How to overcome the workers shortage? Key points for SMBs to consider.

Quick links

Introduction

We are witnessing the biggest talent crisis in recent history. “The Great Resignation” is underway. SMBs especially find themselves in uncharted territory. They are looking for help as they struggle to hire and retain employees. In this article, we will attempt to provide a template that SMBs can use to navigate through these troubled waters.

At the start of the year 2020, before Pandemic, the unemployment rate in the US was around 3.5%. When the Pandemic hit, we lost around 22 million jobs in the US. That’s around 14% of the total. Post Pandemic, with the opening up of the economy, we have recovered all of the lost jobs and, by July of this year, according to the US Labor Department, the overall labor market has more jobs than in February 2020.

While the overall job market has come back to pre-pandemic levels, there are certain sectors which have not recovered completely. State, local governments, schools, and the hospitality industry struggle to fill open positions. As children across the country are going back to school, the teacher shortages have reached crisis levels. The same is true in the restaurant industry where restaurateurs are cutting back on menu items as well as restaurant hours to be able to survive with the shortage of workers. Why are these sectors struggling to attract workers? Let us see if we can draw any parallels.

In the past, in a lot of low paying jobs, security of a regular paycheck was the main need of the employees. If you think of the Maslow’s Hierarchy of Needs, these employees were struggling at the lower two tiers and were not thinking about needs of esteem, recognition etc. which are higher up the Maslow Hierarchy. If the employer provided a regular paycheck, many employees plowed through even if the work environment was stressful or there was lack of recognition of their work or there were less opportunities to grow. Having a paying job was the most important factor. It was an “employers market” where employees had less leverage.

All that seems to have changed with the Pandemic. Now employees seem to have the leverage. Remote work has become a real option. Workers are demanding safe working conditions. Working in close quarters for long hours, like in a restaurant or a school, just seems risky to a lot of people. Plus there seems to have been a mind shift where employees are just not satisfied with a regular paycheck anymore. They expect more. They expect an engaged workplace where their voices are heard. They want to feel appreciated. They are looking for meaning in what they are doing. The reason employers across the country are struggling to fill the open positions is that they have not caught up with this new paradigm shift. They are operating under old rules.

What Can Employers Do To Attract Talent?

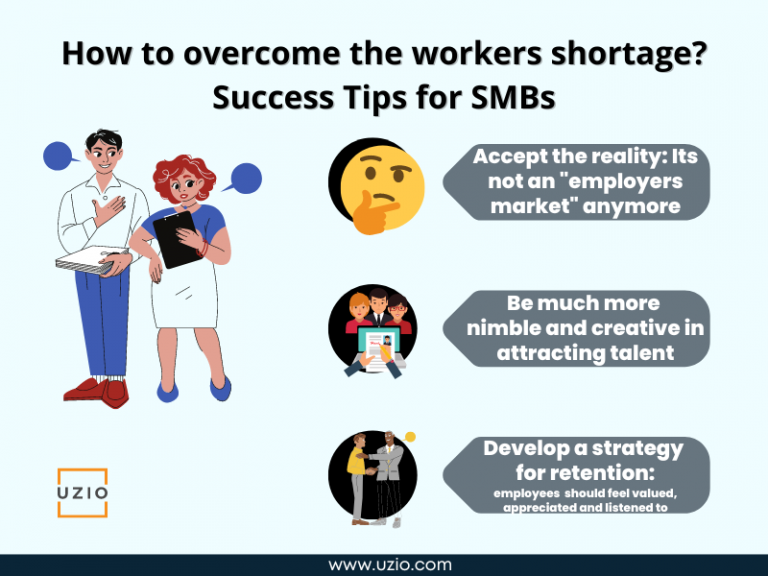

Employers should start by accepting the reality that it is not an “employers market” anymore. It is evident from the fact that hourly wages in many low skill industries have risen significantly since the pandemic.

Second, employers have to be much more nimble and creative in attracting talent. Wage increase, sign-on bonus, relocation allowance, relaxing hiring processes etc. should all be on the table.

Third, employers have to develop a strategy for retention. If your attrition is high, you will never win this race. To help with that, the most important thing employers can do is to create an engaged workplace. Employers should create a workplace where employees feel valued, appreciated and listened to.

Conclusion

Employers can turn the challenge of the shortage of employees into a strategic advantage by adopting the new paradigm. In the new paradigm, employers’ relationship with their employees is not transactional but strategic. Just providing a competitive salary will not be enough. Employers will have to invest in the growth of their employees and most importantly they will have to provide an engaged workplace.

The Ultimate SUTA Tax Guide: What You Need to Know

Quick links

-

What is SUTA Tax?

-

When is SUTA Tax due?

-

How to Calculate the Amount of SUTA Tax Owed

-

SUTA Tax Rate and Wage base Limit by State For 2022

-

How to Best Manage Your SUTA Tax Requirements

What is SUTA Tax?

SUTA is short for State Unemployment Tax Act. This tax is a payroll tax that businesses must pay to fund unemployment benefits. These benefits are provided to qualifying employees by the state to assist in compensation for loss in employment.

For an employee to receive unemployment benefits through the state they must be eligible. An employee may not be eligible if they:

- Are able but not willing to work

- Voluntarily leave their job without just cause

- Are terminated due to performance issues

- Not in compliance with company policies and received numerous violations

Eligible employees will receive a percentage of the wages they would have received if still employed until they have exhausted their benefit or they find employment.

While SUTA is generally an employer tax, there are three states that also require employees to pay state unemployment taxes. These are:

- Alaska

- New Jersey

- Pennsylvania

In these states, you would need to withhold SUTA tax from employees’ wages and remit it to the state in combination with the employer portion of taxation.

When is SUTA Tax due?

First Quarter: April 30th

Second Quarter: July 31st

Third Quarter: October 31st

Fourth Quarter: January 31st

How to Calculate the Amount of SUTA Tax Owed

A company is subject to SUTA taxes up to the wage base paid to each employee. In order to calculate the tax liability, you would use the assigned tax rate multiple times the wages paid- up to the wage base. Once an employee reaches the wage base, the company is no longer liable for the tax.

For Example:

Company ABC is headquartered in VA and has two employees.

