What is WOTC and how can my business benefit from it?

Quick links

-

What is the Work Opportunity Tax Credit (WOTC)?

-

Employees not eligible under the Work Opportunity Tax Credit program

-

How To Apply for the WOTC Credit:

-

How To Claim for the WOTC Credit:

-

Benefits of WOTC

-

Is participation in the Work Opportunity Tax Credit program mandatory?

-

Conclusion

The Work Opportunity Tax Credit (WOTC) was created in 1997 to assist employers in hiring and retaining workers from certain target groups by providing tax credits as an incentive for hiring them.

Since its creation, it has been modified and expanded several times; The latest legislation extended WOTC tax credits retroactively from January 1, 2015, through the end of 2019. Apart from a 5-year extension, the Protecting Americans from Tax Hikes (PATH) Act introduced a new targeted group – long-term unemployed individuals. The WOTC is authorized until December 31, 2025.

The goal of the WOTC tax credit incentive is to reduce poverty and welfare dependency by enabling employees to gradually move from economic dependency into self-sufficiency as they earn a steady income and become contributing taxpayers.

The employers can receive up to $2,400-$9,600 in tax credits per employee, depending on the type of employee they have hired through the WOTC program.

WOTC credit is calculated as a percentage of wages paid to certified employees who work at least 120 hours in the first year of employment. The percentage varies depending on how long employers retain the employee, and the amount of wages applied is determined by the category.

Another added benefit of this incentive is that you can file multiple applications each year if your company hires multiple employees. However, you are not allowed to use the same worker more than once every two years.

What is the Work Opportunity Tax Credit (WOTC)?

WOTC is the tax credit employers can claim when hiring a candidate from one of following different targeted groups:

- Unemployed Veterans

- Temporary Assistance for Needy Families (TANF) Recipients

- Food Stamp (SNAP) recipients

- Designated Community Residents

- Vocational Rehabilitation Referrals

- Ex-Felons

- Supplemental Security Income (SSI) Recipients

- Summer Youth Employees living in Empowerment Zones

- Qualified Long-Term Unemployment Recipient

- Long-Term Family Recipient

Each group has its own eligibility requirements that the individual must meet in order for the employer to qualify for the credit.

No credit is available unless the worker completes at least 120 hours of work. The credit is reduced if the individual works at least 120 hours but less than 400 hours.

WOTC benefits are available only for new hires. Wages paid to an individual who was previously employed and is rehired do not qualify. In addition, wages paid to certain individuals who are related to the employer or business owner do not qualify.

Employees not eligible under the Work Opportunity Tax Credit program

Some exclusions apply to the list of WOTC target groups. Employers who rehire a former employee, a family member or dependent, or someone who will be a majority owner in the business may not be able to claim the tax credit for that individual (even if the individual is otherwise a member of an eligible target group).

How To Apply for the WOTC Credit:

To claim for WOTC, an employer must obtain certification that the individual they are about to hire is a member of the targeted group. To do this, an employer must file the Form 8850 together with ETA Form 9061 or ETA Form 9062 for Pre-Screening Notice and Certification Request for WOTC, with their respective state workforce agency within 28 days after the eligible worker begins work.

How To Claim for the WOTC Credit:

The Employer will claim the credit on form 5884-C, as a credit against the employer’s share of Social Security tax. The credit will not affect the employer’s Social Security tax liability reported on the organization’s employment tax return.

Benefits of WOTC

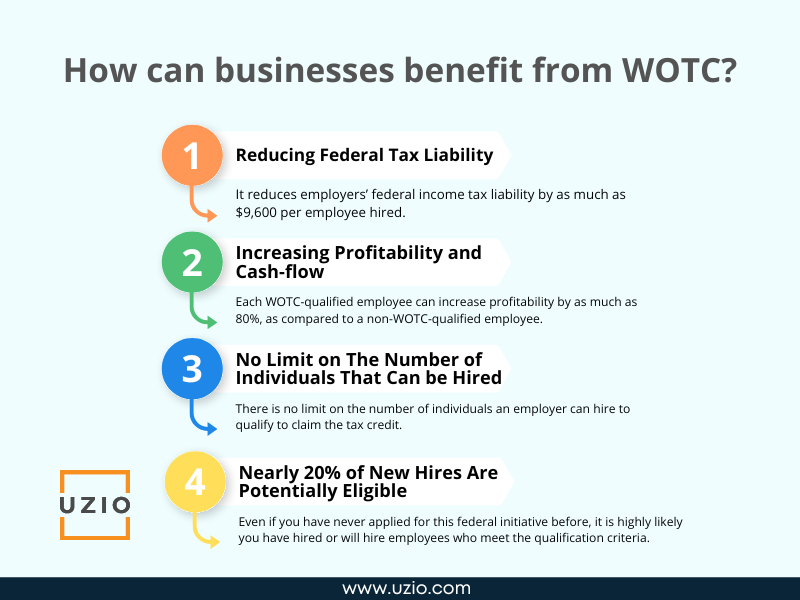

- Reducing Federal Tax Liability: It reduces employers’ federal income tax liability by as much as $9,600 per employee hired

- Increasing Profitability and Cash-flow

- No Limit on The Number of Individuals An Employer Can Hire: There is no limit on the number of individuals an employer can hire to qualify to claim the tax credit

- Nearly 20% of New Hires Are Potentially Eligible

The Work Opportunity Tax Credit (WOTC) is designed to reduce federal tax liability and help employers hire workers from groups that face significant barriers to employment. By implementing a work-focused program that meets qualifications under these tax credits, a company can reduce its federal income tax bill and offer an alternative to traditional hiring methods. The WOTC incentives can be used as an effective tool in retaining valued employees or in new recruitment opportunities.

In case there is no tax liability, employers can still apply for the credit. Unused credits can be carried back one year and carried forward on future tax returns for up to 20 years. It is therefore likely that you will be able to use the credit in the future, once there is tax liability.

Each WOTC-qualified employee can increase profitability by as much as 80%, as compared to a non-WOTC-qualified employee.

By taking advantage of the WOTC benefits, you can increase cash flow, therefore improving your margins and sustainability. With an increasingly high cost of doing business these days, WOTC can make your company more profitable.

There is no restriction on the number of new hires who can qualify you for the tax savings. Whether your business hires 10 or 10,000 eligible employees, your tax credits will continue to pile up and improve your profit margin.

One of WOTC’s benefits is that even if you have never applied for this federal initiative before, it is highly likely you have hired or will hire employees who meet the qualification criteria. Typically about twenty percent of new hires potentially qualify for the program as per many industry reports.

According to the U.S. Department of Labor, an average of more than 500,000 new jobs were added per month in 2022. With an average of 20% of those workers eligible for WOTC tax credits, that’s more than $0.24 billion in tax credits per month that potentially could have been claimed.

Is participation in the Work Opportunity Tax Credit program mandatory?

The Work Opportunity Tax Credit is a voluntary program. As such, employers are not obligated to recruit WOTC-eligible applicants and job applicants don’t have to complete the WOTC eligibility questionnaire. Employers can still hire these individuals if they so choose, but will not be able to claim the tax credit.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

Participating in WOTC can lead to numerous benefits for both an employer and future employees since it encourages business growth while assisting disadvantaged members of a community. Therefore, both sides win.

Even though there are complexities associated with the WOTC administrative process, there are also ways to overcome them. Replacing manual processing with an automated solution ensures that employers complete the full WOTC process in a timely manner, efficiently, and in accordance with program requirements.

Also, by keeping WOTC best practices in mind, companies can be better prepared to capture the credits for which they may be eligible, which can have a significant impact on their bottom line.

UZIO Announces Summer 2022 Product Feature Release

RESTON, VA. June 13, 2022

UZIO, provider of the all-in-one HR Software that includes HRIS, Benefits, Payroll and Time Tracking, released its Summer Update today. Key upgrades include

- Enhanced user interface including customizable views and search functions

- Multiple check printing options

- Customized automatic deduction calculation capabilities

- Time Tracking to accommodate today’s dynamic workforce schedule

- Employee Customizable Management Views

“Special shout out to our team that works tirelessly behind the scenes to enhance and create a more seamless experience, for our customers, for managing payroll, benefits and time tracking. With our UZIO Team, the customer is always first,” states UZIO’s CEO Sanjay Singh. “This latest release includes features our customers have asked for that includes some exciting enhancements including a simplified management interface. All of these features optimize much of the payroll and benefits processes therefore giving our customers valuable time back to their day. We continue to strive to optimize and design our solution so that it not only meets today’s HR needs but continues to optimize, scale and support the dynamic HR environment of tomorrow.”

