in.

5. Banking and Finance

Finding the right people for the job and keeping accurate records in the industry poses a large challenge for banks and other financial institutions.

Thankfully, an HRIS has many features that make this task a lot easier for the HR department to handle.

As the banking industry is mainly service-based, some of the main challenges it faces are managing people while navigating both financial and economic risks.

This huge dependence on the workforce makes HR a top priority. An HRIS can help plan for recruitment, train current employees, manage employee performance, and keep track of employee requirements.

Managing everything from benefits to retirements and resignations, a proper HRIS is crucial for any financial HR department.

Improve Your HR Processes

Any time is a great time to make the necessary adjustments for your business, especially if you’re concerned with company growth.

While there are hundreds of HRIS options available on the market today, it’s important to choose the one that will give an edge to your business.

Start exploring your options by checking out the features and capabilities of UZIO, which offers HR, payroll, benefits, and workers’ compensation solutions.

If your HR department is currently struggling with managing and maintaining your HR department, then it’s time to explore tools designed to optimize your processes and boost your business.

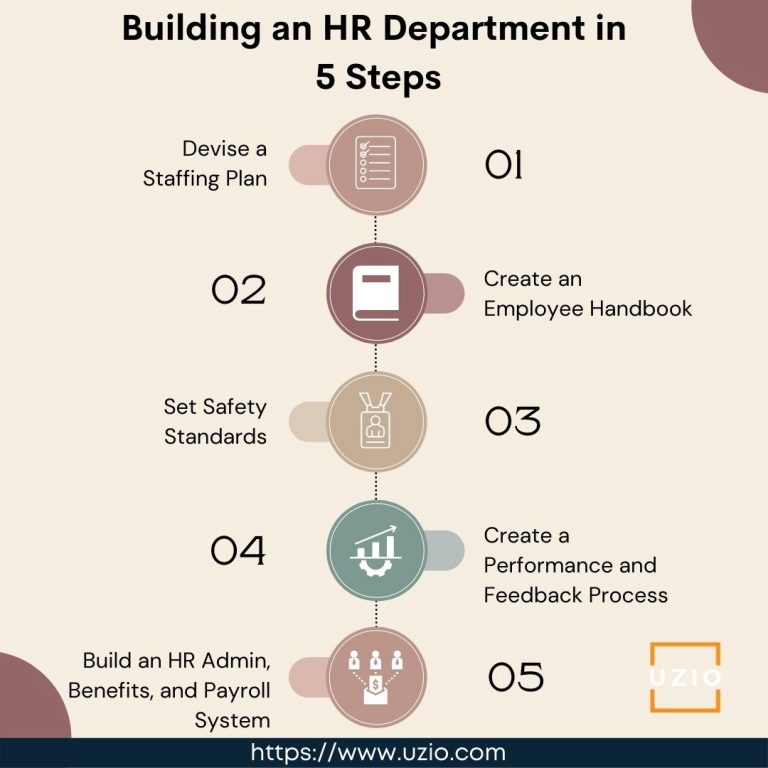

A Playbook to Help You Build Your HR Department in 5 Steps

Quick links

-

Building An HR Department in 5 Steps

-

1. Devise a Staffing Plan

-

Mini-Plan for Building a staffing Plan

-

2. Create an Employee Handbook

-

3. Set Safety Standards

-

4. Create a Performance and Feedback Process

-

5. Build an HR Administration, Benefits, and Payroll System

-

The Conclusion

Today’s most successful businesses thrive by having a strong, cohesive HR (human resources) department.

Without an efficient HR team, it’s hard to imagine running a successful operation. Since an effective HR department is so crucial to the success of a business, even small and medium-sized businesses (SMBs) aspire to establish an HR department.

Sometimes referred to as a people department, the men and women of HR are responsible for overseeing company culture, hiring, employee onboarding, time tracking, employee engagement, payroll, benefits, and workers’ compensation.

A solid HR department takes a load off the business owner, allowing them to focus on more important tasks instead.

Of course, an HR department is policy and process-driven.

Building An HR Department in 5 Steps

If you’ve never set one up before it may seem confusing, so here’s a list of 5 steps to assist you with forming a successful HR department for your business.

1. Devise a Staffing Plan

Staffing requires a strategic, data-driven approach if you want to be successful.

It doesn’t start and end with recruiting the right people. Staffing is an on-going task that includes evaluating organizational needs, growth strategy, and a full spectrum of both skills & resources.

All of this must align with the company-wide business goals to ensure business success. A proper staffing plan helps businesses:

- Improve the recruitment process

- Increase employee retention

- Optimize the promotion process

Here’s a Mini-Plan for Building A Staffing Plan

- Set measurable goals for optimizing staffing and employee development levels. This means:

-

- Deciding which HR metrics to track

- Implementing a way to analyze progress

- Evaluate your current staff. Here’s what you need to look at,

- The existing in-house skillset

- Employee performance levels

- Top-performing employees

- Current compensation rates vs. the industry average

- Predict the optimal staffing levels using:

- Trend analysis

- Industry benchmarks analysis

- Conduct a gap analysis. This will let you:

- Prepare to let go surplus employees and resources

- Analyze current and previous shift management data

2. Create an Employee Handbook

Though we may not always agree with them, rules are there for a reason: they promote unity and growth through a unified code of conduct.

These are the main reasons why you should create a crystal-clear code of employee conduct.

A good employee handbook covers safety, health, and company culture in an easy-to-read digital or print form.

If possible, you should have both a hard and a soft copy available, so employees never have the excuse of “I lost it”.

It’s important to include answers to any current questions (or questions commonly asked by new employees) in a FAQ section as well.

By providing employees with a specific book of instructions and guidelines, you will be standardizing conduct and optimizing your business from the start.

3. Set Safety Standards

These standards cover physical, verbal, and virtual practices.

It’s important to provide employees a clean, hygienic, and safe workplace where they can comfortably spend their 8-10 hour days.