VA wage base is: $8,000

VA Starting Rate: 2.5%

| Employer: Company ABC | EIN: 99-9999999 |

|||

|---|---|---|---|---|

| First Quarter | Second Quarter | |||

| John Smith | Jesse Black | John Smith | Jesse Black | |

| Gross Wages | $10,000 | $5,000 | $9,500 | $5,500 |

| Taxable Wages | $8,000 | $5,000 | $0.00 | $3,000 |

| Tax Due | $200 (8000*.025) | $125 (5000*.025) | $0.00 | $75 (3000*.025) |

SUTA Liability = (Employee A’s Eligible Wages + Employee B’s Eligible Wages) * .025

SUTA Liability = ($8,000 + $5,000) * 2.5%

SUTA Tax Rate and Wage base Limit by State For 2022

If you’re thinking of starting a business, you’ll need to know about SUTA taxes. SUTA, or the State Unemployment Tax Act, is a tax that employers pay on employee wages. The amount of the tax is based on the employee’s wages and the state’s unemployment rate. Each state has its own limit for the wage base subject to SUTA taxes. Below is a chart with the current wage base and starting rates for each respective state.

| State | SUI New Employer Tax Rate | Tax Rate Range for Experienced Employer | State Wage Base Limit |

|---|---|---|---|

| Alabama | 2.70% | 0.65% – 6.8% | $8,000 |

| Alaska | 1.28% | 1.00% – 5.4% | $45,700 |

| Arizona | 2.00% | 0.08% – 20.6% | $7,000 |

| Arkansas | 3.10% | 0.3% – 14% | $10,000 |

| California | 3.40% | 1.5% – 6.2% | $7,000 |

| Colorado | 1.7% to 7.74% | 0.71% – 9.64% | $17,000 |

| Connecticut | 3.00% | 1.9% – 6.8% | $15,000 |

| Delaware | 1.8% to 2.3% | 0.3% – 8.2% | $16,500 |

| D.C. | 2.70% | 1.6% – 7% | $9,000 |

| Florida | 2.70% | 0.1% – 5.4% | $7,000 |

| Georgia | 2.70% | 0.4% – 8.10% | $9,500 |

| Hawaii | 5.20% | 0.01% – 6.6% | $47,400 |

| Idaho | 1% | 0.207% – 5.4% | $44,400 |

| Illinois | 3.18% | 0.675% – 6.875% | $12,960 |

| Indiana | 2.50% | 0.5% – 7.4% | $9,500 |

| Iowa | 1.00% | 0% – 7.5% | $34,800 |

| Kansas | 2.70% | 0.20% – 7.6% | $14,000 |

| Kentucky | 2.70% | 0.3% – 9.0% | $11,100 |

| Louisiana | Varies | 0.09% – 6.2% | $7,700 |

| Maine | 2.31% | 0.69% – 6.01% | $12,000 |

| Maryland | 2.60% | 2.2% – 13.5% | $8,500 |

| Massachusetts | 2.42% | 0.94% – 14.37% | $15,000 |

| Michigan | 2.70% | 0.06% – 10.3% | $9,500 |

| Minnesota | Varies | 0.20% – 8.90% | $36,000 |

| Mississippi | 1.00% | 0.0% – 5.4% | $14,000 |

| Missouri | 2.376% | 0% – 5.4% | $11,000 |

| Montana | 1% to 2.4% | 0% – 6.12% | $38,100 |

| Nebraska | 1.25% | 0% – 5.4% | $9,000 |

| Nevada | 2.95% | 0.25% – 5.4% | $36,600 |

| New Hampshire | 1.20% | 0.1% – 7% | $14,000 |

| New Jersey | 2.80% | 0.4% – 5.4% | $39,800 |

| New Mexico | 0.33% to 5.4% | 0.33% – 6.4% | $28,700 |

| New York | 2.50% | 0.6% – 7.9% | $12,800 |

| North Carolina | 1.00% | 0.06% – 5.76% | $28,000 |

| North Dakota | 1.02% | 0.08% – 9.69% | $39,100 |

| Ohio | 2.70% | 0.3% – 9.4% | $9,000 |

| Oklahoma | 1.50% | 0.1% – 5.5% | $24,800 |

| Oregon | 2.60% | 1.2% – 5.4% | $47,700 |

| Pennsylvania | 3.69% | 1.2905% – 9.9333% | $10,000 |

| Rhode Island | 1.16% | 0.9% – 9.4% | $26,700 |

| South Carolina | 1.03% | 0.06% – 5.46% | $14,000 |

| South Dakota | 1.20% | 0% – 9.35% | $15,000 |

| Tennessee | 2.70% | 0.01% – 10% | $7,000 |

| Texas | 2.70% | 0.31% – 6.31% | $9,000 |

| Utah | Varies | 0.1% – 7.2% | $41,600 |

| Vermont | 1.00% | 0.2% – 7.2% | $14,100 |

| Virginia | 2.50% | 0.11% – 6.2% | $8,000 |

| Washington | Varies | 0.13% – 5.72% | $62,500 |

| West Virginia | 2.70% | 1.5% – 12% | $12,000 |

| Wisconsin | 3.05% – 3.25% | 0% – 12% | $14,000 |

| Wyoming | 1.22% | 0.18% – 8.72% | $28,200 |

Recommended Reading: FUTA Tax: How to Calculate and Understand Employer’s Obligations

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

How to best manage your SUTA Tax requirements?

While you enjoy running and growing your business, chances are you do not enjoy worrying about SUTA, FUTA and other payroll taxes. Payroll taxes are complicated and if not done right, you may be looking at steep penalties and fines. Don’t let the stress of figuring out how to calculate and remit unemployment taxes get in the way of what you want to be doing – running your business. UZIO’s software accurately calculates your tax liability for you and feeds directly into a tax system that our tax experts utilize in filing your payroll taxes on your behalf. Get your demo today and let us ease the burden for you!

Quiet Quitting Work: Why More And More People Are Choosing To Quit Their Jobs Silently

Quick links

-

Introduction

-

What is Quiet Quitting?

-

Why Quit Quietly?

-

What Can Employers Do To Curb Quiet Quitting?

Introduction

Silent Quitting refers to the behavior whereby employees do the bare minimum not to get fired — they are physically present but have mentally checked out from doing anything above and beyond what they absolutely have to.

Though it’s difficult to stop the downward spiral of employees quietly quitting, there are ways to proactively prevent it from happening in your workplace, both by recognizing the signs of quiet quitting in existing employees and making sure you don’t inadvertently push new employees into that frame of mind before they even start their first day on the job.

What is Quiet Quitting?

Quiet Quitting is when an employee does just enough not to get fired. They show up to work, but they’re not putting in any extra effort. They “coast”. It has become a big phenomenon on TikTok with more than 3.9 million video views. If you see some of these videos, you will find that promotores are making a case that it is not quitting but it is setting the right kind of boundaries or it is about having the right kind of work life balance or it is about reducing stress at your workplace. Considering this is spreading on TikTok, it is safe to assume that it is more prevalent in the younger generation.

So how do you know if your co-worker is participating in this new trend? It’s hard to tell. You may not notice a quiet quitter right away because they won’t exhibit typical warning signs that someone might be looking for a new job or getting ready to quit.

There are no telltale signs or red flags that someone has given up on their job like talking about taking vacation time or getting pep talks from friends who are unemployed and available.

But according to Metro, this can take many forms – including turning down projects based on interest, refusing to answer work messages outside of working hours or simply feeling less invested in the role.

Why Quit Quietly?

There are a few reasons why people might choose to quit their jobs silently. Maybe they feel like they’ve given their all to the company and they’re just burnt out. Lack of engagement at work seems like the primary driver of Quit Quitting.

A Gallup poll released earlier this year found just 32% of employees were now engaged, compared to 36% in 2020. A downward shift between 2020 and 2021 marked the first annual decline in engagement in over a decade, according to Gallup.

Sometimes even the best of the employees who are dedicated to their work, who put in the extra effort get discouraged and start thinking about Quiet Quitting because they realize that it is not a level playing field. They don’t get the promotion they so badly feel they deserve or the senior management does not recognize their extraordinary effort or worse still, somebody who has been “coasting” gets promoted.