About UZIO:

With over 150+ broker partners, 1700+ Employers relying on UZIO and 70+ carriers serving plans, UZIO offers an Integrated HR, Benefits Administration, and Payroll technology platform for brokers, employers, and employees in the SMB space. UZIO enables SMBs to manage HR and compliance with its user-friendly platform and advanced features.

visit http://www.uzio.com to learn more about UZIO.

UZIO Product Updates, June 2022

What can an employer do if an employee paycheck is not enough to cover for a voluntary deduction like Health Insurance Premium?

Quick links

Types of Deductions

Employers can make the following three categories of deductions from the employee’s paycheck.

- Mandated by Law: An example would be wage garnishments like child support

- Deductions for Employers convenience: An example would be recovery against overpayment, advances paid to the employee etc.

- Voluntary Deductions: An example would be health benefits premium deduction, charitable deductions etc.

Different Federal and State rules apply for each of these categories In this article, we will focus on rules and regulations an employer should follow while handling Voluntary deductions.

Many states also have minimum wage laws. In cases where an employee is subject to both state and federal minimum wage laws, the employee is entitled to the higher minimum wage.

Administering Voluntary Deductions like Health premium

If employees are enrolled in a Section 125 plan which is an employer-sponsored benefit plan that gives employees access to certain taxable and nontaxable pretax benefits, they can set aside insurance premiums and other funds pretax, which can then go toward certain qualified medical and child care expenses. Depending on where they live, participating employees can save from 28% to 48% in combined federal, state, and local taxes on a variety of items that they typically already purchase with out-of-pocket post-tax funds.

At the time of enrollment, employees agree to have employers deduct their portion of the premium on a pre-tax basis. It all works great if the employee paycheck is large enough to cover the deductions. The challenge arises when the employee is either not working for a short period of time but still is covered by the health benefit plan or the employee has not worked enough hours so that his/her paycheck can not cover the benefit deductions.

Because the employee’s health benefits are still active, the employer is responsible for paying the health insurance carrier the full premium amount even though the employee is not contributing his/her portion of the premium. In such cases, the employer would have to keep track of the deductions owed by the employee and recover the amount owed from future paychecks.

In certain industries, like construction or landscaping, the work is seasonal, meaning employees work only part of the year and so there are months when they are not getting paid because they are not working but are still covered under the employer benefit plan. Employers in these instances struggle to keep track of all the deductions owed if they are doing it manually. Some payroll systems like Uzio, provide employers the ability to automatically track deduction balance. Not only that, the Uzio system also allows the employers to set up the deduction arrear processing method so that they can decide, after discussion with the employee, how to recover the balance from the employee in the future paychecks.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

In the current tight job market, employers have to offer a tax advantage benefit like health insurance to be able to attract and retain employees. While they do that, they also need a system to be able to track the deductions owed by employees in cases where employee paychecks are not big enough to cover it. It can be done manually but it leads to extra work and errors. The employer would do well to make sure their payroll system has the feature to track the deductions owed automatically as well as has the ability to set up different methods to recover the owed deductions from future paychecks.

As an SMB, what do you have to do to remain in compliance with Labor laws, both at the federal and the state level?

Quick links

-

Introduction

-

Federal (USA) labor law basics

-

Fair Labor Standards Act

-

Family and Medical Leave Act

-

Employee Retirement Income Security Act

-

Provide SPD (Summary Plan Documents) to your employees

-

Provide COBRA Insurance

-

Provide Section 125 Plan Document

-

Workplace Posters

-

State labor law basics

-

10 simple steps to remain in compliance with labor laws

-

Utilize technology to simplify the process

-

Conclusion

As a small business owner, you’re probably wondering how you can stay in compliance with all the state and federal labor laws that apply to your company. You don’t want to hire a lawyer to advise you on every single one of these laws. You want to stay in compliance without spending too much time and money on attorney fees. In this article, we will document the steps you can take to remain compliant with Federal and State Labor laws.

Federal (USA) labor law basics

At the minimum, you should be aware of the following labor and workplace laws at the Federal level.

- FLSA (Fair Labor Standards Act)

- FMLA (Family and Medical Leave Act)

- ERISA (Employee Retirement Income Securities Act)

FLSA

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments. Covered nonexempt workers are entitled to a minimum wage of not less than $7.25 per hour effective July 24, 2009. Overtime pay at a rate not less than one and one-half times the regular rate of pay is required after 40 hours of work in a workweek.

Many states also have minimum wage laws. In cases where an employee is subject to both state and federal minimum wage laws, the employee is entitled to the higher minimum wage.

FMLA

The Family and Medical Leave Act (FMLA) entitles eligible employees of covered employers to take unpaid, job-protected leave for specified family and medical reasons with continuation of group health insurance coverage under the same terms and conditions as if the employee had not taken leave. Eligible employees are entitled to:

- Twelve workweeks of leave in a 12-month period for:

- the birth of a child and to care for the newborn child within one year of birth;

- the placement with the employee of a child for adoption or foster care and to care for the newly placed child within one year of placement;

- to care for the employee’s spouse, child, or parent who has a serious health condition;

- a serious health condition that makes the employee unable to perform the essential functions of his or her job;

- any qualifying exigency arising out of the fact that the employee’s spouse, son, daughter, or parent is a covered military member on “covered active duty;” or

- Twenty-six workweeks of leave during a single 12-month period to care for a covered servicemember with a serious injury or illness if the eligible employee is the service member’s spouse, son, daughter, parent, or next of kin (military caregiver leave).

Please note that the FMLA does not apply to very small businesses. It only applies to employers with 50 or more employees in 20 or more workweeks in the current or preceding calendar year.

ERISA

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

While ERISA is a very broad and complicated piece of legislation, here are the key provisions you need to be aware of to be in compliance.

Provide SPD (Summary Plan Documents) to your employees

If your employees participate in a ERISA covered retirement plan or health benefits plan, you must provide them free a SPD which is a detailed guide to the benefits the program provides and how the plan works. Typically your broker will provide you the SPD.

Provide COBRA Insurance

The Consolidated Omnibus Budget Reconciliation Act (COBRA) requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

For example, if you had 20 or more employees in the previous year and if you terminate an employee, you are obligated to provide the employee COBRA coverage. If you are using a benefit enrollment platform, the platform should provide COBRA support. If not, your health benefits broker should be able to help you with this.

Provide Section 125 Plan Document

If you allow your employees to pay group health and other insurance premiums with pre-tax salary deductions, you should have what is called Section 125 Plan Document. The document is named after the IRS code that authorized this plan. The document provides details of the benefit plan you are offering to your employees. Your benefits broker should be able to provide you with Section 125 plan documents.

Workplace Posters

Many of the laws that create rules regarding employment include a requirement that notices about employees’ legal rights under those laws be posted at the workplace.

Employers are federally required to display notices covering a broad range of topics, including the minimum wage, workplace safety, and family and medical leave.

For employers with some remote workers, physical posters are required for onsite employees, and the DOL (Department of Labor) encourages electronic posting for the teleworking employees. Employers with an entirely remote workforce may satisfy continuous-posting obligations using electronic-only means if all employees exclusively work remotely, customarily receive information from the employer via electronic means and have readily available access to the electronic posting at all times.

State labor law basics

In addition to Federal laws, you also need to pay attention to the State labor laws. Depending on where you do business, there may be different state laws and regulations you need to follow. The Department of Labor offers a good starting point for understanding your obligations to state labor laws here.

Some states have their own specific wage and hour statutes that require employers pay certain employees (e.g., non-exempt employees) overtime when they work more than 40 hours per week.

To get up to speed on what’s required by your state, it’s best to check out each individual state department of labor website or consult an attorney who specializes in employment law.

10 simple steps to remain in compliance with labor laws

As a small business owner, staying on top of all your HR obligations can be time consuming and complex. There are hundreds of federal, state and local employment laws governing every action you take related to your employees. The penalties for not staying compliant are severe and can include costly fines, legal fees and even closure of your business. However, there are some steps you can take to ensure that your company is following all applicable rules.

