What is a W2 form and why is it important for small business owners?

Quick links

-

What is a W2 Form?

-

Why is the W2 form important for small business owners?

-

Can I File My Taxes Without a W2 Form?

-

What if your employee loses the W2 form?

-

Consequences of filing an erroneous W2 form

-

How to stay error-free while filing your taxes?

Not sure what the W2 form is and why it’s important?

As with most things in life, understanding the why can make your life much easier in the long run, especially when it comes to taxes and tax season.

The W2 form (officially known as the Wage and Tax Statement) provides you with all of the information you need to prepare and file your state and federal income taxes on behalf of your employees.

This includes how much you paid your employees, the number of hours they worked, and payroll deductions that were withheld throughout the year such as Social Security, Medicare, and federal and state income taxes.

What is a W2 Form? How to make your own form W2?

It is an annual summary of your total wages from your employer.

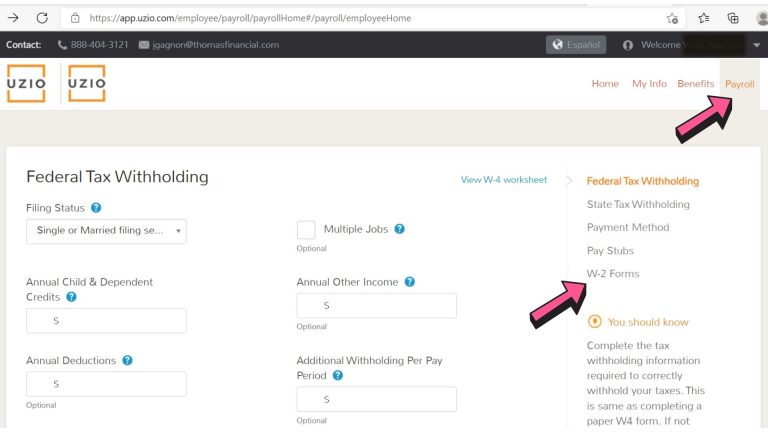

Employees can find Form W-2 in January in their mailbox, or by logging into their online portal if their employer is using any payroll solution with a self-service platform.

When do business send out w2?

January 31st is the deadline to distribute Forms W-2 to employee(s).

In addition to showing total wages earned during a calendar year, Form W-2 includes information about taxes withheld from each paycheck.

These numbers are used to file taxes with both federal and state governments. Employers use Form W-2 as proof that income taxes have been paid on behalf of their employees.

As such, they send out copies of Forms W-2 to employees at year’s end as well as file copies with states and federal agencies that require them regularly throughout the year.

Why is the W2 form important for small business owners? What is a W2 form used for?

Businesses use W-2s to file taxes for their employees, but what you may not know is that if you’re a small business owner without any employees, you still have to get a copy of your employee’s completed W-2 forms to file your own taxes.

Why does having a completed W-2 on hand mean so much when it comes to filing taxes?

Let’s dig into some reasons behind what makes these forms so essential to your financial status as an employer or self-employed person.

For instance, if you are a one-person shop working from home, then every single cent you make—after deducting expenses for things like mortgage payments and utilities—must be reported by using your 1040 return (the main tax form) in addition to filling out separate Schedule C (for sole proprietors) tax forms detailing how much money you made in total during that year.

If you didn’t include information on all of your income sources, then your overall profit would be lower than expected which could lead to serious consequences if you don’t pay appropriate state and federal taxes.

Also keep in mind that according to Section 3108(b)(8) of Title 26, U.S. Code, businesses must withhold social security and Medicare taxes for anyone they employ unless they receive a proper W-4 form for each worker after he or she has begun employment with them. One more thing: As we just mentioned above, you need copies of all four copies of Form W-2 – that were given to your employees at year-end to complete your income tax returns properly.

Can I File My Taxes Without a W2 Form?

If you’re self-employed, you need to file your taxes without a W2 form if your tax situation doesn’t qualify for one. If you were paid by cash, check, invoice, or credit card—but not through payroll—you’ll probably need to file as self-employed.

There are exceptions, of course; if you worked only part of the year or had multiple employers during a year, filing for an exemption might be in order.

Whether you do end up needing to file without a W2 depends on what box(es) on page 1 of IRS Form 1040 are checked off. The most common scenario in which people will need to file without a W2 involves sole proprietorships.

What if your employee loses the W2 form?

Fortunately, you don’t need to wait until tax time.

Your employee can file taxes without their W-2 by using an IRS Form 4852 which is a substitute for the form W2. You can also find two free e-files of Form 4852 on the IRS website that are available year-round. This way, if your employee loses their W-2, they can quickly file Form 4852 online instead of waiting until after tax season starts to receive a replacement from their employer.

However, as an employer, it is your responsibility to provide or reissue the W2 form to your employee in case he/she has lost it.

You are allowed to charge a very nominal cost for this service.

Employers can call the IRS directly at 800-829-1040.

You are supposed to have the following information with you before you contact the IRS:

- Employee’s name, current address, social security number, and phone number;

- Your company’s name, registered address, and phone number;

- The exact date since your employee has been working with you;

- The total wage you paid to your employee and federal income tax withheld this current year.

Consequences of filing an erroneous W2 form

The consequences of filing an erroneous W-2 can be severe.

Small businesses will be fined $50 per incorrect form filed, and employees who file an incorrect W-2 may face tax fraud charges.

If the mistake is minor then it may not face any penalties. But more importantly, these mistakes can hurt relationships with key employees and create distrust between employers and their staff.

If you think you’ve made a mistake on your W-2, talk to your payroll service provider about how to correct it as soon as possible.

It is advised to send a copy of W2 to your employees a month before filing your annual taxes.

How to stay error-free while filing your taxes?

UZIO can help you stay error-free with their full-service payroll platform where you as an employer will have full transparency. As an employer, you are in full control while UZIO does all the heavy lifting for you.

Automate the entire payroll process with full accuracy ensuring you don’t miss out on even a single item while filing your taxes or processing your payroll.