Ensure that these guidelines are strictly adhered to so that no employee is ever in physical danger.

Beyond physical standards, verbal and virtual standards are important as well.

A sexual harassment policy is a must and needs to be readily accessible by any employee.

These policies cover verbal and virtual conduct both inside the workplace and out.

Another important thing? Having an EAP (Emergency Action Plan).

If something goes wrong, employees need to have a response plan in place, especially if evacuation is necessary.

4. Create a Performance and Feedback Process

It’s hard to recognize progress if you have no method in place of measuring it.

Performance expectations provide measurable goals and metrics to monitor both employee and business progress.

A comprehensive performance management and feedback process play a critical role in attracting and retaining key employees.

By monitoring and measuring progress, you ensure employees reach their full potential while confirming they’re happy with their roles and growth within the team.

5. Build an HR Administration, Benefits, and Payroll System

The success of your HR department will ultimately depend on the approach you choose, so go with one that’s adaptable and expandable.

An all-in-one, fully integrated HR, benefits, payroll, and workers’ compensation platform for e.g. UZIO automates your people management workflows and helps you to:

- Eliminate manual tasks while increasing productivity

- Efficiently handle tedious and time-consuming HR administrative tasks

- Ensure 100% payroll accuracy

- Offer a wide range of benefits to your employees

- Quickly address all workers’ compensation claims and policies

The Conclusion…

Having an excellent HR team is essential if you want your business to grow, expand, and prosper.

Without a productive HR team, your employee relations, hiring, training, career development, benefits, and company culture will all suffer!

Of course, now you know how to create your HR department within your company, so take these tips, choose a team size, and start building your HR team today!

The Insiders guide to HRIS system and Features

The word ‘Information System‘ depicts an integrated platform to manage a large chunk of data. Management Information System or MIS is a widely used term in organizations to ensure the safekeeping of their operational records.

But is there any connection between HR and the cloud storage platform? How will it help HR managers to enhance operational efficiency?

HRIS or Human Resource Information System is a software package with a similar bucket of benefits of ‘MIS’ that allows HR managers to embed every crucial data in a single platform. HR managers daily deal with large unorganized datasets scattered on several different platforms. Handling this data from distinct platforms and integrating them to draft analysis is a quite chaotic and strenuous task.

HRIS is the solution, a platform to integrate data from different sources and execute every task efficiently in an automated fashion.

Now the second question one reckons is regarding its value propositions. Most of the organizations store their crucial data in this cloud-enabled platform to streamline their operations. The benefit bucket comprises of the following functions-

- Record-keeping. An HRIS is a record-keeping system for tracking every minuscule information of employees. Organizations observe the severe cases of data breaches for the trail of paperwork and even face financial losses. HRIS system revamps the paperwork system to a digital record-keeping platform. The software accounts for maintaining transparency and eradicating toxic environments in the organization.

- Compliance. Organizations with activities in the U.S. must retain personal expenses from their U.S.- based representatives. Income tax is payable across seven groups, with logically higher rates applied for higher income, going from 10% up to 37%. There is no base limit at which annual income tax is exempt. However, the stipends in each band change for the accompanying gatherings:- single individuals, married people filing separately; heads of households; married people filing jointly; widows and widowers.

Extra business prerequisites include:

- Filing Form 941 (quarterly compromise) toward the finish of each quarter.

- Filing Form W-3 with the Social Security Administration (SSA) every year.

- Providing all workers with Form W-2, which is the annual wage and tax statement, by January 31 of consistently.

Recommended reading: A Guide to Essential Payroll Forms & More for Small Business Owners

Taking care of all these compliances is a big hassle for the HR manager. HRIS is the name of the solution to cater to all these bewilder tasks to give you a sigh of relief from these complexities.

- Productivity: One of the significant functions of HRIS is that it helps organizations to enhance their productivity. Integrating data in a single platform helps in accelerating the process efficiently. An HRIS system is the only constant in your organization to witness the hassle-free completion of the employee life cycle. Starting from an automated onboarding process to smooth reimbursement after the notice period HRIS is the only solution to build a hassle-free process.

- Strategy: The HRIS enables the tracking of data, analyzes it, and implements it in different verticals on the priorities of the organization.

- Transparency: A final benefit is the ability to offer transparency within an organization. The software enables employees to monitor their activities. The right execution of HRIS helps to execute a good employee experience.

The benefit bucket comes with some features to execute the mentioned functions hassle-freely. The innovative software encompasses the following features-

- Onboarding: The process of onboarding usually takes a colossal amount of strenuous paperwork. Employees find it cumbersome to repetitively enter the same pieces of information in various documents. HRIS has turned the monotonous manual labor to a dynamic one by reducing the extensive paperwork in the process. The cloud server will capture every crucial information regarding the employee from one document and deploy that to every other copy and reduce the workload. The only job of the HR manager is to register the employee details initially to the cloud platform and then upload any single document to get filled out manually. The data will get stored in the system and can be retrieved for any other documents automatically in the future.

- Payroll: The payroll system automates the pay process of employees. The cloud-enabled platform tracks every data from attendance to leave taken in that month to calculate the payroll process. HR managers often get bewildered at managing different sets of taxes for both permanent employees and individual contractors. 1099-MISC usually applicable to the independent contractor, to pay over their employment taxes. A W-2 form, on the other hand, applied for permanent employees to deduct payroll taxes from their earnings. An HRIS system will automate the process for both of the tax payments, and it also seamlessly handles payment of state and federal taxes for your organization.

- Employee Benefit Management System (EBMS): Another feature of the HRIS is benefits management. Employee benefits are a crucial aspect of compensation, barring that monetary and non-monetary benefits also get managed in this system. Moreover, it offers each employee a self-service model for benefits management. Employees can monitor health insurance, retirement accounts, vacations, paid time off in a single platform. They can select the customized benefits options from the available bucket. Someone might require additional paternity leave, the other one might opt for an expensive company car. This personalized approach to benefits is also called a cafeteria model.