Here’s a simple 10-step process to follow:

- Review your employee handbook or manual to make sure it reflects current law (e.g., minimum wage, leave requirements). If it doesn’t, update it immediately.

- Make sure you have an up-to-date personnel file for each employee containing basic information such as their date of hire, job title and salary.

- Update your payroll records to reflect any recent changes in employment status (i.e., start date, termination date) or compensation levels.

- Check to see if you need to register with your state’s unemployment insurance agency.

- Confirm that you are paying into Social Security and Medicare based on your employee count.

- Ensure that your health plan meets Affordable Care Act standards, including providing adequate coverage for preventive care services without cost sharing or other financial barriers; no annual dollar limits; coverage for adult children until age 26; no discrimination based on pre-existing conditions; etc.

- Make sure you aren’t using discriminatory hiring practices (such as failing to interview qualified candidates who have disabilities or rejecting applicants because they use tobacco products).

- Conduct training on harassment prevention, equal employment opportunity and sexual harassment prevention—both annually and when new hires begin work.

- Keep track of hours worked by nonexempt employees so that you don’t run afoul of overtime laws; track hours worked by exempt employees so that they receive appropriate pay for hours worked over 40 per week.

- Remember that these are just general guidelines; you may have additional obligations depending on your industry, size of your workforce and other factors. It’s important to consult with a lawyer or human resources professional about specific issues affecting your business.

Utilize technology to simplify the process

Technology can simplify the complex process of ensuring employer compliance of labor laws. By investing in an HR software solution, you can reduce your risk and ensure your business is compliant with all applicable laws.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

For SMBs who typically do not have the luxury of big HR teams, remaining in compliance with labor laws can be tough and expensive. By leveraging technology platforms for your HR needs and by following the steps outlined above, you have a much better chance of remaining compliant with Federal and State labor laws.

Best-of-breed vs Integrated HRMS: which one is best for SMBs?

Quick links

-

Introduction

-

Considerations for a best-of-breed solution

-

Advantages of Best-of-breed HRMS Option

-

Disadvantages of Best-of-breed HRMS Option

-

What are the benefits of an integrated solution?

-

Disadvantages of an integrated solution

-

When to go for an integrated solution, and when to for best-of-breed solution

-

Other considerations before making the decision?

-

Conclusion

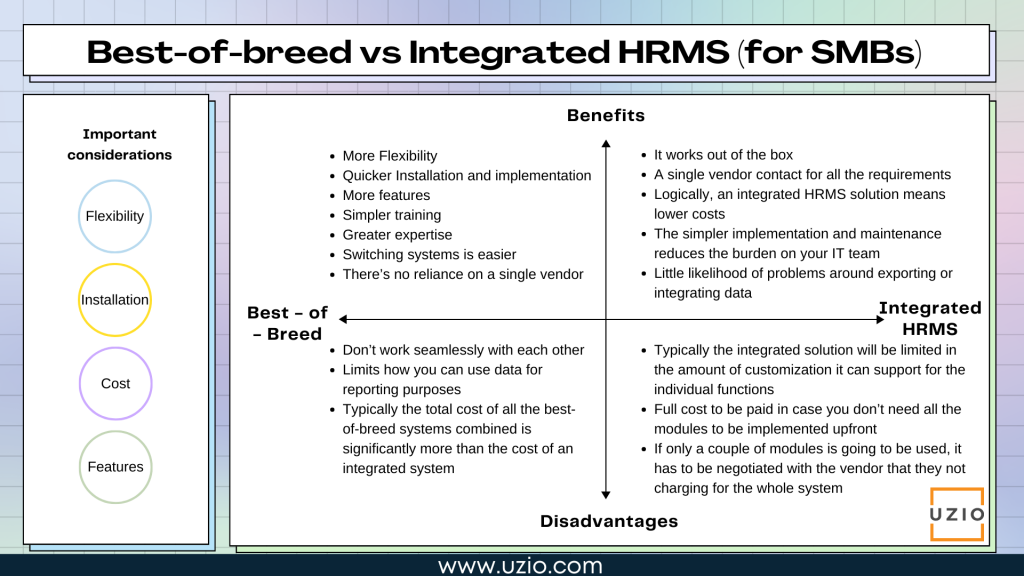

The market for HR management software has exploded in recent years, with companies using these tools to find and recruit talent, onboard employees, track performance and benefits, and much more. But with such diverse options available, how do you know which one is right for your company? This article will examine the pros and cons of best-of-breed vs integrated HRMS so you can make an informed decision.

Considerations for a best-of-breed solution

When you choose the best-of-breed approach, you select individual solutions for individual functions, each from a different vendor. For example, you may have a payroll solution provided by one vendor, your benefits solution from another vendor, your hiring and onboarding module from another vendor and your performance management system from a different vendor.

Considering the obvious challenge that these different systems will not talk to each other out-of-the-box, why will you even consider the best-of-breed approach. Well, there could be various reasons for it. You may have some unique needs in your organization which can only be met by the best-of-breed solution in that vertical. For example, you may have employees in different countries and so you may need to work with a specialized payroll vendor who supports international payroll which is typically not supported by Integrated HRMS vendors targeting the SMBs.

In other cases, you end up with the best-of-breed approach not by design but simply as a result of decisions made in the earlier life cycle of the company when individual function owners chose the vendor they had used in the past for their individual function without thinking about the needs of the HR organization as a whole.

Advantages of Best-of-breed HRMS Option

Best-of-breed software allows companies to select and implement specific modules that perfectly fit their workforce. Companies can customize a package of best-of-breed HRMS software to ensure there are no gaps in functionality and to include only those features that they need. This makes it easier to adopt in small increments and adjust as needs change over time, which means it’s a more nimble option than an integrated solution.

The key advantages of best-of-breed software include:

- Flexibility: When you choose a best-of-breed system, you get the flexibility of implementing smaller chunks of functionality as per your needs instead of taking on a big implementation for all the HR functions at once.

- Installation and implementation is often quicker and easier due to the narrower scope and impact of software seeking to fulfill a single function.

- More features: Often these come with more feature because of the tighter focus on just one HR function

- Simpler training: Training is simpler because of fewer users using each system

- Greater expertise: Since best-of-breed systems are niche specific focussed so these often bring best-of-breed expertise to the table

- Switching systems is easier because the disruption is only to one of your HR functions.

- There’s no reliance on a single vendor; lessening and spreading the risk and impact of a provider unexpectedly going out of business.

Disadvantages of Best-of-breed HRMS Option

The biggest disadvantage of this approach is that different modules don’t work seamlessly with each other. There is no single “source of truth”. It becomes the customer’s responsibility to keep the data in sync across multiple systems. For example if you are using two different systems for your payroll and benefits and an employee changes her benefit selection because of a LSC (Life Status Change like getting married etc), it is the responsibility of the HR team to ensure the premium tied to the new selection is updated in the payroll system otherwise employee will see incorrect amount deducted from her payroll. The HR team ends up copying data from one system to another manually which results in errors and is quite inefficient.

Although these pieces of software might not seem like much individually, when combined together they can make for a complicated array of data that requires lots of manual input from users.

Not only does using separate systems make it more difficult to share information across departments within your organization—it also limits how you can use data for reporting purposes. For example, let’s say you decide to purchase four separate software modules: payroll management, time tracking, recruitment management and employee performance reviews.

Even though these functions are critical to managing employees effectively, none of these modules will be able to talk directly to each other; you’ll still need to manually enter data into spreadsheets or databases before being able to pull reports together.

Another downside to the best-of-breed systems is cost. Typically the total cost of all the best-of-breed systems combined is significantly more than the cost of an integrated system.

What are the benefits of an integrated solution?

A fully-integrated HRMS offers a range of HR functions in one system.

These functions often include at a minimum a workforce database which acts as a system of truth, time and attendance, leave management, payroll solution, recruitment, onboarding, benefits and in some cases even talent management.

Many integrated HRMS packages aim to provide end-to-end management of the whole employee life cycle. All these functions work off a single database – a single system of record – making for easy sharing of information between functions.

This cuts down on training time, ensures consistent functionality across all modules, and makes collaboration with multiple users easier.

The main advantages of an integrated HRMS include:

- It works out of the box. With multiple best-of-breed modules, work is often needed to ensure compatibility and seamless communication, requiring middleware and patches to transmit and ‘translate’ information between different software packages.

- A single vendor contact for all of your HR software support needs means that if you have a problem with an integrated HRMS there’s only one company you need to contact.