Do business owners get w2? W2 for self employed.

If you are operating your business under your own name, then technically, you are an independent contractor and not an employee. As an independent contractor, you won’t be entitled to a W-2.

You also do not issue yourself a W-2 if you are the owner of a business filing a Schedule C as a Sole Proprietor.

How to get w2 from previous employer out of business?

If your last place of employment has closed, it may be difficult to obtain a copy of your W-2. If you are unable to contact your previous employer, you can notify the IRS, who will try to contact the business and, in the event they cannot reach them, provide you with Form 4582 for your tax return .

Get in touch with us for an expert-led demo to know more about UZIO payroll services.

A Guide to Essential Payroll Forms & More for Small Business Owners

Running any successful business requires dealing with a lot of mandatory paperworks.

With pages of various forms and multiple due dates, it can quickly become overwhelming for a single person to manage, especially if you’re a new business owner. Fortunately, there are solutions that will help you overcome these challenges and lead your business to success.

We’ve created this guide to provide an overview of the most common payroll forms for small businesses you’ll run into, neatly organized for your convenience.

Whether you’re trying to do it all yourself or simply want to learn more about payroll forms and payroll reports, you’re sure to learn something from the in-depth list below! Keep reading.

Essential Initial Payroll Forms

To begin our comprehensive list of payroll forms, we’ll start right at the beginning with a short list of the essential forms you’ll need to complete before commencing business.

The completion of these forms allows your company to legally function as a business entity according to the minimum requirements set out by the federal government.

However, this doesn’t necessarily mean that your local jurisdictions (state or local) may not have additional requirements, so we highly recommend looking into this while completing the mandatory federal forms.

- Establishing Your Business

SS-4 Application

Before you can set up payroll for your business, you’ll need to register an EIN (Employer Identification Number) for your company. The IRS allows you to do this for free on their website.

After applying, your business will be assigned a nine-digit number that will serve as a way for the IRS to identify your company (for tax purposes).

This number is extremely important; without it, you will be unable to create company bank accounts, run your payroll, or file taxes, so you should get on this right away (even if your business is still in the process of being established).

Form 8655

This form may be optional: it depends entirely on how you choose to manage your payroll.

Are you planning on managing your payroll personally, or are you planning on outsourcing the job?

If you chose the latter then you’ll need to complete Form 8655.

This form authorizes a third party (your choice of reporting agent) to manage and file payroll taxes on behalf of your company.

Fortunately, this form will be provided by your payroll service provider so you won’t need to track it down yourself. Be sure to complete it right away. Your service provider can’t provide any payroll services until you do!

It’s also worth enrolling in the EFTPS (Electronic Federal Tax Payment System).

Enrolling will allow you to track payments yourself, ensuring that no payments have been missed or made late by your agent.

Employee Onboarding Forms

Next, we’ll take a look at the forms you’ll need to have available for new hires to complete.

The Equal Employment Opportunity Commission (EEOC) requires you to keep all employee information on file for at least one year after employee termination or resignation.

However, the IRS may have longer requirements for retaining files depending on the particular form, so you’ll want to ensure that you comply with these requirements as well. Failure to do so will not end well if the IRS decides to audit your business, since these forms will be requested as part of the audit.

- Onboarding Employees

Form W-4

Chances are, you’ve probably seen this form before. Form W-4 is an IRS-issued form that businesses are required to have completed by all employees before work can begin.

This form collects a variety of important information about the employee, such as their name, Social Security number, current address, and dependents that will be added to the IRS’s records.

However, the most important information collected is deduction information, which will be used to calculate the amount of money withheld throughout the year for income & FICA taxes.

Employee information may change from time to time, so it’s important that you encourage employees to complete a new W-4 when their personal or financial situations change. If not, their deductions may not be correct, meaning they’ll have an incorrect amount withheld from their paychecks which may result in the under (or over) paying of their taxes.

Employee Information Sheet

Unlike most of the other forms included in this list, an employee information sheet is not a mandated form.

However, these sheets collect vital information relevant to that specific employee so we highly recommend including one in your standard onboarding paperwork. The employee information sheet may contain information such as the employee’s address, contact information, pay rate, start date, spouse information, and emergency contact information.

Generally speaking, employers won’t need to reference these forms often, but they can be extremely useful in the event of a work-related incident as well as for maintaining records on both current and past employees.

Form I-9

In order to be legally approved to work, potential employees must prove that they are authorized to work in the United States. Form I-9, also known as the Employment Eligibility Verification form, serves this purpose.

This form is provided by U.S. Citizen and Immigration Services (part of the Department of Homeland Security) and must be completed by every new hire before work can commence.

The new employees must not only complete and sign this form, but also provide you (the employer) with proof of residency for your records. Acceptable documentation for proof of residency varies, but common options include state IDs, driver’s licenses, passports, and Social Security cards.

Direct Deposit Authorization Form

Unless you plan on paying your employees via cash or check, you’ll need to have them complete a Direct Deposit Authorization Form.

As the name suggests, this document provides authorization for the employer to make direct deposits into the employee’s bank account using the ABA routing number and the employee’s personal account number.

This form will need to be completed, signed, and returned before you can begin to pay the employee via direct deposit. If the employee hasn’t completed and returned this form by the end of the first pay period, you will need to provide them with a paper check instead.

Form W-9

Unlike with part and full-time employees, you (the employer) are not required to withhold income or FICA taxes when paying independent contractors (also referred to as freelancers).

However, the IRS still requires employers to gather contractor information to ensure that the contractors pay the proper taxes due. Therefore, when hiring an independent contractor who you anticipate paying over $600 (throughout the entire year), you’ll need to have them complete a Form W-9.

However, if you anticipate paying the contractor less than $600 for the entire year then you’re not required to have them complete a Form W-9. You will need to keep this form on file, but you’re not required to submit it to the IRS unless requested.

Crucial Business Tax Forms

Now that you’ve learned what paperwork and forms you’ll need to register your business and begin to hire employees, let’s go over the various other forms you’ll be dealing with moving forward.

