Navigating the Hazy Horizon: Paychex and the Challenges Facing Cannabis Businesses

Quick links

Introduction

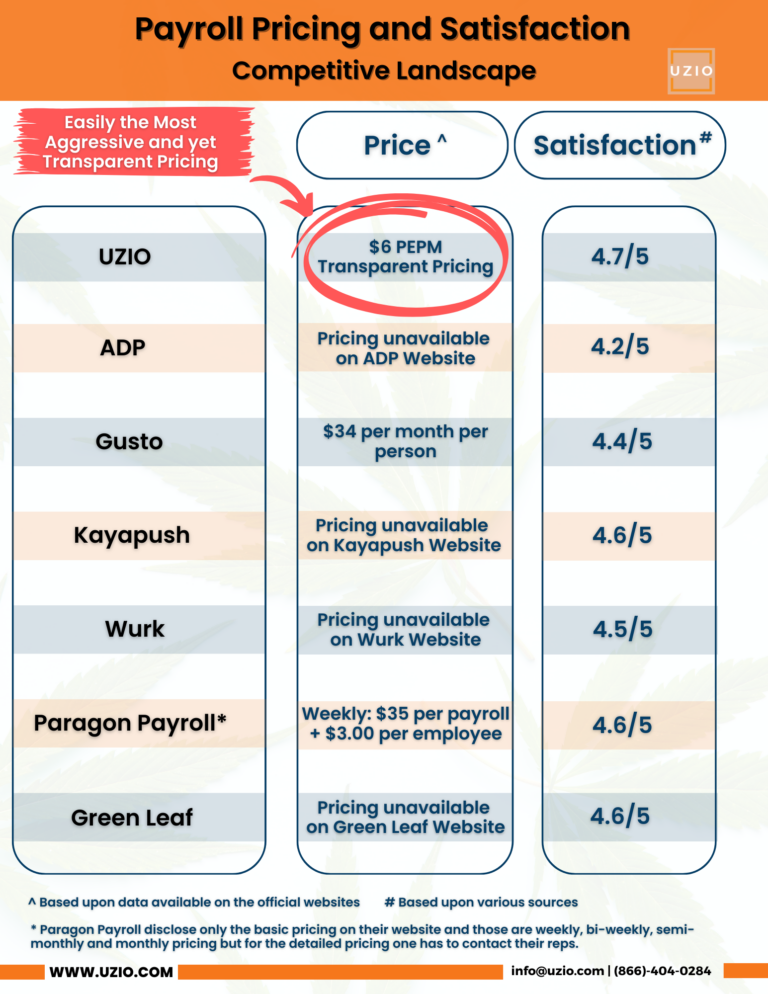

Back in March 2023, Paychex made headlines by cutting ties with all plant-touching cannabis companies, a decision that raised eyebrows and prompted discussions about the challenges faced by businesses operating in the legal cannabis space. Fast forward to today, and Paychex has taken a step further, severing relationships with ancillary businesses associated with the cannabis industry as well.

Paychex’s decision reflects a broader trend among major companies in the U.S. cannabis market, effectively serving as gatekeepers that regulate access for operators and ancillary service providers alike. This move has sparked conversations about the challenges facing businesses looking to participate in this burgeoning industry.

Here are a few key points to consider:

- Navigating Compliance Challenges:

Payroll and HR services are critical for any business, but in the cannabis industry, navigating compliance issues adds an extra layer of complexity. As federal and state regulations clash, companies like Paychex may be hesitant to engage with cannabis businesses due to the ever-changing legal landscape. - Stifling Growth Opportunities:

The decision by Paychex underscores the challenges that cannabis businesses face in securing essential services for their operations. This type of exclusionary behavior not only stifles the growth of existing operators but also discourages potential entrants from exploring opportunities within the industry. - Influence of Federal Regulations:

With cannabis still classified as a Schedule I substance at the federal level, companies operating in this space often find themselves at the mercy of shifting political tides. The reluctance of major service providers like Paychex may be an indication of the influence federal regulations have on shaping the dynamics of the cannabis market. - The Need for Advocacy and Education:

As the industry matures, there is a pressing need for advocacy and education to bridge the knowledge gap between mainstream service providers and cannabis businesses. Companies willing to invest in understanding the unique challenges of the cannabis sector can contribute to a more inclusive and sustainable industry ecosystem. - Uzio’s Commitment to Cannabis Solutions:

In contrast to the recent industry trends, Uzio proudly stands as a service provider dedicated to supporting the cannabis sector. Our commitment extends to offering comprehensive solutions designed to meet the specific needs of cannabis businesses, irrespective of their size or operational focus.

Recommended Reading: Cannabis Company Dropped by Paychex: Overcoming Payroll Challenges with UZIO

Conclusion

By understanding the intricacies of the cannabis industry, Uzio aims to be a catalyst for positive change. Our goal is to empower cannabis operators with essential payroll and HR services, fostering growth, and helping businesses thrive in this evolving landscape.

As we navigate the challenges presented by industry gatekeeping, let’s embrace collaborative efforts and celebrate the commitment of companies to the inclusivity and sustainable growth of the cannabis sector.

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

About the Author:

Zach Zuccari is a dynamic and dedicated Sales Account Executive at UZIO, where his expertise shines in helping businesses navigate the complexities of payroll, benefits, and HRIS technology. His journey in the corporate world is marked by a rich background in sales, payroll administration, benefits administration, and time tracking technology. This diverse skill set empowers Zach to provide comprehensive guidance to his clients, ensuring they master the intricate world of HR management.

