How HR Team can Ensure Maximum Productivity in the Time of Covid Crisis?

In only a matter of months, the world as we knew it changed dramatically, pushed into survival mode as it struggled to adapt to the ongoing COVID crisis. This situation is reflected in the global workforce, where people are struggling with the rapid shifts, health scares, and financial constraints. These constant changes are both stressful and confusing for employees, so they rely on the Human Resources department to control and manage their employment situation. Fortunately, an HRIS (Human Resource Information System) offers some relief to overwhelmed HR departments, providing much-needed support and a way to streamline procedures.

Daily operations and responsibilities of HR teams have been hit by the pandemic, leaving teams without a sense of direction or progress. It makes sense as the pandemic is a crisis of human health, but it also highlights the need for adjustments to be made to the HR function if companies want to match their previous productivity levels. Organizations that are serious about boosting their productivity need to provide their HR teams with the proper tools to achieve their goals. Without them, the bulk of the burden will fall on HR teams that are unprepared, unequipped, and unable to handle the tasks at hand.

Addressing the Remote Working Productivity Problem

It’s easy for managers to check attendance and access productivity while in the office. They can simply pull attendance reports and walk past workstations to ensure everything is up to par. However, when work is being done remotely, it’s impossible to physically check on and monitor staff members.

This presents a problem for employers who need to keep an eye on their employees’ attendance while also keeping productivity in check. Since the virus has rendered physical check-ins impossible, many companies have realized the need to move to a fully digital workspace.

By implementing and utilizing cloud-based integrated payroll solutions (such as UZIO), HR teams can quickly regain control of the employees they’re tasked to manage. Online HRIS and payroll software allow the same procedures and processes to be completed remotely, and the addition of automation allows the HR teams to stay ahead of schedule, not behind it.

HRIS & Payroll Software Is the New Standard

Adjusting to the “new normal” requires a new strategy, and that strategy starts with your HR management system. Since you can no longer evaluate and manage productivity in person, technology is key to enhancing employee engagement and boosting overall productivity. Of course, it’s important to remember that employee engagement is ultimately up to the employees, not the HR department. While mandatory webinars may seem like a possible solution to this, forced engagement is unlikely to promote productivity and may even decrease overall morale.

HR jobs focus on bonding with employees through regular engagement and interaction in a pleasant environment, but they’re also tasked with enabling the employees to succeed. By utilizing HRIS systems and online payroll services, HR teams can empower employees to succeed on their own by providing them with accessibility, automation, and insights. UZIO allows employees to request time off, view pay stubs, and manage their records remotely without relying on an already overtaxed HR department.

The HR department will also play a key role in any business during this pandemic. Administrative duties, benefits management, and record-keeping are where the real work lies. Processing payments on time, statutory compliances, maintaining communications, audits/inspection, updating employee information, reporting, and accounting are just a few of the many tasks left to the HR department. Many of these tasks have an overlap with payroll services, which offers a big advantage to teams that use integrated HR and payroll systems such as UZIO! By using a singular platform to manage both the HR and payroll departments, they can reduce the number of redundant tasks that need to be completed, as all relevant information is stored in the same database.

The constantly changing dynamics of the modern work environment make utilizing a digital system a necessity for the successful function of the HR & the company overall. Many HR teams around the world are already taking advantage of the systems available to them, but many others are yet to implement these changes. If you want your company to maximize its potential, then it’s important to adapt and reimagine your HR processes so that you’re not lagging behind your competitors. Take your company to the next level and provide your HR department with the tools they need to efficiently and effectively manage your business.

Still unsure about the benefits of HR & payroll software? Book a demo, and see how much of a difference the right tools can make in your business.

Online Pay Stubs: The First Step Towards a Paperless Payroll

Although it simply isn’t possible for many businesses to completely eliminate the use of paper, even a small reduction can yield enormous overhead savings, enhanced data security, and increased efficiency overall.

No matter if the business in question is a small start-up organization or a large corporation, there are numerous advantages to reducing paper and going digital.

As time goes on, it’s becoming more commonplace for businesses to rely on digital documents instead of paper ones, and payroll management is certainly no exception.