You’ll want to pay close attention to the due dates of each individual form since some forms must be submitted more often than others. Like the employee onboarding forms listed above, the IRS may require you to keep some of these files on record, so you should double-check before throwing out any old files or forms.

Although this is not a complete list of each and every form you’ll ever need throughout the entire duration of running your business, these are the most common forms that you’re likely to deal with year after year.

- Ongoing Requirements

Form W-2

The Wage and Tax Statement (commonly referred to as Form W-2) is an end-of-the-year form that you (the employer) will need to submit both to your employees and the IRS.

This form summarizes an employee’s earnings for the year and also discloses the amount of taxes withheld.

Taxes withheld may include federal income tax, state income tax, local income tax, and FICA taxes (Medicare and Social Security). You won’t need to fill these forms out until the end of the fiscal year, but you must provide both your employees and the IRS copies by January 31st of the new year.

Form W-3

Unlike Form W-2, which provides specific income and tax information on a per-employee basis, Form W-3 provides a summary of the total wages paid and taxes withheld throughout the entire year for every employee.

In addition to your Form W-2’s for each employee, you will also need to submit your Form W-3 alongside the other documentation.

However, Form W-3 does not need to be provided to your employees, only the IRS. Similar to Form W-2, you must submit your Form W-3 by January 31st of the following year.

Form 940

All employers are required to pay FUTA (Federal Unemployment Tax Act) taxes on the amount paid to employees throughout the year (or, in some cases, per quarter), which is done using Form 940.

Recommended reading: What is Form 940 and What It Means to Small Business Owners?

Currently, the FUTA rate sits at 6.0%, with a maximum payment of $7,000 due per year per employee.

You may have to pay less depending on if your state requires an unemployment tax. If you owe less than $500, then you’re not required to pay FUTA taxes for that quarter. However, FUTA taxes are due once the amount owed exceeds a total of $500.

Currently, the quarterly due dates fall on April 30th, July 31st, October 31st, and January 31st.

Form 941

This form is used to report employee compensation and the taxes withheld so far. The withholdings reported on this form include both income and FICA taxes.

In addition to providing employee withholdings so far, Form 941 also provides the IRS with employer withholding information. Form 941 must be submitted to the IRS every quarter and is also used to calculate employer FICA taxes due.

Form 944

If your company is one of the few businesses that have an annual tax liability of less than $1,000, you’ll file a Form 944 instead of Form 941. Annual liability includes Social Security, Medicare, and federal income taxes due, so the vast majority of businesses do not meet the requirements for submitting a Form 944.

If your business does meet the requirements, then the IRS will usually notify you that you’re eligible to complete Form 944. However, if you do not receive a notification but still believe that your business is eligible, you can reach out to the IRS by phone or mail to request Form 944.

It’s important to remember that you only file Form 944 or Form 941; never file both!

Unlike Form 941, Form 944 is an annual report that only needs to be filed once at the end of the year. It must be submitted to the IRS by January 31st.

Form 1094-B

Acting as “proof of insurance” on a per-individual basis, a copy of Form 1094-B is provided to every employee (as well as the IRS) at the end of the year.

It provides the name of the employer, the name of the insurance company, and the insurance company’s contact information (address & phone number).

Form 1095-B

This short form acts as “proof of insurance” for your business. Generally one page, Form 1094-B is generally provided to the IRS by your insurer & summarizes your individual employee’s health care plans as provided on the Form 1094-B paperwork.

Form 1099

When you hire an independent contractor, their yearly information must be reported using Form 1099, rather than Form W-2.

However, you’re only required to provide Form 1099 if the independent contractor earned over $600 throughout the entire year, meaning you may not need to provide them for small, one-time jobs.

However, if you are required to submit a Form 1099, you must provide one copy to the contractor and another to the IRS.

Like W-2s, these forms must be sent out by January 31st at the latest.

Failure to do so will result in a penalty from the IRS for each form distributed late.

If your state has a state income tax, you may also be required to send a Form 1099 to your state tax authority as well.

Summary

Payroll forms and payroll reports are certainly plentiful, but that doesn’t mean that they’re unmanageable. The most important part of managing your payroll is keeping an accurate record of any due dates, as even accidentally missing a due date may result in unnecessary (and hefty) fines from the IRS.

Although the vast majority of companies will find it much easier to manage their payroll using payroll software, there are other alternatives (such as doing it yourself, hiring an internal payroll staff, or outsourcing your payroll) you may want to consider.

Ultimately, the decision of how to manage your payroll is up to you, but after reading the list above, you’ll at least have a general idea of the files/forms you’ll be dealing with and how to approach them.

Want to learn more about the benefits of using payroll software? Click here!

Social Security Wage Base 2021 [Updated for 2024]

![Social Security Wage Base 2021 [Updated for 2024]](https://www.uzio.com/resources/wp-content/uploads/2021/09/security-taxes-blog.jpg)

Quick links

-

What is the social security wage base?

-

Social Security Wage Base 2024

-

What are social security taxes and their limits?

-

What does social security tax include or fund?

-

Changes in the wage base and social security taxes in the past 10 years

-

Social Security Wage Base 2024 Estimation by SSA

-

Automate Payroll & Compliance with UZIO

The payroll tax that funds Social Security benefits has been a relatively constant 12.4% of wages since its inception in 1937, but the amount of income it applies to has not remained fixed. The wage base limit, also known as the taxable maximum, changes almost every year. It is crucial to understand the wage base limit for both employers and employees. The taxes you pay and the maximum Social Security benefits you are liable to receive depends on this wage base limit.

What is the social security wage base?

Social security wage base is the maximum amount of your wages subject to social security tax. That means you pay social security tax on all of your wages until they hit that point. As an employer, you should already be withholding FICA taxes from your employees’ paychecks if they are making more than the minimum wage base per year (or $0 if they are making less). Individuals must know that any self-employed income also counts toward the annual earnings. Also, keep in mind that wage bases change every year on January 1st or whenever there is a cost of living increase due to inflation based upon averages provided by a specific organization such as the labor statistics bureau or Bureau of Labor Statistics.