- Logically, an integrated HRMS solution means lower costs. A strategy of combining several best-of-breed packages to meet your HR needs can be more expensive than a single solution.

- The simpler implementation and maintenance reduces the burden on your IT team. The technical challenges are greatly reduced with an integrated HRMS.

- That said, the greater number of users usually associated with an HRMS means implementation and initial staff training costs may appear higher but… the single interface means your users are not starting from scratch when learning about each automated HR function – having mastered navigating the system, users have the basic foundation for using the full range of functions. When compared with the cost of multiple best-of-breed implementations, an HRMS suite can still be better value financially.

- An integrated solution has little likelihood of problems around exporting or integrating data. There are no compatibility or format issues between modules because an HRMS works as a streamlined whole (or should do!)

- Similarly, the single database means you eliminate the need for multiple data entry and therefore greatly reduce the possibility of human error and inaccurate or inconsistent data.

- A single point of access or single login for all your HR technology makes life simpler for users.

- The uniformity of software across your HR functions simplifies processes (and access to those processes) for employees. A single user interface gives a familiar and unified feel of your HR platform.

- For employees, the same HR software (with the same interface and experience) handles everything from the initial job application and recruitment, through performance management and progression, to resignation or retirement. This uniformity means that the HRMS effectively becomes a part of your HR team’s brand.

- It’s far easier to generate reports using data in a single suite rather than drawing (potentially incompatible) data from multiple modules.

Disadvantages of an integrated solution

While an integrated system may seem to be a better option when deciding on your company’s HR needs, there are some things to consider before committing.

First and foremost, there’s the cost in case you don’t need all the modules to be implemented upfront. If you are only going to use a couple of modules of an integrated solution, make sure that the vendor is not charging you for the whole system.

It also makes sense to weigh how much customization you need in your HR software against how much time it would take to build out those features yourself with an add-on tool. Typically the integrated solution will be limited in the amount of customization it can support for the individual functions.

When should the SMB use an integrated solution, when should it use a best-of-breed solution, and when can it do both at once?

There’s no one-size-fits answer to these questions, but there are some general guidelines.

If you’re looking to implement a core suite of applications designed to work in harmony with each other, it’s best to pick an integrated solution that covers everything from performance management and talent acquisition to payroll and benefits.

That said, if your business processes are highly specialized—for example, if you have very specific needs around hiring employees—you might be better off choosing a best-of-breed product instead.

It’s also worth noting that many companies start out using best-of-breed products before eventually moving on to an integrated system down the road.

For example, if you run a small restaurant chain and decide to use an applicant tracking system (ATS) from one company while still using another company’s module for human resources management (HRM), then maybe later on you decide it makes sense to integrate those two systems together into one cohesive software package.

In short, don’t get too hung up on whether you should use an integrated or best-of-breed solution; instead, think about what works best for your company today and what will work best tomorrow.

Is there anything else the SMB should consider before making the decision?

If you’re not sure which route to take, here are a few more things to consider before making your decision.

Ask yourself these questions, and you’ll find a clear answer.

- What is it like to work with [Integrated/Best of Breed] vendors on an ongoing basis?

- How can I make my new system fit in with my existing technology stack?

- Am I willing to commit long term to [Integrated/Best of Breed] provider or will I need flexibility down the road in case there’s something better that comes along?

- How do I get started?

- What are some of your favorite features?

Once you have brainstormed these points, and weighed your options, you will be better placed to make an informed decision.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

There is no right or wrong answer when it comes to choosing between best-of-breed and an integrated system. It really depends on your company’s unique needs. If you still need help making this decision, please reach out to Uzio. We offer an integrated HRMS solution that is designed for SMBs and is the most effective and easy to use solution in the market.

As a small employer, what are your options to offer cost effective health insurance coverage to your employees?

Quick links

-

Introduction

-

Join a PEO

-

QSEHRA

-

Allow employees to purchase insurance in the individual marketplace

-

Conclusion

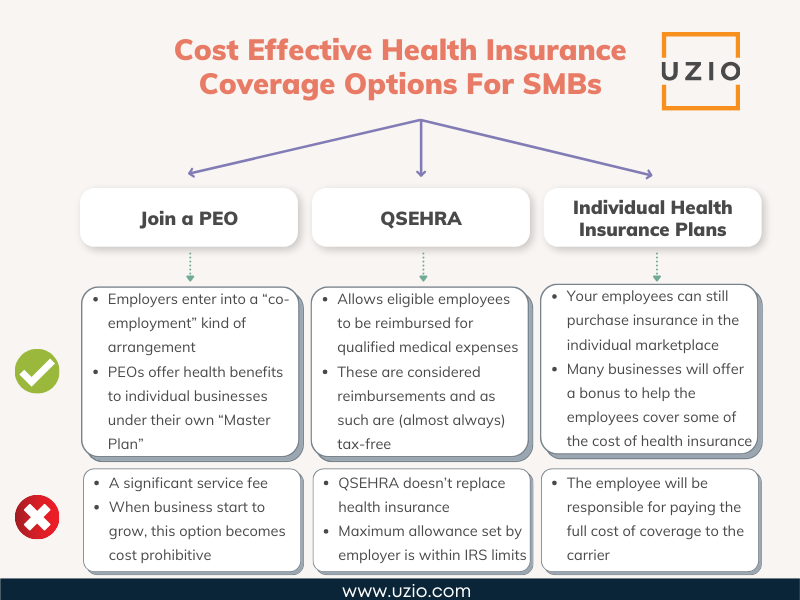

If you are a small business, let us say with less than five employees, you have very few options to offer cost effective health insurance coverage to your employees.

The main reason is that Health Insurance Carriers consider these micro groups (employers with less than 5 employees), “bad risk”.

Typically, these micro groups are not profitable for carriers and carriers don’t want these groups. So carriers do not offer any commission to broker agents for selling these groups.

Thus broker agents have no incentive to sell health insurance coverage to “micro groups”. Because group insurance coverage is mostly sold thru broker agents, small employers find it very hard to get cost effective coverage for their employees.

In this article, we will explore different options available to small businesses to obtain cost effective health insurance coverage.

Join a PEO

For very small employers, joining a PEO (Professional Employer Organization) can be an option to be able to offer benefit coverage to their employees.

With PEOs, employers enter into a “co-employment” kind of arrangement. Because of the co-employment arrangement, PEOs can combine the risk across all the employees of their customers and use that to offer health benefits to individual businesses under their own “Master Plan”.

For a small business owner, this might seem like a good option. The downside is that PEOs charge a significant service fee which in some cases can outweigh the savings on the benefits side. Also, even though PEOs might be a viable option when the business is small, when business start to grow and hire more and more employees, the PEO option becomes cost prohibitive.

Below is an article which explains the challenges of working with PEOs.

Recommended Reading: How to transition out of a PEO and bring your HR, payroll and benefits in-house?

QSEHRA

Another option for small employers is QSEHRA which stands for qualified small employer health reimbursement arrangement (QSEHRA). It’s a way for small businesses—that don’t offer a group health insurance plan—to reimburse employees for health-related and medical costs. It doesn’t replace health insurance, but rather allows eligible employees to be reimbursed for qualified medical expenses. This is how it works:

Employees pay for their health expenses. For example, employees can purchase health insurance in the individual market either through Obamacare or by directly going to the website of the carriers in their state.

The cost of the health insurance premium as well as other medical services, or eligible medical product expenses are reimbursed by the employers under QSEHRA. Employees pay the insurance company or medical bill directly and then submit eligible claims to get reimbursed by their employer. These are considered reimbursements and as such are (almost always) tax-free for employees and employers.

QSEHRA doesn’t replace health insurance. Employees must get qualifying health insurance coverage through the health insurance marketplace, or another employer-sponsored plan (like through a spouse’s or parent’s coverage), in order to participate in a QSEHRA.

The employer sets a maximum allowance; this is the maximum amount per year that can be reimbursed for each employee. The IRS has dictated a ceiling on these so that the maximum allowance set by the employer cannot exceed a certain amount.

According the IRS, the 2022 QSEHRA limits can reimburse employees for:

– Up to $5,450 of qualified medical expenses per year (or $454.16 per month) for employee-only coverage, or

– Up to $11,050 per year (or $920.83 per month) for family coverage.

QSEHRA benefits are completely funded by employers (meaning: employers are responsible for covering the approved reimbursement costs up to the max allowance for each employee).