With cloud payroll solutions becoming more affordable and readily available, the move to a digital workspace offers a clear path to reducing your payroll costs and increasing your efficiency.

As per Deloitte Global Payroll Benchmarking Survey 2020, 74% of respondents are already using or are implementing a cloud-based technology and 10% have planned to implement it in next 3 years. This accounts for 84% out of the total 750 respondents.

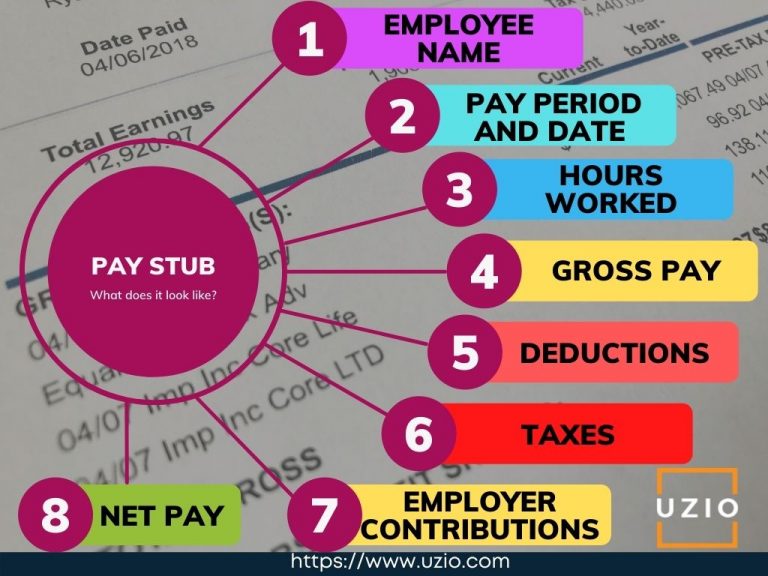

Pay stubs are documents that an organization issues (alongside a paycheck) that record an employee’s gross earnings, deductions, and net pay.

Depending on the pay schedule, these can be issued monthly, bi-weekly, or even weekly. Pay stubs can be issued in paper form, or a soft copy may be issued instead.

Soft copies are usually sent through email, or viewable via an online portal. While soft copies don’t cost anything to create and distribute, the cost of printing, organizing, and distributing hard copies can quickly add up!

Businesses with a limited amount of resources often process their payrolls manually.

Unfortunately, this often results in a maze of spreadsheets, hard documents, various online tools, and more every pay period.

This ends up costing them more money in the long run because these inefficient processes take longer to finish, resulting in more payable hours owed to the department in charge of payroll.

Integrated and comprehensive payroll software offers a much better solution for these small businesses, allowing them to grow freely without being held back by an abundance of paperwork.

Using cloud payroll services, the time required to issue paychecks and pay stubs (even with the addition of new employees) is negligible.

Are Paper Pay Stubs Holding You Back?

If your organization is still providing your employees with paper pay stubs then you’re missing out on all the benefits of paperless payroll software.

Paper pay stubs need to be printed out at the end of every pay period and then manually distributed (or mailed) to employees!

Recommended reading: Ascertain The Right Payroll Period For Your Employees

Not only does this time-consuming process waste precious man-hours, but it also has additional costs as well. When you factor in the costs of paper, ink, envelopes, and stamps, it’s clear that expenses add up over the year.

Managing paper pay stubs also presents an obstacle for the payroll team. In order to keep the payroll information organized, the team must keep stacks of organized folders containing pay statements and tax forms.

Keeping all of the employee information arranged in chronological order places a massive burden on the payroll department, and takes up precious time that could be allocated better elsewhere.

Paper pay stubs also present a security risk.

Hard copies of documents can be easily lost. Paystubs contain sensitive personal information about employees, so the last thing you want is for this paperwork to get into the wrong hand.

If information is stolen, your company may be found liable and you could be open to legal complications.

Fortunately, you can easily protect yourself against these privacy and security concerns by using payroll software instead of paper pay stubs.

As the decision-maker for your organization, it’s up to you to manage your company’s payroll in the most efficient manner possible.