Social Security Wage Base 2024

The Social Security wage base for 2024 is $168,600. This is an increase of $8,400 (or 5.2%) from 2023. If you earn over $168,600 in 2024, then only $168,600 will be subject to FICA tax – not your entire salary.

What are social security taxes and their limits?

Social security tax, also known as FICA (Federal Insurance Contributions Act) is an employment tax levied by the Federal Government on individuals earning income in the United States. It is paid by both employees (6.2%) and employers (6.2%). If your total wages are above $168,600 then only the first $168,600 will be subject to social security tax. The wage base is set to rise from year to year based on average national wage indexing. However, what most people don’t know about FICA tax rules is that there are no limits when it comes to Medicare taxes which is 1.45% of all earnings regardless of how much or how little you earn each year or what age you are.

What does social security tax include or fund?

Social security tax is used to fund Social Security Retirement, Dependents’ Benefits, Spousal Benefits, and Disability Benefits. Even though SS tax is often called FICA (Federal Insurance Contributions Act) tax, it only applies to about half of an employee’s contributions. No portion comes from employers’ profit margins or taxes they pay on their profits from businesses they operate—and employees aren’t allowed to deduct either part of their taxes as a business expense. This makes sense when you think about social security: It isn’t a company or self-employment benefit. It was created in 1935 so workers who had spent most of their lives contributing to society wouldn’t be left behind when they needed support. But there are special rules around self-employed people and small business owners: They can claim certain portions as deductible business expenses on Schedule C because they’re paying into social security even if it isn’t taken out directly from each paycheck.

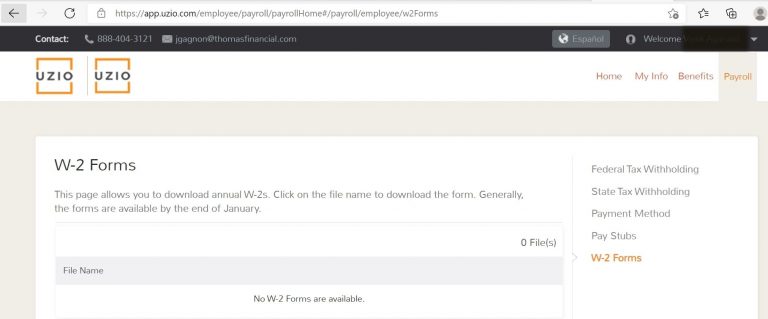

Changes in the wage base and social security taxes in the past few years (1998-2024)

(Source-Wikipedia)

The Social Security wage base is increasing in 2024

The Social Security Administration announced that the wage base for computing Social Security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Wages and self-employment income above this threshold aren’t subject to Social Security tax.

2024 Updates

For 2024, an employee will pay:

- 6.2% Social Security tax on the first $168,600 of wages (6.2% of $168,600 makes the maximum tax $10,453.20), plus

- 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus

- 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

For 2024, the self-employment tax imposed on self-employed people is:

- 12.4% OASDI on the first $168,600 of self-employment income, for a maximum tax of $20,906.40 (12.4% of $168,600); plus

- 2.90% Medicare tax on the first $200,000 of self-employment income ($250,000 of combined self-employment income on a joint return, $125,000 on a return of a married individual filing separately), plus

- 3.8% (2.90% regular Medicare tax plus 0.9% additional Medicare tax) on all self-employment income in excess of $200,000 ($250,000 of combined self-employment income on a joint return, $125,000 for married taxpayers filing a separate return).

Automate Payroll & Compliance with UZIO

These changes are bound to happen every year, and yet UZIO can ensure you are adhered to all the latest compliances and taxes by the federal and state government. Process your payroll with UZIO with just a few clicks. Get an expert-led demo of our full-service payroll platform available for all the 50 states in the US. Click here to book a demo with us.

Recommended reading: Social Security Changes in 2023: What you need to know?

How to Manage Contractor Payroll in 2021

Quick links

-

Why should you care about managing contractor payroll?

-

Contractors – Are they equivalent to your employees?

-

Contractors payroll management

-

What are my obligations?

-

How can UZIO help?

Since the advent of online platforms that allow independent contractors to find jobs and employers to hire them, contractor payroll has become an important task for many managers in charge of managing their company’s finances. Contractor payroll in 2021 is different from how it was managed 10 years ago, as tax laws change and the ways in which employers pay contractors to change with them.

Payroll can be complicated even in the most traditional employment situations, but it can become much more so when dealing with independent contractors and their unique tax situations and payroll requirements. Knowing how to manage contractor payroll will help you make sure that your business is paying its contractors the amount of money it owes while also ensuring that it isn’t falling short on any of its federal or state tax obligations. Here is some advice you must keep in mind before hiring a contractor.

Why should you care about managing contractor payroll?

It’s easy to put off managing contractor payroll. But it can really come back to bite you if your contractors work outside of your company for more than a few months and don’t meet specific criteria. Sometimes even a scanty mistake can lead to sumptuous penalties that may affect you severely if you are a small business.

Contractors – Are they equivalent to your employees?

How you classify workers can have a profound impact on your bottom line. Make sure you know what you’re dealing with so that your tax obligations match up with your business structure. There are many factors at play, including whether they receive benefits from their job and whether they work at an office. This breakdown of how to manage contractor payroll for independent contractors will help clarify matters and ensure that you are compliant with IRS laws and regulations.

Contractors payroll management

As an employer, you’re required to pay payroll taxes on behalf of your independent contractors. The Internal Revenue Service (IRS) classifies workers as employees or contractors depending on how much control your company has over their work. So, what does it mean for a worker to be an independent contractor? The IRS has some factors that determine whether a worker is an employee or contractor: Behavioral control: Are you telling them what hours they have to work? Financial control: Do you set their salary and tell them when and how much they will be paid? These are a few examples of when financial control can be relevant; not every business owner will apply these same rules. Whether your company exercises behavioral or financial control over a worker matters more than anything else

What are my obligations?

