The Quick & Easy Guide to Payroll Management

Quick links

-

The Importance of Proper Payroll Management

-

The Payroll Management Process: How It Works

-

Payroll Management Software: An Alternative to Manual Processes

-

The Benefits of Using Payroll Management Software

-

How Integrated HR, Payroll & Benefits Administration System Help the Overall Business Process

The Importance of Proper Payroll Management

Regardless of the type of business you’re running, the end goal remains the same: to turn a profit. Of course, as your business grows you will inevitably onboard more employees, and these employees must be properly compensated for their time, lest your employee retention rates should fall. This brings us to the main point of this article: payroll and payroll management.

Payroll management, as it’s most commonly described, encompasses everything related to paying your employees, such as computing hourly rates, tax withholdings, paycheck distribution, processing payments via other preferred mediums, etc. When a business has a proper payroll management strategy in place, these numbers are calculated and processed in a timely manner, ensuring the employees are compensated on time while keeping overhead costs relatively low. On the other hand, poor payroll management can lead to a variety of problems including ACA non-compliance, legal fees, low employee retention rates, and even business failure! The many potential consequences of poor payroll management highlight why having a proper system in place is necessary for the long-term success of any business.

This is especially true for businesses with plans for expansion. Without a proper payroll system in place, the onboarding of new hires can easily overwhelm the current payroll staff, forcing you to choose between increased overhead costs or inefficient payroll processing (and potentially the fines that come with it). Rather than playing with fire, we strongly recommend taking a look back at the current payroll management system you already have in place, or implementing one if you haven’t already to prevent complications further down the road.

The Payroll Management Process: How It Works

Payroll management can be broken down into three different stages: pre-calculation, calculation, and distribution. Each part of this process must be applied each pay period, which contributes to the large workload that is split among the payroll staffs. Below we’ll be taking a look at each part of the process in detail.

Pre-calculation

The pre-calculation stage begins by establishing company payroll policies. These policies cover everything from overtime pay and payroll distribution methods to vacation time and attendance requirements. By setting a list of actions from the start, a company can standardize its payroll process in the future, preventing confusions and errors moving forward. Using pre-established payroll policies, the pre-calculation stage continues on an individual level, taking an employee’s pay rate and hours worked into account each pay period. Every employee on the payroll must have their hours reviewed and approved by management before the hours can be used to calculate their gross pay.

Payroll Calculation

After the hours of each employee have been reviewed and approved, the gross paycheck amount is calculated, either by payroll staff or the company payroll software. At this point, it’s time to apply deductions to every paycheck to produce their net pay, which is the amount that will be distributed to the employee via direct deposit, check, cash, or other methods of distribution.

There are many different factors that go into applying deductions, but the major ones always remain the same. Regardless of an employee’s location, they will always be responsible for contributing 7.65% of their gross income to FICA taxes, which covers both Social Security and Medicare taxes. They must also provide part of their income to federal taxes, and possibly an additional percentage towards state taxes. Federal tax rates are based on yearly income, with rates ranging from 10 to 37 percent of their annual salary. State taxes vary by state, with some states doing away with income taxes altogether, and others (like California) taxing up to 13.3% of an individual’s annual income. Depending on the location where the work was performed, an employee may also be responsible for paying local taxes as well.

After federal, state, local, and FICA taxes have been applied, additional deductions such as health insurance can be calculated. There are many different types of deductions an employee may be held liable for, and these are broken down into two subsects: voluntary and involuntary. Voluntary deductions include health insurance, retirement plans, life insurance, and union dues, among others. Involuntary deductions include child support, wage garnishments, bankruptcy orders, and other types of court-order debt repayments.

Distribution

Distribution is the final stage of the payroll management process, and as the name would imply, involves distributing paychecks and pay stubs to the employees. Employees can be paid in a number of ways, including cash, by check, prepaid debit card, or direct deposit. After wages have been distributed, the payroll department is responsible for accounting for all payments issued during that pay period. The records made in each pay period must be kept, as they will be used later on in the year-end reporting process.

Payroll Management Software: An Alternative to Manual Processes

As you can see, payroll management is a long and complicated process that must be repeated each pay period, forcing employers to hire more payroll staff as their companies grow larger. Obviously, expanding staff means increased overhead costs, but fortunately, there is an alternative: payroll management software. This software includes a variety of programs designed to effectively and automatically manage a company’s payroll while remaining ACA compliant, which reduces staffing needs while improving overall efficiency.

Most payroll management solutions integrate with T&A (Time & Attendance) software, which allows employers to record and manage their employee’s working hours. Basic options can include a clock-in/clock-out feature, which records an employee’s hours using timestamps on a digital time card. More advanced options, however, integrate GPS location into their timestamps, allowing employers to verify that the employee was on-site during their scheduled work hours. These records are automatically recorded and can easily be approved or amended later on, making calculating payroll a much easier process.

The main feature of any payroll software is automated payroll and tax calculations. Using data acquired from the employees’ digital information, payroll software calculates paychecks for each and every employee on the payroll, applying individual hourly pay rates, taxes, and deductions to each paystub. When payroll is processed manually, attention must be paid to ensure that each paystub produced remains up-to-date with ever-changing tax laws and requirements. This is not an issue with payroll software, since the software itself updates automatically, applying new changes as needed. These paystubs are stored within the system for future reference, which is extremely helpful in generating year-end tax documents.

Payroll software usually includes the option to manage the distribution process as well. While direct deposit remains the primary method of distribution for most companies, some payroll software can also accommodate other methods of payment such as checks, cash, or prepaid debit cards.

The Benefits of Using Payroll Management Software

Utilizing the available payroll software (as opposed to traditional manual payroll processing) offers many advantages to companies, regardless of the current size of their operations, starting with reducing staffing needs. Since the software handles the vast majority of payroll processing tasks and requires minimal input, companies aren’t forced to employ more payroll staff to manage (or expand) their current operations. In fact, utilizing payroll software allows businesses to reduce their payroll staff, which lowers their overhead costs. Payroll software can scale up or down according to your business, which means you won’t need to employ more staff even if your business grows: your current staff will do fine!

Another benefit is increased efficiency. With manual payroll processing, the likelihood for errors remains fairly high even if you only employ a well-trained staff. Humans are, by nature, prone to mistakes from time to time, and even the simplest of mistakes can end up costing a business thousands of dollars in non-compliance fines! Payroll software automatically updates to reflect the latest compliance laws, ensuring your business remains ACA compliant at all times.

Time is also a limiting factor when it comes to manual payroll processing. Payroll staff is limited in the amount of paperwork they can process per day, but payroll software performs the necessary calculations in real-time as the information comes in, which guarantees workers will receive their wages on time. Since the software operates independently of payroll staff (with minimal intervention required on occasion), a company can easily expand the size of their operations without worrying about their increasing payroll staffing needs. Most software charges on a per-employee basis, a $4.5 per employee per month is a far lower cost to pay than an entire month’s salary of an additional member for just manually handling the payroll. So, it doesn’t matter if you keep growing, your existing manpower for handling payroll should be enough to handle any employee size if you are using an automated payroll solution.

Accurate account and reporting is a vital task for any business, which can easily end up costing thousands of dollars in fines if left unattended. Fortunately, payroll software tracks and stores data throughout the entire process, making past pay records retrievable in only a couple of clicks, as opposed to searching through multiple file cabinets for a particular document. Some payroll software is also capable of generating reports, which makes completing monthly, quarterly, and yearly reports a non-issue.