An online payroll system like UZIO allows you to pay your employees, issue pay stubs, and keep inflow/outflow records on a single platform, instead of wasting time manually printing and distributing documents.

Choosing to utilize an online payroll system is a great first step on the way to a completely paperless payroll system!

The Advantages of Online Paystub for Your Business

Your employees will definitely appreciate the switch to a comprehensive cloud payroll service.

Online pay stub services allow them to view their pay information at their leisure, so they won’t have to wait on paperwork from the payroll office. They will be able to view their earnings and deductions online, and (since they won’t have a paper copy to lose) their information will be safe in the cloud.

As the employer, you will also benefit from managing your payroll online. Online payroll solutions such as UZIO allow you to track business costs, resources, expenses, loans, and more using a single platform.

UZIO can even assist you with your taxes! Many tasks previously delegated to the payroll department can be easily handled by the cloud software. By automating the payroll process, you can ensure that your employees will always be paid on time, regardless of holidays, complications, or unexpected events.

Even if you’re not ready to switch to an entirely paper-free setup, it’s hard to deny that cloud-based payroll setups offer many advantages over their paper-based counterparts.

From improving security to increasing efficiency, nearly every business can benefit from cloud-based payroll services!

Don’t be left in the paper-filled past; lead your company into a paperless future!

Types of Payroll Deductions Employers Should Know About

Calculating deductions and withholdings can be a complicated task for any business.

Deductions and withholdings, which are mandated by both state and federal laws, can be voluntary or court-ordered, so they may vary widely from employee to employee.

These complicated calculations can be hard to do yourself, but fortunately, quality payroll software (such as UZIO) can solve these problems for you. In this article, we’ll cover some of the common deductions and withholdings you may encounter during each pay period.

Mandatory Deductions

State Income Tax:

Each state government sets its own income tax (although some states may not have one).

Most states have an income tax, and the amount is set by that individual state. Fortunately, employers are not required to pay anything to the state, but employees are required to pay state income tax to the state where they reside.

If they move to another state, they will be responsible for paying state taxes there as well.

State income taxes are based on a couple of different factors: the number of allowances, taxable income, marital status, and the employee’s W-4 paperwork.

Recommended reading: A Guide to Essential Payroll Forms & More for Small Business Owners

Employees may catch a break though: if their wages are too low and/or they have many personal exemptions, then they may not be required to have state income tax withheld from their paychecks.

Federal Income Tax:

An employee decides how much federal income tax will be deducted from each paycheck when they initially fill out their W-4 form.

If the amount withheld exceeds the amount due, then the employee will get a tax refund at the end of the year when they file their taxes.

On the other hand, if they don’t deduct enough then they will be presented with a bill from the IRS for the balance owed.

The amount of federal income tax that is due will vary by employee. It depends on a variety of factors such as their number of allowances, marital status, and total taxable income.

Medicare Tax (FICA):

Another common paycheck deduction is Medicare. The Medicare tax shows up on a paycheck under FICA (Federal Insurance Contributions Act).

FICA covers both Medicare and Social Security, which are due as part of the federal taxes.

The Medicare tax provides a wide variety of services to people 65 or older. It can help them with nursing care, hospital care, and doctor fees—it even provides assistance for those on Social Security Disability Assistance!

Federal tax laws require employers to withhold 1.45% of an employee’s pay for Medicare. If the employee makes over $200,000 per year, this amount is reduced to 0.9% of their salaried (or hourly) income.

Social Security (FICA):

The second part of FICA is withheld for Social Security. Social Security is a program that provides disability benefits, retirement funds, survivors’ benefits, and family benefits. Employers are responsible for deducting 6.2% of an employee’s annual salary (or wages) which goes towards Social Security.

However, any wages they make exceeding $147,000 are exempt (in 2022), meaning they don’t have to contribute towards Social Security after $147,000.

Recommended reading: Social Security Wage Base 2021 and Estimation for 2022 (Updated for 2022)

Involuntary Types of Mandatory Deductions

Tax liens:

Employees who owe back taxes may have an additional amount deducted from their paychecks.