This kind of environment can push even good dedicated employees to become Quite Quitters. This is their way of protesting. They feel like they were wronged. After putting so much time, effort, and energy into a company, they don’t receive any recognition or actual benefits.

What can employers do to curb Quiet Quitting?

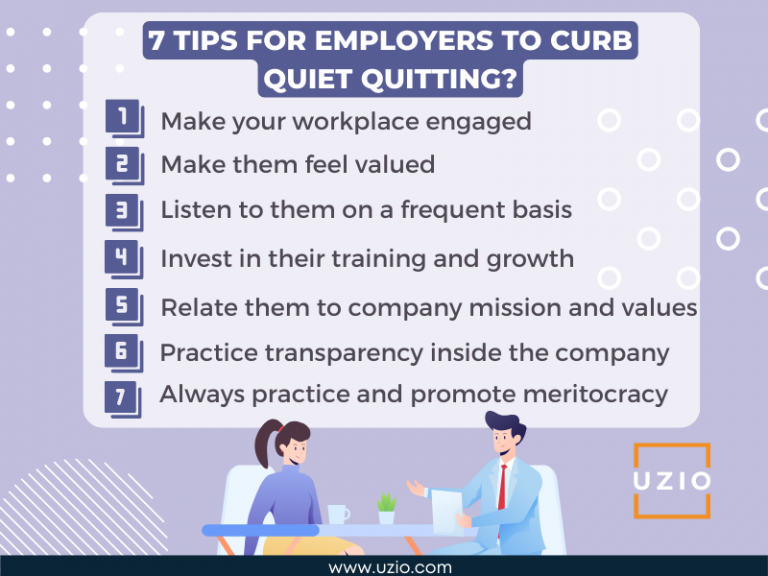

An engaged workplace is the antidote to Quiet Quitting. The key to having an engaged workplace is the culture of the company. Do employees feel valued? Do employees feel listened to? Does the company invest in their training and growth? Do employees see meaning in what they do? Can they relate to the mission and values of the company? Is transparency practiced inside the company? Does the company practice meritocracy?

If the employers are looking for ways to curb Quiet Quitting, they should focus on getting the right answers to the questions posed above.

FUTA Tax: How to Calculate and Understand Employer’s Obligations

Quick links

-

Introduction

-

The Basics of FUTA Tax

-

When is FUTA Tax due?

-

How to Calculate the Amount of FUTA Tax Owed

-

Who is exempt from FUTA?

-

How to report your FUTA Tax?

Introduction

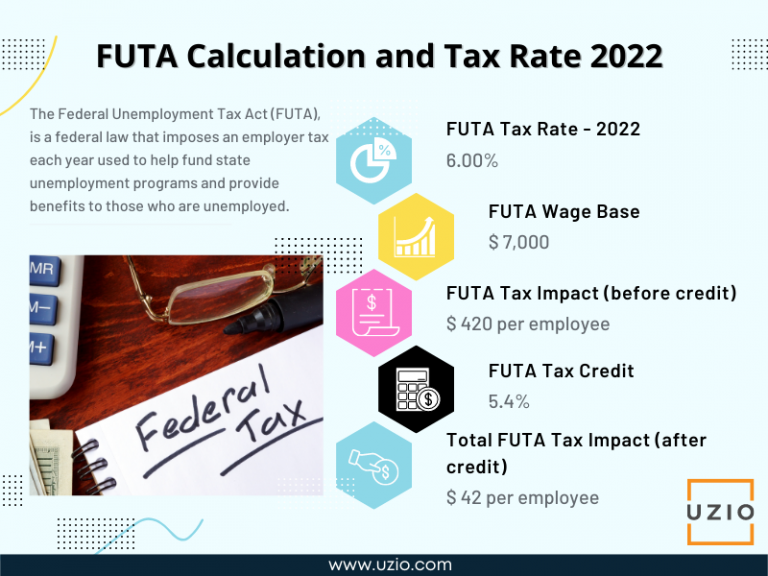

The Federal Unemployment Tax Act (FUTA), is a federal law that imposes an employer tax each year used to help fund state unemployment programs and provide benefits to those who are unemployed.

The Basics of FUTA Tax

FUTA tax is a federal payroll tax that employers must pay to the federal government if a business pays wages above $1,500 or more in a calendar quarter. The FUTA tax rate for 2022 is 6.0% on the first $7,000 of wages paid to each employee during the year. However, it is subject to a reduction of a maximum of 5.4% from state unemployment contributions.

FUTA tax is only paid by the employer. No amount is deducted from an employee’s paycheck towards FUTA taxes.

FUTA tax is used to fund the following:

- Share of the federal government cost of unemployment programs with all the states.

- The unemployment program of the states.

- The unemployed workers who are eligible to claim their unemployment insurance.

When is FUTA Tax due?

First Quarter: April 30th

Second Quarter: July 31st

Third Quarter: October 31st

Fourth Quarter: January 31st

Note: If the FUTA tax liability of your business for a quarter is less than $500, there’s no need to deposit taxes at the end of the quarter. You may roll over the tax liability to the next quarter and pay the tax amount if the liability exceeds the $500 threshold.

How to Calculate the Amount of FUTA Tax Owed

A company is subject to FUTA taxes on the first $7,000 of wages paid to each employee. The FUTA tax rate for 2022 is 6.0%, and employers often receive a credit of up to 5.4% against this tax.

Sample Calculation

Let’s take the example of Company ABC, which employs two individuals. Employee A was paid $10,000 of wages subject to FUTA taxes in Q1 and Employee B was paid $5,000 of wages subject to FUTA taxes in Q1.

FUTA Sample Calculation

| Employer: Company ABC | EIN: 99-9999999 |

|

|---|---|---|

| John Smith | Jesse Black | |

| Gross Wages | $10,000 | $5,000 |

| Taxable Wages | $7,000 | $5,000 |

| Tax Due | $420 (7000*.06) | $300 (5000*.06) |

FUTA Liability for Company ABC = (Employee A’s Eligible Wages + Employee B’s Eligible Wages) * 6% (0.06)

FUTA Liability = ($7,000 + $5,000) * 6%

FUTA Liability = $720

The company’s FUTA tax liability would be $720. Please note that the company may be eligible for a tax credit of $648 ($12,000 * 5.4%); if this is the case, the company would only owe $72.

In this example, the company ABC doesn’t have to make a deposit because its liability is less than $500 for the first quarter. However, the company must carry this liability over to the second quarter.

Who is exempt from FUTA?

Most businesses are required to pay federal unemployment tax (FUTA) and state unemployment tax (SUTA). Certain organizations, including government employers, and nonprofit religious, charitable, and educational institutions are exempt from paying these taxes.

Also an employer is exempt from paying FUTA only if they have paid an employee less than $1,500 in wages during a calendar quarter, or if they haven’t had an employee for 20 weeks or more within a calendar year.

Payments Exempt From FUTA Tax

Various forms of payments are paid to employees that are exempt from the Federal Unemployment Tax Act. The payments include:

- Fringe benefits, which include the value of certain meals and lodgings, employer contributions to accident and health plans for employees, as well as employer reimbursements for qualified moving expenses.