The first step is to understand your responsibilities for managing a contractor’s payroll. The IRS says you’re required to withhold federal taxes from their paychecks, regardless of whether they’re an employee or an independent contractor. It’s also your responsibility to calculate and collect any taxes on payments made by 1099 contractors. When it comes time for your contractors to file taxes, you should send them Form 1099-MISC at year-end with details about their income; that form includes information about payments made during that tax year.

If you fail to withhold Medicare taxes from independent contractors who don’t have a Social Security number or ITIN, you could be hit with a hefty fine. Similarly, if you fail to contribute towards unemployment insurance premiums on time because they’re misclassified as 1099 contractors when they should be employees with W-2 forms, your business could wind up paying fines equal to 15 percent of what would have been paid had the taxes been paid on time.

How can UZIO help?

While independent contractors can be appealing from a business perspective because they cost less than employees, businesses that contract them are required by law to withhold taxes and contribute various types of insurance. UZIO helps you classify your contractors on the basis of your requirement and handles payroll & taxes on your behalf to ensure compliance in an automated fashion. This minimizes your effort to little or nothing at all. Get a one-on-one interactive session with one of our payroll experts today and get access to a 30-day obligation-free trial.

What are payroll taxes and why do small business owners must know about them?

Quick links

-

Federal Income Tax

-

FICA (Social Security and Medicare)

-

Unemployment Taxes

-

State Payroll Taxes

-

Worker’s compensation

-

File your taxes on time

-

Automate your payroll

How do payroll taxes work in the US? What types of payroll taxes are there? How can small business owners use these taxes to their advantage? Let’s have a look at these payroll taxes in detail, and find out what you need to know about them.

It’s no secret that running a small business can be expensive – there are always new expenses to account for, and tax rates keep rising every year. The total cost of payroll taxes can exceed the cost of your employee’s wages, especially if you hire workers who earn high salaries or work in expensive areas like New York City or San Francisco. As an employer, you’re legally required to pay these taxes to the government on behalf of your employees, so it’s important to understand what they are and how they work before you make any payroll-related mistakes.

The principal types of payroll taxes are associated with: federal, state, FICA, unemployment insurance (UI), and workers’ compensation. Payroll taxes are funds taken out of employees’ checks by employers on behalf of federal and state government agencies. These funds are allocated into different areas; such as Social Security, Medicare, unemployment insurance, and federal income tax withholding.

1. Federal Income Tax

You’ll need to withhold income tax from your employees, as well as from any freelancers or independent contractors who work with you. The federal government requires you to pay Social Security and Medicare (also known as payroll taxes) on behalf of all full-time employees; you must also withhold these taxes from any freelancers or independent contractors that work for you.

2. FICA (Social Security and Medicare)

Employers and employees each pay 6.2 percent on wage income up to $127,200. This is matched by an equal amount paid by employers. Social Security tax is paid half by the employer and half by the employee. Self-employed individuals pay all 12.4 percent themselves. Medicare tax (1.45%) applies only to wages received over $200,000 in a calendar year ($250,000 if married filing jointly). Because benefits are tied to contributions, individuals who do not have sufficient earnings history under Social Security can opt-out of Social Security payments altogether through voluntary withholding agreements.

3. Unemployment Taxes

Employers are responsible for paying federal and state unemployment insurance tax on a portion of each employee’s wages. This money goes into an account to provide temporary income if employees lose their jobs through no fault of their own. The calculation is based on how much employees are paid when they’re paid, and whether or not any advances were made. The more you know about it, however, the better your chances will be at avoiding it: so make sure you understand how unemployment tax works before you hire your first worker.

4. State Payroll Taxes

If you’re a sole proprietor, you’ll pay both state and federal payroll taxes. The amount will vary depending on where your company is located. You’ll also be responsible for withholding money from employees’ paychecks and sending it to local taxing authorities regularly. Different states also have different thresholds when it comes to requiring businesses to pay quarterly or annually; some do not require employers to make any payments at all if they don’t have any employees or if their employees work less than a certain number of hours per year.

5. Worker’s compensation

All businesses must pay workers’ compensation insurance. If your company doesn’t have five or more employees, you are considered a sole proprietor and will be responsible for paying self-employment tax in addition to regular income tax. Self-employment tax is a combination of Social Security and Medicare taxes. If you have two or more employees, your company is required to withhold payroll taxes from each employee’s paycheck every payday. Worker’s compensation insurance and federal payroll taxes are paid out-of-pocket by your business while state payroll taxes are deductible as an expense from gross income before calculating federal income tax obligations. Your accountant can help determine which expenses apply to your specific situation so you can maximize deductions while minimizing costs.

6. File your taxes on time

Before you hire a single employee, understand what payroll taxes are and how they apply to your small business. Employers fund these programs through their payroll (employee’s wages). Failure to make payroll tax payments could result in steep penalties and fines levied by both federal and state governments. In most cases, individuals or companies who don’t make required contributions will be liable for paying 100% of that amount, plus interest.

7. Automate your payroll

Save time and money by automating your payroll. With a full-service solution in place, you can set up payroll with just a few clicks online—and even better, when you run payroll through us there’s no need to go through a separate tax filing process. We file all federal and state payroll taxes directly to government agencies on your behalf, so that your employees don’t pay any fines for failing to file their reports.

Schedule a demo with our payroll expert today to learn more about UZIO and get started with a 30 day free trial with no commitments at all.

Avoid These Common Payroll Compliance Mistakes

Quick links

-

Classifying Independent Contractors

-

Failing to Account for Vacation Time

-

Failing to Track Sick Leave Time

-

Failing to Calculate Overtime Pay

-

Offering Disability Benefits without Reporting Them on W2s

-

Missing important deadlines

-

State-wise payroll and tax calculation

-

Automate your payroll to avoid mistakes

Working with payroll compliance can seem like a daunting prospect if you’ve never done it before.

Luckily, plenty of other business owners have done this, and you can benefit through the wisdom they gleaned from their successes and their mistakes. This guide on how to stay compliant with your payroll will help you with everything from employee tax withholdings to overtime pay to payroll tax payments.