How Integrated HR, Payroll & Benefits Administration System Help the Overall Business Process

So far, we’ve gone over the benefits that payroll software can have specifically for the payroll department, but surely the benefits can be applied to other departments as well! Depending on the setup of your individual company, payroll and HR may be different departments entirely or payroll may simply be a part of the HR department. Regardless of your current setup, much of the data used in payroll calculations is also used by the HR department, and vice versa. UZIO has recognized this overlap and therefore has developed the all-in-one payroll, HR, and Benefits software solutions that cater to the needs of both departments through a single platform. Have you ever fantasized about reducing the size of your tech stack? This could be one way to do it!

The biggest benefit of AIO (All-In-One) HR software is the elimination of duplicate data entities. Without AIO HR software, required employee information (such as their address) must be entered into both the HR and the payroll systems. With AIO HR software, the information added during the onboarding process can easily be accessed later on by the payroll department, and vice versa. This data integration offers many benefits, allowing for streamlined data exchanges, multi-department report generation, quick cross-referencing, and more. It also makes it easier to stay ACA compliant, which is a priority for any business.

Another benefit AIO often offers is the employee self-service feature. What features this actually entails will depend on your particular platform of choice, but often include benefits management and the ability to view pay stubs. Some software even allow employees to request time-off and/or schedule changes from within the self-service portal, which can then be approved or denied by managers without requiring an in-person visit to HR.

Payroll Management: A Summary

Like it or not, payroll management is a crucial part of running a business. While relying on manual processes may have worked sufficiently in the past, with modern companies often employing hundreds of workers, attempting to manually manage payroll is largely impractical. This is why the release (and continued expansions) of payroll software is so important: it allows companies of all sizes to effectively manage their payroll without worrying about ACA compliance, staffing issues, or distribution disruptions. Although some companies are small enough to get by without using payroll software, the vast majority will see a substantial benefit from choosing to implement the more modern solution.

So how do you start the process of implementing payroll software for your company? Well, there are many different payroll service providers and software options on the market today, so one option is to spend hours upon hours researching multiple solutions to find one suitable for your company. However, for a quicker start to your journey, you can head over to an expert lead UZIO demo, Regardless of which option you choose, you’re sure to see an instant benefit to your business once you switch from manual processes to software management, so don’t wait. Take the next step for your business, and make the switch today!

The Five Variables to Factor in When Choosing a Benefits Administration Platform Partner

Choosing the right benefits administration platform for your business is important if you value employee satisfaction. High levels of employee satisfaction lead to a higher employee retention rate, which means less time spent onboarding new hires and more time spent tending to the job at hand. Of course, with so many ben admin platform providers on the market today, it can be hard to determine which one offers the best employee benefits for your particular business. Here are five things you should factor into your final decision.

Benefits Offered

One of the most important things to consider when choosing a ben admin platform is the variety of employee benefits they offer. While life insurance, health insurance, and dental insurance are all fairly standard offerings, it’s important to think about your employee’s specific needs. If a vast majority of your employees have pets, does this potential provider offer pet insurance? Assuming that some workers will retire from your company, what can this potential provider offer them for retirement options? You may want to consider getting input from your staff while reviewing the options, since actual employee needs may differ from your initial assumptions.

Insurance Carrier Support

Although technically possible, it’s highly unlikely that all of the benefits offered will be routed through a single insurance company. Instead, you will most likely be receiving benefits through multiple carriers (with 8 to 12 being fairly commonplace). It’s important to ensure that your new ben admin platform is not only capable of handling employee benefits with multiple carriers, but also that they can do so in a quick and timely manner. This is especially important during high-activity times, such as open enrollment, when a large amount of employee information must be processed in a short amount of time.

PPI Security

Unfortunately, cybersecurity is something that you must take into serious consideration, no matter the current size of your business. Ransomware is often used to disable computers from use until the hacker’s monetary demands are met. In some cases, even after being paid off, the devices still won’t be usable, leaving businesses out of luck and in need of new computers. Employee PPI (Personally Identifiable Information) is another common target for hackers, who can sell the information online to the highest bidder. You’ll want to discuss cybersecurity with any potential ben admin platform to ensure that all information (both business and individual) is protected from cyberattacks.

Ease of Implementation

Like most things, switching to a new employee benefits provider will take time—the question is, how much? You’ll need to figure this out in order to determine a realistic timeframe for implementation. It’s also worthwhile to look into the overall process itself: What information will need to be provided? Will you have training and/or assistance during the implementation? What can you expect for a final bill? Is there ongoing support provided? These are all important questions to ask before committing to a specific benefits administration platform.

Customer Support

This is another important consideration that must not be taken lightly. If you choose a benefits administration platform without any customer support, then you’ll need to figure out any technical issues yourself. Ideally, the new provider will offer U.S.-based customer support, who can attend to any issues you may have with your new system. On the benefits side, we recommend choosing a provider who offers detailed benefits descriptions. If not, your employees may end up being under (or over) insured, as employees who can’t educate themselves properly on the available benefits are unlikely to make the most suitable choices. Unfortunately, this can end up costing them thousands down the road.

Whether you’re choosing a benefits administration platform for the first time or trying to find a better service provider, the choice you make is important. Not only does it affect your business as a whole, but it also influences the lives of all your current employees (and highly satisfied employees mean a productive workforce!). If you want to kill two birds with one stone, consider choosing an all-in-one system like UZIO, which combines payroll and HR into a single system for maximum overall productivity. Finding the perfect balance between business needs and employee benefits may take time, but with a little bit of research and some stunning testimonials, you’re sure to make the best decision for your company as a whole.

UZIO Releases Another Major Product Update for its Payroll, HRIS and Benefits Modules

RESTON, VA. JUNE 14, 2021

These updates are specific to the Payroll, HR, and Benefits functionalities of the system and are aimed at making it easier and more efficient for SMB employers and employees to perform their HR related functions.

The following improvements are now available:

Payroll:

The newest round of updates to the UZIO platform adds support for multiple pay rates per employee, using the “Additional Jobs” function to set pay rates on the employee’s duties they perform. Each job will have its job code which is used to calculate both overtime pay and worker’s compensation at a job level for each employee. Employers can opt to pay overtime and double overtime to their employees, either at a blended rate or at a straight rate. This information will be synced from UZIO Time Tracking for the employers using our Time Tracking module.

Time Tracking:

Using UZIO Time Tracking, employers now can set custom overtime rules for each employee. By default, any hours worked over 40 are considered overtime, and Sunday is considered the first day of the workweek, but these rules can be modified to suit the needs of any particular organization. Overtime rules can be set for both daily and weekly and if both are used, the system will take care of any necessary calculations.

Mobile:

Employer mobile users can now view and approve timesheets in the mobile app using the Time Tracking feature. Employee mobile users can now view and download their current and previous pay stubs from within the app.

Benefits:

In addition to providing EOI (Evidence of Insurability) requirement support for Voluntary Life, Basic Life, and Critical Illness products, UZIO now supports Voluntary AD&D EOI. The system will trigger an EOI if the enrolled coverage amount exceeds the employee’s or spouse’s guaranteed issue coverage, which can be approved or denied by the broker. UZIO has added additional guaranteed issue amount and step increase amount rules for Voluntary Life and Voluntary AD&D insurance.

“Right from the beginning, we have instituted a company culture where our team members make an extra effort to listen to the feedback from our customers and are always on the lookout for ways to improve the end user experience. ” said Sanjay Singh, CEO of UZIO. “A number of enhancements in this release are the direct result of a collaborative working relationship we have with our customers where their feedback is listened to and given high priority as we make investment in our product roadmap,” he added.