The Ultimate Guide to Payroll Processing for SMBs (2024)

Quick links

-

Introduction

-

Understanding Payroll: Basic Concepts and Definitions

-

Setting Up Your Payroll Process

-

Executing Payroll: A Step-By-Step Guide

-

UZIO: The Best All-in-One Payroll Solution for SMBs

-

Outsourcing Payroll: When and How to Hire a Professional

-

Payroll Management Best Practices

-

Common Payroll Challenges and Solutions

-

Payroll Costs and Budgeting

-

Payroll Compliance and Legal Considerations

-

Embracing Digital Solutions for Payroll Management

-

Payroll Resources and Support

-

Conclusion

Introduction

Welcome to our comprehensive guide on payroll processing for SMBs! Whether you’re a new business owner or looking to refine your payroll process, this guide is designed to walk you through every essential step, keeping your business running smoothly and compliantly.

1. Introduction to Payroll for SMB Owners

Payroll management is a crucial aspect of running a SMB. It involves more than just issuing paychecks; it’s about understanding legal requirements, managing employee information, and ensuring accurate and timely tax filings. Getting payroll right is vital for the health of your business and the satisfaction of your employees. For an in-depth look at the latest payroll innovations, check out UZIO’s December Product Release: Exciting New Features.

2. Understanding Payroll: Basic Concepts and Definitions

2.1. What Is Payroll Processing?

Payroll processing refers to the entire process of managing the payment of wages by a company to its employees. This involves tracking hours worked, calculating pay, deducting taxes, and ensuring timely disbursement of salaries.

2.2. Manual Processing vs. Using a Payroll Service

Deciding between manual payroll processing and using a service depends on your business size, complexity, and budget. Manual processing is more hands-on and cost-effective for very small businesses, while payroll services offer time-saving automation and compliance features. For a comparison of top payroll software solutions, visit our blog on Comparing Top Payroll Software Solutions for the Cannabis Industry.

3. Setting Up Your Payroll Process

3.1. Step 1: Establish Your Employer Identification Number (EIN)

Your EIN is like a Social Security number for your business. It’s required for reporting taxes to the IRS and for state payroll reports.

3.2. Step 2: Collect Employee Tax Information

Ensure all employees complete a W-4 form, which provides the necessary information to calculate withholding taxes. Learn more about the importance of proper documentation in our article on What Does a Pay Stub Look Like.

3.3. Step 3: Choose a Payroll Schedule

Decide how often you’ll pay your employees: weekly, biweekly, semimonthly, or monthly. Each has its own advantages and impacts on cash flow and payroll processing.

3.4. Step 4: Understand and Comply with Overtime Regulations

Familiarize yourself with the Fair Labor Standards Act (FLSA) to properly compensate eligible employees for overtime. For more insights, see our guide on List of 2024 Federal Holidays for Small Businesses That You Need to Know.

4. Executing Payroll: A Step-By-Step Guide

Step 1: Review and Approve Time Sheets

Carefully check time records for accuracy. Inaccurate timekeeping can lead to payroll errors.

Step 2: Calculate Gross Pay

Determine the total pay owed to each employee before deductions based on their hours worked and pay rate.

Step 3: Calculate and Withhold Income Taxes

Use each employee’s W-4 and IRS tables to calculate federal income tax withholding, along with state and local taxes where applicable.

Step 4: Determine Other Deductions

Include deductions like retirement plan contributions, health insurance premiums, and wage garnishments if applicable. For a deeper understanding of benefits in the cannabis industry, see our blog on 401k Plans in the Cannabis Industry.

Step 5: Calculate Net Pay and Pay Employees

Subtract taxes and other deductions from gross pay to determine each employee’s net pay. Then, issue payments via check, direct deposit, or other agreed-upon methods.

Step 6: File and Report Payroll Taxes

Regularly file all required payroll tax forms with the IRS and your state tax agency.

Step 7: Store and Maintain Payroll Records

Keep detailed records of your payroll process, including time sheets, tax filings, and proof of payments, typically for at least three years.

5. UZIO: The Best All-in-One Payroll Solution for SMBs

5.1. Why Choose UZIO for Your Payroll Needs?

UZIO is a leading SaaS-based payroll software provider, offering a comprehensive all-in-one payroll, HRIS, and benefits solution specifically designed for SMBs. With UZIO, you can automate and streamline your payroll process, ensuring accuracy, compliance, and efficiency. Learn about UZIO’s exciting features in our October Product Release.

5.2. Integrating Payroll, HRIS, and Benefits Seamlessly with UZIO

UZIO simplifies payroll management by integrating it with HR and benefits administration. This integration offers a unified platform for managing all aspects of employee compensation and benefits, reducing administrative burdens and improving overall workflow efficiency. Discover how UZIO can enhance employee retention through payroll software in our blog Enhancing Employee Retention Through Payroll Software.

Recommended Reading: Biggest pain point with Payroll and HR software

6. Outsourcing Payroll: When and How to Hire a Professional

6.1. Benefits of Hiring a Payroll Specialist or Company

Outsourcing payroll to a specialist can save you time, reduce the risk of errors, and ensure compliance with changing tax laws and regulations. For more on this topic, check out Why Switching Payroll Providers in The Fourth Quarter Makes Perfect Sense.

6.2. Steps for Outsourcing Your Payroll

Select a reputable payroll provider, set up your account with employee and company information, and transition your payroll process to the provider.

7. Payroll Management Best Practices

7.1. Designing Effective Payroll Policies

Create clear payroll policies covering aspects like pay periods, overtime, leave, and bonuses to ensure transparency and consistency.

7.2. Classifying Workers Correctly

Correctly classify employees as either full-time, part-time, or independent contractors to comply with labor and tax laws.

7.3. Tracking and Documenting Employee Pay Accurately

Maintain meticulous records of hours worked, wages paid, and deductions made for each employee.

8. Common Payroll Challenges and Solutions

8.1. Frequent Payroll Mistakes and How to Avoid Them

Understand common payroll mistakes, like misclassifying employees or miscalculating overtime, and implement checks and balances to prevent them.

8.2. Correcting Payroll Errors

Develop a process for quickly and accurately correcting payroll errors when they occur.

8.3. Managing Payroll during Employee Leave and Holidays

Familiarize yourself with the rules regarding paid and unpaid leave to ensure proper payroll adjustments.