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Allow employees to purchase insurance in the individual marketplace

If QSEHRA is not an option for you, your employees can still purchase insurance in the individual marketplace.

While you can not offer pre-tax dollars to cover the cost of the premium, many businesses will offer a bonus to help the employees cover some of the cost of health insurance.

Of course, the bonus will be considered part of the compensation and would be taxed. In this option, employees will go to Healthcare.gov or their state SBE (State Based Exchange) to directly enroll in an individual health insurance plan.

The employee can also enroll in the plan by directly going to websites of health insurance carriers in their state. The employee will be responsible for paying the full cost of coverage to the carrier.

Conclusion

If you are a small business, it is not easy to obtain cost effective health insurance coverage for your employees. The options outlined above can help you navigate the complex world of health insurance and obtain coverage for your employees.

How to transition out of a PEO and bring your HR, payroll and benefits in-house?

Quick links

-

Introduction

-

Reasons for wanting to leave your PEO

-

Do you have the right team in-house?

-

How to leave a PEO and bring your HR, payroll and benefits in-house

-

What to Consider After Leaving the PEO

-

Conclusion

Many companies, typically in the earlier stages of their growth cycle, decide to outsource their payroll, HR and Benefits functions to PEOs (Professional Employer Organizations).

When you are small, it makes sense to outsource these functions. Even though PEOs charge a high fee to provide these services, outsourcing seems cost effective compared to hiring people inhouse to manage different HR functions.

Moreover there could be other factors that may favor using a PEO. For example, you may only have a few employees and if one of these employees has a medical condition that makes it cost prohibitive to purchase medical benefits in the open market, it probably makes sense to join a PEO so that you can be covered under their master plan.

However many of these benefits of working with a PEO seem to fade away as you start to grow and at a certain point you may decide to leave the PEO and bring the HR functions inhouse. Here are some of the reasons you may decide to leave your PEO:

Reasons for wanting to leave your PEO

Higher Monthly Fees:

PEOs charge a significant high PEPM (Per Employee Per Month) fee for their services. When you are small, these high fees seem justified because of perceived savings in the cost of health benefits. As you hire more and more employees, the total service cost per month starts to become prohibitive.

Limited choice of medical benefits:

What was once an advantage when you were small, quickly becomes a disadvantage when you start to grow and hire more and more employees, maybe in different parts of the country. Your benefit choice is limited by the master plan of the PEO. You can not shop around across national and regional insurance carriers to get the best benefit for your employees.

Poor Employee Experience:

In today’s hot job market, the key to attracting and retaining talent is providing competitive compensation along with top-notch benefits and great employee experience.

When employees have questions about their ‘401K deductions’ or ‘whether a doctor is in the network’ or ‘why a claim was not approved’, they want quick and accurate answers.

This is easy to achieve if you have a dedicated internal staff who is measured on the employees satisfaction. Typically, we have seen, PEOs are not able to be as responsive as an in-inhouse employee when it comes to resolving complex employee issues.

For reasons outlined above, you may decide to transition out of a PEO and bring your HR functions in-house. In this article, we will provide you step by step instructions on how to complete this transition.

Do you have the right team in-house?

The first thing you want to do is to assess the capabilities and skill sets of your in-house HR team.

When you were working with the PEO, you might not have hired experienced HR professionals in house. However, now your team will be responsible for all employee related functions starting with hiring and onboarding, payroll, benefits, performance management, training, terminations etc.

Do you have the right kind of team members? If not, you can either hire somebody from outside right away or you can lean on the HRIS technology vendor you will work with to provide you some dedicated HR bandwidth giving you time to build this capability inhouse.

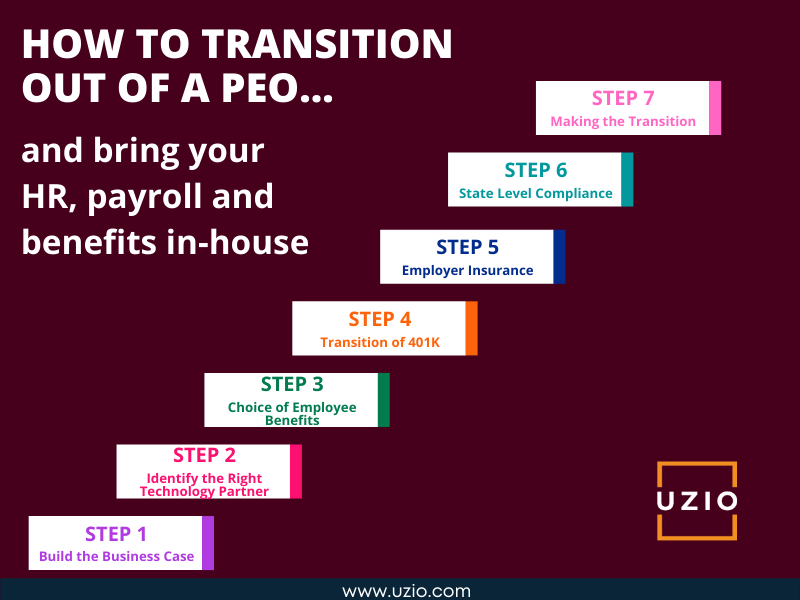

How to leave a PEO and bring your HR, payroll and benefits in-house

Step One : Build the Business Case

There are many reasons why you may want to transition away from a PEO, but cost efficiency is often cited as being one of the top motivators.

Even if you choose not to bring everything in-house at once, there will be some immediate savings if you have been using managed payroll services from PEOs or outsourced providers. You’ll need to build a business case before making the big decision about bringing the HR function in-house.

That means breaking down what your PEO is costing you now and what you will likely pay to replace it. Part of the challenge in this step is determining what you’re paying the PEO and what it covers.

PEOs tend to charge just one large service fee on top of the benefits and business insurance costs. That makes it hard to determine what each individual HR function is costing you. So it’s better to break down what it will cost to replace each service and compare the total costs. You should end up with a table like the one below (this table is an example of a company choosing between a PEO and bringing it in house as an unbundled option).

Let us assume that the company has 100 employees, PEO service fee is $125 PEPM (Per Employee Per Month) and total fee for the unbundled option is $25 PEPM. These numbers are quite typical.

In this scenario, the annualized savings will be around $220,000. This includes a saving of $100,000 on Medical benefits which is again quite typical when you shop around a group of this size.

| Unbundled Option | PEO | Difference | ||

|---|---|---|---|---|

| Employer Insurance | ||||

| Workers Compensation | $30,000 | $30,000 | $0 | |

| EPLI | Included | Included | ||

| Compliance | ||||

| COBRA | Included | Included | ||

| State Registration | Included | Included | ||

| New Hire Registration | Included | Included | ||

| ACA Reporting | Included | Included | ||

| Employee Benefits | ||||

| Medical | $500,000 | $600,000 | $100,000 | |

| Open Enrollment Support | Included | Included | ||

| Benefit Guide | Included | Included | ||

| Retirement Planning | ||||

| 401K | Included | Included | ||

| Service Fee | $30,000 | $150,000 | $120,000 | |

| Hiring & Onboarding | Included | Included | ||

| PTO Tracking | Included | Included | ||

| Document Storage | Included | Included | ||

| Employee Communication | Included | Included | ||

| Time Tracking | Included | Included | ||

| Payroll | Included | Included | ||

| Benefit Enrollment | Included | Included | ||

| HR Legal | Included | Included | ||

| Dedicated A/C Rep | Included | |||

| Total Annualized Savings | $560,000 | $780,000 | $220,000 | |

Step Two : Identify the Right Technology Partner

One of the advantages of working with the PEO is that you have one platform for all your HRIS functions. You don’t need to duplicate data across multiple systems.

Now that you are coming out of the PEO, your HR team members and your employees will expect the same seamless workflow for payroll, benefits, HRIS etc. This means you should identify a partner who offers a technology platform where all the core HR functions Payroll, HRIS, Benefits etc work seamlessly. Uzio offers such a platform and a number of our current customers were previously with a PEO.

Step Three: Choice of Employee Benefits

In addition to savings coming from not having to pay very high PEO service fees, the next big savings will come from your ability to get competitive quotes from different insurance carriers for health benefits.

To be able to do this, the key would be working with the right benefits broker. When customers who are leaving the PEOs come to Uzio, we introduce them to our strategic broker partners.