About UZIO:

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carriers serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

visit http://www.uzio.com to learn more about UZIO.

Media Inquiry:

Sunny Arora

AVP & Head of Marketing at UZIO, Inc.

sunny.arora@uzio.com

UZIO Releases Another Major Product Update for its Payroll, HRIS and Benefits Modules

A Comprehensive Payroll Implementation Guide for SMBs

Index

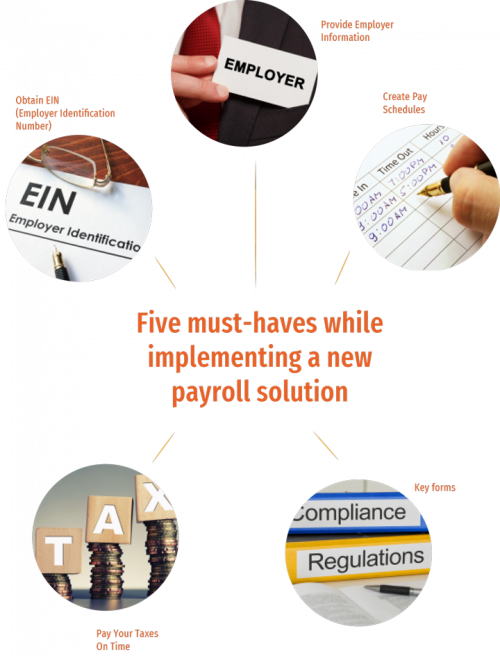

- Five must-haves while implementing a new payroll solution!

- What Type of Payroll Management Options Are Available?

- How to Choose Your Payroll Software?

- Why You Need to Invest in Payroll Technology & the Advantages?

INTRODUCTION

When you’re just starting to implement a payroll for your small business, it can be easy to make mistakes.

Unfortunately, small oversights in the business world can be a huge blunder resulting in hefty fines!

An easy way to avoid these errors is by using a payroll software solution to handle all your payroll tasks.

Most payroll solution providers such as UZIO help you in the overall setup and implementation of the software. However, if you’d rather want to implement it yourself then you must be aware of all the required paperwork you’ll need, as well as the procedures you must follow before attempting to implement a payroll solution in your company.

Lucky for you, we’ve gathered a list of things you’ll need to keep in mind to avoid being fined, stay compliant with federal regulations, and successfully implement a payroll solution into your small business.

Read on to learn about the five must-haves while implementing a new payroll solution!

01. Obtain EIN(Employer Identification Number)

Every business operating legally within the United States is required by the IRS (Internal Revenue Service) to be assigned an EIN.

This number allows the IRS to easily identify your business for tax purposes. However, it’s quite easy to apply for an EIN and you can do the process for free!

The easiest way being online (which you can do by clicking here). To apply for an EIN, you will need a valid Taxpayer Identification Number (you can use your Social Security Number, Individual Taxpayer Identification Number, or a pre-existing EIN).

If you don’t like doing things online, you can also apply for an EIN by fax or mail using Form SS-4. For business owners located outside of the US, the IRS has a phone number you can call to be assigned your EIN.

Recommended reading: How to Apply for an EIN (IRS Official Website)

Having an EIN for your business is important for reasons beyond the simple IRS requirement.

Without an EIN, you won’t be able to open a business bank account, which means that your business accounts and personal accounts will be the same (which opens them up to access in the event of a debt collector or lawsuit). You will also need an EIN to hire any employees, or (if you’re self-employed) to set up a 401(k) plan.

02. Provide Employer Information

Employer Information forms are a vital part of your business if you plan on employing foreign workers.

To hire a foreign worker, you will first need to determine if they are going to be a temporary worker or a permanent employee. Depending on which type of worker they are, you will either have to:

A.) file a nonimmigrant petition, or

B.) assist them in obtaining a green card.

If you choose not to follow these requirements, not only will you be losing the benefits of E-Verify but you also risk your workers being deported.

03. Create Pay Schedules

Pay schedules are used to determine how often you pay your employees for the hours worked in that specific pay period.

Although there are some requirements (which vary by state), beyond that you will have the general freedom to set your employee’s pay schedules.

Recommended reading: State Payday Requirements– Table of State Payday Requirements (An official website of the United States government)

While the simplest option is to have all employees on the same pay schedule, you can also create separate pay schedules for different departments if you wish.

Creating these pay schedules manually is time-consuming, so you may want to consider investing in payroll software to save yourself some time (and prevent mistakes!).

Recommended reading: Biggest pain point with Payroll and HR software

You have a few different options when it comes to creating your payment schedules.

The most common choices are weekly and bi-weekly pay schedules.

Monthly is another option (although less common). You can also choose to pay employees semi-monthly.

With this type of pay schedule, employees will get paid on the same days of the month each month. Regardless of which payment schedule you choose to use, it’s important to explain both the pay periods and the pay schedules to your employees.

If they don’t understand why they’re being paid so much (or so little), they are more likely to walk away from your company. Don’t let a simple miscommunication ruin your retainment records! We highly recommend reviewing pay periods and schedules with all employees, not just the new ones.

04. Pay Your Taxes On Time

All businesses (even those who are self-employed) are required to pay taxes to the IRS. Your annual taxes must be filed at the end of the year when you file your annual income tax return (unless you’re a partnership, in which case you would file an information return).

Recommended reading: Business Taxes (small businesses/self-employed) (An official website of the United States Government)

However, your business may also be required to make estimated tax payments throughout the year.

If you don’t pay these on time, then the IRS may apply late fees and interest to your amount owed. The frequency of payments you are required to make depends on the size of your business, but you will always need to make at least quarterly estimated tax payments to the IRS.

If you choose to use a Payroll platform (like UZIO) then the software will let you know when your payments are due, but if not, then you will have to figure out these payment dates for yourself.

Recommended reading: Estimated Taxes for small businesses and self employed (An official website of the United States Government)

In addition to the taxes your business owes, you must also keep track of the taxes your employees owe. As the employer, you are responsible for withholding federal, state, and local taxes from your employee’s paychecks. These taxes may include (but are not limited to):

- Federal Income Tax

- Social Security Tax (FICA)

- Medicare Tax (FICA)

Recommended reading: What are payroll taxes and why do small business owners must know about them?

Taxes owed to the state or locality will vary by location, so be sure to look into these requirements as well to ensure you’re withholding all relevant taxes.

05. Keep These Key forms Handy

As you can see, starting a payroll isn’t a simple process. There are many forms and other types of documentation you will need to keep on file if you choose to do this process manually.

Recommended reading: How to manage payroll when you are just starting out

Fortunately, utilizing payroll software for small businesses can help keep the clutter out of your office, and will also ensure you remain compliant with the ever-changing rules and regulations regarding your payroll.

However, if you decide to forgo using small business payroll software and instead do it all yourself, here are a few of the forms you’ll want to have handy at all times.

- Form W-2 – This form reports withheld employee wages.

- Form W-3 – This form provides a summary of your W-2 information.

- Form 940 – This form reports your Federal Unemployment Tax Act (FUTA) liability.

- Form 941 – This quarterly form reports employee wages and payroll taxes.

- Form 944 – This form reports annual employee wages and payroll taxes.

- Form 1094-B – This form is used to record employee health coverage.

Recommended reading: A Guide to Essential Payroll Forms & More for Small Business Owners

What Type of Payroll Management Options Are Available?