9. Payroll Costs and Budgeting

9.1. Understanding Payroll Processing Costs and Fees

Be aware of the costs associated with different payroll processing methods, including software subscriptions and outsourcing fees.

9.2. Reducing Payroll Costs without Compromising Efficiency

Explore strategies to reduce payroll costs, such as leveraging technology or adjusting payroll schedules, without impacting employee satisfaction or legal compliance.

10. Payroll Compliance and Legal Considerations

10.1. Tax and Social Security Obligations

Understand your obligations for withholding and paying federal and state taxes, as well as Social Security and Medicare contributions.

10.2. Employer Contributions for Social Security and Medicare (FICA)

Ensure accurate calculation and timely payment of FICA taxes to avoid penalties.

10.3. Adhering to Federal and State Payroll Tax Laws

Stay informed about the latest federal and state payroll tax laws to maintain compliance and avoid costly fines.

11. Embracing Digital Solutions for Payroll Management

11.1. Security and Privacy in Online Payroll Processing

Implement robust security measures to protect sensitive payroll data from cyber threats and ensure privacy compliance.

12. Payroll Resources and Support

12.1. Helpful Tools and Software Recommendations

Recommendations for tools and software that can simplify the payroll process and improve accuracy.

12.2. Where to Find Professional Payroll Advice

Resources for professional advice, including payroll consultants, online forums, and professional organizations.

13. Conclusion: Streamlining Your Payroll Process

In conclusion, effective payroll management is a cornerstone of a successful small business. By understanding the essentials and leveraging tools like UZIO, you can ensure a smooth, compliant, and efficient payroll process.

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

UZIO’s December Product Release – Exciting New Features!

Great Falls, VA. December 26th, 2023

At UZIO, our commitment to platform improvement remains unwavering, aimed at providing customers with a more robust and user-friendly experience. We are thrilled to announce a range of exciting new features that are launched this month, which we believe will significantly enhance customer experience.

Here are the details of these features:

UZIO Payroll Enhancements

- UZIO Payroll Services Now Covers Puerto Rico

- Enhanced Security Measures: Introducing Employer Level Direct Deposit Configuration

- Introducing the Project Details Report

UZIO HRIS Enhancements

- Introducing New Fields into Employee Profile

- Gender Identity

- Pronouns

- Marital Status

- Employees Not On Payroll

UZIO HRIS Enhancements

- Set Up and Manage Breaks in UZIO Time Tracking

For more details about any of these features, please click here. For any other query, please email info@uzio.com or give us a call at (866) 404-0284.

A word from the CEO:

“Right from the beginning, we have instituted a company culture where our team members make an extra effort to listen to the feedback from our customers and are always on the lookout for ways to improve the end user experience.” said Sanjay Singh, CEO of UZIO Technology Inc. “A number of enhancements in this release are the direct result of a collaborative working relationship we have with our customers where their feedback is listened to and given high priority as we make investment in our product roadmap.“

About UZIO Technology Inc.:

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carriers serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

15 Best Cannabis Social Networks for Dispensaries in 2024

Quick links

-

Introduction

-

The Top Cannabis Social Networks

-

Mainstream Social Networks and Cannabis

-

Leveraging Social Networks for Dispensary Marketing

-

Building Community and Engagement

-

Navigating Legal and Compliance Issues

-

Innovative Features of Cannabis Social Networks

-

Future Trends in Cannabis Social Networking

-

Conclusion

Introduction

The cannabis industry is a rapidly evolving landscape, marked by swift changes that can be challenging for professionals to navigate. With new trends, developments, and regulatory shifts happening frequently, there’s a pressing need for a platform where cannabis businesses and aficionados can engage and connect seamlessly. This need is precisely what has given rise to the niche of cannabis business social networks.

Despite cannabis being legal in most U.S. states, the restrictions on advertising and posting about cannabis-related content on mainstream social media platforms are still significant. Major platforms like Facebook, Instagram, Snapchat, and TikTok enforce stringent guidelines, partly due to cannabis’s classification as a controlled substance in the USA. This poses a question for cannabis businesses and advocates: where can they go to effectively promote, engage, and build their network? The answer lies in cannabis business social networks.

These networks serve as a vital hub for industry leaders, business owners, and cannabis enthusiasts, offering a space to freely exchange ideas, experiences, and insights. Curious about which platforms are the most cannabis-friendly? We’ve compiled a list of the top 15 cannabis social networks that are shaping the way the industry connects and communicates.

I. The Top Cannabis Social Networks and Forums

- Grasscity Forums – The #1 Marijuana Community Online:

Grasscity Forums is a legendary online community where cannabis enthusiasts gather to discuss various topics related to cannabis cultivation, consumption, and culture. It also has its own app on Google Play Store. - WeedLife – Join the Cannabis Social Network:

WeedLife.com is the largest cannabis social network in the world, accessed by more than 120 countries. This network is a social hub for cannabis businesses and consumers, offering a space for sharing updates, educational content, and industry news. - Weedable Cannabis Social Network Marketplace:

Weedable focuses on connecting cannabis businesses with customers globally, providing an online marketplace for products and services. Their mission is to promote the legalization of medical marijuana across the globe through social dialogue between people. - CannaSOS:

CannaSOS is a comprehensive network offering a blend of social media, business, and knowledge sharing. It’s great for dispensaries aiming to educate and engage. It enables crypto payments for over 400+ cryptos through several popular wallets and exchanges, as well as bank transfers with our user friendly and seamless payment interface. - MJLink Cannabis Business Social Network:

A professional network for the cannabis industry, MJLink facilitates connections between businesses and experts in the field. It is one the best cannabis business social network. One can connect, share and learn with other cannabis businesses across the globe. - 420 Magazine Forum:

The forum is an informational hub discussing various topics related to cannabis, including legal issues, growing tips, and medical uses. It is one of the most established and trusted forum on the internet dedicated to cannabis growers and marijuana users worldwide. - Leaf Wire:

This platform is like the LinkedIn of cannabis, perfect for dispensaries looking to network with industry professionals and investors. Leafwire is a networking platform that helps Cannabis businesses find Investors, Employees and Partner Companies that will help them grow in the new cannabis economy. - HempTalk:

Focused on hemp and CBD, HempTalk offers a space for sharing knowledge, news, and insights about the hemp side of the cannabis industry. HempTalk Business Social Marketplace is for industrial hemp and CBD industry professionals to connect, share and learn, and market their brands - MjInvest:

This network is designed for cannabis investors and entrepreneurs, offering insights, investment opportunities, and industry trends. The only social investor network solely focused on the cannabis industry containing the most up-to-date news, community connections, education and exclusive interviews all. - CannaBuzz:

CannaBuzz offers a welcoming community for cannabis users and businesses to share photos, videos, and experiences. A Cannabis Social Network & Community, it is the online home for cannabis lovers. - MassRoots:

This platform is aimed at a community of cannabis users, offering dispensaries a space to connect with a large user base and share their products and services. - Rollitup:

This site is ideal for growers, Rollitup offers a wealth of knowledge about different growing techniques, equipment, and strain reviews. It’s a great place for both beginners and experienced cultivators. Here you’ll find marijuana growing and cannabis cultivation resources, Marijuana seeds, thousands of articles for growing cannabis. - THCtalk:

This is another comprehensive forum that caters to a wide array of cannabis-related discussions. It includes sections on growing, breeding, legal issues, and general cannabis talk. - IC Mag

International Cannagraphic Magazine offers a forum where users from around the world contribute to discussions about cultivation, hash making, and different cannabis strains. - Cannabis Culture Forums

Run by the popular Cannabis Culture Magazine, this forum features discussions influenced by the magazine’s content, including activism, politics, and culture.

These forums are not only about sharing information; they also foster a sense of community among members, allowing them to connect with like-minded individuals and stay updated with the evolving cannabis culture. Whether you’re a seasoned enthusiast or new to the world of cannabis, these forums offer a welcoming space to learn, discuss, and grow.

II. Mainstream Social Networks and Cannabis

Despite the potential of mainstream platforms, dispensaries often face challenges due to restrictions on cannabis-related content. Navigating these platforms requires a nuanced approach, focusing on education and community engagement while adhering to their policies.

III. Leveraging Social Networks for Dispensary Marketing

Effective use of these networks involves showcasing products, sharing educational content, and engaging in community discussions. Successful campaigns often include interactive content, customer testimonials, and behind-the-scenes glimpses of dispensary operations.

IV. Building Community and Engagement

Creating a sense of community is key. Encourage discussions, respond to comments, and create content that resonates with your audience. Highlighting customer experiences and sharing informative content can foster a loyal customer base.

Recommended Reading: Comparison of Top 7 Payroll Software Solutions for the Cannabis Industry

V. Navigating Legal and Compliance Issues

It’s crucial for dispensaries to stay compliant with legal regulations on these platforms. This includes avoiding direct sales pitches and ensuring content adheres to the legal standards of the platform and the region.

VI. Innovative Features of Cannabis Social Networks

Many of these platforms offer innovative features like virtual dispensaries, forums, and P2P networks. These tools can be leveraged to enhance visibility, connect with customers, and stay ahead in the competitive market.

VII. Future Trends in Cannabis Social Networking

As the legal landscape evolves, we can expect to see more innovative features, increased user engagement, and perhaps more leniency in advertising regulations on mainstream social media platforms.

Conclusion

For dispensaries, navigating the world of cannabis social networks in 2024 is about finding the right platforms that align with their marketing goals and audience. By engaging on these platforms, dispensaries can build a robust online presence, connect with the community, and grow their customer base.

For more information on utilizing these platforms for your dispensary, check out additional guides and resources available on each platform’s website.

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

Maximizing Cannabis Industry Innovation: Leveraging R&D Tax Credits

Quick links

-

Introduction

-

What is R&D Tax Credit in the US?

-

Eligibility Criteria for R&D Tax Credits in the Cannabis Industry

-

Common Misconceptions About R&D Tax Credits in Cannabis

-

Case Study: A Success Story Powered by OnCentive

-

The Importance of R&D Tax Credits

-

How OnCentive Can Help

-

Conclusion

Introduction

In the ever-evolving cannabis industry, innovation is key to staying competitive. Understanding and utilizing Research & Development (R&D) Tax Credits can significantly aid businesses in this sector. This blog post, powered by OnCentive’s expertise, delves into how cannabis businesses can leverage these credits effectively.

1. What is R&D Tax Credit in the US?

The R&D tax credit is a dollar-for-dollar, non-dilutive tax incentive for US-based companies that innovate. The Tax Credit was originally established in 1981. The Protecting Americans from Tax Hikes (PATH) Act of 2015, which broadened the ability of many small-to-midsize businesses to monetize the R&D credit made the credit permanent. Companies across industries can qualify, including early-stage startups and profitable companies. Qualifying expenditures generally include the design, development or improvement of products, processes, techniques, formulas or software.

As per one of the reports of OECD: Between 2000 and 2018, the number of R&D tax relief recipients effectively more than doubled in the US, from around 10,500 R&D tax relief recipients in 2000 to over 26,000 in 2018.

Over the period 2000-2013 period (for which relevant data are available), SMEs accounted for the majority of R&D tax relief recipients with a share of around 70-75% in more recent years.

2. Eligibility Criteria for R&D Tax Credits in the Cannabis Industry

To qualify for R&D tax credits, cannabis businesses must engage in activities that meet certain criteria. These include the development or improvement of products, processes, techniques, formulas, or software. Specifically, activities should involve experimentation to eliminate uncertainty, relying on science or technology. This could encompass creating new cannabis strains, developing hemp-based products, or enhancing manufacturing processes. It’s important for businesses to document their R&D activities thoroughly to substantiate their claims.