Court-ordered garnishment:

Employees may be required to pay additional deductions, such as child support, student loan garnishments, or creditor garnishments. In some cases, the employer may be reimbursed for the administrative costs. If you’re not sure if you’re entitled to reimbursements, a service like UZIO can help.

Pre-tax Deductions vs. Post-tax Deductions

Pre-tax deductions, such as health insurance, are taken from the gross pay of a paycheck before any taxes have been applied. Post-tax deductions, like wage garnishments, are removed after pre-tax deductions, federal taxes, state taxes, and FICA taxes have been withdrawn from the employee’s paycheck.

Voluntary Deductions

Retirement Deductions:

There are many different types of retirement deductions, but two of the most common are employer-sponsored 401(k) and 403(b) retirement plans.

In both of these plans, an employee’s contributions are deducted each pay period from their pre-tax funds. In a 401(k) plan, each employee selects the percentage of each paycheck that they want to contribute and works with a plan advisor to invest their funds.

Also available is the nearly-identical 403(b) package, which is only offered to non-profit or government employees. Employees still decide the contribution amount and where to invest the funds, but unlike 401(k) plans, 403(b) plans are exempted from

Insurance Plan Deductions:

Some employers offer vision, dental, or other types of health plans to their employees.

If an employee opts into one of these plans then they can expect to see a deduction (which covers the cost of their plan) on each of their paychecks.

Employees can also open an HSA (Health Savings Account) to help with their medical expenses. The funds contributed are tax-exempt upon both deposit and withdrawals, assuming the funds are used towards a legitimate medical expense.

Employer Debt:

If a worker borrows money from their employer or purchases items from them (such as tools or uniforms), these costs may be deducted from their paychecks.

Purchases of U.S. savings bonds:

Employees may choose to have automatic deductions made from each of their paychecks, which will go towards the purchase of U.S. Savings Bonds.

Charitable contributions:

If an employee wants to donate to a charitable cause like the Red Cross or the United Way, they may ask for this amount to be deducted from their paychecks. There are a lot of different contributions they can make, so having a dedicated payroll software will make these deductions a lot easier to process.

Union dues:

In some cases, employers may choose to automatically deduct union fees from their employees’ paychecks.

You may encounter additional types of withholdings or deductions as well. These can be either voluntary or involuntary (such as child support). Remember, for voluntary deductions you will need to get signed approval from the employee.

Calculating payroll deductions and withholdings can quickly turn a simple payroll process into a complicated mess.

Fortunately, complete payroll solutions offer a quick way to easily calculate and automate these deductions!

Services like UZIO provide a support staff as well, who are there to answer any questions you may have and give assistance when needed.

Employees deserve to be paid quickly and accurately for their work, so using payroll software helps ensure they’ll be satisfied come payday.

Interested but not convinced? Book a demo and see what UZIO can do to help boost your business!

UZIO Appoints Daniel Molas as Vice President of Sales

Daniel Molas will join the leadership team to lead sales and revenue growth

Reston, VA – April 05, 2021:

UZIO, one of the leading providers of SaaS based all-in-one Payroll, HRIS and Benefits platform for SMBs, today announced that Daniel Molas has joined Uzio as Vice President and Head of Sales effective immediately.

Dan brings over a decade of experience in building and leading sales teams targeting SMBs. As Head of Sales, he will be responsible for the top-line growth, exploring new channel opportunities, and managing and growing the sales team. Dan’s track record of success in his past organizations will help Uzio achieve its revenue goals and drive the company’s overall growth strategy.

“We all are very impressed with Dan’s exceptional background and his proven track record of building and growing sales organizations,” said Sanjay Singh, CEO and Founder of Uzio. “His experience in leading sales teams selling to SMBs makes him the ideal candidate for our next phase of growth. I am thrilled to have him on board to lead our sales organization.”

Dan joins UZIO from Solarwinds, a leading provider of IT Infrastructure Management Software company where he was Director of Sales.

“Joining Sanjay and the UZIO team to help SMB’s with their HR/Payroll needs was an easy decision. With Sanjay’s track record and UZIO’s technology, we are in a great position to help so many SMB’s with this part of their business.” said Daniel Molas, Vice President of Sales at UZIO. “I am thrilled to join at this stage to help UZIO and our customers grow.”