When it comes to managing your payroll, you’ll have a choice between a traditional, done-by-hand approach or the more modern, electronic route of using dedicated payroll software for small businesses

Each option presents its own set of potential issues, but they both have a few advantages as well. Let’s take a quick look to compare the pros and cons of each option.

Manual Payroll Processing

This approach requires manually tracking employee hours, calculating applicable taxes, and distributing paychecks (or direct deposits) yourself

PROS:

- Low starting costs since you only need a computer with Excel (or other similar software). If you prefer to do things entirely by hand, you can also payroll record book.

- Readily available and requiring no additional purchases, a manual payroll approach can be implemented easily at any time.

- Potentially low ongoing costs are also a benefit. You won’t need to pay an outside company or contractor to handle your payroll.

CONS:

- Hard to scale and easily falling behind, manual payroll processes will steadily perform worse as your company grows.

- Prone to errors, a system handled entirely by individuals can result in thousands of dollars worth of penalties from even the smallest mistake.

- Time-consuming manual payroll processes will only compound as your business expands.

Automatic Payroll Processing

This approach uses cloud-based payroll software to automate employee hour tracking, tax calculations, and paycheck (or direct deposit) distributions.

PROS:

- Easily scalable since all calculations and processes are handled by an automated payroll program.

- The least errors occur when using an electronic payroll process because most payroll software checks for compliance issues while automatically calculating your payroll.

- Faster payroll processing times, thanks to an automated system that accurately calculates employee paychecks in real-time.

- No third-party services are required to charge you for every transaction, you can all do it yourself with a few easy clicks. This saves you a lot of money.

- No software installation is required and can easily be accessed using your browser.

CONS:

- Requires initial training to get acquainted with the process.

- Employees must be trained to get familiar with the self-service platform that will require employees to stop bothering the employer for stuff like paystubs, basic know-how about their payroll, etc.

Manual payroll services may work for extremely small businesses, probably up to 5 to 8 employees, but if you’re planning on growing your company beyond a few employees, we strongly recommend you consider implementing electronic, complete payroll solutions.

How to Choose Your Payroll Software?

If your business is expanding and you’ve decided to implement payroll software, you must take an educated approach to your new venture.

Not doing so may be costly for your business, ineffective at addressing issues, and create more problems than it solves.

Here’s a step-by-step guide you can follow to ensure you pick the payroll software that’s right for your business.

01. Defining Your Needs

Before you start considering specific payroll services it’s important to define your expectations. If a payroll platform can’t meet all of your basic needs then you can instantly cross it off the list. Here are some common basic needs.

- Time Tracking: Being able to keep track of your employees’ time and attendance is a key feature of any payroll software. Make sure your choice of the platform includes this.

- Tax Calculations Efficiency is the key to success, so automated tax calculations are a must-have in any reputable payroll platform.

- Payroll Reporting :These detailed reports are something you won’t want to miss. The valuable details contained within can give important insights regarding the financial flow of your business.

- Security: When Social Security numbers are in question, you need to be able to trust your payroll software provider to keep this information secure.

02. Considering Your Wants

- Integrated Platform: As the business grows, you will need to ensure you are not juggling from one app to another to manage your employees. Therefore you will need a system that has solutions for your future needs and assure the information provided or changes made anywhere is reflected across the entire system. This approach is not only going to save you from future hassles but also centralize your HR process & operations.

- Flexible Pay Options: While a weekly, bi-weekly, or monthly payment schedule may work for some businesses, eventually some employees will want a different pay schedule. Fortunately, complete payroll solutions often offer various pay schedules within their platform. Just make sure it’s not a paid add-on!

- Direct Deposits: Employers should be able to directly deposit the payments to their employees’ or contractors’ bank accounts. This saves a lot of time and creates a healthy environment within the organization.

- Compliance: Your payroll software must be compliant with the local federal laws and regulations. Staying compliant is essential for an effective payroll management system.

- Automatic Salary Changes: Your system must be smart enough to ensure any changes reflected in one place to be communicated across the platform in real-time. An otherwise situation may result in disasters for employers in the long run.

- Automatic Tax Filing: You will want all your taxes to be filed on your behalf to the right federal tax authorities on time. This is a very crucial feature which not many have but the prominent players in the industry.

03. Analyzing the Implementation Process

How easy will it be to implement your new payroll software? You should lean towards platforms that won’t cause any disruption to your current payment schedule and can be fully implemented fairly quickly. The last thing you want is for your company payroll to be split between the old system and the new one!

04. Calculating the Price

Upfront costs are an important consideration, but the focus should be on the cost of ongoing service.

If your payroll platform offers discounts for new customers, what will the cost be after the promotional period?

Remember, high initial costs with low ongoing costs are much better than low initial costs with high ongoing costs, so make sure to research all potential pricing issues before making your decision.

After you’ve considered all available options and settled on a few, it’s time to ask your team for input. You may have to explain the benefits of the new system to them, so be prepared to answer any questions they may have.

If they have concerns, take them into account. At the end of the day, you’re the one deciding how they get the paychecks they rely on, so you should be willing to meet them in the middle, basing the final decision on employee input and your system analysis.

Why You Need to Invest in Payroll Technology & the Advantages?

Utilizing payroll software offers a clear advantage over using manual processes to handle your payroll. That said, while automation is certainly helpful, you might find yourself wondering if payroll software is truly a need, rather than just something you want.

To help you decide this answer for yourself, here are our top reasons why we think having payroll technology is a necessity for running a successful business.

- They can help prevent legal fees. Most payroll software for small businesses reviews your documents to ensure your payroll remains compliant with federal, state, and local tax laws. If you manage your payroll manually, it can be hard to stay compliant with these ever-changing regulations. Unfortunately, you will be held responsible for compliance regardless of how you manage your payroll, so even the smallest of manual errors could result in large fines for your company. By using small business payroll software, you can avoid any potential fines because the program will ensure your payroll remains compliant.

- They save you time. One of the biggest benefits of using complete payroll solutions is automation. With an automated system, payroll processes that previously took hours of staff time can be completed in an instant using your choice of payroll software. This allows your staff to manage their time more effectively since they’ll no longer have to manually process your payroll and can instead focus on other priority tasks at hand.

- They guarantee accuracy. When you’re manually calculating the payroll, it can be easy to get caught up in the repetition and accidentally miss something. Whether it’s a simple miscalculation or omitting an entire process, these mistakes will mess up your entire payroll process, leaving employees with inaccurate paychecks. Your staff is unlikely to take this information well, so in addition to dealing with unhappy employees, you’ll also have to go back and recalculate your entire payroll to ensure all the information is correct. Having a payroll platform in place provides peace of mind because you’ll never have to worry about these types of mishaps hindering your business.

- They give employees easy access via self-service. If you don’t have any payroll services in place, your employees will rely on HR and payroll staff to answer any questions they may have regarding their paychecks. They will also need to visit HR/payroll if they want to make any changes to their information on file—such as updating an address—or to request time off. Having a complete payroll solution in place will allow employees to tend to these issues themselves using an online portal, rather than relying on the HR staff to handle them. Your HR staff is sure to thank you, as they’ll spend less time addressing employee concerns and have more time to manage other essential tasks.

- They allow you to manage documents easier. Managing documentation and forms can pose a huge challenge if your current process relies on paper records. Unlike traditional methods which require you to sift through piles of paperwork to find the information you need, small business payroll software makes it easy to access this information with just a few clicks! Having information essentially available “as needed” makes updating forms, finding files, and referring to previous records a more streamlined process, providing an obvious advantage over traditional methods.