Following these simple tips will help keep you out of trouble with the law and ensure that your employees get paid properly each month.

1. Classifying Independent Contractors

A common payroll compliance mistake is while classifying employees as independent contractors instead of W-2 employees. If you choose to hire workers as ICs instead of W-2 employees, it can open your business up to a host of problems like nonpayment of taxes, underpayment of wages and overtime pay, discrimination issues, sexual harassment suits, and much more.

2. Failing to Account for Vacation Time

Vacation is a tricky thing to account for when processing payroll. Vacation time, sick time, jury duty—these can all factor into an employee’s pay. If you don’t take these considerations into account, you could end up paying your employees more than you’re supposed to or not paying them enough.

What exactly are they supposed to’s? That depends on what kind of business you run and what kind of employment contracts (if any) you have with your employees.

3. Failing to Track Sick Leave Time

According to payroll laws, if an employee is sick for less than a full day, you are not required to pay them. This means that your company’s policies must accurately track their hours; otherwise, you might have to pay employees for time they weren’t actually at work—and risk falling out of compliance with state and federal payroll laws. Compensate hourly workers based on hours worked, which can include overtime or not-to-exceed pay amounts.

4. Failing to Calculate Overtime Pay

While only salaried employees who work more than 40 hours per week are entitled to overtime pay, it’s important that you check to see if your state requires you to pay employees a set wage for certain periods.

For example, in California, employees must be paid time-and-one-half for all hours worked over eight in a day. If you fail to calculate and remit overtime properly, not only can you face steep fines, but also potentially lose your employees’ trust.

5. Offering Disability Benefits without Reporting Them on W2s

Employers who offer disability benefits as part of their total compensation package may wonder whether they have to report these payments to their employees on Form W-2. The short answer is no unless they meet one of three criteria for reporting them.

The information below will help you determine if your disability benefit payments should be reported on your employee’s W-2 or elsewhere on your tax return. It also covers how you and your employee can report them correctly.

6. Missing important deadlines

Missing important deadlines, such as filing employee timesheets or paying payroll taxes can lead to steep fines and possible criminal charges. Make sure you review each state’s reporting requirements.

For example, some states require monthly reports on employment taxes while others only require reports twice a year.

Be sure to check with your state tax agency so you don’t miss any required reporting deadlines.

7. State-wise payroll and tax calculation

When it comes to payroll taxes, there are several state-based regulations that must be complied with. An easy way to avoid payroll compliance mistakes is to know what those regulations are and where they apply. If you are operating in more than one state you need to ensure you abide by the specific state’s payroll laws and compliance.

Automate your payroll to avoid mistakes

If you have employees, it’s important to understand your payroll laws and to implement a system for tracking their hours and compensation. One of the best ways to avoid making costly payroll compliance mistakes is to automate your payroll processing.

While it’s true that no news is good news, it’s not necessarily a good thing when you hear absolutely nothing from your payroll provider. In fact, if you don’t stay on top of your payroll and ensure compliance with federal and state laws and regulations related to compensation issues, you could face severe penalties or fines.

To help minimize your risks related to payroll compliance mistakes, consider automating your payroll to lower costs and maintain efficiency while minimizing these errors.

Get in touch with one of our payroll experts to set up a demo and start your 30-day free trial.

An Abbreviated Guide to Virtual Onboarding in 2021

Quick links

As a result of the COVID-19 pandemic, a remote working environment is now commonplace in the business world. Of course, the lack of a physical workplace and face-to-face interactions has resulted in some major changes to the way onboarding works, since it’s often done virtually rather than in-person. Companies that have never virtually onboarded a new hire before may struggle to determine the best way to go about this, which is why we’ve put together this short five-step overview of how to go about the virtual onboarding procedures.

The Interview

Although reviewing potential candidates is where the process begins, the actual virtual onboarding process starts with the initial interview. Since meeting in person isn’t possible, many companies are using free video calling services such as Google Meet, Skype, or Zoom to host their initial interviews. This part of the onboarding process will be easy & fairly familiar to most HR employees since the interview process will remain largely the same as an in-person interview. Virtual interviews also allow for a bit more flexibility, meaning interviews can be scheduled outside of normal business hours (assuming it’s more convenient for the parties involved). After the interview(s) have concluded and the best candidates have been chosen, you’ll need to reach out to your new hire(s) to let them know they’ve gotten the job. Although not required, it’s also polite to send an email to the candidates that were not chosen to let them know the position has been filled.

Initial Onboarding Paperwork

Once you’ve got in touch with the new hire(s), you’ll need to begin the onboarding paperwork. Using the UZIO cloud-based HRIS, you can send them direct links to the onboarding forms they will need to complete. Information gathered by the HR software will be automatically integrated into your payroll system once the forms have been completed. After the onboarding forms have been completed, you will need to send the new hire(s) an email informing them of their virtual orientation date.

Virtual Orientation

Orientation is a critical part of the virtual onboarding process and will vary by business. This is the time to cover all of the new hire’s work responsibilities, which includes showing them how to use company software, educating them about your payroll system, telling them about the available benefits (if applicable), and anything else they may need to know that you would normally discuss in a physical orientation. The best way to host your virtual orientation is by video call. This allows you to talk face-to-face with the new hire(s); you can also screen-share while covering company systems so the new employees can have a demonstration of how the systems work. Depending on the complexity of your systems, this orientation could last anywhere from a few hours up to a couple of weeks.

You should also schedule a team-wide meeting at some point so you can introduce the newest employee(s) to their fellow workers. This too can be accomplished via a video call. It’s important to set this time in advance so that your entire remote team will be able to attend the meeting. The meeting is also a great time to let the new hire(s) know where they fit into the overall operation!