The broker partner works directly with the company to collect the census information and shops around the group for the most competitive quotes. The next step would be to choose the right benefit from a number of quotes provided by your benefits broker. This requires a collaborative effort between the company and the benefits broker.

Once the decision is made and the benefit provider is selected, the benefit plans are loaded onto the technology platform and an open enrollment is kicked off. As part of open enrollment, employees are invited to log onto the platform and make benefits selections. Because this will be the first open enrollment outside of the PEO, the company, the broker and the technology vendor need to work very closely to ensure a smooth experience for the employees.

Step Four: Transition of 401K

If your company offered 401K thru the PEO, you will have to make important decisions regarding the transition.

Decision regarding 401k Record Keeper

The first decision would be whether you want to stay with the record keeper offered by the PEO.

The record keepers are like the book keeper of your plan. They keep track of who is in the plan, what each participant owes etc. Record Keepers are companies like Fidelity, Empower, Vanguard, TransAmerica etc.

Some PEOs will allow you to keep the record keeper even when you are transitioning out of the PEO. If you like the record keeper and your PEO lets you keep it after transition, that may be your best option.

If not, you will have to find a different record keeper and this is where 401K Advisor comes into the picture.

Decision regarding Advisor of Record

You will need to select an Advisor/Agent of Record. As the name says, an advisor will advise you and your employees regarding 401K. The Advisor will help you make decisions regarding the Record Keeper as well as the TPA (Third Party Administrators). The Advisor will ask for a “Agent of Record” change letter from you before s/he starts working with you. Your HRMS technology vendor should be able to introduce you to a number of Advisors.

Decision regarding TPA

You will need to select a TPA for your 401K plan. The TPA manages the day-to-day aspects of your 401k plan. The TPA is responsible for preparing plan documents, making sure the plan is in compliance with IRS requirements etc. Your Advisor should help you choose the TPA.

Step Five: Employer Insurance

Now that you are not part of the PEO, you will need to get your own Workers Compensation insurance. You may also need Employment Practice Liability Insurance (EPLI). Your technology provider should be able to arrange this for you by introducing you to the right broker agent.

Step Six: State Level Compliance

When you were with the PEO, all your HR related compliance needs were handled by the PEO. Now that you are on your own, you would be responsible for all the HR compliance needs. Here is a list of compliance items you will be responsible for.

- Out of state registration: If you decide to hire an employee in a state different from the home state, you want to make sure that you are registered in that state. Your technology vendor might be able to offer you this service. We at Uzio do this for our clients who are transitioning away from the PEOs.

Checkout our blog: Hiring an Out-of-State Employee? Here’s What You Need to Know

- New Hire Registration: In addition to the state registration, you also need to register your new hires with that state agency. Please make sure the technology partner you have chosen does it otherwise this responsibility will fall on your HR team.

Step Seven: Making the Transition

Once you’ve figured out how to replace your PEO effectively, it’s time to make the transition.

While it’s most important to make sure the final result leaves your company and its employees in better positions than they were in under a PEO, it is also important to make the transition as smoothly and efficiently as possible.

You want to cause as little disruption to your employees’ experience and your processes as possible to achieve the best business outcomes.

You can make the transition in a matter of just 60-120 days so long as you understand the steps involved in a successful transition.

Here is a high-level list of the steps you will need to take once you have decided on your new go-live date:

- Choose the right HRMS technology vendor

- Assign a dedicated person who will act as the primary contact and liaison for the implementation of the new HRMS system

- Ensure all the necessary data is provided to the new HRMS software provider, making sure forms contain complete and accurate information

- Set up payroll-related items (i.e., tax setups and filings, deductions, pay schedule, time and attendance)

- Set up applicable federal and state tax accounts

- Create standardized procedures and workflows for the employee lifecycle

- Assist with the creation of an employee handbook customized to your companies need

- Select employee benefit and retirement plans that are appropriate for your workforce and will integrate with your HRMS

- Create a communication plan for employees regarding changes in systems and responsibilities

- Transition to new HRMS

What to Consider After Leaving the PEO

After you have completed the transition and have run your first payroll inhouse, your work does not stop. Hopefully, the change went well, but if not, now is the time to fix any issues.

Your situation will be unique, but it may help to consider the following actions:

- Schedule the HR team to follow up with the “new employees” to help them navigate the changes

- Make sure your payroll data is being fed into your accounting system

- Make sure you are paying invoices from your benefits carriers, your workers comp carrier and other HR services you have contracted with

- Setup regular reviews with your HR technology vendor. In these reviews you can provide them feedback on the gaps and issues you are encountering

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

If you follow the steps outlined above, you should be able to complete the transition out of the PEO with the least amount of disruption and realize the core objectives of cost savings and better employee satisfaction. At Uzio, we have helped countless companies transition away from the PEOs. If you are considering such a transition, please get in touch with us.

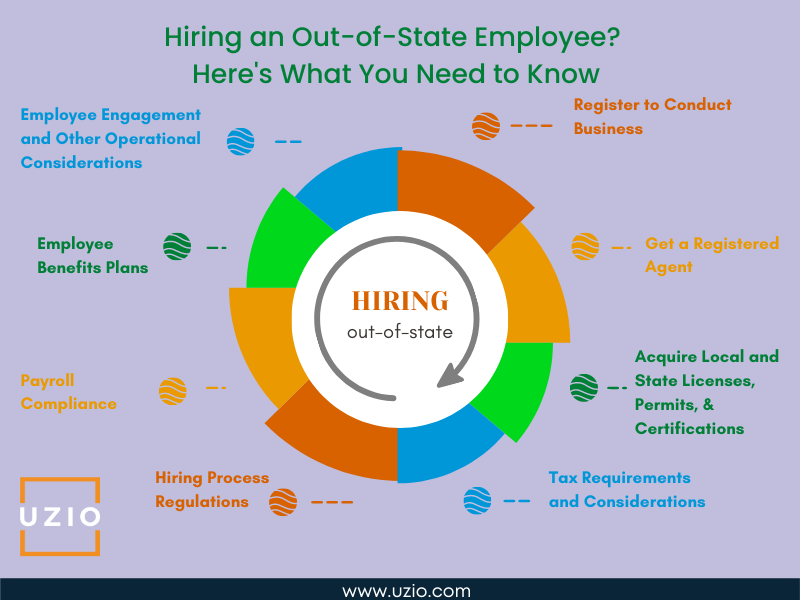

Hiring an Out-of-State Employee? Here’s What You Need to Know

Quick links

-

Introduction

-

Register to Conduct Business

-

Get a Registered Agent

-

State Income Tax Withholding Account

-

State Unemployment Tax (SUTA) or State Unemployment Insurance (SUI)

-

Worker’s Compensation Insurance

-

Payroll

-

Summary

Your business is growing and to manage this growth you need highly qualified employees. Considering the very tight job market and the desire for employees to work remotely, you decided to expand your employee search beyond your home state and started looking for remote employees in other parts of the country.

It makes perfect sense and really what could go wrong? Well, a lot if you do not take the necessary steps to remain in compliance with state registration, taxation, unemployment insurance and workers compensation insurance laws and regulations of other states.

In this guide, we will give you step by step instructions so that you remain in compliance with different state laws and regulations and avoid paying big fines and penalties.

Let us get started.

Register to Conduct Business

If you are hiring employees outside of your home state, the first thing you need to do is to register to do business in that state. Each state has a slightly different process for this. SBA (Small Business Administration) has the information you need on how to register with federal and state agencies.

Get a Registered Agent

If your business is an LLC, corporation, partnership, or nonprofit corporation, you’ll need a registered agent in the state where you are hiring your employee.

A registered agent receives official papers and legal documents on behalf of your company. The registered agent must be located in the state where you register.

Many business owners prefer to use a registered agent service rather than take on this role themselves.

Now that you have taken care of registering with the state where you are hiring the new employee, the next step is to ensure that when you process payroll for this employee, you can withhold applicable taxes on behalf of the employee and also pay unemployment insurance tax in that state.

If your payroll system either does not support out of state tax withholding or is not sophisticated enough to prompt you to get applicable SIT (State Income Tax withholding account) and SUTA (State Unemployment Tax account) details, you may unknowingly be in violation of that state laws and may incur penalties and fines. We have seen this with a number of employers who came to Uzio because their previous payroll provider did not have comprehensive support for out of state hires and the employer ended up with big fines.