- Your data remains secure. When you’re manually processing your payroll, chances are there will be a lot of paperwork involved. This paperwork needs to be organized, which is usually done by keeping documents in folders or binders. Unfortunately, anyone with access to the office can easily snag these forms, stealing valuable data such as employee social security numbers, income information, or contact information. Proper payroll software stores your payroll and HR information digitally, preventing any would-be thieves from stealing valuable employee information by storing it in the cloud. You should choose a company like UZIO that values cybersecurity because online data theft is unfortunately a common occurrence. You don’t want to make your business an easy target.

- Most payroll software doesn’t require a specialist. Manually calculating payroll requires employing dedicated payroll specialists, lest you risk an inaccurate payroll and possible fines. Hiring these types of workers can be quite costly, especially if you want a payroll expert with a great reputation. Fortunately, you can save yourself on the costs by using payroll software for small businesses. Not only is the price of these programs generally cheaper than hiring a specialist, but their ease-of-use means that your current staff won’t have a problem adapting to and starting to use them right away.

- Payroll solutions usually offer multiple options for distributing employee pay. This is especially helpful if you’ve previously only offered checks to your workers. These days, you might lose top-tier workers to competitors if you don’t offer direct deposits, so it’s essential to offer multiple payment options. This will keep your workers happy, and your employee retainment rate up. Options vary by payroll platform, but common payment methods include direct deposit, prepaid cards, and paper checks.

- Payroll reports can be produced by the software. Calculating annual reports can be a very intimidating process for HR and payroll staff. Having to review the past year’s documentation and generate a report with complete accuracy poses a huge obstacle for staff already overwhelmed by an abundance of other tasks. Thankfully, complete payroll solutions can solve this problem for you, as they automatically record and calculate your payroll information year-round. Instead of spending days manually reviewing data to create a report, you can create monthly (or even yearly) reports with just the click of the button!

- You’ll be able to save office space. Securely storing an entire company’s paperwork requires a lot of office space. File cabinets can quickly turn a large office room into a cramped space with little room to move. This claustrophobic setup can be extremely detrimental to the overall morale of staff. Thankfully, cloud-based payroll services don’t require any physical space, so your staff will quickly be able to regain their office space after you implement payroll software into your company.

That said, we think the reasons listed above show the true value that proper payroll software can bring to your business, therefore making it a need, not a want, for your company.UZIO is an all-in-one solution for your efficient HRIS, payroll & benefits management needs.

How to become a Benefits Administration Rockstar in two simple steps.

Look at some of the champions of any industry – entertainment (George Clooney), sports (Lionel Messi), or technology (Elon Musk). You probably have one of two perspectives:

- a.) They were born lucky, or

- b.) They’re freaking talented!

Of course, this is true to an extent—they’re undoubtedly talented and lucky, but what if they somewhat told you that their success was actually due to the strategic choices they made? You probably wouldn’t believe them. It’s obvious that there’s more at play here than just luck, talent, or strategy.

The actual key to their success is a combination of things: talent, smart strategies, and a winning mindset! This is what enabled them to become rockstars in their respective industries. Now, let’s forget them for a second, and talk about YOU instead!

Truth be told, there’s no such thing as a naturally-born benefits administrator. Great benefits administrators definitely make it look easy, but their superior performance wasn’t just handed to them at birth. It’s a result of all the work they’ve put in, the time they’ve taken to sharpen their skills, and their dedication to improving the employee experience.

We know you chose this field because you:

- Care about the employee experience.

- Understand the transformative impact of benefits in employees’ lives.

Curious how to reach your peak performance in the benefits administration space? Keep reading to find out!

Why employees don’t always use benefits effectively.

Health care costs are constantly increasing, and benefits strategies continue to get more complex every year. These increasing complexities result in many employees who don’t use their benefits effectively. This is highly unfortunate because around 60% of people report benefits and perks being among their top considerations before accepting a job (according to a 2016 Glassdoor survey). However, since truly utilizing their benefits will require investing a lot of time into understanding them, most employees simply don’t bother. This results in higher health care costs for both the employees and the employers.

Of course, not understanding their benefits isn’t the only reason employees underutilize them. A couple of other potential deterrents include:

- An overstrained HR department.

- Higher personal costs as a result of cost-sharing.

- Hard-to-use benefits.

The complications and roadblocks present in the current benefits environment give you the perfect opportunity to establish yourself as a benefits administration rock star. True, you may have limited resources and find yourself at odds with intricate benefits strategies, but now is the perfect time for you to focus on delivering a delightful employee experience! So, the question is: do you want to be a good benefits administrator or a champion?

If you chose to be a champion, read on!

1. Brand Your Benefits Well

The first thing you’ll want to do is accurately gauge your employees’ perception of the benefits program you currently offer. An easy way to do this is by sending out an email survey, but you can also host a live discussion or offer lunchtime focus groups as well.

After you’ve gathered some feedback, it’s time to add a layer of branding to your benefits programs. Crafting a clear, unique, and concise mission statement will help communicate the value of the program to employees, motivating them to self-enroll. Branding your benefits programs also helps strengthen the bond between HR and the employees, building trust while making benefits easy to understand for potential enrollees.

Successfully branding your benefits isn’t something that you do once and then you’re done. You need to keep evaluating and refining your benefits strategy as time goes on. Make sure to keep gathering employee experiences and feedback about your benefits program to increase the overall value you can deliver. Continuing your branding efforts on a regular basis is sure to result in a benefits program that your employees will love (and more importantly, actually use!).

2. Lean on Automation

Automation has been available in benefits administration for years now, but many employers still operate using paper forms, inefficient spreadsheets, and manual data entry. No good! The reality is the downfalls of manual paperwork far outweigh the cost of an automated solution. Automation reduces your total paper cost, the number of errors present, and ensures you keep compliant with the ever-changing regulations.

An automated solution creates value for employers by guiding employees through the decision-making process. According to CFO.com, it costs only around $22 when an employee self-enrolls in benefits online. If the HR team manually enrolls an employee, the cost (per employee) jumps up to a whopping $110!

Switching over to an automated process will also help your business go paperless, as the HR team won’t need to deal with physical copies of forms. Unlike manually filing paperwork (where illegible handwriting may require multiple clarifications from employees), a digital approach empowers employees to self-manage their own benefits, resulting in 15% more available time for the HR department!

Another benefit of automation is the elimination of duplicate data entry. In a paper-based approach, the same information will often need to be written down over and over again on multiple forms. This is highly annoying, wasting time that could be better spent elsewhere, and can definitely act as a deterrent for people interested in enrolling in your benefits program. Fortunately, this isn’t a problem if you use an automated solution like UZIO, which integrates HR benefits and payroll onto the same platform!

Misplacing paperwork and compliance issues can be a big problem when it comes to benefits administration. Fortunately, a secure digital platform will manage and organize all of your documents for you, eliminating the risk of misplaced (or worse, stolen!) paperwork. A proper automation system will also ensure you remain compliant, avoiding large penalties resulting from even the smallest of mistakes in your paperwork.

When it comes to HR benefits automation software, you’ll have plenty of choices, so it’s important to choose the right platform for your business. When considering your options, be sure to keep in mind your specific business requirements, budget, and technical expertise.

Connect with us to learn more on how to become a Benefits Administrator rockstar today!

What is an IRS W-3 Form (and Why is It important)?

Employees are a crucial asset to any business, but they do require some responsibilities on the part of the employer, one of which is the annual reporting of employee wages and taxes.