- Identifying Training Needs: Training and development is a prime element when it comes to employee management. This module allows HR to develop a tailor-made training module according to the need of the employees. The machine learning algorithm helps to analyze the qualifications, certifications, and skillsets of the employees, and predict the training need for that particular person. The training need will be unique for every employee, and they can also track the Learning Management System in their dashboard.

- PTO management: Do your employees retaliate with you for miscalculating paid leaves? Unfortunately, this is the usual scenario of every workplace, and coping with that is indeed a big challenge. Often employers fallaciously slip-up in the calculation, and on many occasions, employees commit the same mistake.HRIS is the platform to embed the details paid leaves and gives notifications to both employees and employers to utilize it effectively.

- Analytics in an HRIS: HR managers can also track their performance through this software. They can analyze their strategic implementation and success rate of the same through records. Starting from manpower planning to attrition percentage the data will help HR managers to work upon critical areas.

UZIO is the name of these precedent solutions. Automation is not only enhancing productivity but also helps to optimize operational expenses. Organizations can integrate every piece of information on a single platform and operate from there to reduce the maintenance cost of different software. UZIO HRIS is a disruptive technology with the superior attributes to sweep away the traditional strategic approach of Human Resource Management. If you still haven’t incorporated the state-of-the-art solution, spontaneously contact the industry expert to entice your workforce efficiency. Contact UZIO out rightly for their virtuoso guidance.

10 Employment Benefits to Ensure a Happy Workplace

It’s often said that an entrepreneur is the mind of any business, whereas employees are the hands and legs that bridge the gap between goals & their execution.

With that in mind, it quickly becomes obvious that maintaining a happy workforce is important to the success of any company.

Ensuring your employees have a quality workplace & working experience has been proven to improve both proficiency and productivity in a business.

If you haven’t already, a great place to start is by offering various benefits to your employees.

Respecting your employees and appreciating their work are among the many factors that contribute to the success of a business.

Various studies have shown that a decrease in employee satisfaction is directly proportional to a decrease in motivation and productivity. So it’s important to cater to your employee’s requests. Employees often look for long-term benefits in addition to competitive wages, so you’ll want to take that into consideration. Offering a toxic-free workplace can be a great way to improve employee satisfaction and motivation.

Unfortunately, overall employee satisfaction has taken a turn for the worse as more and more employers are switching to work-from-home models. With remote work, the needs and requirements of workers have dramatically changed, so you’ll want to think outside the box to address these needs.

While traditionally, options such as PTO or worker’s compensation would be enough, but nowadays even little things such as diet should be considered.

Did you know that employees are 20% more likely to improve productivity and overall performance just by eating fruits and vegetables at least four times a week? Think of everything you haven’t addressed yet (no matter how small) as having potential to boost success.

The small changes needed will vary by business, so it’s impossible to know which ones to make – you’ll simply have to try and see!

Recommended reading: What small business owners should know about benefits management?

However, we’ve done the research when it comes to company must-haves, so here are ten benefits you can offer to ensure a happy workplace.

1. Health Insurance

Providing financial stability in case of a medical emergency is a great way to show compassion and care towards your workforce. Having company health insurance coverage available to your employees (and their families) can help them manage challenging times such as accidents, death, or disability with far lower out-of-pocket expenses.

2. Tuition Reimbursement

Helping your employees with educational expenses is a great way to quickly become a highly sought-after employer. The employee reports the course costs to you, and once the course is completed, your company reimburses them for part (or all) of the incurred expenses.

3. Corporate Discounts

Offering corporate discounts is an easy way to get on an employee’s good side. Employees with this benefit can buy goods and services at discounted rates from their company. These discounts are especially effective when dealing with electronic products.

4. Paid Vacation

As time goes on and businesses cut costs, fewer and fewer companies are offering vacation time to their employees. Simply allowing vacations is great, but offering paid vacations makes your company extremely attractive to potential (and current) employees. While you will incur some expenses for the paid vacations, your employee retention rate will be higher than companies that don’t offer this benefit.

5. Stock Options

Employees are more invested in a company if they own part of it. Offering stocks at a discounted rate to employees will motivate them to achieve new heights in their work, as they feel like a significant part of the business.

6. Retirement Benefits

Most employees plan on retiring someday. Retirement benefits, such as pension plans, offer them financial security in the future and are considered to be one of the most valuable benefits available. They benefit the employer as well because employees who have pension plans through a company are much less likely to change employers.

7. Profit-Sharing

This program incentivizes employees by offering them a share in the company’s profits. An allotted proportion of pre-tax profits is distributed among eligible workers, motivating them to achieve goals more efficiently (in order to maximize their returns).

8. Office Perks

One of the easiest ways to ensure your employees stay happy is by breaking away from the monotonous strict working environment. Free meals, recreational games, and chill zones are a few of the office perks you can offer to your employees. Best of all? They’re relatively low-cost to implement, and can actually improve work efficiency!

9. Employee Training

Employees don’t just want a job; they want an opportunity to grow, so having employee training available can help retain employees. By providing multiple training programs and facilities, you’ll enable workers to expand their area of expertise while improving the overall workforce.

10. Performance Bonuses

Employees love to feel appreciated, especially by the higher-ups. Verbal appreciation is a good start, but providing performance and other bonuses to employees really lets them know you value their work. All these little things add up to make them more likely to stay in the company.

Employee retention is a complicated and complex matter. The modern business world is full of fierce competition, so it’s vital for a company to consider offering multiple benefits to employees if they want to retain talent in their workforce.

What is the Paycheck Protection Program?

As part of the CARES Act, the government released the Paycheck Protection Program (PPP) to help protect and sustain US small businesses during the COVID-19 pandemic. As long as the loan amount is used towards payroll and eligible business expenses, it does not have to be repaid and will be fully forgiven.