One-on-one Manager Meeting

It’s a proven fact that up to one in five new hires will quit their new position within forty-five days, a number that’s likely gone up in recent months. Some common reasons cited are a lack of job clarity, insufficient management, and limited opportunities for job advancement. It’s important that you keep these points in mind during your onboarding process, and ensure that the new hire(s) are very clear on what their responsibilities are, who they report to, and what advancement opportunities are available to them. Unfortunately, there’s no way to guarantee that all of these questions will be adequately answered during the initial onboarding, which is why a one-on-one meeting with a manager is so important! You can schedule this at the end of the new hire’s first week. By having this meeting, you’ll give the new hire(s) an opportunity to get answers to any questions they might have and clarity on things they may be unsure of. This is also a great time to get feedback on your onboarding process to determine if there are any areas that need improvement.

The process of onboarding virtually is a new challenge for many businesses around the world. Fortunately, by utilizing the resources available from the UZIO all-in-one HR & payroll platform, you can overcome this obstacle and continue to expand your business despite the changes to your routine operations. For specific questions related to onboarding new hires virtually, feel free to reach out to our friendly team by clicking here.

UZIO Announces Numerous Updates to Its Payroll, HR, and Benefits Management Platform

RESTON, VA. Aug 17, 2021

Driven by its goal to offer the best HR, Payroll, and Benefits Solution on the market for SMBs, UZIO is happy to announce the release of various new features and enhancements of its platform. These new features benefit both employers and their employees, saving them time and money and making them more productive.

SMBs using the UZIO payroll system will no longer need to worry about maintaining federal, state, or local requirements for minimum wage on a “per paycheck” basis. The newest round of updates will allow employers to set minimum wage rates for employees, which the system will automatically compare against employee pay stubs. If the system determines an employee is receiving less than the required minimum wage, their compensation for that pay period will be adjusted accordingly to meet the mandated minimum. Since many states require employers to provide PTO information, UZIO has also implemented “Paid Time Off Details”, an information field that is automatically generated on each employee paycheck, providing employees with their time accrued, used, and total PTO balances.

Adding more to the payroll, UZIO has added a new feature where employers can modify the working hours of salaried employees from the default 40 hours to custom hours. Now employers can pay the contractors via check or direct deposit. Employers can access quarterly tax reports with just a click and Payroll Providers will be able to generate individual or consolidated ACH reports for their clients very conveniently.

The most recent round of updates has also improved the Time Tracking solution, allowing employees to manage their own time entries from the self-service portal. This feature is available to reporting managers as well. Entries can be added, edited, or deleted up to the point of manager approval. System administrators can enable or disable this feature as needed via the system settings.

The time tracking dashboard has been further enhanced to show paid time-offs and holidays in a separate column to avoid confusion. Also, the employees can apply for partial leaves from one or more policies for the same day.

“Our team has been hard at work this summer. As our customer base expands, we are receiving great feedback from our customers and our team is using the feedback to continue to enhance our platform which further helps us sign up more customers. ” said Sanjay Singh, CEO of UZIO. “This is working like a flywheel which is picking up momentum with every product release” he added.

Interlinked companies will benefit from recent changes to the HRIS system. Documents uploaded to the Employee Documents module can now be shared between employers linked together via EIN. This enables employers to configure employee documents efficiently, processing employee documents for multiple companies at once, rather than on a per-company basis. Businesses that utilize contractor services (such as CPAs) to manage their group(s) will now be able to add non-employee users into the system. These users will appear as “Non-employee” users on the Manage Users page, making it easy to differentiate between employee and non-employee group users.

The latest round of updates to the UZIO platform will also benefit employees by allowing for shared contributions between employees and employers on voluntary disability plans. Previously, contribution amounts were limited to 100% by either employee or employer, but now the costs can be split between employer and employee.

The other miscellaneous updates include enhanced tax withheld reports, detailed pay stubs, automatic overtime or double overtime earning codes, system syncs with user’s time zone, and more.

UZIO has released its third round of innovative updates this year as part of its pledge to provide excellent customer service to all of its customers. Throughout the remainder of 2021 and beyond, UZIO will continue to review, refine, and release new features on its mission of providing the best HR, payroll, and benefits solutions for the SMBs on the market.

About UZIO:

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carriers serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

visit http://www.uzio.com to learn more about UZIO.

Media Inquiry:

Sunny Arora

AVP & Head of Marketing at UZIO, Inc.

sunny.arora@uzio.com

UZIO Announces Numerous Updates to Its Payroll, HR, and Benefits Management Platform

Paperless Payroll: The Path to Efficient Payroll Management

Quick links

-

Faster Payroll Calculations

-

Accurate and Compliant Paychecks

-

No More Missing Paperwork

-

Employee Self-service

-

Your Company Will Be “Green”

-

Switching to Payroll Software for Small Businesses

Far gone are the days where managing payroll manually was an effective approach. Thanks to the convenience of small business payroll software, even companies with only two or three employees stand to benefit from migrating over to a paperless, software-based solution.

While we can’t argue the fact that personally performing payroll calculations yourself (as opposed to hiring a specialist) is the cheapest option, is it really worth all the extra effort?

After all, time is money, so you’re still paying, just not in dollars. Surely there’s some reason why online payroll solutions are so popular?

Well, there are multiple reasons actually, and in this short article, we aim to explain a few!

Faster Payroll Calculations

Manual payroll processing may be free on paper or spreadsheets, but once you calculate all the time spent reviewing timesheets and calculating paychecks, it quickly becomes apparent that there are more productive activities you could be doing with that time.

Don’t manage your payroll personally?

That’s worse!

Even after hiring an in-house team of specialists to manage your payroll, the process still requires a lot of time to perform all the necessary calculations (and now, you have to pay for them!).

It’s around this point that using payroll software becomes a much more appealing option.

Although you will have to pay a small fee for the convenience, your entire payroll can be calculated and ready to process in a matter of minutes, rather than days, by using a software solution—which only needs a browser with an internet connection.— instead!

Accurate and Compliant Paychecks

People are prone to making mistakes, so any manually-managed payroll is bound to have errors here and there.

Small errors now can easily turn into bigger issues later on, which may require reissued paychecks or even result in fines from the IRS!