W-2 forms (officially known as the “Wage and Tax Statement”) are mandatory Internal Revenue Service (IRS) tax forms used in the United States to report wages paid to employees (and the taxes withheld from them). Alongside income tax information, they also report Federal Insurance Contributions Act (FICA) taxes for the Social Security Administration (SSA). Employers must provide a Form W-2 to each employee for who they’ve paid a salary, wage, or other compensation as part of the employee benefits management program. These forms must be provided to employees before/on January 31st. This deadline gives employees about two months to file their taxes before the April 15th income tax due date.

The form has six different copies:

- Copy A – Submitted by the employer to the Social Security Administration (SSA).

- Copy B – Provided to the employee and reported by the employer with the employee’s federal income tax returns.

- Copy C – Send employees to be kept in their record.

- Copy D – Kept by the employer for their records.

- Copy 1 – Registered with the employer’s state or local income tax returns (if applicable).

- Copy 2 – Recorded with the employee’s state or local income tax returns (if applicable).

The purpose of a Form W-3 is to verify the accuracy of Form W-2 copies. The W-3 acts as a summary of all the Form W-2 copies, and also serves to justify your quarterly tax payments for the year. The Form W-2 and the Form W-3 copies must be submitted to both the IRS & the Social Security Administration by January 31st.

Since the W-2 and W-3 forms are remarkably similar, reporting nearly the same data, but both are required to be filed by the employer. If they’re both so similar, the question arises: why do employers have to file a W-3 when they’re already required to file the Form W-2?

Though slight, there actually are a few differences between Form W-2 and Form W-3. The main difference is that Form W-2 reports individual information (such as salaries and taxes) for each employee. By contrast, Form W-3 reports the total wages, taxable wages, and taxes withheld for all of the employees.

There are three main types of taxes:

- Withholding taxes – These are the taxes an employer withholds from an employee’s pay (both the standard income tax and the employee’s portion of FICA taxes). The employer must withhold these taxes and deposit them with the appropriate tax authority. Withholding taxes are included on Form W-3.

- Employer taxes – As the name implies, these are the taxes paid by the employer.

- Shared taxes – These taxes are split (usually 50/50) between the employer and employees. FICA taxes (which include Social Security and Medicare) are some of the most important shared taxes. Your employees’ total contributions are also reported on your W-3 form.

Individual employee tax rates vary depending on their annual income, qualified depends, and other factors. This amount needs to be deducted by employers from each paycheck. Whereas income taxes make up the largest portion of the IRS tax base, FICA taxes are paid to the SSA, contributing towards Social Security and Medicare.

As of 2019, the standard FICA tax contributions owed come out to 7.65% for each party (the employee and the employer). These contributions are broken into two sections:

- 6.2% for Social Security taxes (also called OASDI)

- 1.45% for Medicare taxes

It’s important to note that the Social Security taxes only apply to the first $132,900 of an employee’s pay. Once their earnings exceed this amount, no additional deductions are owed by the employee or the employer.

The opposite applies to Medicare. Employees making over $200,000 (or $250,000 for joint filers) must pay an additional 0.9% tax on their earnings towards Medicare. Fortunately, the additional Medicare tax is only applied to the employee, not the employer.

Sounds complicated? It is… but there’s a solution! Comprehensive payroll software makes sure all of your forms are filed currently, meeting all the necessary requirements, and allowing businesses to file both W-2 & W-3 forms hassle-free. If you haven’t already, consider an all-in-one payroll system to meet all of your tax-related needs!

New strategies that benefits brokers can adopt to meet changing requirements in 2021 and beyond.

These days, the tasks required of health care benefits brokers extend beyond simply helping employers select a benefits package. Brokers have their work cut out for them, as they need to produce competitive benefits plans designed to attract top talent. These plans need to be affordable yet flexible, staying compliant with the ever-changing health care regulations without presenting budgetary issues down the road.

Since benefit broker roles have become much more dynamic, it’s important they understand an organization’s specific requirements for their benefits policies. In this article, we provide evergreen tips and strategies to assist benefits brokers in adapting to employer needs despite economic uncertainty, the slowdown due to the COVID pandemic, and other changing requirements as time goes on.

Providing Recommendations to Control Benefits Costs

In a benefits broker survey conducted by ConnectYourCar, 63% of respondents stated that offering recommendations to employers about controlling benefits costs was the highest value they could provide. However, brokers also have to manage employer concerns about the increasing expenses associated with these health care benefits

Support and Service Factors

Excluding costs, 56% of brokers said that support and service are the main factors they consider when changing their client companies’ third-party benefits administrator. Surprisingly, only 15% said they considered pricing as an important factor in the change

Technology Adoption

44% of benefits brokers placed technology as an important factor, saying clients need a self-service system equipped to handle their staff’s benefits needs, whereas 24% of brokers placed a self-service solution as a requirement for their client’s health care benefits. This information offers helpful insight for brokers when recommending and managing tax-advantaged accounts.

Strategy Changes Needed for 2021 and Beyond

Brokers should recommend suitable technology solutions for their clients, as it helps companies save money and improve the overall efficiency of their operations. This allows employers to maximize their benefits budget and use any leftover funds to create more effective benefits plans focused on employees.

For clients unsure about investing in tech-based solutions, brokers should provide advice and recommendation on relevant applications for their clients. It’s important to mention to the client that technology investments can be funded using tax-advantaged accounts and payroll tax savings, without affecting the overhead costs.

Brokers must stay up-to-date on the latest benefits trends and regulations. Partner communications, new certifications, webinars, and e-newsletters are all resources that can be utilized to deliver a better value to their employer clients.

Help employer clients handle rising health care costs.

Unfortunately, as health insurance premiums increase so does the overall cost of family health coverage. These rising expenses have a direct impact on the benefits budgets of employers looking to provide the much-needed coverage to their employees. Brokers must help their client businesses maximize the potential of their present budget, prepare for cost increases in the future, and still offer benefits plans that satisfy the clients’ employees.

Technology is the answer

Fortunately, technology offers a direct solution for clients that can save them both time and money. Online tools and systems help improve the efficiency of the benefits administration, ensure employers meet compliance standards and offer assistance for account administration, open enrollment, & other critical functions.

Employers can utilize funds saved from more efficient technology-based operations by preparing improved benefits plans for their employees. A proper technology solution will boost the end-user experience, increasing overall productivity, engagement, and enrollment of their currently offered benefits plans. This means businesses won’t need to spend as much time addressing complaints or answering the questions of employees. Of course, budgetary restraints will often be one of the first things on a clients’ mind when it comes to their technology investments, so brokers should take the ROI (return on investment) into account when suggesting new technology to their clients.

Sometimes, a client will already have a technology-based solution in place, but it may not be current enough or suitable for the clients’ needs. Brokers need to stay educated and prepared so they can offer superior technology recommendations. When researching the current solutions available, it’s important to look for options that cater to companies of all budgets and sizes.

It’s also important that brokers understand their client’s individual requirements. Ideally, they should come up with solutions that can mesh with a client company’s existing infrastructure but are able to be customized as needed. Solutions offered by brokers must solve existing problems, not create new ones.

How brokers can improve their knowledge?

Brokers can refer to experts in the health care & HR fields in order to keep themselves updated on the best HR practices, technology systems, and ever-changing legislation. E-newsletters, email blasters, webinars, industry websites, and magazines also offer other easy ways to stay informed.

Brokers should maintain up-to-date certifications on popular topics like health savings accounts and flexible compensation so they can offer the best service to their clients. They may also find third-party administrators to be a helpful resource. Utilizing administrator tools such as educational content, legislative information, and communication libraries will help them provide valuable assistance to their present (and future) clients.