Dan most recently served as the Director of Sales at Solarwinds, and prior to this, Dan has held a variety of senior roles with a demonstrated history of success building and growing sales teams targeting SMBs. Dan’s addition is part of Uzio’s plan to build and broaden its leadership team.

About UZIO

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carrier serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

Visit https://www.uzio.com/uzio-leadership/ to learn more about the UZIO leadership team.

UZIO Appoints Daniel Molas as Vice President of Sales

COVID-19 Effect: Rippling Changes in the World of HR

COVID-19 spread throughout the world like wildfire, leaving millions of people unemployed and thousands of businesses struggling to stay afloat in its wake. Many businesses were forced to shut down as the pandemic went on, especially small businesses who bore the brunt of the impact. There were a few survivors though, and the HR teams of organizations that did manage to survive are now finding themselves busier than ever.

Recently, we stumbled upon a very interesting article on Bizwomen by Ellen Sherberg. Centered around Katie Burke (the Chief People Officer at Hubspot), this article discussed her views on how to manage a calendar chock-full of tasks. She explains her approach to reopening the company’s global offices, internal communications, travel policies, and other employee-related issues she’s faced during these tough times. Katie also talks about Buddhist teachings, and how for each bad incident there are two “arrows”. The first (“event”) arrow is out of your control, causing you unavoidable pain (like the COVID-19 pandemic). The second (“suffering”) arrow is actually under your control and determines how you react to the pain. As the article goes on, she underlines how she’s focused on avoiding the second arrow amid the COVID-19 crisis.1

Chances are, you probably want to avoid the second arrow too, so let’s take a look at how to do that!

Despite many technological advances, many businesses still rely on spreadsheets and other paper-based processes for their human resources management. Processes such as employee onboarding, payroll, time tracking, benefits administration, and a plethora of additional tasks are extremely time-consuming, especially when done by hand. Truthfully, any toll on productivity is intimidating in these grim times, so businesses are scrambling to find more efficient solutions to their troubles.

As we continue to shelter-in-place and have largely switched to a remote working environment, paper-based tasks and other labor-intensive processes have emerged as the biggest roadblock facing many businesses today. Sadly, many HR workers are finding the tasks difficult to manage, ultimately losing their drive and productivity. This leaves companies at a disadvantage, struggling to find both short and long-term solutions to their HR issues.

It’s Time to Swap to Cloud-based HR technology and Automated Workflows

If you haven’t already, the time is right to start using a cloud-based workforce management platform. Unlike a paper-based operation, an online environment can streamline your whole HR function including HR administrative tasks, benefits, payroll, and workers’ compensation. Here are the advantages of a paper-free workforce.

1. No More Errors

How old would you guess spreadsheets are? If you guessed 10 (or even 20) years old, you’re wrong – spreadsheets are now 40 years! It’s time to face the facts: spreadsheets are outdated and broken. Almost 90% of spreadsheets contain significant errors, and even the most thoughtfully developed, tried, and tested spreadsheets contain at least 1% of errors throughout the formula cells. This may not seem like much, but these errors actually end up costing U.S. companies billions of dollars!

Unfortunately, a single error can render an entire spreadsheet inaccurate. Hours of assessing and reassessing the same spreadsheet are required to find and fix these errors, wasting both time and resources better spent on other tasks. Furthermore, spreadsheets need to be physically delivered and shared, posing a potential security risk. Spreadsheets also can’t store a lot of data, which leaves the HR department with hundreds of spreadsheets to misplace or lose by accident.

2. Improved Time Management

Relying on spreadsheets and other paper-based processes takes a lot of time. Tasks like creating customized employee onboarding documents or monitoring COVID-19 paid leave are a nightmare, and the problem worsens if your organization is a growing one. Fortunately, switching to a cloud-based, self-serve people operations platform (like UZIO) allows you to save a lot of time. Time previously spent on paper-based tasks can now be focused on strategic initiatives and business goals rather than wasted on repetitive paper-based tasks. An added bonus? It improves the employee experience as well!