Instead of spending time calculating gross income, computing the proper tax withholdings, and applying the necessary deductions, place your trust in an automated payroll system that does it right the first time, every time.

UZIO uses up-to-date tax rates and individual employee withholding information stored within its internal database to ensure that all withholding and deductions are applied correctly.

This approach to payroll calculations turns it from a minimum five-day process into a few minutes one!

No More Missing Paperwork

Physical forms, spreadsheets, and paper folders are easy to misplace.

As your company grows, the amount of paperwork you’ll have to organize will increase ten-fold.

When information is spread throughout various folders and multiple file cabinets, instant data retrieval is simply impossible.

Routine tasks like producing business reports turn into day-long assignments, and employee PII (Personally Identifiable Information) is open to theft. By choosing a cloud-based payroll solution, all your important f

Employee Self-service

When employees have questions or concerns about their current or past paychecks, they often have no choice but to head to the payroll department for answers.

This can be very frustrating, especially if they have to take time out of their busy schedules to wait around for answers to a seemingly-simple question.

Not only is this time-consuming for the employee, but it also takes valuable time away from the payroll specialists.

Thankfully, UZIO offers a solution: employee self-service portals!

Using these portals, employees can check their pay stubs and submit their hours online (if they are using the UZIO time tracking module as well) without ever having to refer to the payroll department.

If your company is using complete payroll solutions, employees will even be able to manage their benefits from this portal, saving them a trip to the HR department as well!

Your company will be “Green”

Staying environmentally responsible is important for any type of business, and one of the easiest ways your company can build rapport with potential (and current) customers is by “going green”.

Simply put, “going green” is making an effort to be more eco-friendly, either by eliminating single-use items, using recycled materials, or—in this case—reducing paper waste!

Beyond gaining a positive public rapport, using payroll software will also help cut overhead costs, since less paper used means less money being spent on paper products.

This may not seem like a big difference initially, but the savings will surely add up throughout the year!

Switching to Payroll Software for Small Businesses

Performing a major overhaul of your entire payroll system may seem like a daunting task, but in truth, it’s really not!

With the proper timing, planning, and the right choice of system, making the switch from a paper-based payroll to a paperless one is a simple transition that any company can do.

Of course, like any payroll task, there is a “right” way and a “wrong” way to go about it, so head over here for more details on how to get the transition started.

5 Essential Strategies for Scaling Your SMB

Quick links

-

Create a Customer Persona

-

Base Your Marketing Strategies on Customer Research

-

Explore New Channels

-

Diversify Your Current Offerings

-

Use Payroll Software to Manage Your Payroll

-

Summary

Whether you’re the entrepreneur behind a startup just trying to get on its feet or a long-time business owner hoping to scale your current operations, knowing (and implementing) the proper growth tactics can make the difference between running a sustainable business or a profitable one.

Throughout this short article, we’ll be going over various tips on business scaling strategies you’ll want to utilize in order to make the most profit using your current setup.

From customer personas to the importance of a payroll management system, there’s a lot to consider when it comes to scaling your small business effectively, so without further ado, let’s get started!

1. Create a Customer Persona

If you want your marketing strategies to be successful, you’ll need to hone in on your target audience.

What motivates them to buy?

What discourages them from purchasing?

Conduct a review of your current customers and find the similarities between them all.

Use this information to create a customer persona. Is this persona identical to your ideal customer?

If so, you’re headed in the right direction!

Use this information to guide your marketing efforts moving forward. If not, you’ll need to compare your current customers to your target audience and decide how to approach the situation in a way that won’t alienate your current customers, but will also be more attractive to your target audience.

2. Base Your Marketing Strategies on Customer Research

Using the information you gathered while making your current customer persona, you’ll create new targeted advertisements.

You may deploy online and offline marketing options. Like Google Ads, Facebook Ads etc. for online.

If your target audience and current customers are identical then you’ll only need to create a single marketing campaign.

If they’re different, however, you may want to create multiple marketing campaigns targeting potential customers by demographic, motivations, fears, and buying habits.

3. Explore New Channels

One way to attract more customers to your business is by exploring new marketing channels.

For brick-and-mortar businesses, this could mean setting up an online store.

Online businesses can establish a physical presence via a storefront, or purchase billboard space.

By expanding your marketing efforts beyond your usual advertising attempts, you’ll be exposing your business to new potential customers, some of whom will be motivated to purchase your products!

There’s nothing wrong with a bit of experimentation, so consider trying multiple strategies.

Record your results while doing so; you’ll quickly be able to see which advertising channels are effective, and which are not.

4. Diversify Your Current Offerings

Depending on the type of business you’re running, it may be practical to expand your current offerings.

For physical businesses such as a restaurant, this could mean adding new items to your menu or implementing weekly specials.

For online companies, this could be offering add-on services to the solutions you already provide.

Regardless of how you choose to diversify, this decision doesn’t come without risk.

Therefore, instead of offering products/services based on a whim, you should review your market research periodically to see which offerings are likely to perform the best, and begin with those.

5. Use Payroll Software to Manage Your SMB Payroll

Using payroll software alongside an HRIS is vital if you want to scale your business successfully.

Time spent manually processing your payroll is better spent invested in your marketing efforts, so the obvious solution is to automate the entire process.

All-in-one solutions such as UZIO provide HR software in addition to payroll services, which helps expedite the employee onboarding process.

By choosing a cloud-based platform, you’ll be able to manage your internal affairs from anywhere with an internet connection, allowing you to tend to essential business functions even when you’re not physically in the office.

Recommended reading: Biggest pain point with Payroll and HR software

Summary

Successfully growing your business requires an all-around comprehensive strategy; simply focusing on one area is not enough.

While creating a customer persona is important, this information does you no good if you don’t implement these insights into your marketing.

Just as opening a new storefront is impractical if you can’t onboard new employees fast enough to properly staff it.

Hopefully, this short article has highlighted the challenges you’ll face coming up, and provided you with enough information to formulate a strategy moving forward.

Remember, having the proper tools is only half the battle; it’s how you choose to use them that brings real results for your business.