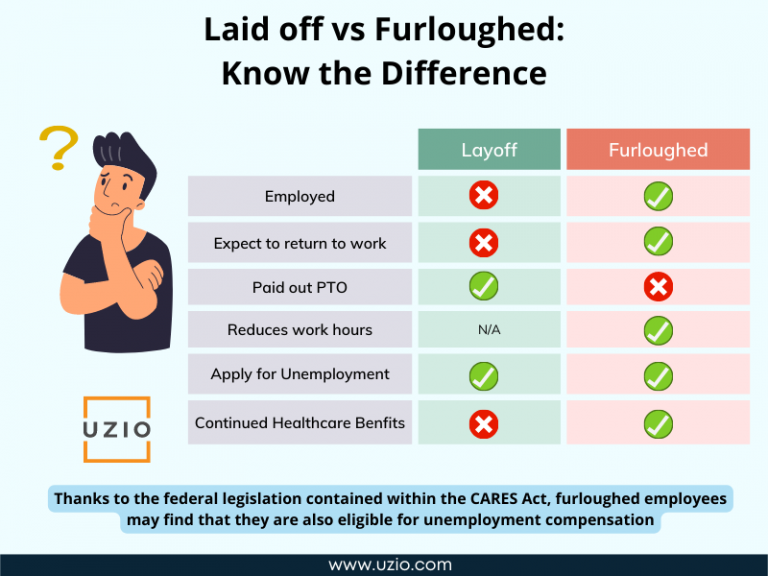

Laid Off vs Furloughed: Know the Difference

The COVID-19 pandemic crashed the world economy, leaving companies of all sizes to consider cost-cutting measures as a way to sustain themselves. In an effort to remain afloat, many organizations around the world chose to furlough or lay off their employees. While being “laid off” is a familiar term for most people, many aren’t aware of the ways it differs from a furlough. Let’s go over these two terms.

- A layoff refers to an employee termination for reasons unrelated to his/her work performance. In this case, the employee holds no responsibility for their termination (unlike being fired). After being laid off, the workers are no longer employees of said company, so they lose all of their benefits and protections.

- A furlough is a mandatory (but temporary) leave of absence. Unlike a layoff, the employee is expected to eventually return to work. Furloughs are usually used when employers are running low on funds but don’t want to terminate their employees. Furloughed staff are technically still employees; as such, they retain both their jobs and their benefits.

Collecting Unemployment

It’s widely known that laid-off employees can collect unemployment insurance. However, thanks to new federal legislation contained within the CARES Act, furloughed employees may find that they are also eligible for unemployment compensation. When laid-off employees request unemployment benefits, the State requires that they produce evidence proving that they’ve been actively searching for work. Since furloughed employees technically still have jobs, they are exempt from this requirement.

Healthcare Benefits

Since furloughed employees are still employed by their company, they maintain their group health coverage. Some companies may pay for the employee contributions; others may ask workers to repay them when they return to work. Of course, these opportunities are only available to furloughed employees. Since laid-off employees are no longer employed, they aren’t eligible for healthcare benefits provided by a business’s group healthcare plan.

Terms of a Furlough

The specific terms and conditions of a furlough will vary from employer to employer. Furloughs generally have a time limit, but they always consist of unpaid time and can reduce the hours, days, or weeks an employee works.

Duration of a Furlough

The length of a furlough will vary depending on the employer. The employer may consider many different factors when deciding the duration of a furlough, such as how to maintain operations with limited (or a lack of) revenue. Furloughs aren’t designed to discriminate against certain employees; rather, furloughs are generally distributed evenly among employees to keep individual hardship to a minimum.

Layoffs may be the right option for companies who want to permanently reduce their workforce, but it’s important to consider the repercussions of layoffs. Rehiring costs, the loss of valuable employees, and low company morale are all common side-effects of company-wide layoffs. On the other hand, furloughs don’t involve permanently dismissing employees, so rehiring costs, loss of employees, and negative effects on company morale will be minimal. Still, the duration of a furlough will have a great effect on the overall effectiveness of this strategy. Employees who are furloughed for a long period of time are much more likely to quit anyway.

If you’re considering a furlough or layoff for your company, it’s important to weigh the pros and cons of each option (for both the company & the employees) before making a decision.

How to Create an Employee Onboarding Process That Doesn’t Fall Flat

Quick links

-

Introduction

-

Why does Onboarding Matter?

-

How to have an onboarding process that your new employees will love?

-

Challenges with paper-based onboarding process

-

Digital Onboarding: More Delighted Hires, Greater Productivity

You want your new hires to fall in love with your company, so it’s important to avoid getting off on the wrong foot.

This is why having a foolproof employee onboarding process in place is so important.

Scenario A:

You explain the entire hierarchy of your company to the new hire. After this, you give them a 20-minute rundown of their roles and responsibility, then take them directly to a cubicle and assign them a project.

Despite being given their first assignment, your new hire is left unprepared and overwhelmed right from the start.

Scenario B:

You sit your new hire down for an in-depth presentation on your company’s core mission, values, business information, hierarchy, important head functions, and any other relevant information.

Next, the new hire meets their new boss, who then introduces them to the entire team and educates them on company culture and other basic information.

Which scenario do you think would make the employee feel valued, safe, and secure in their new job?

It’s obvious—Scenario B!

Scenario B underlines the importance of a memorable and helpful employee onboarding process that makes a new hire feel like a valued member of their new organization.

Unfortunately, this approach doesn’t seem commonplace in most businesses: in fact, Gallup reported only 12% of employees strongly agreed that their organization does a great job onboarding new employees!

Why does it matter?

Starting with screening through gigantic piles of resumes, followed by filtering candidates through multiple rounds of interviews, and finally walking them through the onboarding process, the Human Resources (HR) team must be mindful of the approach they take with new hires during the first month or so.

According to Recruiting data, 1 in 4 new hires will leave their present employer within the first 180 days.

The initial first few days of any employee’s experience will have a great effect on their performance, productivity, and engagement with other team members (and the company as a whole!). If you don’t offer an excellent employee onboarding experience then you run the risk of high turnover rates & less productive teams.

You’ll definitely notice a difference in retention, and statistics compiled by O.C. Tanner, finds that 69% of employees are more likely to stay with a company for three years if they experienced great onboarding.

How to have an onboarding process that your new employees will love?

There isn’t a one-size-fits-all process, so onboarding will vary for each employee.

Unfortunately, it’s one of the most commonly overlooked aspects of a successful employee journey, so it’s definitely one that you will want to address. To guarantee a delightful employee onboarding experience for your new hires, you’ll need to pick the right key elements from your organization and integrate them into your process flow.

We’ve listed a few tips and suggestions for you to follow when onboarding a new employee below.

Pre-Boarding Process Flow

- Paperwork:

- Obtain required documents such as W-4, I-9, Insurance forms, Direct Deposit forms, etc., from the selected candidate

- Sign the non-disclosure agreement (NDA)

- Provide company employee handbooks as well as other relevant policies/procedures

- Inform the new hire of the general guidelines regarding office location, dress code, vehicle parking, time reporting, and the necessary documents which need to be brought to work

- Tools and technology:

-

- Get the computer prepared

- Get their company email address prepared

- Get all the required software installed

- Get a workstation prepared

On the Joining Day

According to the Society for Human Resource Management (SHRM), a new employee’s most important day on the job is their first day

- Book your calendar: Reserve some time to spend with the new hire on the office tour

- Meeting with the boss: Set up a 1:1 meeting between the boss/reporting manager and the new hire. The boss will clearly explain the role, responsibilities, success metrics, and additional expectations from the hire. They should be prepared to answer any questions the new hire might have

- Introduction to the team: Have the new hire meet their fellow team members and other functional heads that they might need to know

- Assign a mentor: A mentor can act as the new hire’s friend and have a “Welcome Lunch” with them

It’s important to understand that even after these formal meetings and office tours, the new hire may still feel awkward sitting at their new workstation alone, awaiting additional instructions. To avoid this, consider providing the new employee with written instructions that explain what’s expected of them during the beginning stages of their new role at your company. It’s also helpful (both to you and the employee) to provide them with additional reading material relevant to their role.