- Group term life insurance

- Employer retirement/pension contributions to a qualified plan, such as a SIMPLE IRA plan or a 401(k) plan

- Dependent care not exceeding $500 per employee (or $2,500 for married couples filing separately) for qualifying person’s care

- Other payments, such as payment made to an employee under worker’s compensation law because of a sickness or injury inflicted at work; non-cash payments and certain cash payments to H-2A Visa workers for agricultural labor; payments for services provided by a spouse, parent, or child under 21 years; and payments to non-employees who are treated as your employees by the state unemployment agency

Recommended Reading: The Ultimate SUTA Tax Guide: What You Need to Know

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

How to report your FUTA Tax?

The employers use Form 940 to report their annual FUTA tax. The due date for filing the Form 940 is January 31. However, if you deposited all FUTA tax when due, you have until February 10 to file.

For more details, please click the official link to the Employer’s Annual Federal Unemployment (FUTA) Tax Return – Filing and Deposit Requirements.

What happens if the gross wages are under-reported by the employer?

Quick links

-

Introduction

-

Gross Wages VS Taxable Wages

-

Unemployment Taxation Breakdown

-

What Happens if gross wages are under reported?

-

Conclusion

Introduction

If you are using a payroll provider to process your payroll, it is their responsibility to report gross wages, taxable wages, income taxes, unemployment tax, social security tax and Medicare taxes to the IRS as well as state agencies. Payroll providers do that thru Quarterly and Year end filings with IRS and the state agencies. Sometimes, because of the glitch in the software or human error, gross wages might be under reported. In this article, we will explore the implications of reporting errors on wages and/or employment taxation.

Gross Wages VS Taxable Wages

Gross wage is what an employee earns before any deductions for taxes, benefits and other payroll deductions are withheld from their wages. Examples of gross wages:

- An employee works full time (40 hours per week) at $20 per hour would have a weekly gross wage of $800 (40×20=800)

- A salaried employee earns $50,000 annually. The gross wage would be $50,000 or equivalent to the annual salary.

Taxable Wages is the portion of your gross wages which are subject to taxation by a governmental agency…Here is an example to clarify this. In this example, an employer has one employee to report to Virginia for SUTA. The first $8,000 in wages is taxable. The employer would calculate taxable wages for the four quarters during the year as follows:

- Taxable Wages subject to withholding: Gross wages reduced by section 125 deductions

- Taxable Wages subject to unemployment: Gross wages up to each states or federal taxable wage base

Here is an example to clarify this. In this example, an employer has one employee to report to Virginia. The current wage base for Virgina is $8,000 for 2022. Which means the employer is liable for unemployment taxation for the first $8,000 of each employee’s gross wages. The employer would calculate taxable wages for the four quarters during the year as follows:

Unemployment Taxation Breakdown

| Employer: ACME Corp. |

EIN: 99-9999 |

|||

|---|---|---|---|---|

| Name/SSN | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

| John Smith Wages Paid ***-**-9999 |

$5,000 | $12,000 | $12,500 | $13,000 |

| Taxable wages VA Wage Base: $8,000 VA SUI Rate: 5% |

$5,000 | $ 3,000 (8,000-5,000=3,000) |

$ 0 (Wage Base reached in Q2) |

$ 0 (Wage Base reached in Q2) |

| Tax due (5%) | $250.00 (5000x.005=$250) |

$150.00 (3000x.005=$150) |

$ 0 | $ 0 |

What Happens if gross wages are under reported?

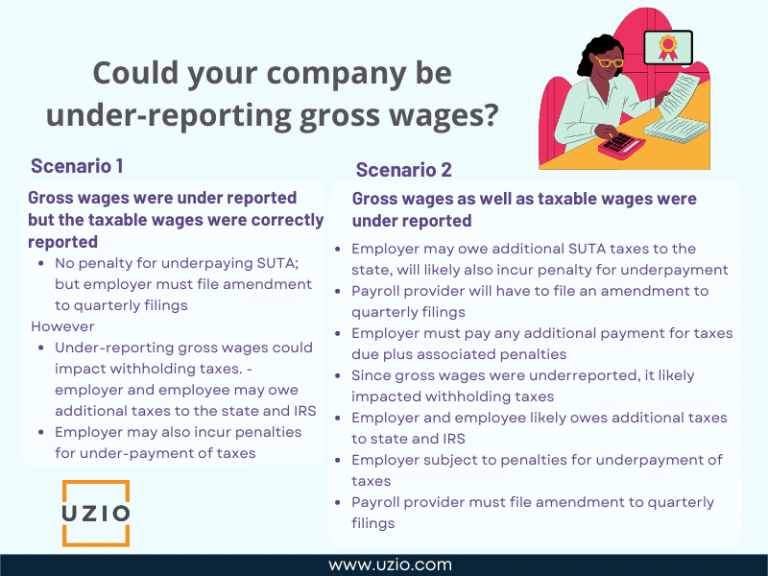

If the gross wages were under reported, the impact on the employer will depend on a number of factors.

Let us consider these factors one at a time.

Scenario 1

Gross wages were under reported but the taxable wages were correctly reported

In this case, where the gross wages were under reported but the taxable wages were correctly reported, the employer would have paid the correct amount for the SUTA tax because the SUTA is calculated based on the taxable wage. So there will be no penalty assessed for underpaying SUTA. The payroll provider will have to file an amendment to the quarterly filings done to the state with the correct amount for the gross wages.

Because gross wages were under reported, it may have an impact on withholding taxes. If the system under-calculates the withholding taxes because of under-reporting of gross wages, the employer and the employee may owe additional taxes to the state and to the IRS. The employer may also be levied with penalties for under-payment of the taxes. However, if the taxes were withheld correctly and the error was simply in reporting of the gross wages, in that case, the state and IRS will not levy the penalty for underpayment of taxes. The payroll provider will still be required to file the amendment to the quarterly filings.

Scenario 2

Gross wages as well as taxable wages were under reported

In this scenario where the taxable wages were also under reported, the employer may owe additional SUTA taxes to the states. The state will most likely levy a penalty for underpayment of SUTA tax. The payroll provider will have to file an amendment to the quarterly filings done to the state with the correct amount for the gross and taxable wages. The employer will have to make additional payment for the taxes due as well as for the penalty.

Similar to scenario 1, because gross wages were also under reported, it may have an impact on withholding taxes. If the system under-calculates the withholding taxes because of under-reporting of gross wages, the employer and the employee may owe additional taxes to the state and to the IRS. The employer may also be levied with penalties for under-payment of the taxes. However, if the taxes were withheld correctly and the error was simply in reporting of the gross wages, in that case, the state and IRS will not levy the penalty for underpayment of taxes. The payroll provider will still be required to file the amendment to the quarterly filings.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

The under reporting of the gross wages and or taxable wages can lead to considerable headaches for the employer. If this happens, clear communication between the employer and the payroll provider would be essential. The Payroll provider would have to reconcile past payrolls to determine adjustments to be made, update their system and file the amendments with the IRS and the state agencies.

How to Choose the Right Payment System for Your Gig Workers?

Quick links

-

Introduction

-

Emergence of Gig Economy

-

How to choose the right payment system for your gig workers?