Through the Small Business Administration (SBA), the government will provide $310 billion in funding and requires that applications are submitted through an approved lender of choice. Small businesses, nonprofit organizations, and sole proprietors are eligible to apply beginning April 3rd, whilst independent 1099 contractors can apply beginning April 10th. Although the original deadline to apply was June 30, it has been extended to August 8th, 2020 with an anticipated second round of funding following approval by the Senate and House of Representatives.

Who can apply?

Qualifying small businesses, sole proprietorships, independent contractors and self-employed individuals are eligible for the PPP.

Your business is eligible for this loan as long as you have less than 500 employees and was fully operational on or before February 15, 2020.

What are the terms of this loan?

At least 60% of the loan must be used towards payroll costs and employee benefits.

- No more than 40% of the loan can go towards rents, utilities, and mortgage payments.

- Each business is eligible for up to 2.5 times their monthly average payroll. ● Each loan carries an interest rate of 1%.

- The loan has a maturity rate of 2 years and loans made after June 5, 2020, have a length of 5 years.

- Each loan is eligible for either partial or full forgiveness.

- In most cases, the small business owner or individual must make loan payments until either their forgiveness application is processed or 10 months after the covered period ends

How can I apply?

To apply, complete an application form and submit it through one of the SBA’s approved lenders before the deadline.

As part of your application, you’ll be asked to:

- Review and verify the direct economic impacts of COVID-19 upon your business and supporting its ongoing operations.

- Confirm that these funds will be used to retain workers & maintain payroll or to make the mortgage, lease, and utility payments.

- Confirm that you have not and will not receive another loan under this program. ● Confirm that the lender will calculate the eligible loan amount using the tax documents you submitted and must also confirm that the tax documents are identical to those you submitted to the IRS.

Furthermore, you’ll also need to provide payroll or bookkeeping records to prove your payroll expenses. These could include the following:

- Payroll processor records

- Payroll tax filings

- Payroll tax forms from 2019 (Forms 941, 940, and W-3)

- Form 1099-MISC records

- Schedule C for a sole proprietorship

If you have employees (and you’re paying yourself through payroll too), the easiest way to get the financial information you’ll need is by downloading a payroll report through your payroll provider.

For more information, please visit the Small Business Administration’s website with more details on the PPP and all other funding programs or check out this information sheet with frequently asked questions from the US Treasury.

An insight to Bereavement leave policy

Employees are the cornerstone of any for-profit organization, so it’s crucial to maintain a positive relationship with them. If this relationship suffers, the overall productivity of your company may suffer as well. Fortunately, many businesses these days are realizing the importance of employee satisfaction, and therefore considering ways to improve both workplace practices & company culture. After all, employees are hard to retain if they can be easily persuaded away to another company, so offering excellent benefits is key if you want to hire (and keep) the best of the best. One benefit you can offer that’s sure to attract potential employees is a Bereavement Leave Policy!

Bereavement leave is a unique benefit that ensures an employee time off if they experience a loss in the family. Employees are often worried to request time-off (even in the event of a family death), for fear of retaliation or being fired. Having a bereavement leave policy in place is a great way to show your employees that you care about them by placing value on their personal lives. It is great for employee retention because employees are much less likely to leave a company where they feel valued.

Unsure if a bereavement leave policy is right for your company? Here are a few facts to help you in your decisions.

- In most states, a bereavement leave policy is not required. Generally speaking, offering bereavement leave is up to the company’s discretion. However, in Oregon, you’re required to offer this type of leave (which can run up to two weeks) if you have more than 25 employees. In Illinois, the law is more lenient towards the company and only requires you to grant bereavement leave if an employee (parent) loses their child.

- The length will vary. As different religions perform different rituals, it’s hard to give an exact length for the bereavement leave offered. However, a general leave policy lasts from 3 to 5 days. Of course, the exact time required will vary per employee, so the HR department will have to handle this on a case-by-case basis.

- You’re not required to pay. In general, bereavement leave is offered as a courtesy, not a legal requirement, so you aren’t required to pay an employee for their time off. That said, many larger companies choose to pay their employees for their time off, but smaller businesses may not. It depends entirely on the policy set forth by your company.

- In general, bereavement leave is up to the discretion of management. This leave is supposed to offer time off to deal with a loss in the immediate family. Who the policy covers remain generally up to your company to decide. Some employers may include parents, in-laws, children, grandparents, or siblings in this category, while others may even include uncles/aunts, cousins, or pets in their policies.

- Though not required, it’s a good practice to put the policy on paper. Designing a formal document covering the benefits, duration, and limitations of bereavement leave are preferred over an unspoken agreement. This can prevent any disagreements in the future, and (assuming you add it to the employee’s personal file) you can reference it if needed later on.

When creating a written bereavement leave policy, you’ll want to make sure the policy covers all the ins and outs of any potential situation. Here are a few things you’ll need to include in the policy.

- The number of days allowed – Both the employee and the employer must be clear on how many days can be taken off. You can record this leave time in your HRIS software for future scheduling.

- Eligibility – You need to clarify the requirements for bereavement leave. Some companies may offer it to employees from day one, while others may require a certain amount of time on the job before taking bereavement leave.

- Who is covered under the policy – As mentioned before, this may vary by company. You can choose to limit bereavement leave to the death of an immediate family member, or extend it as far as employee pets! This is entirely up to your discretion.

- Paid or unpaid? – Paying employees for time-off is recommended, but not required. This will definitely improve your employer-employee relationship, however, some employees may use this policy to take advantage of you. Weigh the advantages vs. the disadvantages and make your decision accordingly.

A bereavement leave policy isn’t offered by every company, and many smaller businesses simply can’t afford it. Nevertheless, bereavement leave offers a great way to build employee trust, make employees feel valued, and attract potential new talent, so you should definitely consider if a bereavement policy makes sense for your business.

Ascertain The Right Payroll Period For Your Employees

Are you in a fix whether to process your payroll weekly, bi-weekly or semi-monthly? If that is so, then don’t worry we are about to shed some light on this. You will soon unearth the ideal modus operandi to process your payroll, and finally, get rid of the conflict that you have been pondering over.