During the First Month

- Ensure that paperwork is finished: Make sure that all paperwork is completed and no additional documents will be needed from the new employee(s)

- Request their boss to set up a few 1:1’s with the new hire: This will help both the manager and the new hire understand each other’s working style. Beyond specifying expectations, this can also help them form a solid working relationship

- Organize training sessions for the new hire: It’s important to provide appropriate educational training sessions designed specifically for the new hires. This will familiarize the new hire with the work-related processes. It will also make the new hire feel more confident implementing their knowledge and likely increase overall productivity in the upcoming assignments

- Get the boss to assign the first project: The manager should assign the first project to the new hire after a few training sessions related to their role. This is the time to highlight the company’s performance evaluation criteria

- Weekly HR meetings with the new hire: This allows you to provide constructive criticism based on feedback from the reporting manager of the new hire and other team members that they may have worked with during their first month

- Check their conduct and cultural fit: It’s important to understand that the real culture match/fit is only revealed when the employee starts working with the team. Consider sending out a small questionnaire to the whole team that can be filled out anonymously. Use this to gain feedback about the new hire directly from the team.

- Check with the new hire for any guidance/assistance needs: It’s important to find out if the new hire has any specific training or guidance requirements that will help them exceed in their new role

We hope that this step-by-step framework has provided you with the insider tips needed to perfect your employee onboarding process. It’s important to attract top talent to your team, but engaging with and retaining them is just as crucial to running a successful business. So, with the above in mind, what’s your company’s current onboarding process look like? It is:

- 100% digital

- Mostly digital

- Mostly paper-based

- 100% paper-based

If your current onboarding process is mostly paper-based, you’re not alone! The majority of companies today rely on a paper-based process, but unfortunately, this can present them with a variety of unnecessary issues not present in a digital approach.

Challenges with paper-based onboarding process

- It feels impersonal. A traditional paper-based employee onboarding process requires extra time and paperwork. It’s not uncommon to see the new hire losing up to a week of their initial job experience because they’re busy filling out a stack of forms. This approach removes peers and managers from the onboarding process, thus making the whole ordeal feel far too impersonal.

- The experience can be overwhelming. Piles of papers that need to be filled out or read by the new hire may quickly overwhelm them (and they’re sure to find them frustrating!). A negative first impression is extremely counterproductive from a long-term employee retention perspective.

Recommended reading: How Virtual Onboarding Of Employees Can Benefit Your Business

Digital Onboarding: More Delighted Hires, Greater Productivity

Digital Paperwork

Ditch the piles of paperwork and manually-filed forms. Digital onboarding does away with these laborious tasks by utilizing an e-signature, which allows employees to quickly sign multiple documents electronically.

This saves them hours of entering the same information over and over on multiple forms, wasting valuable man-hours. An integrated HR solution that offers digital onboarding will save both you and the new hire hours of time processing forms. Best of all, all of the new hire’s information and documents will be conveniently available in one place!

Employee Digital Induction

A digital induction process will help you create tasks for each part of the new hire’s workflow. These tasks can be easily reviewed by someone outside of the HR team to make sure the new hire’s performance is up to par, and you can send out automated reminders to ensure the review is completed.

Online Payroll Processing

If your HR automation solution includes an integrated payroll system, it will automatically integrate data from the candidate’s profile. This will save the HR department hours manually copying data, allowing them to dedicate newly-freed hours to higher-priority tasks at hand.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.

COVID-19 Debunks Top 3 Remote Work Myths

If you were to log in to LinkedIn today, you’d most likely find your feed full of COVID-19 centered photos and video. People have many different ways of coping with remote style work, which results in some pretty intriguing stores for us to read (or see). For example, you might see a suited-up man on a video call with a client, but then a toddler suddenly bursts into the room, screaming and running around as his mother attempts to catch him. Obviously, this is not the optimal situation! On the flip side, you’re just as likely to see photos of a woman sitting seaside, clicking away at her keyboard as palm trees sway and the ocean tide grows steadily higher. The overall experience of remote work depends a lot on the environment you’re working in, so we highly doubt the “guess what happened at work today!?” stories will be coming to an end anytime soon.

Many traditional employers are still on the fence about the idea of remote work, but unfortunately, COVID-19 has made that choice for them. Since the World Health Organization (WHO) declared COVID-19 a worldwide pandemic back on March 11, most of the global workforce has since switched to a fully remote workplace.1 According to a new survey by Slack, it took only a few weeks for 16 million workers across the U.S. to switch over to their new, virtual workplace. They were the lucky ones. Unfortunately, the crisis has also taken jobs away from millions of Americans. Others have been forced to choose between putting their families’ health at risk or keeping their job.

The remote workstyle is steadily becoming more commonplace, but many myths and misconceptions are still floating around. Let’s take a quick look at some of these stereotypes, find the facts within the fiction, and get a balanced perspective on this modern style of working.

Myth #1: “Remote employees laze around or indulge in self-care at home.

At a quick glance, this wildly inaccurate claim seems highly believable, but the fact of the matter is, it simply isn’t true. A survey conducted by Owl Labs actually found that 71% of employees willingly decide to work remotely because it increases their overall productivity and focus. Even without the traditional office settings, employees are still working hard to contribute to their businesses. Faced with potential layoffs or salary cuts, employees know they need to work harder than ever to make sure their business survives (so they don’t lose their jobs). As a result, remote workers today seem to be more productive and focused than ever!

“Now that I’m working from home, I work longer hours. This new work flexibility has improved my life,” says a UZIO employee. “In addition, my productivity has also improved manifold since there are fewer distractions and no hours on commute wasted. I can focus entirely on my work day-to-day.”

Here at UZIO, we use various project management practices to help us maintain complete visibility and accountability for all of our team members. Surprisingly, a digital workplace makes it easier (not harder) to collaborate in real-time. As a result, our processes have quickly become more streamlined and efficient.

Myth #2: Communication is hindered

If you’re used to the usual office banter and mandatory staff meetings, then opting for a digital workplace could definitely seem like a way to kill communication. Truth be told, we actually thought this ourselves before the COVID pandemic hit. However, being forced into a remote workplace has shown us that we were wrong, and honestly, we’re glad we were.

Working in solitude can get lonely sometimes, but communication itself is 10 times easier. Productivity goals, project management tools, and communication platforms all play a vital role in keeping our team connected. Utilizing services like WhatsApp, Google Hangouts, Zoom, Google Drive, and other cloud-based tools have actually pushed us closer together, not farther apart. Regardless of where we are, all it takes is a quick message to another employee and we’re instantly connected once more.

If maintaining active communication still poses an issue, then virtual meetings offer an easy way for managers to regain control of the situation. Virtual meetings are just like regular face-to-face meetings, covering company-wide initiatives and project expectations. All team members can easily be made aware of the expectations when it comes to staying productive and meeting business goals (without the hassle of getting everyone in the same physical location!).