-

Factors to consider when choosing a the payroll provider for paying the gig workers

-

Implications of AB5 and the road ahead

Introduction

The gig economy has grown substantially in recent years, and this trend isn’t likely to slow down anytime soon. In fact, many people are now turning to the gig economy as their main source of income, which means that you’ll need to be prepared to pay gig workers on a regular basis. Whether you’re just getting started or you already have lots of freelancers working for you, it’s important to choose the right payment system for your Gig workers so that everyone gets paid consistently and on time.

Emergence of Gig Economy

The gig economy is a labor market characterized by the prevalence of short-term contracts or freelance work as opposed to permanent jobs. You can pay your gig workers using the same payroll system you use to pay your W2 employees. The difference will be that in case of gig workers, you will not withhold any taxes or make any deductions for benefits etc because gig workers are responsible for paying their own taxes and are typically not offered any benefits. There are many different payroll systems available, and choosing the right one will depend on your specific needs.

How to choose the right payment system for your gig workers?

You should consider the following factors when choosing a payment method for your gig workers.

Scale of the business

If you are just starting out, you might be writing checks to pay your gig workers. It is also possible you are using new payment methods like Venmo, Zelle etc to make your payments when you are working on a small scale. However when you start to grow, these payment methods will not scale. You need a more robust system to pay your gig workers and it might be the right time to select a payroll system for paying your gig workers.

Need to switch from contractors to W2 employees

Hiring freelancers or independent contractors provides much needed flexibility to the business. You don’t have to be responsible for deducting taxes, you do not need to offer benefits, overtime etc. If you think you can run and scale your business by hiring freelancers or contractors alone, you can work with a payment system that lets you easily ACH payments to your contractors. However if you think you will need W2 employees also either now or in the future and may also need to convert some or all of your freelancers and contractors to W2 employees because of state laws like the one in California (law AB5), you may be better off choosing a payroll system that can support paying your W2 employees as well as your freelancers and contractors.

Factors to consider when choosing a the payroll provider for paying the gig workers

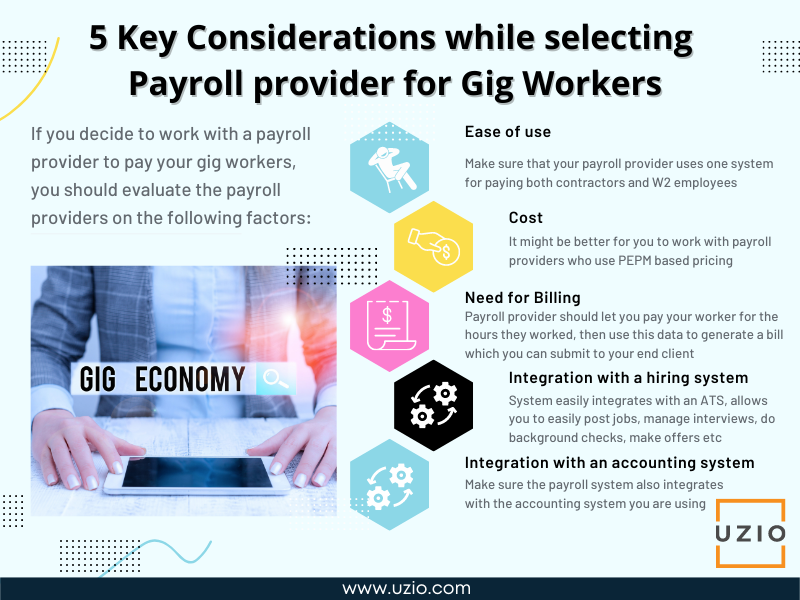

If you decide to work with a payroll provider to pay your gig workers, you should evaluate the payroll providers on the following factors:

-

Ease of use

- Let us say you are starting out with a few W2 employees and a large number of contractors and you know that down the road you will have to convert your contractors to W2 employees, you should make sure that your payroll provider uses one system for paying both contractors and W2 employees. If that is the case, it will be much easier to convert contractors to employees. However if your provider has completely different systems to pay contractors versus the employees, when the time comes to convert the contractors to employees, it will be a heavy lift because all the information from one system will have to be transferred to another system. This can lead to delayed payments, errors etc.

-

Cost

- Many payroll providers have different pricing mechanisms for paying contractors versus W2 employees. Contractors might be getting paid daily, weekly, biweekly or monthly. W2 employees typically do not get paid daily. Some payroll providers charge on “per pay check basis” whereas others charge on PEPM (Per Employee Per Month) basis where they allow you to run as many payroll as you want within a month for a fixed fee per employee. Depending on the number of employees and the frequency of payment, it might be better for you to work with payroll providers who use PEPM based pricing.

-

Need for Billing

- In many industries who employ gig workers or freelancers, the amount paid to the contractor is an exact fraction of the amount charged to the end client by the company. For example, you may be running a tutoring service which provides qualified tutors to families. You charge families by the hour, for example $100/hour for every hour of tutoring provided. You also pay the tutor you have hired on an hourly basis, for example $50/hour. Because you will pay your tutor for the hours she worked and you will also charge the family for the same number of hours, you should look for a payroll provider who lets you pay your tutor for the hours she worked and use the same hours to generate a bill which you can submit to your end client. By combining the two functions into one system, you will avoid duplicity of data, errors and also potentially save on cost.

-

Need for integration with a hiring system

- Industries which employ a lot of contractors or freelancers typically see high turnover of workers. The employers are constantly hiring. When choosing a payment system, you should make sure that the system easily integrates with an Application Tracking System (ATS). These systems allow you to easily post jobs, manage the interview process, do background checks, make offers etc. You want to make sure that your ATS system easily integrates with your payroll system. It will save you lots of time and avoid errors. Otherwise your staff will spend countless hours copying and pasting data from your ATS system to your Payroll system. UZIO payroll platform seamlessly integrates with ZOHO Recruit which is a system used by lots of companies who hire contractors and temp employees.

-

Need for integration with an accounting system

- Similar to the need for integration with ATS, you want to make sure the payroll system you choose also integrates with the accounting system you are using. For example UZIO payroll system seamlessly integrates Quickbooks online system so that when you run your payroll, the needed data is seamlessly transferred to Quickbooks.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

Choosing the right payment system is a strategic decision which can impact the growth and profitability of your business down the road. You will be well served by taking into account all the factors outlined above when choosing the right payment system for your business.

Time-Off Policies: How to Create the Perfect Time-Off Plan for Your Employees

Quick links

Introduction

You want your employees to be fully engaged and work at their full potential. You want them to have the right kind of work life balance so they do not feel burned out. One way to do this is to create a paid time off (PTO) policy that provides your employees adequate time off needed as well as meets your business needs. If you can successfully do this, your employees will feel valued and appreciated. They will be able to use PTO to take care of their family members or for vacations or just to take a break from work. In this article, we will share some of the best practices in designing the PTO policy.