Here are some tips on For a Massage Franchise owner: How to correctly calculate wages for your massage therapist? – UZIO Inc, so that you can stay focused on running your business and still comply with the FLSA.

State Income Tax Withholding Account

Most but not all states have state income tax and they require employers to withhold state income tax from employees wages who are working in that state. You should get a state tax id number so that you can withhold taxes. You can find more information about how to procure a state tax id here.

State Unemployment Tax (SUTA) or State Unemployment Insurance (SUI)

In addition to withholding state income tax on behalf of employees, the employers are also required to pay state unemployment tax. You will see SUTA and SUI terms being used interchangeably. Every state has a slightly different process for registering for SUTA/SUI.

Once you register, you will receive an account number and a tax rate. You want to make sure that your payroll solution is updated with the account number and corresponding rate so that unemployment taxes are withheld and deposited with the right agency.

Worker’s Compensation Insurance

When you hire an out-of-state employee, you want to make sure you purchase Workers compensation Insurance for that employee in that state. ‘Workers comp’ as it is usually called provides coverage to employees when they are injured in an accident at work.

The coverage provides for medical care as well as compensation for a portion of the income employees lose when they can not return to work because of the injury. Many states require employers to submit proof of the coverage and if the proof is not provided in time, the employer can be fined hundreds or even thousands of dollars.

So it is critical that you have workers compensation insurance coverage for your employees in the state they are working. If you are working with a payroll provider like Uzio, we make sure that you have workers comp coverage for all your employees. If your payroll provider does not provide you this service, you can also work with a broker to purchase the required coverage.

Payroll

The federal government sets a minimum wage of $7.25 per hour, and many states have higher requirements. If you’re hiring out-of-state employees, keep in mind that overtime rates are typically time and a half of your normal pay rate for any hours worked over 40 hours in a single week.

Additionally, each state has its own rules regarding pay frequency and pay stub requirements; it is important to comply with these rules if you want to avoid expensive fines and penalties.

For example, California requires employers to provide pay stubs on or before payday—and pay stubs must include all information required by law (e.g., deductions). Failure to do so can result in a fine of up to $100 per employee for each violation.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Summary

Hiring remote workers in the very tight job market seems like a no-brainer however as an employer you want to make sure you follow the steps outlined above to remain compliant with the state laws and avoid costly fines. It may seem daunting at first however if you work with a payroll provider like Uzio, we take care of all the steps outlined above. If you are looking to hire out-of-state employees, you should first give Uzio a call.

For a Massage Franchise owner: How to correctly calculate wages for your massage therapist?

Quick links

-

Introduction

-

Does your Franchise POS system easily integrate with your payroll system?

-

Does your Payroll system understand the difference between Hours Worked and “Service Hours”?

-

An illustration

-

Case 1: Maria did 10 massages that week

-

Case 2: Maria did 15 massages that week

-

Summary

Owning and operating a massage franchise is a very challenging undertaking. Of the many challenges you will face, one of the hardest would be to hire and retain high quality massage therapists. Critical to that goal would be your ability to calculate and pay correct wages to your therapists as per the Fair Labor Standards Act (FLSA).

Here are some tips on how to calculate wages as a Massage Franchise owner, so that you can stay focused on running your business and still comply with the FLSA.

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, and recordkeeping standards affecting employees in the private sector and in Federal, State, and local governments. Covered nonexempt workers are entitled to a minimum wage of not less than $7.25 per hour. Overtime pay at a rate not less than one and one-half times the regular rate of pay is required after 40 hours of work in a workweek.

To be able to correctly pay your therapists, you will need to address the following two questions?

Does your Franchise POS system easily integrate with your payroll system?

Normally when you sign up for the massage franchise, as part of the package, you will receive access to use the POS (Point of Sale) system of the Franchise. This system will allow you to manage all parts of your franchise including clocking in and clocking out by your staff so you know how many hours your staff worked.

When you are ready to run your payroll, you will need the number of hours worked by your staff. Most of the payroll systems typically do not integrate with the Massage Franchise system which means you now have the responsibility and the extra work of manually entering hours worked from the Franchise system into your payroll system. This can lead to wasted time and to very costly errors resulting in your therapist not getting paid correctly.

Uzio payroll system seamlessly integrates with a number of Massage Franchise systems so that hours worked seamlessly flow from your Franchise system to your payroll system. It reduces errors and saves you lots of time.

Does your Payroll system understand the difference between Hours Worked and “Service Hours”?

What is the meaning of the the term “Hours Worked”?

According to the Department of Labor (DOL), “hours worked ordinarily include all the time during which an employee is required to be on the employer’s premises, on duty, or at a prescribed workplace.”

What is the meaning of the term “Service Hours”?

Service hours refer to the time spent actually working, for example, giving a massage.

Because FLSA requires you to pay at least the minimum wage for hours worked, it is important for you to know how to calculate the wages as per the hours worked as well as the service hours. Here is an example to help clarify:

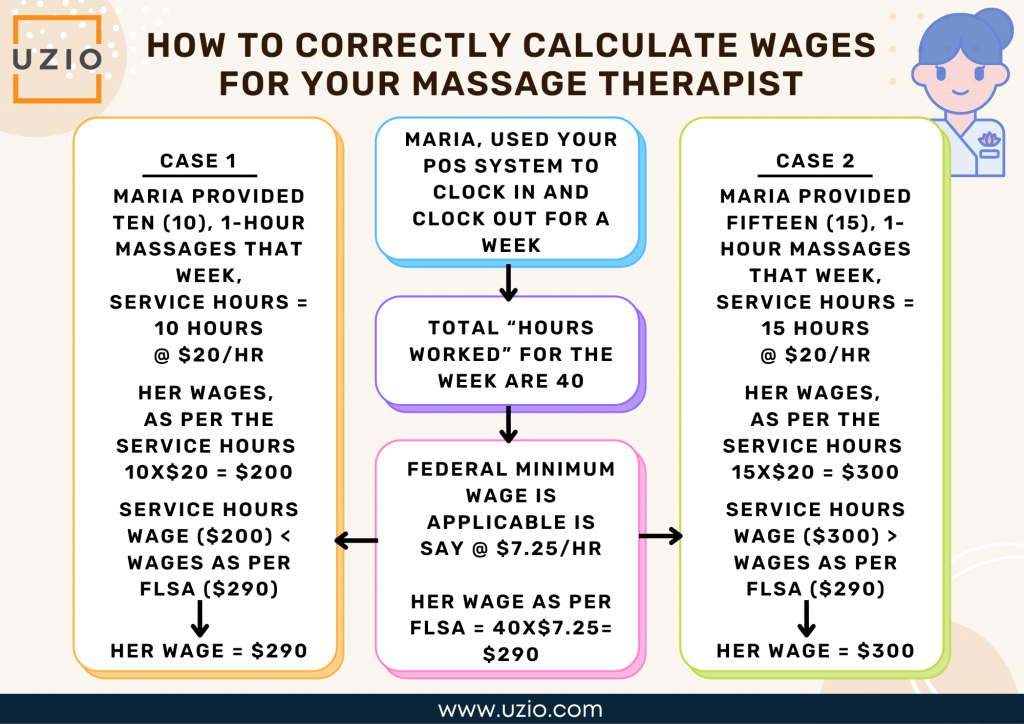

An illustration: How to calculate weekly wage for Maria, a massage therapist?

Let us say one of your massage therapists, Maria, used your POS system to clock in and clock out for a week such that her total “hours worked” for the week are 40. Let us assume that your franchise is in a state where the federal minimum wage is applicable.

This means, as per FLSA, Maria should be paid 40X$7.25=$290 for that week.

Let us assume that her rate as a massage therapist is $20/hr.

Case 1: Maria did 10 massages that week

Let us also assume that Maria provided ten, 1-hour massages that week, resulting in total “service hours” worked that week of 10 hours.

In this case her wages, as per the service hours, for the week would be 10X$20 = $200.

Because her wages as per her service hours are less than wages as per FLSA, Maria would be paid $290 for that week.

Case 2: Maria did 15 massages that week

Let us also assume that Maria provided fifteen (15), 1-hour massages that week, resulting in total “service hours” worked that week of 15 hours.

In this case her wages, as per the service hours, for the week would be 15X$20 = $300.

Because her wages as per her service hours are more than wages as per FLSA, Maria would be paid $300 for that week.