3. Better Communication

Most HR departments are scattered all over the place. Adding spreadsheets to the mix only worsens this lack of organization, especially since these paper files can easily be lost. As business grows and teams expand, the HR department and all of its responsibilities grow as well. Unfortunately, this will increase their dependency on spreadsheets, leading to what is affectionately known as “Spreadsheet Dependency Syndrome”. Unlike a paper operation, cloud-based HR solutions keep everyone on the same page, allowing you to notify stakeholders immediately of any last-minute changes. This prevents employees from wasting valuable time seeking approval or needing to contact other departments.

4. Compliance Is Easier

Many businesses (both big and small) struggle to adhere to the constantly changing state and federal labor laws. These laws cover things like paid leave, time tracking, offboarding and more, and failing to comply may leave your company with heavy fines. HR technology like UZIO keeps track of the new compliance regulations, allowing you to easily update information while automating your workflow.

5. Streamline Onboarding & Offboarding

Employee onboarding is one of the biggest challenges routinely faced by HR teams. A cloud-based HR platform standardizes the onboarding process, streamlining employee onboarding by replacing the usual paper forms. Rather than wasting an entire day filling out paperwork, the new employees can simply enter their information into one platform and be done. The other challenge often faced by HR teams is offboarding employees. An HRIS (Human Resources Information System) simplifies the process, providing HR teams with the relevant terminations policies and procedures throughout the offboarding.

6. Your Business Can Grow Freely

If you’re trying to rapidly expand your business, then spreadsheets are sure to hold you back. Since spreadsheets are created manually by individuals, they may be hard for the next employee to interpret. By using a standardized cloud-based platform, information will be easy to understand, allowing the next employee to easily pick up from where the last employee left off.

The Future Won’t Wait, So Neither Should You

No matter how great your business is already running, there’s always room to improve. If your goals are to:

- Gain back time throughout the day

- Increase overall productivity

- Focus on core HR objectives

- Ensure 100% payroll accuracy, and

- Offer the most competitive benefits package for your employees

Then the UZIO team is right here to help. Call us today (or send us a message). We can’t wait to hear from you!

References:

UZIO Introduces Time Tracking Solution designed for SMBs.

Reston, VA – March, 2021:

UZIO, a SaaS based platform for HR, Payroll, and Benefits solutions for SMBs, today announced the availability of its Time Tracking solution for SMBs. The UZIO time tracking solution will work seamlessly with its HRIS, Payroll, and Benefits solutions. Similar to UZIO Payroll and HRIS platform, SMB owners who run multiple companies will be pleased to learn that this solution supports multiple companies on a single account, allowing them to switch between companies with just the click of a button.

SMBs often are at a disadvantage when it comes to finding one solution for all their employee related needs. They end up using multiple disparate systems for Payroll, HR, Benefits, and Time Tracking which many times leads to errors and extra work. UZIO’s mission is to make life easier for SMBs. UZIO’s SaaS platform offers one easy solution for everything an SMB might need to manage their workforce. From HRIS, Payroll, Time Tracking to Employee Benefits and more, in the platform, everything works seamlessly without data being duplicated across multiple systems.

The modern user interface of the UZIO Time Tracking Solution offers an easy way for SMBs to track the working hours of their employees. Using the device’s GPS, the UZIO mobile application gives employees whereabouts when clocking in, clocking out, or going on break. The optional geofencing feature will allow the business owners to set a radius around the employee’s work location if needed.

Time clocked through the mobile app will appear in the cloud-based platform, where it can be viewed as a summary, approved or amended during each pay period. SMBs won’t have to manually separate regular time, overtime, double overtime, or PTO as it is automatically sorted within the solution, saving them time and unnecessary paperwork. What makes it even easier for the employers is that all their information is synced with the Payroll and a summary of payroll hours can be viewed by the employers in one place.

“We want to be the company known for making the life of the business owner or the HR manager of an SMB, a little easier. All the UZIO team members are driven by this simple goal. ” said Sanjay Singh, CEO of UZIO. “The release of our Time Tracking solutions is another step towards that goal.” he added.