Let’s face it, managing businesses is not a piece of cake, and gradually you realize that it is a vicious circle with numerous compliances and regulations to abide by. Apart from focusing on your business, you need to take care of a lot of other things that you may not have thought of yet.

Payroll processing and management is the problem child of regular business transactions that puts you in dire straits.

Let us make it simple by addressing first, how frequently you should pay your employees depending upon the size and nature of your business.

The payroll frequency trends in the United States:

Let us understand how other businesses have been processing their payroll when it comes to the frequency of payments.

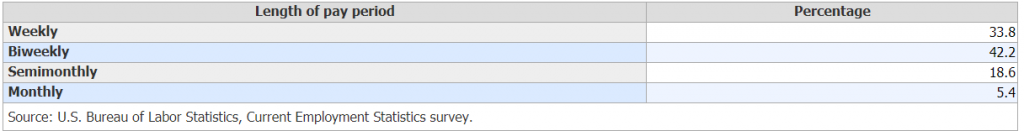

According to the U.S. Bureau of Labor Statistics bi weekly payroll processing is the most commonly practiced frequency with 42.2% followed by weekly at 33.8%. Semi monthly and monthly payroll frequencies are least practiced with 18.6% and 5.4% respectively.

Here is a small chart for your reference.

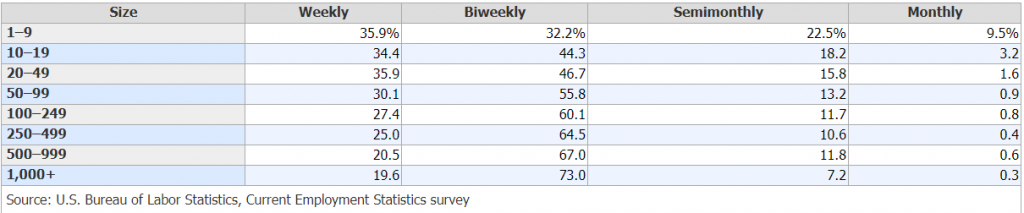

But, only because bi weekly payments are most popular this doesn’t mean you should make a decision right away, just going by the data. There are other factors involved too such as the size of the business and the industry you operate in. This data repositions with the number of employees for which a business is processing payroll.

Despite being the most popular choice of payroll frequency, bi weekly payments are preferred less by small employers as compared to large employers. Employee size of 1-9 has the least biweekly payroll frequency which gradually increases in coherence with the employee size.

Refer to the chart below to get more clarity on this.

Refer to the chart below to get more clarity on this.

Some payment frequencies seem to be more popular in certain industries; for example, the construction industry tends to use biweekly payroll with over 76% as per the survey conducted by the CES. Weekly & Semi monthly payroll seems to be more popular with small business sizes.

Understanding biweekly & bimonthly payroll

The companies that pay their employees bi weekly, will have three pay periods instead of two for two months in a year. This means that a total of 26 transactions will have to be made in case of biweekly payments and 24 transactions if chosen to pay semi monthly. The transactions are even higher when you tend to process your payments weekly.

What is the ideal frequency for you

Truth to be said, the ideal frequency is the one that your employee prefers. Employers should allow their employees to choose the frequency of their payments. Every worker has their personal needs, and one solution fits all may or may not work if you have over 50 plus employees. The more the number of employees, the more diverse the needs of the employees are.

Small employers may tend to avoid weekly or more frequent transactions because of the amount of work and calculations required in quick successions. If you are managing your payroll on spreadsheets you may not want to process your payroll frequently, but rather choose a monthly payments option. However, monthly payments are not very popular among the workers in the United States and may hamper your reputation as an ideal employer.

But more transactions mean more accrual costs for your accountant to process the payroll, and paying your vendors who might be charging on a per transaction basis.

UZIO has a fixed payroll transaction fee per employee per month that should save you from burning holes in your pockets. The pricing plan of UZIO has been created keeping in mind the different businesses, their needs, and the ability to adapt for employers of all sizes.

Automate your payroll

If you are still using spreadsheets to manage your payroll, then you might be losing a good chunk of your precious time that otherwise could have been utilized to grow your business.

Learn how you can automate your payroll with a few easy clicks, and give your employees the freedom and happiness they deserve.

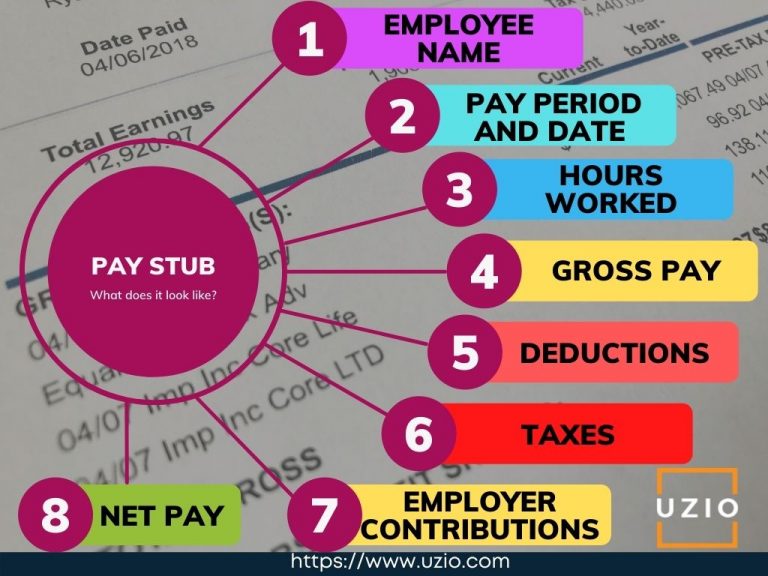

What does a Pay Stub look like?