3. Common Misconceptions About R&D Tax Credits in Cannabis

There are several myths surrounding R&D tax credits in the cannabis industry. A common misconception is that these credits are only for ‘breakthrough’ innovations. However, even modest improvements in products or processes can qualify. Another misunderstanding is that R&D tax credits are only for large companies with formal R&D departments. In reality, small and medium-sized enterprises, including startups, are eligible if they engage in qualifying R&D activities.

4. Case Study: A Success Story Powered by OnCentive

Consider a cannabis client who developed creams, lotions, and food products from legal cannabis. This process involved extensive testing and development, costing over $2.8 million. With OnCentive’s guidance, the company successfully claimed an R&D Tax Credit of $370,500, underscoring the significance of innovative efforts in the cannabis industry.

5. The Importance of R&D Tax Credits

These tax credits are vital for encouraging innovation in the cannabis sector. They provide financial relief which can be reinvested into further R&D, propelling the industry forward.

Recommended Reading: What is R&D Tax Credit and How Do I Claim it?

6. How OnCentive Can Help

OnCentive’s role in navigating the complexities of R&D tax credits is invaluable. They offer expertise in identifying qualifying activities and ensure compliance, maximizing the benefits for cannabis businesses.

Conclusion

R&D tax credits are a strategic resource for cannabis businesses aiming to innovate and grow. OnCentive’s expertise in this area is a crucial asset, helping businesses to capitalize on these opportunities. For more information, visit OnCentive at oncentive.com or contact them at info@oncentive.com.

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

Navigating Local Marketing Strategies for Cannabis Dispensaries: A Practical Guide

Quick links

-

Introduction

-

Mastering Local SEO

-

Strategic Social Media Use

-

Effective Email Marketing

-

Forming Strategic Partnerships

-

Engaging with the Community

-

Prioritizing Customer Service

-

Developing a Strong Brand Identity

-

Staying Compliant

-

Utilizing Data-Driven Insights

-

Embracing Patience and Persistence

-

Conclusion

Introduction

Exploring local marketing strategies for cannabis dispensaries is crucial in this distinct industry. The cannabis industry is rapidly evolving, and with it, the marketing landscape for dispensaries. In today’s competitive market, it’s more important than ever for dispensaries to have a strong local marketing strategy in place. This guide offers practical tips and industry insights for effective local marketing.

1. Mastering Local SEO

Local SEO is crucial for dispensaries to be found by nearby customers. Ensure your dispensary is listed in key online directories like Google My Business, Yelp, and Weedmaps. Creating locally relevant content, like blog posts on community events or cannabis topics, enhances your online presence.

To further understand its importance, read Moz’s guide on local SEO.

2. Strategic Social Media Use

While navigating strict marketing regulations, use social media to share informative content and engage with your audience. Promote new products and run contests while adhering to guidelines like avoiding medical claims and targeting adults over 21.

3. Effective Email Marketing

Build a subscriber list with customer consent and use email marketing to inform about new products, promotions, and educational content. This helps in dispelling myths and keeps your audience engaged with your brand.

Lendio offers great tips on email marketing that can be applied in the cannabis industry.

4. Forming Strategic Partnerships

Collaborate with local businesses to reach new customers. Partner with health stores or event companies for product launches or educational seminars, enhancing community presence.

Check out Forbes’ article on strategic partnerships for insights on their importance in business growth.

5. Engaging with the Community

Actively participate in community events, charities, or volunteer work. This not only builds goodwill but also establishes your dispensary as a trusted community member.

Recommended Reading: Biggest pain point with Payroll and HR software

6. Prioritizing Customer Service

Excellent customer service leads to positive word-of-mouth. Train your staff to be knowledgeable and customer-centric, ensuring every visitor leaves satisfied.

Learn more about enhancing customer service from this Shopify article.

7. Developing a Strong Brand Identity

Your brand identity sets you apart. Maintain consistency in your logo, tagline, and messaging across all marketing channels, creating a memorable brand.

8. Staying Compliant

Adherence to regulations is non-negotiable. Ensure all marketing efforts comply with industry guidelines, from advertising to product labeling.

9. Utilizing Data-Driven Insights

Leverage data analytics to track and optimize your marketing strategies. Analyze website traffic, social media engagement, and email responses to refine your approach.

Google Analytics provides useful guidance on leveraging data for business.

10. Embracing Patience and Persistence

Building a successful dispensary is a long-term endeavor. Stay consistent and adaptable in your marketing efforts, and the results will follow.

Conclusion

Effective local marketing for cannabis dispensaries involves a multifaceted approach, combining digital strategies with community engagement and compliance. By following these guidelines, dispensaries can build a robust local presence and foster lasting customer relationships.

Key Takeaways:

- Master local SEO for enhanced visibility

- Utilize social media strategically, adhering to regulations

- Leverage email marketing for customer engagement

- Form strategic partnerships for broader reach

- Engage actively in community events for trust building

- Prioritize excellent customer service for positive word-of-mouth

- Develop a strong, consistent brand identity

- Ensure strict compliance with marketing regulations

- Utilize data analytics for strategy optimization

- Embrace patience and persistence for long-term success

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

Crafting a Cannabis Business Model Resilient to Policy Shifts

Quick links

-

Introduction

-

Understanding the Policy Environment

-

Flexibility in Operations

-

Financial Planning for Uncertainty

-

Embracing Technology and Innovation

-

Building a Culture of Compliance

-

Advocacy and Community Engagement

-

Conclusion

1. Introduction

In the ever-evolving cannabis industry, where regulatory landscapes are as dynamic as the markets themselves, crafting a business model that can withstand policy shifts is not just strategic—it’s essential for survival. The National Cannabis Industry Association’s (NCIA) recent discussions, including insights from experts like John Hudak of the Maine Office of Cannabis Policy, underscore the importance of resilience in the face of change. Here’s how cannabis businesses can build a model that endures and thrives amidst the ebb and flow of policy changes.

