How to transition out of a PEO and bring your HR, payroll and benefits in-house?

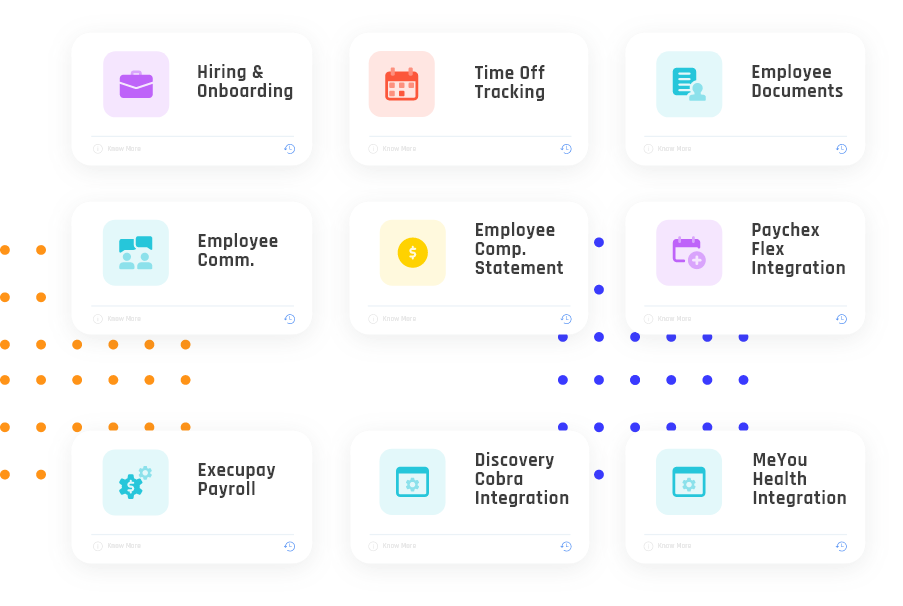

Quick links Introduction Reasons for wanting to leave your PEO Do you have the right team in-house? How to leave a PEO and bring your HR, payroll and benefits in-house What to Consider After Leaving the PEO Conclusion Many companies, typically in the earlier stages of their growth cycle, decide to outsource their payroll, HR …

How to transition out of a PEO and bring your HR, payroll and benefits in-house? Read More »