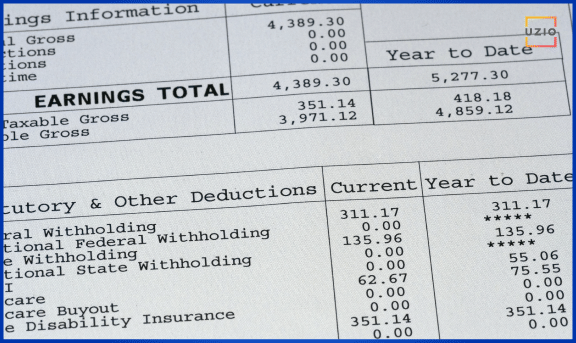

A pay stub is part of a paycheck that enumerates information about the employee’s pay.

It lists the wages earned for the pay period and year-to-date payroll. The pay stub also attests to taxes and other deductions taken out of an employee’s income. And, the pay stub shows the amount the employee receives (net pay).

Fair Labor Standards and Labor Standards Act Compliance: In compliance with the Fair Labor Standards Act (FLSA), pay stubs must meet certain standards to ensure workers are paid for all the hours they work, including overtime. This federal act establishes minimum wage, overtime pay eligibility, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in federal, state, and local governments.

A pay stub incorporates information both managers and employees can use. Employees get pay stubs as records of their earnings. By reviewing their pay stubs, workers can make sure they were paid rightly and follow their deductions.

- Gross wages

- Taxes, deductions, and contributions

- Net pay

1. Gross wages

Gross wages are the beginning stage of your worker’s salary. The gross wages incorporates cash owed to a worker before deductions are taken out.

Hours worked: Pay stubs for hourly workers consolidate the number of hours worked. Salary workers likewise have the hours worked recorded on their pay stubs.

If you get paid every hour, your pay stub should include:

- The rate every hour for both standard and extra time work

- The number of hours worked at each rate

- The aggregate sum due for each pay rate

Pay rate: The pay rate should be remembered for a worker’s pay stub. For hourly workers, note every representative’s time-based pay rate.

Understanding Your Hourly Rate: For non-salaried employees, the pay stub should break down the hourly rate. This includes the regular hourly rate, as well as any differential rates for overtime or holiday pay. Understanding your hourly rate is crucial for verifying that you are being paid correctly for all the time you work.

Gross pay: A pay stub records the absolute wages procured before allowances. Other than standard wages, a representative may gain extra pay. This can incorporate overtime, sick pay, holiday pay, bonuses, personal time, and payroll advances.

Direct Deposit Details: Many employers offer direct deposit, which is an electronic transfer of a paycheck directly into the employee’s bank account. Pay stubs often include direct deposit information, showing the bank account number and routing number where the paycheck was deposited.

2. Taxes, deductions, and contributions

Alike gross pay, taxes, and deductions are separated into two sections. One category shows prevailing deductions, and the other shows year-to-date results.

The following are common deductions seen on pay stubs:

Employee tax deductions: Usually, government agencies (like the IRS and state tax departments) tax an employee’s salary. Taxes deducted involve federal income tax, the employee portion of FICA tax, and, state and local income taxes.

Understanding Social Security and Medicare Deductions: Social Security and Medicare taxes, commonly known as FICA tax, are key components of payroll deductions. Every pay stub should clearly list these deductions to ensure employees are aware of their contributions towards Social Security and Medicare. These contributions provide long-term benefits, such as retirement income and healthcare coverage during retirement.

The Role of Medicare Taxes: Medicare taxes are withheld from an employee’s earnings and are used to provide medical benefits to individuals when they reach retirement age. Your pay stub will show the exact amount deducted for Medicare, which is critical for future healthcare entitlement.

Benefits and other deductions: Other payroll deductions shown on a pay stub differ depending on the small business employee benefits you render.

Health Insurance Premium Deductions: For many employees, health insurance premiums are deducted directly from their wages. The pay stub should list these deductions separately, often under a section for ‘benefits’. This transparency helps employees understand how much of their paycheck goes toward health coverage each pay period.

Employer contributions: Some things remembered for a worker’s pay stub are not deducted from the gross compensation. They display sums you provide as a business.

Employer Contributions Beyond Deductions: Employers often contribute to certain taxes and benefits on behalf of their employees. These employer contributions, such as those toward unemployment tax, workers’ compensation, or additional health insurance benefits, should also be indicated on the pay stub, even though they are not deducted from the employee’s gross pay.

3. Net pay

Net pay is the sum left over after taking away allowances from the gross pay. It is the employee’s salary.

If an employee abruptly quits or is fired, you might need to pay them quickly. Knowing pay stub data makes the cycle smoother.

Exploring worker pay stubs can likewise draw botches out into the open. Check for the right pay rates, hours worked, and complete income. On the off chance that a sum appears to be strangely high or low, you can get blunders right on time to dodge IRS punishments and clashes with employees.

Pay stubs make it easier for workers to know how and how much they are getting paid.

It might save you the trouble of answering repeated questions about withholdings and overtime payment.

