Quick links

- Introduction

- Federal (USA) labor law basics

- Fair Labor Standards Act

- Family and Medical Leave Act

- Employee Retirement Income Security Act

- Provide SPD (Summary Plan Documents) to your employees

- Provide COBRA Insurance

- Provide Section 125 Plan Document

- Workplace Posters

- State labor law basics

- 10 simple steps to remain in compliance with labor laws

- Utilize technology to simplify the process

- Conclusion

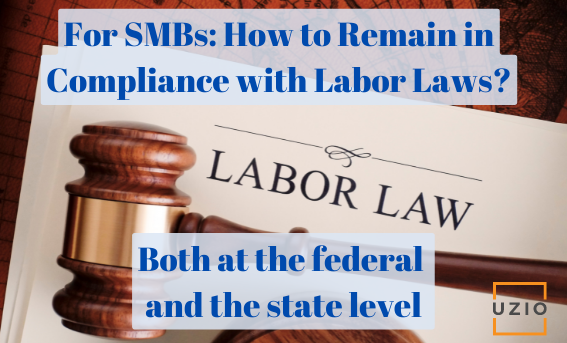

As a small business owner, you’re probably wondering how you can stay in compliance with all the state and federal labor laws that apply to your company. You don’t want to hire a lawyer to advise you on every single one of these laws. You want to stay in compliance without spending too much time and money on attorney fees. In this article, we will document the steps you can take to remain compliant with Federal and State Labor laws.

Federal (USA) labor law basics

At the minimum, you should be aware of the following labor and workplace laws at the Federal level.

- FLSA (Fair Labor Standards Act)

- FMLA (Family and Medical Leave Act)

- ERISA (Employee Retirement Income Securities Act)

FLSA

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments. Covered nonexempt workers are entitled to a minimum wage of not less than $7.25 per hour effective July 24, 2009. Overtime pay at a rate not less than one and one-half times the regular rate of pay is required after 40 hours of work in a workweek.

Many states also have minimum wage laws. In cases where an employee is subject to both state and federal minimum wage laws, the employee is entitled to the higher minimum wage.

FMLA

The Family and Medical Leave Act (FMLA) entitles eligible employees of covered employers to take unpaid, job-protected leave for specified family and medical reasons with continuation of group health insurance coverage under the same terms and conditions as if the employee had not taken leave. Eligible employees are entitled to:

- Twelve workweeks of leave in a 12-month period for:

- the birth of a child and to care for the newborn child within one year of birth;

- the placement with the employee of a child for adoption or foster care and to care for the newly placed child within one year of placement;

- to care for the employee’s spouse, child, or parent who has a serious health condition;

- a serious health condition that makes the employee unable to perform the essential functions of his or her job;

- any qualifying exigency arising out of the fact that the employee’s spouse, son, daughter, or parent is a covered military member on “covered active duty;” or

- Twenty-six workweeks of leave during a single 12-month period to care for a covered servicemember with a serious injury or illness if the eligible employee is the service member’s spouse, son, daughter, parent, or next of kin (military caregiver leave).

Please note that the FMLA does not apply to very small businesses. It only applies to employers with 50 or more employees in 20 or more workweeks in the current or preceding calendar year.

ERISA

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

While ERISA is a very broad and complicated piece of legislation, here are the key provisions you need to be aware of to be in compliance.

Provide SPD (Summary Plan Documents) to your employees

If your employees participate in a ERISA covered retirement plan or health benefits plan, you must provide them free a SPD which is a detailed guide to the benefits the program provides and how the plan works. Typically your broker will provide you the SPD.

Provide COBRA Insurance

The Consolidated Omnibus Budget Reconciliation Act (COBRA) requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

For example, if you had 20 or more employees in the previous year and if you terminate an employee, you are obligated to provide the employee COBRA coverage. If you are using a benefit enrollment platform, the platform should provide COBRA support. If not, your health benefits broker should be able to help you with this.

Provide Section 125 Plan Document

If you allow your employees to pay group health and other insurance premiums with pre-tax salary deductions, you should have what is called Section 125 Plan Document. The document is named after the IRS code that authorized this plan. The document provides details of the benefit plan you are offering to your employees. Your benefits broker should be able to provide you with Section 125 plan documents.

Workplace Posters

Many of the laws that create rules regarding employment include a requirement that notices about employees’ legal rights under those laws be posted at the workplace.

Employers are federally required to display notices covering a broad range of topics, including the minimum wage, workplace safety, and family and medical leave.

For employers with some remote workers, physical posters are required for onsite employees, and the DOL (Department of Labor) encourages electronic posting for the teleworking employees. Employers with an entirely remote workforce may satisfy continuous-posting obligations using electronic-only means if all employees exclusively work remotely, customarily receive information from the employer via electronic means and have readily available access to the electronic posting at all times.

State labor law basics

In addition to Federal laws, you also need to pay attention to the State labor laws. Depending on where you do business, there may be different state laws and regulations you need to follow. The Department of Labor offers a good starting point for understanding your obligations to state labor laws here.

Some states have their own specific wage and hour statutes that require employers pay certain employees (e.g., non-exempt employees) overtime when they work more than 40 hours per week.

To get up to speed on what’s required by your state, it’s best to check out each individual state department of labor website or consult an attorney who specializes in employment law.

10 simple steps to remain in compliance with labor laws

As a small business owner, staying on top of all your HR obligations can be time consuming and complex. There are hundreds of federal, state and local employment laws governing every action you take related to your employees. The penalties for not staying compliant are severe and can include costly fines, legal fees and even closure of your business. However, there are some steps you can take to ensure that your company is following all applicable rules.

Here’s a simple 10-step process to follow:

- Review your employee handbook or manual to make sure it reflects current law (e.g., minimum wage, leave requirements). If it doesn’t, update it immediately.

- Make sure you have an up-to-date personnel file for each employee containing basic information such as their date of hire, job title and salary.

- Update your payroll records to reflect any recent changes in employment status (i.e., start date, termination date) or compensation levels.

- Check to see if you need to register with your state’s unemployment insurance agency.

- Confirm that you are paying into Social Security and Medicare based on your employee count.

- Ensure that your health plan meets Affordable Care Act standards, including providing adequate coverage for preventive care services without cost sharing or other financial barriers; no annual dollar limits; coverage for adult children until age 26; no discrimination based on pre-existing conditions; etc.

- Make sure you aren’t using discriminatory hiring practices (such as failing to interview qualified candidates who have disabilities or rejecting applicants because they use tobacco products).

- Conduct training on harassment prevention, equal employment opportunity and sexual harassment prevention—both annually and when new hires begin work.

- Keep track of hours worked by nonexempt employees so that you don’t run afoul of overtime laws; track hours worked by exempt employees so that they receive appropriate pay for hours worked over 40 per week.

- Remember that these are just general guidelines; you may have additional obligations depending on your industry, size of your workforce and other factors. It’s important to consult with a lawyer or human resources professional about specific issues affecting your business.

Utilize technology to simplify the process

Technology can simplify the complex process of ensuring employer compliance of labor laws. By investing in an HR software solution, you can reduce your risk and ensure your business is compliant with all applicable laws.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

For SMBs who typically do not have the luxury of big HR teams, remaining in compliance with labor laws can be tough and expensive. By leveraging technology platforms for your HR needs and by following the steps outlined above, you have a much better chance of remaining compliant with Federal and State labor laws.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.