UZIO Time Tracking mobile app is available both at the App Store (iOS) and Google Play (Android) for download.

About UZIO

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carrier serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

visit www.uzio.com to learn more about UZIO.

List of US Federal Holidays 2021

“The best things in life are the people we love, the places we’ve been, and all the memories we’ve made along the way.” – Unknown

We all dream of building a life we don’t need a vacation from. But while the sentiment is strong, the dream does not seem plausible. Everyone needs a break from time to time to get away from routine and recharge themselves. All work and no play makes Jack a dull boy. Rightly so! It is vital that an employer sanction necessary leaves of employees for their personal lives. In order to ascertain that, the HR department of an organization needs to add these holidays in their company’s annual day-offs calendar. HRIS software comes with a preset feature to manage holidays. Federal holidays can be incorporated directly into the system so that each employee can monitor the holiday dates in real-time and can plan their schedules accordingly. There are some dates in the calendar that come with a holiday of their own. Let’s have a look at the US federal holidays for the year 2021.

- Friday, January 1: New Year’s Day

- Monday, January 18: Martin Luther King Jr. Day

- Monday, February 15: President’s Day

- Monday, May 31: Memorial Day

- Sunday, July 4: Independence Day

- Monday, July 5: Independence Day (observed)

- Monday, September 6: Labor Day

- Monday, October 11: Columbus Day

- Thursday, November 11: Veterans Day

- Thursday, November 25: Thanksgiving Day

- Friday, December 24: Christmas Day (observed)

- Saturday, December 25: Christmas Day

- Friday, December 31: New Year’s Day (observed)

While it is a list of holidays established by the US federal law, it is nowhere stated that an employer has to give a day off to his employees. It is also not mandatory for the holidays to be paid leaves. It is strictly up to the employer to decide whether to observe these holidays or not. However, it is mandated by the federal law that employers offer appropriate leave sanctions for the religious holidays of each employee. Some employees adjust these holidays as floating holidays which is defined as a paid day off from work, given as a substitute for a public holiday, and typically taken on a day was chosen by the employee.

Offering day-offs for festivals and observances can go a long way in achieving employee satisfaction. This boosts employee morale and grows into genuine business relations. Download the printable holiday list here for the year 2021 and plan those vacations you have been dreaming of!

Replenish the Exhausted Ppp Loans: Round 2 Stands Approved

The Paycheck Protection Program (PPP) has run out of funds. Yes, you read that right. On April 16, the PPP exhausted nearly $350 billion allotted for low-interest loans designed to help small businesses stay afloat throughout the COVID-19 pandemic. Both small and big businesses were quick to take advantage of this opportunity, and only 14 days later, the funds were completely exhausted.

According to the terms of the Paycheck Protection Program (which is part of the CARES act), eligible businesses can apply for loans to cover 8 weeks of employee compensation, benefits, and other eligible costs. If a business contributes at least 75% of the loan to restore full-time employment and payroll funds, the PPP loan can be partially or even completely forgiven!

The Second Round of Funding Is on the Way

The White House and congressional leads came to an agreement on April 21st, securing the second wave of COVID-19 relief funding. The new bill included $310 billion of funding for the Paycheck Protection Program, with $250 billion refilling the program and an additional $60 billion being allotted for smaller lenders. These changes to the PPP were approved by the House of Representatives on April 23rd.

Just Hang in There!

Faced with a fast-spreading virus and a lack of response to their loan applications, the situation seemed dreary for many small business owners. If they didn’t receive loan funding in a timely manner, then it seemed that closing down shop would be their only option. With ongoing expenses, dried-up revenues, and no change in sight, the future ahead seemed grim.

According to Dave Boster (the chairman of SCORE Bucks County), their business advocacy nonprofit was being flooded with calls from small business owners whose focus revolved around a single, key question: “They want to know how to stay afloat until they can reopen their doors again.”

“As this is progressing and weeks are turning into months, we are looking at our rents that are due, invoices that are outstanding, and payroll … Some are having to let staff go because they can’t keep doors open,” said Derrick Morgan, who owns Monkey’s Uncle with his wife, Jeanell Morgan, in Doylestown, PA.