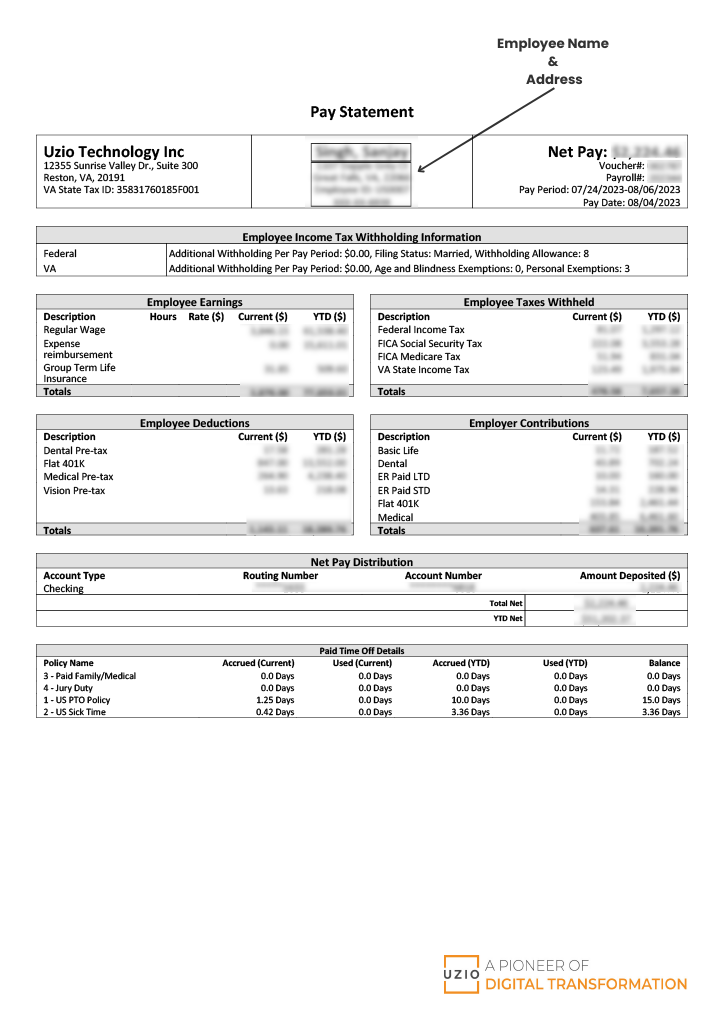

What does a pay stub look like?

- Employee name

- Pay period and date

- Hours worked

- Gross pay

- Deductions

- Taxes

- Employer contributions

- Net pay

For what reason should a pay stub be given?

As an employee, a pay stub is valuable for charge purposes, and it tends to be utilized to determine any disparities with representative compensation.

Why You Might Need Your Pay Stub

- To secure lodging or get credit: When you’re applying for a loan, leasing an apartment, or buying a house, you may be asked to render copies of your pay stubs from a certain period.

- To verify employment and salary history: Requesting later and current salary hits are one way that employers confirm employment. Corporations may also ask for pay stubs as part of the hiring process, to check that you’ve provided an accurate salary history.

- To ensure the data is right: It’s a smart thought to start checking on your pay stub and keeping either a physical or an advanced copy if you actually need to confirm your payment or deductions. This is particularly significant when you start a new job, so you can affirm that all the allowances in your first paycheck are correct.

- Retirement Plan Contributions: Contributions to retirement plans, whether a 401(k), an IRA, or other retirement funds, can also be found on a pay stub. These deductions are part of the employee’s pre-tax contributions, lowering taxable income and simultaneously preparing for long-term financial stability.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.

How Virtual Onboarding Of Employees Can Benefit Your Business

2020 was a huge turning point in the way companies managed business.

Companies that had only previously considered remote operations were now forced to put them into action because of the pandemic. The majority of the workforce (many who had never even considered remote work) were now working from home.

While the world is still adjusting to the “new normal” and continuing to embrace remote operations as a whole, there are certain factors common among many businesses that have room for improvement. Business leaders need to adapt to the new manner of handling their businesses, and a great place to start is with company onboarding procedures.

The hiring of new employees was not stopping even during the pandemic.

Successful onboarding ensures a clear path for employees as they begin their work at a new company. Even in these difficult times, remote business operations are no excuse for a complicated onboarding process.

New employees expect the hiring and training period to be as smooth as before, so it’s up to the organization to ensure this process is successful.

By focusing on optimizing the onboarding processes and providing new employees with tools necessary for their success, employers can easily make themselves more attractive to prospective employees than other companies that are yet to do so.

Like it or not, remote work is here to stay, so businesses need to adjust to this new workflow. The adjustment process to this online working culture begins with setting up a successful onboarding process for new employees and providing necessary tools to the current employees to work from home.

Fortunately, virtual onboarding is very much similar to in-person onboarding at the office.

The main difference is that interviews and initial training are done via video calls & video meetings instead of in-person meetings.

Of course, remote work doesn’t mean that company culture goes out the window!

In fact, company culture expands far beyond the walls of any workplace and is more critical than ever as your company transitions to a fully-remote working environment.

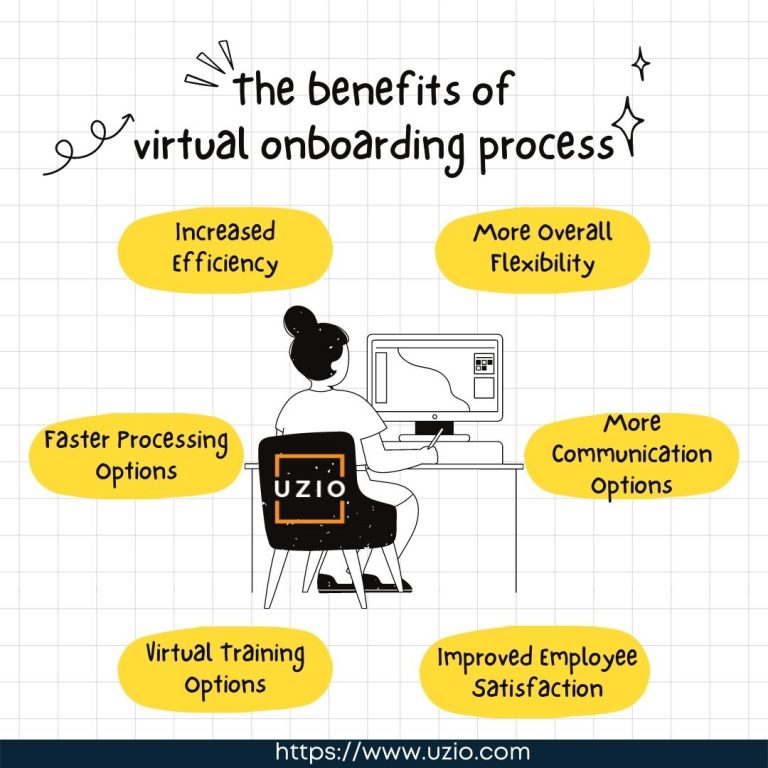

Let us check out the major Organizational benefits of Virtual Onboarding of Employees:

1. Increased Efficiency

Arguably the biggest benefit of a virtual onboarding process is increased efficiency.