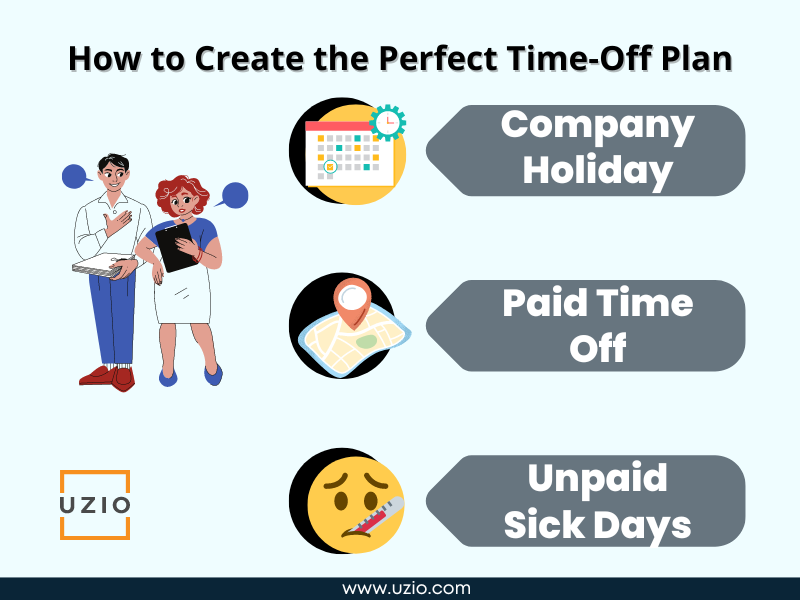

When designing the PTO policy for your company, you want to think holistically. You should think of various ways your employees can take time off. Here are different components of your time off policy that need your consideration.

Company Holidays

Company holidays are offered in addition to the PTO. Many companies but not all, provide company holidays on federal holidays or some variation of it.

Checkout the list of Federal Holiday 2022 here.

What holidays a company offers is also a function of the kind of the business the company is in. For example, July 4th is a federal holiday and is observed by most of the companies but there are businesses who are not closed on July 4th. Companies may choose to offer a certain number of fixed holidays, say 7 to 8 a year and offer 2 to 3 “floating holidays” a year. Employees can choose which days to take off against the floating holidays.

Paid Time Off – PTO

PTOs are a great way to give employees some flexibility with their time off. By allowing employees to take a personal day when they need it, you can show that you trust them to use their time off wisely. Plus, personal days can help reduce stress and promote a healthy work-life balance. While designing PTO policy for your company, here are some of the important decision points you will have to consider:

Does everybody get the same amount of PTO or it varies with position, seniority etc.

There is no right or wrong answer to this question. For example, you may decide that everybody gets a minimum of two weeks of paid vacation. After you have stayed with the company for a certain number of years, you get an extra week of PTO. You can also have different policies for different levels of employees in the company. A certain class of employees may get two weeks of vacation whereas a different class of employees, let us say, senior managers and above, may receive three weeks of PTO. Companies have lots of freedom when it comes to designing PTO. However you do not want to arbitrarily decide who gets how many days of PTO to make sure you are not discriminating against certain employees.

Is PTO earned throughout the year or is allocated all at once at the start of the year?

In most of the cases, PTO is accrued at a certain rate so that the employees earn the PTO as they work however you may decide to allocate the total amount of PTO all at once at the start of the year.

For example, let us say you offer two weeks of PTO to your employees. One of your employees has a one week vacation planned right at the beginning of the year meaning if you approve the PTO, the PTO balance will be negative because the employee has not accrued 1 week of PTO yet. Many companies allow PTO balance to go into negative but it is a policy decision you should be making when designing and implementing PTO.

Will you allow PTO to be carried over to the next fiscal year?

The reason you offer PTO is so that your employees take regular breaks from work, recharge and come back roaring to go. So you want to nudge your employees to take regular PTO if they have accrued it and not wait until the end of the year. If your employees have accrued PTO and they are not able to take PTO at the end of the year because of business or personal reasons, will you allow the PTO to be carried over to the next fiscal year? If yes, is there a cap on the total amount of PTO that can be accrued and carried forward. Please note that some states like California do not allow employers to implement “use it or lose it” rules for PTO.

Do you have to payout accrued PTO when an employee leaves?

The answer of this question varies depending on which states the business is located in. For example, in California, earned PTO is considered like a cash component owed to the employee and as such it should be clearly displayed on the payslip and is also owed to the employee when the employee leaves the company.

Do I also need to provide Paid Sick Leave?

While this varies from state to state, in general, if you have a clearly defined PTO policy which allows employees to take time off when they are sick, you do not need to provide additional paid sick leave.

Unpaid Sick Days

According to the U.S. Department of Labor, the Family and Medical Leave Act (FMLA) requires employers with 50 or more employees to allow eligible employees to take up to 12 weeks of unpaid, job-protected leave per year for certain family and medical reasons.

This includes leave for the birth or adoption of a child, caring for a sick family member, or dealing with one’s own serious health condition. For employers who have fewer than 50 employees, there is no requirement that they provide paid time off for this.

However, in these cases employers are still required to maintain benefits such as health insurance during the time an employee is on FMLA leave.

There’s no one size fits all approach to creating this type of policy so it’s important to consider your company culture as well as potential challenges with absenteeism or staffing levels before drafting it.

Employees should also have guidelines on how much advance notice they need to give in order to get time off. You’ll also want to decide if your company will offer compensatory time instead of paying out unused vacation hours at the end of the year, if there are limits on consecutive days off (e.g., 5), and whether there’s a limit on total hours taken in a year (e.g., 240).

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

How to keep track of it all?

Without the right software, the administrative cost of continually calculating balances, accruals, and responding to requests can be overwhelming for HR and managers. Use of UZIO’s Time-Off module allows you to track both paid and unpaid leave. You can automate accruals, renewals, approvals, and policy changes. You can also create as many time-off types as you like and employees can access their balances anytime.

Are your workers employees or independent Contractors? Are you in compliance with laws like California AB5?

Quick links

-

Introduction

-

Independent contractors Vs Company employee

-

Requirement for Legislation

-

California AB5 law introduced

-

What is California AB5 law?

-

Implications of AB5 and the road ahead

Introduction

Businesses often bring in independent contractors instead of hiring full time employees. There are many reasons for it. Economic uncertainty, lack of visibility into sustained customer demand or temporary surge in customer demand typically causes the business owners to bring in an independent contractor instead of hiring a full time employee. The contractors do the same job which is done by the employees but they are not on the payroll, they are not offered benefits, they do not have the same protections as employees of the company.

Independent contractors Vs Company employee

Should independent contractors (ICs) be treated as employees, has been a topic of debate for far too long between corporations and workers rights groups. Because independent contractors do not have the same protections and rights as those of employees, many times the total cost of an independent contractor is less than the total cost of hiring an employee. Corporations find this as an added advantage of working with independent contractors. Workers rights groups consider this as an exploitation of contractors and have been pushing for contractors to be treated as employees.

This dispute has taken a whole new meaning in the gig economy. In recent years, millions of people have been working as independent contractors for App based companies like Uber, Lyft, DoorDash etc. Additionally, many other companies have sprung up who bring demand (customers) and supply (contractors providing services like tutoring, massages, nannies, chefs) together. Almost all of these companies engage with contractors to fulfill the demands of their customers.

Requirement for Legislation

Looking at this growing trend, legislatures in different states are taking notice. Concerned that contractors might be getting exploited by these companies, they are coming up with legislation to codify who is an employee and who is a contractor.