If you’re a small business owner, we strongly recommend considering alternative sources of funding, such as:

- Venture capital financing

- Employee retention tax credit

- State, city, and county resources

- Crowdsourced funding

- Borrowing from family and friends

Unfortunately, these types of alternative loans often have terms and conditions, such as high interest or unmanageable payment plans, that render them too expensive for the SMB owner’s needs. This is why many small businesses are relying on the PPP for their funding needs. It’s important to remember that hope is not long, so hang in there! The second round of funding is on its way.

UZIO is adding Quoting Solution to its Benefits Administration platform

Reston, VA – November. 2019: UZIO, the leading HR and Benefits platform for SMBs, earlier this month announced an in-house Payroll solution for SMBs and today they added Quoting solution to its Benefits Administration platform.

The Uzio Quoting solution would be completely integrated with its state-of-the-art Benefits Administration and HR platform. The roll-out of the Quoting solution is one more step towards its goal of providing a one-stop-solution for agents focused on serving SMBs for their Benefits needs.

“Our vision has always been to help our Benefits Broker Partners become more efficient at serving their SMB clients” said Sanjay Singh, CEO of UZIO. “Our Quoting solution which integrates seamlessly with our Benefits Administration platform helps our Broker Partners sell more instead of spending countless hours collecting quotes from various carriers.”

“We are very pleased that UZIO is rolling out their Quoting solution which integrates seamlessly with their Ben Admin platform” said Andrew Lindsey, President/CEO of Lindsey Solutions of Chantilly, VA. “In the past, Quoting has been a time sink. We will have to go to various carrier websites to get quotes, spreadsheet them and do all that all over again if the client changes its mind. The UZIO solution saves us time and money. We can run quotes in seconds and literally close a sale in one meeting.”

Brokers serving SMB clients have struggled in the past with silos solution for Quoting, Enrollment, Renewals, Carrier Integrations etc. UZIO vision is to address this pain by providing an integrated end-to-end Ben Admin solution for the Benefits Brokers.

Click here to know more on Uzio Quoting.

About UZIO

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carrier serving plans, Uzio provides an Integrated HR, Benefits Administration and Payroll technology platform for brokers, employers and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

Media Inquiry:

Sunny Arora

Sr. Director – Head of Marketing & Inside Sales at UZIO, Inc

sunny.arora@uzio.com

UZIO is adding Quoting Solution to its Benefits Administration platform

UZIO announces the addition of Payroll solution to its HCM platform for SMBs

Reston, VA – November. 2019: UZIO, the leading HR and Benefit Platform for SMBs, announced today the immediate availability of its in-house Payroll solution.

The Payroll solution, developed by UZIO, would be completely integrated with its state-of-the-art Benefit Administration and HR platform. The roll-out of the Payroll solution is one more step towards its goal of providing a one-stop-solution for SMBs for all their HR, Benefits and Payroll needs.

“Our vision has always been to meet the needs of HR managers at SMBs end-to-end” said Sanjay Singh, CEO of UZIO. “With the roll-out of our own Payroll solution, we are showing that we are committed to realizing that vision.”

“We are very pleased that UZIO is rolling out their in-house Payroll solution” said JS Gagnon, President of the Employee Benefits Division at Thomas Financials. “We have been a partner of UZIO for many years and a number of our customers have been asking for an integrated Benefit, HR and Payroll solution. Their needs would be wonderfully met with this new solution.”

SMBs have struggled in the past with silos solution for HR and Benefits. HR and Benefit managers end up copying and pasting data across various HR, Benefit and Payroll solution they use. UZIO vision is to address this pain by providing an integrated in-house built HR, Benefit and Payroll solution.

To know more visit: https://www.uzio.com/payroll/

About UZIO

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carrier serving plans, Uzio provides an Integrated HR, Benefit Administration and Payroll technology platform for brokers, employers and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

Media Inquiry:

Sunny Arora

Sr. Director, Head of Marketing at Uzio, Inc

sunny.arora@uzio.com

UZIO announces the addition of Payroll solution to its HCM platform for SMBs