Recommended Reading: Biggest pain point with Payroll and HR software

2. Understanding the Policy Environment

The first step in building a resilient business model is to develop a deep understanding of the current policy environment and anticipate potential changes. This means keeping abreast of both state and federal regulations, as well as international trends that could signal shifts in the industry. Businesses must also engage with policy discussions, providing feedback and data that can shape sensible regulations.

3. Flexibility in Operations

A resilient cannabis business model is one that is inherently flexible. This flexibility can be manifested in various aspects of the business, such as:

- Diversified Product Lines: Offering a range of products can protect a business from fluctuations in market demand that policy changes might precipitate.

- Scalable Processes: Building scalability into cultivation, production, and sales processes ensures that a business can adjust its operations in response to regulatory changes.

- Adaptable Supply Chains: Establishing a supply chain with multiple options allows for quick pivots should a supplier become non-compliant with new regulations.

4. Financial Planning for Uncertainty

Financial resilience is key in an industry subject to policy-induced market swings. Cannabis businesses should:

- Maintain Strong Capital Reserves: Having a buffer can help a business weather periods of uncertainty during policy transitions.

- Explore Diverse Revenue Streams: Beyond product sales, consider ancillary services or educational initiatives that can generate income.

- Plan for Taxation Changes: Stay prepared for shifts in tax laws, which can have significant financial implications.

5. Embracing Technology and Innovation

Technology can provide the tools needed to adapt quickly to policy changes. Implementing robust tracking and reporting systems not only aids in compliance but also provides valuable data that can inform strategic decisions. Additionally, investing in research and development can lead to innovative products that transcend regulatory barriers.

6. Building a Culture of Compliance

A culture of compliance within the organization ensures that every team member understands the importance of adhering to regulations and is vigilant about changes. This culture is supported by:

- Continuous Education: Regular training sessions on compliance matters can keep staff informed and engaged.

- Clear Communication Channels: Establishing protocols for disseminating information about policy changes ensures that all parts of the business can respond promptly.

7. Advocacy and Community Engagement

Active participation in advocacy efforts can not only influence policy outcomes but also provide early insights into potential changes. Building strong relationships with community and industry groups can lead to a collective voice that is more likely to be heard by policymakers.

8. Conclusion

In the cannabis industry, change is the only constant. Businesses that anticipate and prepare for policy shifts position themselves to navigate the uncertainties of regulation with confidence. By understanding the policy environment, incorporating flexibility into operations, planning financially for uncertainty, embracing technology, fostering a culture of compliance, and engaging in advocacy, cannabis businesses can develop a model that is not just resilient but also primed for growth in the face of policy shifts. The goal is not merely to survive the changes but to use them as a springboard to new opportunities and continued success.

Get in touch with us for an expert-led demo to know more about UZIO all-in-one payroll software.

Employee Onboarding – the importance of creating the right experience

Quick links

-

Introduction

-

The Importance of a Systematic Approach

-

Onboarding Checklist for New Business Owners

-

Workspace Setup

-

Socialization With the Team

-

Orientation Sessions

-

Schedule Check-Ins and Training

-

Key Takeaways

1. Introduction

Hiring and onboarding new employees is a critical process for any business, large or small. It sets the tone for an employee’s experience with your company and can impact their long-term success and satisfaction. A bad onboarding experience can lead to confusion, frustration, and a lack of motivation among new hires. This, in turn, can result in decreased productivity and increased turnover rates, which ultimately affects the overall success of your company. Some reports show it takes approximately 11.2 months of joining an organization for employees to reach their full potential. With poor onboarding you can expect poor employee retention.

According to research employee turnover cost on average is 33% of a worker’s annual salary just to replace one employee. Additionally, low productivity due to stress and anxiety can cost your business $600 per worker annually. So you can see, for an SMB business owners’ without a dedicated HR team, it’s particularly important to create a structured onboarding program to ensure that every new hire receives the same level of attention and information. This process not only helps to reduce first-day jitters but also lays the groundwork for integrating new employees into your company culture and operations.

2. The Importance of a Systematic Approach

A standardized onboarding process ensures that all legal requirements are met and that each employee is equipped with the tools and knowledge they need to perform their job effectively. It’s not just about paperwork; it’s about making your new team members feel welcome and prepared. From setting up their workspace to explaining benefits and conducting regular check-ins, every step should be planned and executed with care.

3. Onboarding Checklist for New Business Owners

Complete New Hire Paperwork

Completing new hire paperwork is a fundamental first step in the onboarding process. It involves gathering and filing all the legal and formal documents necessary to employ someone legally and ethically. This process is critical because it ensures that your business complies with labor laws and taxation requirements. It also provides a clear contract between the employer and the employee regarding job expectations and obligations.

- Key Documents to Complete:

- Form I-9: Verifies the employee’s legal right to work in the United States.

- Tax Forms: Ensures the correct tax withholdings and reporting.

- Employment Contract: Outlines the terms of employment, including salary, job responsibilities, and conditions of employment.

- Legal Documents: Protects proprietary information and business interests.

- Employee Handbook: Informs the employee about company policies and procedures.

- Benefits Explanation: Details the company’s benefits programs and eligibility.

- Job Description: Clarifies the employee’s role and expectations.

Devices and Credentials

Providing devices and credentials is essential for equipping your new hire with the tools they need to perform their job functions. This step is about more than just hardware; it’s about ensuring that new employees have access to the information and systems they need to be productive and effective.

- Essential Technology and Access:

- Computers, phones, and other necessary devices.

- Login information for email, intranet, and essential software.

- Permissions for access to necessary data and communication channels.

4. Workspace Setup

Creating a workspace that is both welcoming and functional is crucial for a new employee. A well-set-up workspace helps new hires feel valued and ready to start contributing to the team. It’s also an opportunity to demonstrate your company’s culture and values through the environment you provide.