As almost always happens in cases like this, California has taken the lead in passing the legislation to address the issue of who is an employee and who is a contractor.

California AB5 law introduced

A law called AB5 took effect in California on January 1, 2020 that dramatically changed the rules employers must use to determine whether workers are employees or independent contractors (“ICs”) in the state.

The law applies only to workers in California—regardless of where the employer is based. It does not apply to workers outside of California even if the employer is based in California.

As a result of AB5, many California workers who had previously been classified as ICs must be reclassified as employees and are entitled to employee benefits and protections. This led to an uproar in the business community.

Uber, Lyft and other online hiring platforms sponsored a successful ballot proposition (Proposition 22) which exempted most drivers of App-based ride share and delivery platforms from the law. Plus the law was also amended to add more exemptions.

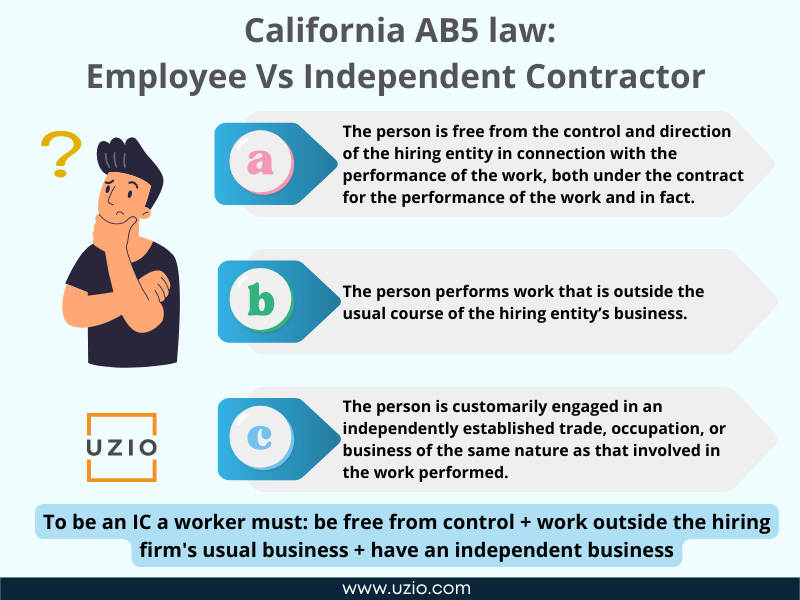

What is California AB5 law?

The rules discussed below apply to all California workers who are not exempt from AB5.

According to the law, for CA workers who are not exempt from the law, a test called “ABC Test” must be applied to classify Nonexempt workers.

Under this test, a worker is an IC only if he or she:

(A) is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact, and

(B) performs work that is outside the usual course of the hiring entity’s business, and

(C) is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

All three prongs of the ABC test must be satisfied for workers to be independent contractors. In other words, to be an IC a worker must: be free from control + work outside the hiring firm’s usual business + have an independent business.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Implications of AB5 and the road ahead

It’s difficult for most workers to qualify as independent contractors under the ABC test. If your business is based in California and you have been using ICs, you should start planning for converting them into employees if they do not pass the ABC test.

As a payroll company that serves SMBs in all 50 states, we are seeing a trend where an increasing number of businesses in California who were initially using ICs are now converting them into employees. We are also tracking similar legislation underway in a number of other states, meaning even if you operate in other states, you may face this issue sooner than later.

What is R&D Tax Credit and How Do I Claim it?

Quick links

-

What is R&D Tax Credit in the US?

-

How Does R&D Tax Credit Work?

-

Do I Qualify for R&D Tax Credit?

-

How to Claim R&D Tax Credit?

-

What happens after I submit my R&D tax credit claim?

-

How long does it take to get R&D tax credits?

-

Conclusion

What is R&D Tax Credit in the US?

The R&D tax credit is a dollar-for-dollar, non-dilutive tax incentive for US-based companies that innovate. The Tax Credit was originally established in 1981. The Protecting Americans from Tax Hikes (PATH) Act of 2015, which broadened the ability of many small-to-midsize businesses to monetize the R&D credit made the credit permanent. Companies across industries can qualify, including early-stage startups and profitable companies. Qualifying expenditures generally include the design, development or improvement of products, processes, techniques, formulas or software.

As per one of the reports of OECD: Between 2000 and 2018, the number of R&D tax relief recipients effectively more than doubled in the US, from around 10,500 R&D tax relief recipients in 2000 to over 26,000 in 2018.

Over the period 2000-2013 period (for which relevant data are available), SMEs accounted for the majority of R&D tax relief recipients with a share of around 70-75% in more recent years.

How Does R&D Tax Credit Work?

For early-stage startups – Startups may use federal R&D credits against up to $250,000 of their payroll taxes in five separate taxable years—a total of $1.25M—if they have:

Gross receipts less than $5M in the tax credit year and no gross receipts for any of the four preceding tax years. The credits can also be carried forward as an asset on their balance sheet until utilized.

For mid-stage and mature companies – If a company has gross receipts over $5M or began bringing in sales over 5 years ago, it could qualify to offset unlimited income taxes with R&D credits.

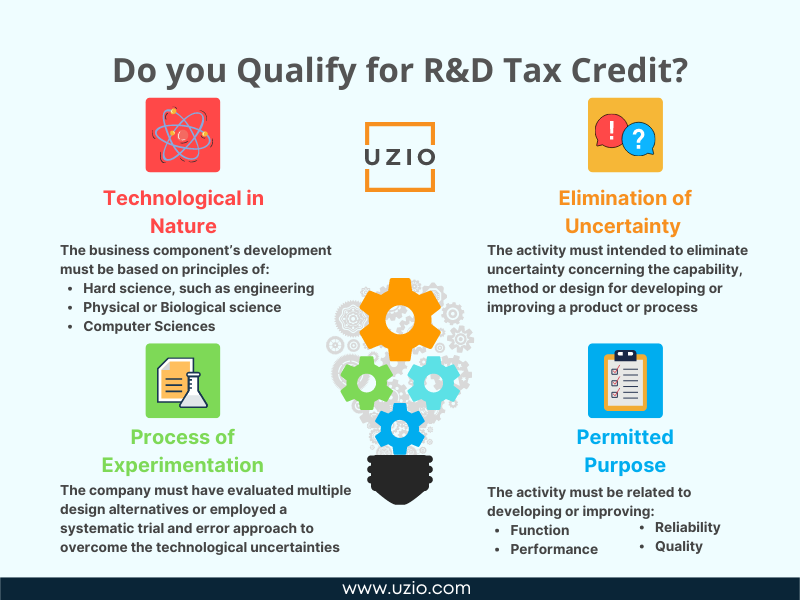

Do I Qualify for R&D Tax Credit?

To claim R&D Tax Credit, you need to be sure that your expenses qualify as qualified research expenses (QREs). QREs are defined by the four-part test outlined below:

- Permitted purpose: The activity must be related to developing or improving the functionality, quality, reliability or performance of a business component (i.e. product, process, software, technique, formula or invention).

- Technological in nature: The business component’s development must be based on a hard science, such as engineering, physics and chemistry, or the life, biological or computer sciences.

- Elimination of uncertainty: From the outset, the organization must have faced technological uncertainty when designing or developing the business component.