As you can see, the payroll system used by the franchise should have this logic built in. Otherwise, as the franchise owner, you will have to manually calculate the service hours pay, compare it with pay as per FLSA and determine the wages to be paid to the massage therapist. This will add to your workload and also can lead to errors.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Conclusion

Being a Massage Franchise owner is a tough job. You can simplify a part of the job by choosing a payroll system like Uzio that has been customized for the Massage industry. It will reduce your workload, reduce errors and help you attract and retain massage therapists.

What are the unique needs of staffing agency payroll and HRIS?

Quick links

-

Introduction

-

Overview of the staffing agency business model

-

Unique business needs of the staffing agencies

-

High Turnover of Employees

-

Higher Unemployment Claims

-

Contract to Hire Clause

-

Affordable Care Act (ACA) 1095 Reporting

-

High Cost of Payroll Platform

-

Summary

Like every other business, staffing agencies have to deal with paying their employees and calculating payroll taxes on an ongoing basis.

However, due to the unique business drivers of the staffing agency, these processes are often more complex than usual.

This article will provide you with the information you need to handle payroll in your own staffing agency so that you can avoid mistakes and maximize your profits while complying with all relevant regulations.

Overview of the staffing agency business model

Staffing agencies act like a middleman between the employers and the workers.

They recruit and supply workers for businesses that are looking to fill certain positions. Many times staffing agencies will have a “contract to hire” clause in their contract with their customers whereas the customer will have the right to hire the worker onto their payroll after the worker has worked certain hours for the business as a staffing agency employee.

Staffing agencies provide value to businesses by taking care of their flexible staffing requirements in line with the ebb and flow of their business needs.

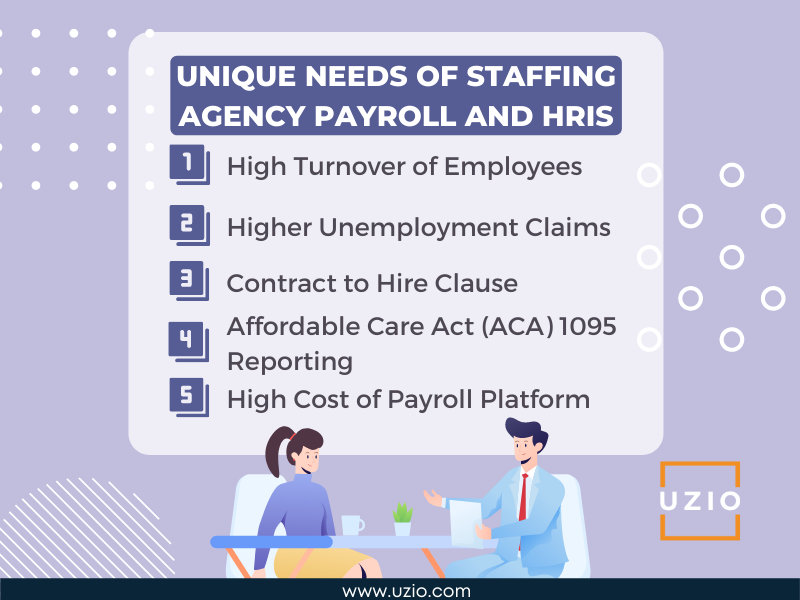

Unique business needs of the staffing agencies

Staffing agency businesses have certain unique business needs because of the nature of their business. The Payroll and HRIS software platforms targeting staffing agencies should address these unique needs otherwise their clients will face higher cost and will be unable to provide great customer service. Here is a short list of these unique needs.

High Turnover of Employees

One of the biggest issues faced by staffing agencies is very high turnover of employees. No other kind of business faces such high employee attrition.

It is not uncommon for a staffing agency to have the number of terminated employees to be five to ten times of the number of active employees.

Such a high employee turnover has a direct impact on the kind of functionality the Payroll and HRIS platform needs to support. Because Staffing agencies are constantly recruiting, the Payroll and HRIS system needs to provide support for a robust Recruitment functionality, also known as ATS (Application Tracking System).

This need can be met in a couple of ways. Either the Payroll platform can have a built in ATS functionality or the Payroll platform should provide a seamless integration with some of the leading ATS platforms in the market.

For example, Uzio platform supports seamless integration with a number of leading ATS platforms. If the Payroll vendor does not provide support for ATS, the agency staff has to manually enter data from their ATS platform into their Payroll platform. Considering the very high attrition faced by the staffing agency and thus the need to continuously hire new employees, this leads to significantly high cost and errors.

In an ideal scenario for the staffing agency, their payroll vendor will either have built in ATS functionality or will support seamless integration with some of the leading ATS vendors, leading to smooth recruitment and employee onboarding and reduced cost of operations.

Higher Unemployment Claims

A direct result of the high employee turnover is the high cost of unemployment claims faced by the staffing agencies. You may wonder how a HRIS platform may be of help when it comes to high unemployment claims.

Here is how.

The payroll and HRIS platform used by staffing agencies should be the “System of Record” (SOR) for the employee data. This means the system should provide support to capture and store all the details regarding the employee from hiring to termination including detailed notes captured during employee’s performance review sessions, feedback provided and notes taken regarding the employee performance at client site etc. during the life cycle of the employee with the agency.

The system should enable the employer to keep detailed notes of the feedback provided regarding performance gaps, issues faced at client site etc in line with the procedures laid out in the company handbook. When unemployment claims are made against the agency, these detailed notes can be used to fight certain unemployment claims. If you are successful in fighting some of these claims, you keep your unemployment rate from going up and that leads to direct savings.

Uzio platform is first and foremost an employee SOR. When a staffing agency uses the Uzio payroll system, they automatically have access to all the detailed employee records including all the notes captured during the employee lifecycle with the company. These notes come very handy when agencies are fighting unemployment claims.

Contract to Hire Clause

One of the unique business needs of the staffing agencies is to support the concept of “Contract to Hire” whereas their customers can hire the employee supplied by the agency by paying a pre agreed rate. Typically this rate reduces as the employee works more hours at the client site and in many cases becomes zero after a certain number of hours.

This means clients are constantly asking staffing agencies for information about hours worked by different employees. Staffing agencies need an easy way to generate reports which will show hours worked for an employee on a particular client contract. In absence of these custom reports, in many cases, agency staff manually goes through different paystubs of employees to calculate total hours worked during a certain period.

This is very time consuming and error prone. Uzio platform provides easy to use reports where with a click of a button, reports can be generated showing the total hours worked by an employee during a certain time period. Agencies can submit these reports to their clients and keep them satisfied.

Affordable Care Act (ACA) 1095 Reporting

The ACA requires Applicable Large Employers (ALEs)—employers that during the prior year had 50 or more full-time employees or the equivalent when part-time employees’ hours are combined—to submit 1095 reporting forms to the IRS. These reports indicate which employees were offered qualified health benefits.

Employees are considered full-time if they work 30 hours per week (based on a 52-week year) or 130 hours per month (based on a 12-month calendar year).

Because Staffing agencies have very high employee turnover where employees are constantly joining and leaving the company, it is crucial that the payroll and HRIS platform used by the staging agency provides a very easy way to track total hours worked by each employee during a calendar year.

The staffing agency should be able to easily generate reports showing hours worked by employees and provide these reports to their benefit broker or other vendor who is helping create the ACA 1095 reports for the staffing agency.

The accurate and timely generation of these reports helps the staffing agency remain in compliance with ACA reporting requirements and avoid very costly penalties.

High Cost of Payroll Platform

Most of the payroll platforms in the market today charge by the number of W2s. Because of the high employee turnover faced by the staffing agency, their number of active employees is only a fraction of the total number of employees including the terminated employees.

For example, a staffing agency may only process payroll for 250 employees in a week but may have as much as 1,000 plus W2s or more in the system, most of these being terminated employees. If the Payroll platform provider charges by the W2s, this can lead to the very high cost of running payroll for staffing agency.

At Uzio, we charge only for the number of employees who get paid in a week or a month irrespective of how many W2s the agency has on our system. This leads to significant cost savings for the staffing agency.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Summary

In this article, we have tried to highlight the unique business needs of a staffing agency and how it impacts their choice of the Payroll and HRIS platform. Instead of choosing a generic payroll provider, the staffing agency can save thousands of dollars in cost and better serve their clients if they work with a Payroll vendor like Uzio who are built to address the unique needs of the staffing agencies.