- Components of a Well-Prepared Workspace:

- Desk, chair, and other necessary office furniture.

- Office supplies and equipment.

- Welcome kit with company-branded items and a guide to the office.

5. Socialization With the Team

Socialization is a vital aspect of integrating new employees into the company culture. It involves formal and informal activities designed to introduce new hires to their colleagues and immerse them in the workplace community. This part of the process can significantly affect an employee’s ability to work well within the team and their overall job satisfaction.

- Key Socialization Activities:

- Team introductions and a new hire announcement.

- Social gatherings such as a team lunch or welcome event.

- Inclusion in team meetings and group projects from the outset.

6. Orientation Sessions

Orientation sessions provide a structured way for new employees to learn about the company, its policies, and their benefits. These sessions are essential for communicating expectations, resources, and the support available to help employees navigate their new workplace.

- Essential Orientation Topics:

- Explanation of health benefits, insurance plans, and other employee programs.

- Detailed review of the employee handbook, safety guidelines, and technology use.

- Assignment of a peer mentor for ongoing support.

7. Schedule Check-Ins and Training

Scheduling regular check-ins and training is crucial for monitoring the progress of new hires and providing ongoing support and education. These check-ins serve as milestones for the employee’s development and offer opportunities to give and receive feedback on the onboarding experience.

- Important Check-In Milestones:

- Immediate feedback opportunity following the onboarding sessions.

- Scheduled training sessions to enhance skills and knowledge.

- Formal check-ins at one week, 30 days, 60 days, and 90 days to track progress and address concerns.

Recommended Reading: Affordable 401(k) Plans that Sync with Payroll and Benefits

8. Key Takeaways

- Complete legal and informative paperwork to ensure compliance and clarity

- Provide necessary technology and access to enable productivity

- Prepare a personal and equipped workspace for a warm welcome

- Encourage team socialization for cultural integration

- Conduct thorough orientation to align understanding of company practices

- Plan regular check-ins and training for continuous employee development

By following this comprehensive checklist, SMB business owners can create a consistent and effective onboarding process that fosters a positive work environment and sets the stage for new employee success. By following this structured approach, you’ll help your new hires to become productive, engaged members of your team from day one.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.

Why Switching Payroll Providers in the Fourth Quarter Makes Perfect Sense

Quick links

-

Introduction

-

Why Consider Switching Payroll Providers in the Fourth Quarter

-

Switching Payroll Companies – A Checklist

-

Conclusion

1. Introduction

Payroll is traditionally both one of the biggest operating costs and one of the heaviest administrative burdens, especially for companies that manage payroll manually. And for good reason—mistakes can result in both stiff IRS penalties and unhappy employees. As we find ourselves in the fourth quarter of the year, it’s a crucial time for small to mid-sized businesses to evaluate their payroll provider and consider making a switch if necessary. Payroll is a fundamental aspect of any business, and ensuring accuracy and efficiency in this process is paramount. In this article, we will explore why switching payroll providers now is the right move, how to identify the best fit for your business, and the steps to make a successful transition.

2. Why Consider Switching Payroll Providers in the Fourth Quarter

Your employees rely on timely and accurate paychecks, and your business depends on their satisfaction and productivity. When your current payroll provider isn’t meeting your needs, it’s time to consider a change. Here are some reasons why making the switch in the fourth quarter is advantageous:

- Avoid Historical Data Hassles: Switching at the end of the calendar year allows you to avoid the hassle of transferring historical payroll data. Switching payroll providers often involves transferring historical payroll data, employee information, and financial records. This process can be time-consuming and costly, especially if you have a large workforce. While exact cost savings will vary depending on the size of your business and the complexity of your data, switching in the fourth quarter can save money by reducing the need for extensive data migration.

- Streamlined Tax Processes: Changing providers mid-year can complicate tax payments and filings. Fourth-quarter switches can simplify tax processes, as you’ll start the new year with a clean slate in terms of tax reporting and filings. This can reduce the risk of errors and late filings, potentially leading to cost savings by avoiding penalties and fines.

- Employee Payment Consistency: Ensuring that employees are paid on time and without disruptions is critical for maintaining morale and productivity. Switching providers at a time that doesn’t interfere with regular payroll schedules can help avoid any issues related to late or incorrect payments. Consider the following factors:

1. Cost: Evaluate if you are paying more than you should for your current provider.

2. Customer Service: Assess the reliability of your current provider’s customer service.

3. Ease of Use: Determine if your current provider’s software is user-friendly or causing unnecessary difficulties.

4. Customization: Ensure the provider offers services tailored to your specific business needs.

3. Switching Payroll Companies – A Checklist

Here’s a checklist to guide you through the process of switching payroll providers:

- Pick the Right Time: Consider switching at the end of the year (most recommended) or the beginning of a quarter for a smoother transition.

- Determine Needed Services: Identify the payroll services (payroll, HRIS, benefits administration, etc.) that are essential for your business. Questions to ask the potential vendor could include:

- What is the customer service experience typically like at your company? Which representatives would I speak with?

- Would my applications be compatible with your current software? What integration capabilities do you have?

- How would your organization handle the transition? What are typical timelines? What would my responsibilities be during the transition and afterward?

- How secure is your platform?

- What would happen if a payroll mistake is made?

- Check Current Contract: Review the terms of your current contract, including cancellation fees and notice requirements.

- Notify Current Provider: Communicate your plans to switch with your current payroll provider to facilitate a smooth transition.

- Choose a New Provider: Research potential payroll companies and ask for references from their customers.

- Gather Information: Collect necessary information from your company to provide to the new payroll provider. Information you will need include:

- Employee info

- Business info

- Payroll Registers and/or Quarterly Reports

- A voided check

- Proof of FEIN (Federal Employer Identification Number) from the IRS

- Payroll tax returns for the current year quarters

- Copies of payroll registers for each check date of the current quarter

- W-2 Forms

- Copies of a payroll quarterly report for each completed quarter for the current year

- Copies of quarterly tax returns for the current year

- Employee profile information including, name, address, social security number, tax withholding information (information found on the W4 form), rates of pay, recurring earnings/deductions, garnishment paperwork, and direct deposit information.