- Process of experimentation: The company must have evaluated multiple design alternatives or employed a systematic trial and error approach to overcome the technological uncertainties.

How to Claim R&D Tax Credit?

You can claim R&D Tax credit by filing the IRS Form 6765.

Here is the official IRS document link (revised Jan 2022) to “Instructions for Form 6765”.

This form has five parts which correspond to specific categories used by the IRS to calculate your R&D tax credits.

To document their qualified R&D expenses, businesses must complete the four basic sections of Form 6765:

- Section A is used to claim the regular credit and has eight lines of required information (lines 1, 2, 3, 7, 8, 10, 11 and 17).

- Section B applies to the alternative simplified credit (ASC).

- Section C identifies additional forms and schedules that warrant reporting based on business structure.

- Section D is only required for qualified small businesses (QSBs) making a payroll tax election.

What happens after I submit my R&D tax credit claim?

After submitting your completed Form 6765, it takes anywhere from 4–6 weeks for your application to go through review at the IRS. During that time, you will receive one or two letters asking for additional documentation depending on how thorough your original application was.

When everything is finalized, you will receive either a Notice of Allowance or Rejection letter explaining why your claim was accepted or denied. If you did not qualify for R&D tax credits, then you might still be eligible for Alternative Simplified Credit (ASC). ASC works similarly to regular research credits (RRC) except that it doesn’t require quite as much work on behalf of both taxpayers and auditors.

Know More about Calculating the R&D Tax Credit: RRC vs ASC Method

How long does it take to get R&D tax credits?

It depends on a number of factors including the complexity of your claim and the size of your company. Most claims take between four and six months to complete, but some can take up to a year.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

R&D Tax Credit is an important tax incentive for US based companies to innovate. It can result in significant savings for companies of all sizes in a wide variety of industries. Because the onus of proving eligibility for the tax credit is on the business, it is strongly recommended that businesses work with their CPAs or with firms specializing in helping companies claim this credit.

What Are The Tax Implications Of Leaving Your PEO Mid-Year?

Quick links

-

Introduction

-

Tax Implications for the employees

-

Tax Implications for the employer

-

Social Security Tax:

-

FUTA Tax:

-

SUTA Tax:

-

Closing thoughts

Many companies who start out using a PEO (Professional Employer Organization) for their HR, Payroll, Benefits needs, sooner or later decide to transition out of the PEO and bring their HR functions inhouse. The companies make this decision because of a number of reasons like:

- High Monthly Fees charged by the PEO

- Poor Employee Experience

- Limited choice of medical benefits

For a detailed guide on How to Transition out of a PEO, please refer to our earlier blog post on this topic.

Recommended Reading: How to transition out of a PEO and bring your HR, payroll and benefits in-house?

Once you made the decision to leave your PEO, you are now wondering what are the tax implications if you do this transition mid-year. This article will provide information that can help you make that decision confidently.

Let us start by stating the obvious which is that it is always better to transition out of the PEO relationship at the end of the year. The main reason is that all the federal and state taxes for the employer as well as employees get reset at the start of a new year. When it comes to taxes, there is no negative impact on the employer or the employee of the transition if it is done at the end of the year.

However let us assume that you can not wait till the end of the year for the transition. Here is a list of tax related items you should consider before you make that decision.

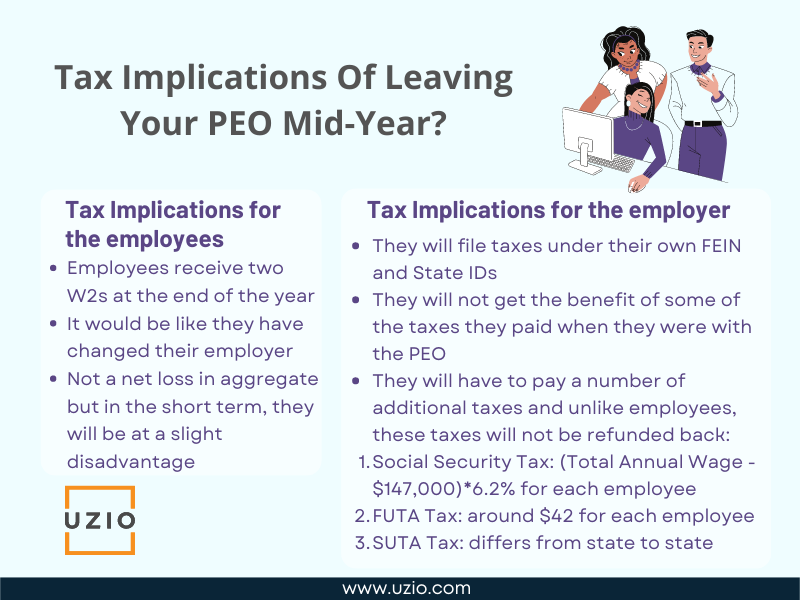

Tax Implications for the employees

Having come out of the PEO, you will be filing the federal and state tax returns under your own FEIN and state IDs. For your employees, it would be like they have changed their employer even though they continue to work for you. Information of the social security taxes already paid by the PEO for an employee, will not come over.

For example, let us assume that an employee had already met the wage base for social security tax which is $147,000 in 2022 and so the PEO was not withholding the Social Security tax from the employee anymore for the year. Once the employer comes out of the PEO, the Social Security Tax will be withheld for the employee for the remainder of the year until the wage base is met again.

The employee will receive two W2s at the end of the year. When the employee files the taxes next year, the extra Social Security Tax withheld will be refunded to the employee. So while it is not a net loss to the employee in aggregate, in the short term, the employee will be at a slight disadvantage.

Tax Implications for the employer

After the employer exits the PEO, the employer will file taxes under their own FEIN and State IDs meaning they will not get the benefit of some of the taxes they paid when they were with the PEO. They will have to pay a number of additional taxes and unlike employees, these taxes will not be refunded back.

Social Security Tax:

For each employee, the employer portion of the social security tax will have to be paid. This will not be refunded back to the employer. Rough calculation of the extra Social Security Tax paid by the employer for each employee would be something like:

(Total Annual Wage – $147,000)*6.2%

When this is added for each employee, it can be a significant amount.

FUTA Tax:

FUTA is Federal Unemployment Tax which is effectively 6% on each employee’s eligible wage upto $7,000. However you receive a tax credit of 5.4% if you pay all your state unemployment tax.

Rough calculation of the FUTA paid by the employer for each employee would be around $42, which is $7,000 times 0.006.

SUTA Tax:

SUTA is State Unemployment Tax which is assessed by the state on the employer. Unlike FUTA, it differs from state to state.

Rough calculation of the SUTA paid by the employer for each employee would be SUTA rate times wage base. For example if the SUTA rate is 2.7% and the wage base is $9,000, the SUTA tax would be $243.

There may be some other minor additional taxes withheld for the employer and the employee based on where the employee lives.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Closing thoughts

From the tax perspective, the ideal time to leave the PEO is at the end of the year. However if you have to leave the PEO mid-year, please use this guide to calculate the additional tax liabilities. Even though, as an employer you will be paying extra taxes as outlined in the article above, it might still be worth leaving the PEO if your employees are unsatisfied with the service or you are paying too much in the PEO fees.