Since forms are managed digitally rather than on paper, this means new employees can fill out forms faster and with less repetition.

Many times, the same information is required on various forms, which normally would need to be written down multiple times.

However, since forms are being filled out digitally, new employees can take advantage of the “copy and paste” functions, saving them from writing (or typing) the same information over and over again on multiple forms.

2. More Flexibility to Compare Available Perks

Benefits offered by employers are some of the most commonly sought-after perks that potential employees are looking for. Many forms traditionally filled out by hand, such as health insurance paperwork, can now be filled out digitally.

This reduces the processing time, and also allows the worker to compare multiple plans easily without shuffling through piles of paperwork.

If possible, you should include benefits forms as part of your virtual onboarding process.

3. Faster Processing Options

When filling out these forms, a signature will be needed.

Fortunately, there are many e-signature solutions available online, which makes it easy for new hires to read and sign any necessary hiring documents.

As the information is filed digitally and available in an instant, using e-signatures for your paperwork is a far superior solution to manually managing onboarding paperwork.

4. More Communication Options

New employees need active communication and instruction as they adjust to their new responsibilities.

Since in-person help was not an option, you can assign new employees a “welcome buddy” to provide direct support on their first day, who they can easily communicate with via chat.

A friendly face (even behind a screen) will help new employees feel welcome and comfortable within your company.

While this may not seem like a traditional introduction to you, the age of social media has made online introductions commonplace, so it’s unlikely that the new employee will have any trouble utilizing this approach.

5. Virtual Training Options

A virtual workplace allows new employees to quickly get assistance throughout the workday, and you can even create “meet and greet” roadmaps to introduce employees to their fellow workers.

This is beneficial beyond comradery – it also lets employees know who to turn to when they need help going forward!

If an employee is struggling to adjust to their new work environment, you can always assign them a virtual mentor to speed up the learning process while allowing space for growth and improvement.

Ready to go digital? Give virtual operations a try with a free 30-day trial from UZIO!

Final words

When you hire a new employee, it’s important to get them up to speed as quickly as possible, so they can start making valuable contributions immediately.

For hourly employees, you can accomplish this through an orientation of the workplace and the role they’ll be playing.

But what about salaried and office workers?

When you hire someone who doesn’t work on-site, it can be difficult to prepare them effectively, which results in added time and expense before they are productive members of your team.

In this blog we have discussed the benefits of virtual onboarding that will help you get new hires productive faster.

If you’re not sure about Employee onboarding process, check out our step-by-step guide: How to Create an Employee Onboarding Process That Doesn’t Fall Flat.

The Payroll Tax Deferral Plan of 2020

On Aug. 8, 2020, President Donald Trump issued an executive order which deferred payroll tax obligation for employees in light of the ongoing COVID-19 crisis. Active from Sept. 1 through the end of 2020, this order was intended to place cash directly in the pockets of employees, right when they needed it most. However, the order didn’t require employers to withhold taxes; it simply gave them the option to. It’s important to note that this order was a deferral, not an exemption, so payroll taxes deferred for the year are still due in 2021.

Here’s How SMBs Handled the Payroll Tax Deferral Plan

The payroll tax in question was the FICA (Federal Insurance Contributions Act) taxes, specifically the Social Security tax. Normally, the cost of Social Security taxes are split evenly between the employer and the employee, with each party being responsible for 6.2% (for a total of 12.4%). If a company chooses to defer these taxes, then the employee would have seen a 6.2% increase in their take-home paychecks. Since the order didn’t exempt companies from paying taxes, the businesses still needed to pay their 6.2% of the taxes owed as normal to the IRS (Internal Revenue Service).

Were the Tax Deferrals Mandatory? No. Companies were free to accept or decline the tax deferrals proposed in Notice 2020-65. Unfortunately, implementing these changes posed a complicated task requiring multiple updates in a company’s payroll system, so many small businesses choose to opt-out of the tax deferral program.

Depending on the amount of their employment tax liability, employers deposit their taxes on a day-after, semi-weekly, or monthly basis. As the executive order didn’t exempt employers from paying Social Security taxes, they continued to pay taxes as normal (minus the employee’s contribution). However, there was a lot of confusion at the time regarding the order. Employees were unsure if they would be held responsible for the deferred taxes, and had no way to know if their taxes would be deferred until it happened. Trump’s order didn’t require employers to notify employees before making the changes, so they simply had to wait and find out. Some employees noticed higher paychecks, but many employers (such as Costco and JPMorgan Chase) declined to implement the deferments.

Ultimately, the tax deferment plan didn’t help as much as originally intended, partially due to a lack of participation, but mainly due to a general lack of interest in the program.

The President Memoranda

The Presidential Memoranda stated that “the deferral shall be created offered with relation to any worker the quantity of whose wages or compensation, as applicable, owed throughout any bi-weekly pay amount usually is a smaller amount than $4,000, calculated on a pre-tax basis, or the equivalent quantity with relation to different pay periods.” To simplify this, any employee who made less than $104,000 per year (an average of $4,000 or less every two weeks) was eligible for the deferral. Unfortunately, eligibility was recalculated every two-week pay period, so an employee could be eligible for the first period in a month and ineligible for the second (due to overtime, bonus pay, or other factors). This ongoing eligibility determination probably influenced the overall success of the program, as it added a burden to the employer’s HR department.

Which payroll taxes did the executive order apply to?

The order only applied to the employee portion of Social Security payroll taxes. It didn’t apply to employee Medicare payroll taxes, and employers were still responsible for their normal portion of the FICA taxes.

The IRS has continued to make amendments to the original order. Currently, deferred taxes (from Sept. 1, 2020, to Dec. 31, 2020) are due by January 1, 2022, rather than the initial due date of May 1, 2021. If payments are not completed by this date, then the business(es) in question will be held liable for all applicable penalties, interest, and additions as set by the IRS.