- Set Up Your Contract: Familiarize yourself with the new contract and understand your responsibilities and fees.

- Notify Employees: Inform your employees about the switch and guide them in the process for accessing their new pay information.

Recommended Reading: Affordable 401(k) Plans that Sync with Payroll and Benefits

4. Conclusion

Payroll is a critical aspect of your business, and a reliable provider is essential. If your current provider isn’t meeting your expectations, don’t hesitate to consider a switch. Doing so in the fourth quarter can save you time, effort, and potential disruptions, ensuring a smooth transition for both your business and your employees. Remember that choosing the right payroll provider is an investment in the success and satisfaction of your workforce.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.

Incorporating Background Checks in Cannabis Startup Hiring: A Comprehensive Guide

Quick links

-

Introduction

-

The Importance of Background Checks for Cannabis Startups

-

Types of Background Checks Available

-

Best Practices for Conducting Background Checks

-

The Checkr-UZIO Integration

-

Conclusion

1. Introduction

The cannabis industry is one of the fastest-growing industries in the United States. According to Statista, the cannabis industry is projected to reach $33.88B in 2023 with an annual growth rate (CAGR 2023-2028 of 14.66%)* As more and more states legalize cannabis for recreational or medical use, the demand for qualified workers is soaring. However, hiring the right people is essential for any business, and it is especially important in the cannabis industry, where compliance with regulations is paramount.

One of the best ways to ensure that you are hiring qualified and trustworthy employees is to conduct background checks. According to SHRM approximately 92% of organizations conduct background checks. A major reason to conduct background checks is to avoid harm or legal liability of various types to employers or others.* Background checks can help you identify potential red flags, such as criminal convictions, drug use, or employment history issues. By conducting background checks, you can reduce the risk of hiring someone who could pose a threat to your business, your employees, or your customers.

This blog post provides a comprehensive guide to incorporating background checks into your cannabis startup hiring process. We will discuss the importance of background checks, the different types of background checks available, and the best practices for conducting background checks. We will also introduce the Checkr-UZIO integration, a seamless and affordable solution for cannabis background checks.

2. The Importance of Background Checks for Cannabis Startups

Background checks are important for all businesses, but they are especially important for cannabis startups. There are a few reasons for this:

- Compliance: Many states and municipalities require cannabis businesses to conduct background checks on their employees. Failure to comply with these regulations could result in fines, penalties, or even the revocation of your business license.

- Risk Mitigation: Background checks can help you identify potential red flags, such as criminal convictions, drug use, or employment history issues. By hiring trustworthy employees, you can reduce the risk of theft, fraud, and violence in your workplace.

- Customer Protection: Your customers deserve to feel safe and secure when they interact with your business. By conducting background checks, you can help to ensure that your employees are not a threat to your customers.

3. Types of Background Checks Available

There are a variety of different types of background checks available. The most common types of background checks for cannabis employees include:

- Criminal background checks: These checks search for criminal convictions and arrests.

- Drug testing: These tests screen for recent drug use.

- Employment history checks: These checks verify the applicant’s previous employment and identify any red flags, such as termination or disciplinary action.

- Reference checks: These checks involve contacting the applicant’s previous employers and references to get their feedback on the applicant’s performance and character.

4. Best Practices for Conducting Background Checks

When conducting background checks, it is important to follow best practices. Here are a few tips:

- Get consent from the applicant. Before conducting a background check, you must obtain the applicant’s consent. This consent should be in writing and should clearly explain the types of background checks that will be conducted.

- Use a reputable background check company. There are a number of companies that offer background check services specifically for the cannabis industry. Choose a reputable company that has experience working with cannabis businesses.

- Comply with all applicable regulations. Many states and municipalities have specific regulations regarding background checks for cannabis employees. Be sure to comply with all applicable regulations.

- Treat applicants fairly and consistently. Treat all applicants fairly and consistently throughout the background check process. This means using the same background check company for all applicants and conducting the same types of background checks on all applicants.

5. The Checkr-UZIO Integration

Checkr, an industry leader in background checks, has partnered with UZIO, a SaaS-based payroll software provider for small and medium-sized businesses (SMBs), to provide cannabis businesses with a seamless and affordable way to conduct background checks.

- Transparent Pricing Model: Checkr introduces a transparent pricing model where businesses are charged per background check, inclusive of pass-through fees, eliminating the need for long-term contracts or hidden fees.

- Digitization of Processes: The partnership heralds the end of cumbersome paperwork and manual verifications. Businesses can initiate checks and receive results directly through the Checkr Dashboard, streamlining the entire process.

- Leveraging Automation: Checkr employs machine learning to enhance accuracy and efficiency. This includes validating identities, providing precise estimated turnaround times, and effectively interpreting the nuances of report findings.

With the UZIO-Checkr integration, cannabis businesses can easily order background checks for new hires and existing employees directly from their UZIO account. The results of the background check are then automatically delivered to the UZIO account, making it easy for businesses to review the results and make hiring decisions.

The Checkr-UZIO integration is a great solution for cannabis businesses of all sizes. It is affordable, easy to use, and compliant with all applicable regulations.

Recommended Reading: Affordable 401(k) Plans that Sync with Payroll and Benefits

6. Conclusion

Background checks are an essential part of the hiring process for any business, but they are especially important for cannabis startups. By incorporating background checks into your hiring process, you can reduce risk, protect your business, and create a safe and secure workplace for your employees and customers.

If you are a cannabis business owner, we encourage you to learn more about how the UZIO-Checkr integration can help you with your background check needs. Visit the UZIO website today to get started.

Interested in learning about 401K companies that would serve your business?